Hook + thesis

Solid Power (SLDP) is a classic high risk/high reward swing candidate today. The company is developing sulfide-based all-solid-state battery cells aimed at electric vehicle makers. The narrative - safer, denser batteries that could displace liquid-electrolyte lithium-ion cells - is powerful and has driven investor enthusiasm across the sector. At the same time Solid Power is still pre-commercial and loss-making, which makes shares volatile and dependent on a few binary milestones.

My view: this is a tactical-long, swing trade. If you believe solid-state battery scaling and OEM deals will be the next leg for EV supply chains, SLDP offers asymmetric upside from the current price of $4.86. But the path is bumpy: negative free cash flow, a sub-$1B market cap, meaningful short interest, and valuation metrics that assume a lot of future revenue. Treat positions as speculative, size accordingly, and use tight risk controls.

What Solid Power does and why the market should care

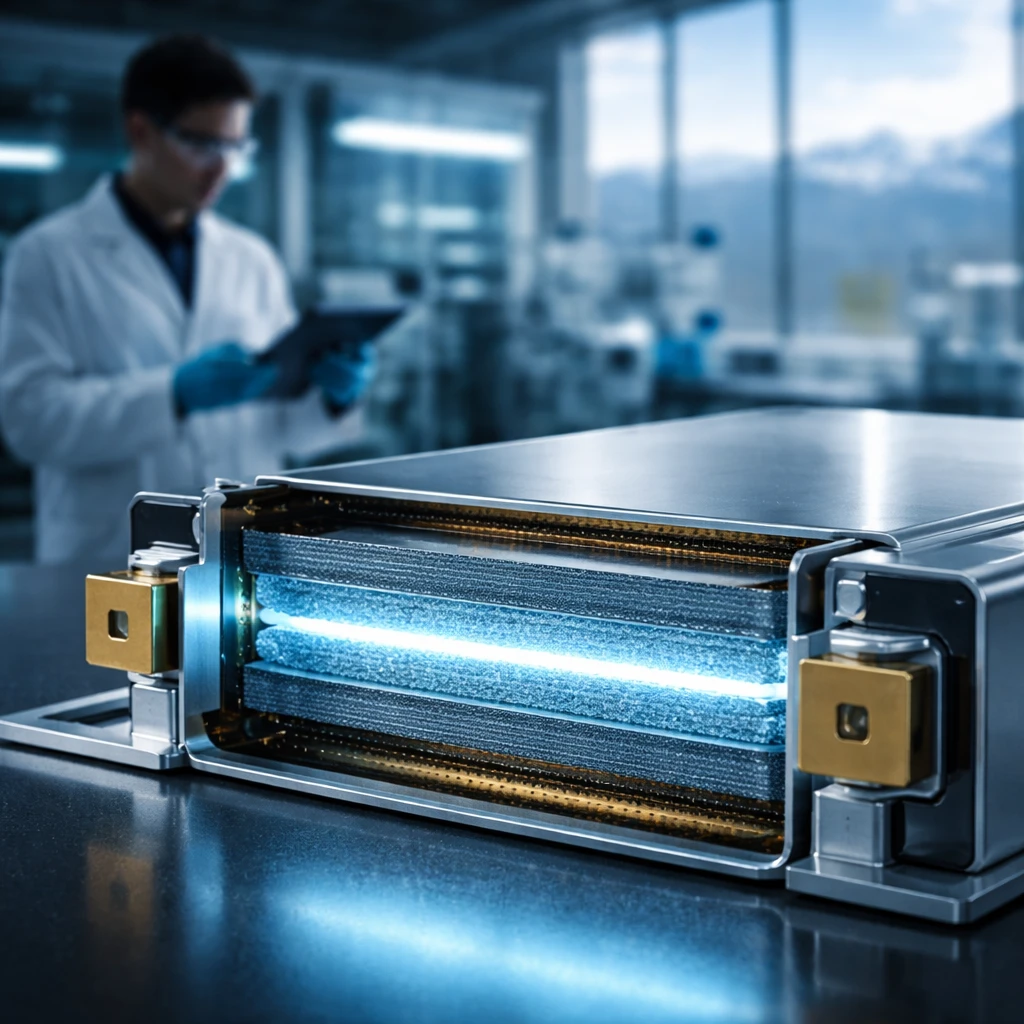

Solid Power manufactures and supplies all-solid-state battery cells and solid electrolyte materials focused primarily on the EV market. The company replaces liquid or gel electrolytes with a sulfide-based solid electrolyte, which in theory improves safety and energy density - two endpoints that matter to automakers and their suppliers.

Why investors care: automakers want higher energy density and better safety without huge weight or cost penalties. Industry estimates included in recent coverage project the global solid-state battery market could grow from roughly $85 million in 2023 to $963 million by 2030, implying a multi-year runway and high compound annual growth if the technology reaches scaled production. That addressable market thesis is what drives premium valuations for early-stage developers.

Key fundamental snapshot

| Metric | Value |

|---|---|

| Current price | $4.86 |

| Market cap | $926,466,400 |

| Enterprise value | $861,031,075 |

| EPS (trailing) | -$0.51 |

| Price / Book | 2.38 |

| Price / Sales | 43.89 |

| Free cash flow (latest) | -$79,191,000 |

| 52-week range | $0.68 - $8.86 |

Reading the numbers

There are a few points to highlight. Market cap sits just under $1.0 billion at about $926M while enterprise value is roughly $861M, which tells you equity claims are the primary valuation component. Price-to-sales and EV-to-sales multiples are extremely rich (P/S ~43.9, EV/Sales ~41.6), reflecting tiny current revenues and the market pricing in significant future top-line growth.

Operationally the company remains loss-making - EPS is -$0.51 and free cash flow was negative $79.2M in the last reported period. Balance sheet ratios in the snapshot show liquidity metrics that indicate solvency for now, but negative cash generation means Solid Power will either need to convert partnerships into paid orders or access capital markets to fund scaling - a key execution risk.

Technical and market structure notes

- Shares currently trade below the short-term moving averages: the 10-day SMA is $5.28 and the 50-day SMA is $5.06 while the stock sits at $4.86.

- RSI near 43.6 suggests no immediate overbought condition but momentum indicators are mixed; MACD is in bearish momentum territory.

- Short interest is material: around 22.9M shares short (settlement 01/15/2026) and days-to-cover roughly 4.0, with recent short volume spikes indicating active bearish positioning. That creates both downside pressure and the potential for sharp squeezes on positive news.

Valuation framing

Valuing Solid Power on conventional multiples today implies the market is pricing in a dominant future role in EV battery supply chains. P/S near 44 and EV/S around 42 are not grounded in current revenue but in expected scale: if the company were to reach meaningful GWh output and OEM contracts, the multiple could normalize. Conversely, if Solid Power fails to commercialize or needs significant dilutive financing, the current valuation looks fragile.

Compare this to the history of other pre-revenue or early-revenue battery developers: markets tend to re-rate quickly on contract news or production milestones, but also collapse sharply on misses or funding dilution. With a market cap under $1B, SLDP sits in a sweet spot for headline-driven moves: not so large that a single partnership can’t move the market, but large enough that any misstep attracts immediate selling.

Catalysts to watch (2-5)

- OEM qualifications - any announcement of cell qualification testing progress or pilot vehicle integration with an automaker will be a major positive.

- Scale-up milestones - proof of pilot-line yields, first pilot production volumes, or successful cost reductions that move cost/kWh estimates materially lower.

- Partnership expansions - multi-GWh supply agreements or joint ventures with auto OEMs or tier-1 suppliers will re-rate sentiment.

- Financial moves - non-dilutive funding, grants, or strategic investments from large industrial partners can buy time and credibility.

Trade plan - actionable idea

Trade direction: Long. Risk level: High. Time horizon: swing (45 trading days) - mid term (45 trading days). I view this as a tactical swing trade targeted at a mid-term catalyst window where newsflow around qualifications or partnerships is most likely to drive price action.

- Entry: $4.80. Enter on a pullback to $4.80 or on a disciplined, partial entry near current levels if you prefer averaging in.

- Target: $7.50. The target sits below the 52-week high of $8.86 but above recent trading ranges; it represents meaningful upside if the market re-rates on positive OEM or production news.

- Stop loss: $3.50. Cut losses if price violates $3.50, which would indicate the downtrend is accelerating and the thesis is under threat.

Position sizing guidance: keep this trade to a small allocation of overall capital (single-digit percentage of a speculative sleeve). Expect high intraday volatility and wide spreads in news-driven sessions.

Why this trade makes sense

The setup is attractive for a swing trader because there is a clear binary path: positive qualification or OEM contract news can re-price future revenue expectations quickly; absent that, the stock can fall a lot. With short interest significant and short volume spikes recently, upside moves can amplify rapidly on good news. The technical picture shows the stock below short-term averages but not deeply oversold, which favors a measured entry and tight stop.

Risks and counterarguments

- Execution risk - scale-up and manufacturing: Solid-state chemistry is hard to scale. Yield issues, unexpected degradation, or production-cost realities could delay commercialization and force disappointing updates.

- Funding and dilution risk: Negative free cash flow of about $79.2M and ongoing losses mean the company may raise capital. Equity raises would dilute holders and can quickly compress the share price in absence of offsetting positive news.

- Competitive risk: Larger competitors or other solid-state developers (and incumbent lithium-ion improvements) could win OEM contracts, leaving Solid Power on the sidelines even if the market grows.

- Valuation sensitivity: Current multiples (P/S ~43.9, EV/S ~41.6) embed high expectations. Any slowdown in expected revenue growth or missed milestones will likely produce outsized negative moves.

- Short-squeeze nuance - a double-edged sword: Heavy short interest can fuel rallies but also keeps downside pressure strong; traders can be caught in fast reversals if sentiment shifts.

Counterargument to the bullish thesis: you could argue Solid Power is priced like a growth winner but is early in a capital-intensive race. If other players secure the first large-scale OEM contracts and demonstrate cost parity, Solid Power may be forced into a secondary market raise at a lower price or be relegated to a niche supplier role. In that scenario this trade would fail even without outright technical problems in the chemistry.

What would change my mind?

I would materially raise conviction if Solid Power delivered 1) a paid multi-year OEM supply agreement or 2) pilot production demonstrating repeatable yields at economics that suggest competitive cost per kWh. Conversely, repeated misses on qualification milestones, a major dilution event that meaningfully increases share count, or confirmation that the chemistry cannot meet cycle-life targets would make me abandon the bullish stance.

Conclusion

Solid Power is a speculative, event-driven play that offers asymmetric upside if the company converts its technology promise into manufacturable cells and OEM customers. The trade laid out above - entry $4.80, stop $3.50, target $7.50 over a mid-term window of 45 trading days - balances upside potential with strict risk control. This is not a buy-and-hold idea for a conservative investor; treat it as a tactical position sized for volatility and monitor catalysts and cash-position headlines closely.

Trade setup summary: long SLDP at $4.80, stop $3.50, target $7.50, horizon mid term (45 trading days) - speculative, tighten size and watch milestones.