WarrenAI Ranks Top Automotive Suppliers Poised for EV Adoption

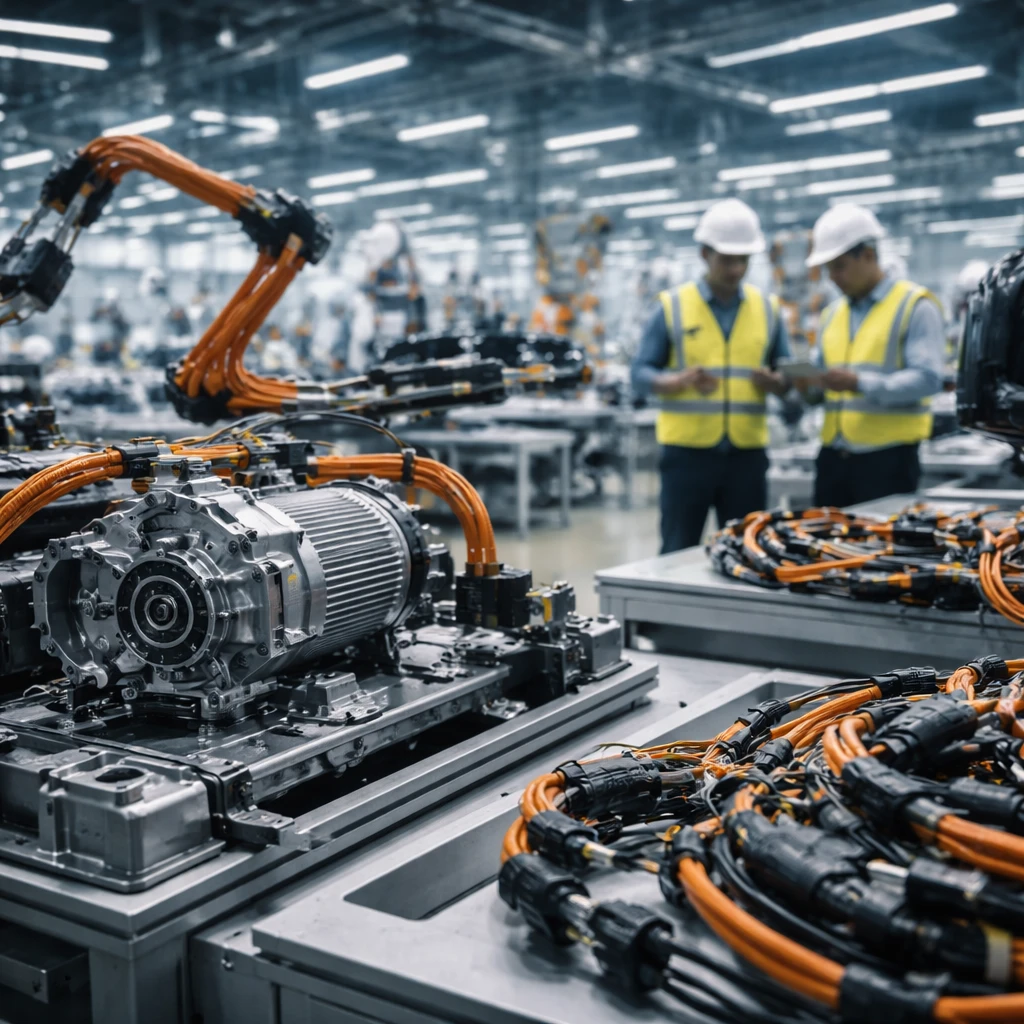

An AI-driven ranking from WarrenAI highlights three automotive suppliers with notable exposure to electric vehicles and compelling financial metrics. Autoliv, BorgWarner and Lear appear prominently for their recent stock returns, projected upside to fair value, and dividend yields. The analysis frames these firms as positioned to benefit across bot…