Vishay Intertechnology: The Quiet Components Stock Riding the Next Upturn

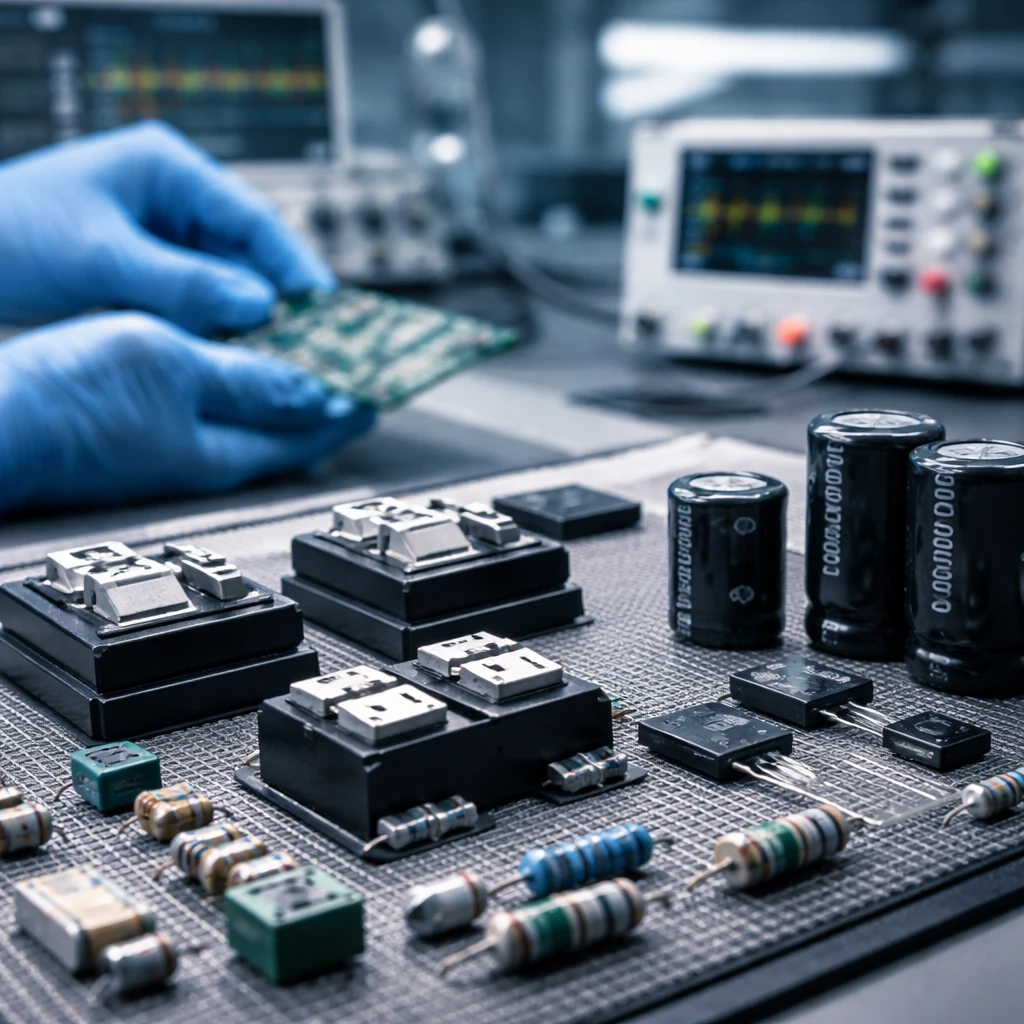

Vishay (VSH) is a behind-the-scenes supplier of power semis and passive components that show up in industrial power supplies, EV/HEV systems, telecom gear, and more. The stock just pulled back to ~$18.45 after a sharp run, but the trend remains constructive with bullish momentum signals and a clear near-term catalyst on 02/04/2026 (Q4 and FY2025 re…