Hook / Thesis

Power Solutions International (PSIX) is a profitable industrial hardware company sitting squarely at the intersection of two market narratives investors want exposure to in 2026 - industrial power systems and the data center build cycle driven by AI compute demand. The stock has pulled back from a 2025 peak and is trading at a valuation that, on surface metrics, looks reasonable for a profitable manufacturing business: a P/E around 14.4 and EV/EBITDA roughly 15.5.

That combination - recurring orders from data-center and industrial customers, visible margin improvement through recent operating leverage, and a solid free cash flow print - makes PSIX an actionable long idea for investors willing to stomach event risk (accounting headlines and cyclical order timing). This article lays out why the company matters, the valuation case, catalysts that could re-rate the stock, and a concrete trade plan: entry at $72.60, target $95.00, stop loss $64.00 on a long-term (180 trading days) horizon.

Why the market should care - business overview and fundamentals

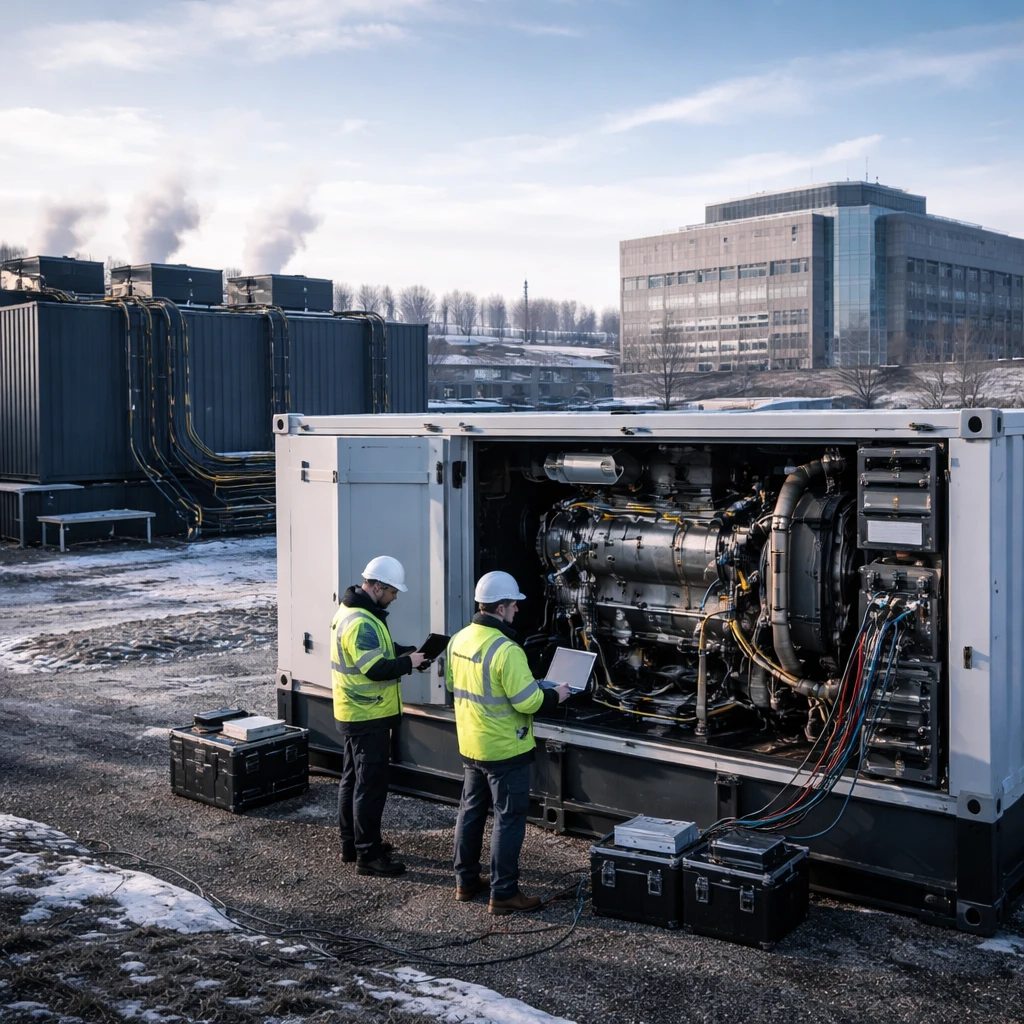

Power Solutions designs, manufactures and trades power systems and electrical power generation equipment for energy, industrial and transportation markets. It sells integrated turnkey solutions to OEMs and end users - the kind of modular, reliable power systems enterprise data centers need for backup and distributed generation. Recent company announcements explicitly tie part of the revenue growth to higher demand from the data center sector and AI compute deployments.

Headlines supporting that demand narrative include a partnership with HD Hyundai Infracore announced on 08/27/2025 to expand industrial engine offerings in North America and a company uptick to Nasdaq on 12/24/2024 that improved visibility and liquidity. Management also reported a record fourth quarter and full year results on 03/24/2025 driven by the power systems business, which provides an operational proof point that demand is converting to profits.

What the numbers say

The snapshot of PSIX shows a market cap of about $1.67 billion and enterprise value of roughly $1.79 billion. The shares are profitable on a trailing basis: earnings per share are reported at about $5.26 and the P/E is ~14.4. Price-to-sales is ~2.58, and management generated reported free cash flow of approximately $51.8 million. Liquidity and leverage metrics are solidly investment-grade for an industrial: current ratio ~2.26, quick ratio ~1.17, and debt-to-equity of ~0.6.

Those figures matter: a profitable industrial with positive FCF and manageable leverage is not the speculative story many AI plays have become. At a P/E in the mid-teens and EV/EBITDA near 15.5x, PSIX is trading at a discount to what you might expect for a pure data-center infrastructure vendor benefitting from sustained multi-year demand. The company also has a history of improving operating margins - recent quarters were described as "record" for profitability, and net income for Q4 2024 was cited at $23.3 million with diluted EPS of $1.01 in one release.

Valuation framing

Simple valuation math: market cap ~$1.67B with trailing EPS ~$5.26 implies the current trading multiple (P/E ~14.4). EV/Sales ~2.65 and EV/EBITDA ~15.46 place PSIX in a middle ground - not dirt-cheap relative to cyclical industrial history, but materially cheaper than high-growth data-center hardware peers that trade at much higher multiples. Consider also the share base - float is relatively tight (~8.52 million) versus shares outstanding ~23.04 million - which creates the potential for sharper moves on catalysts.

| Metric | Value |

|---|---|

| Market Cap | $1,665,859,201 |

| Enterprise Value | $1,792,344,220 |

| EPS (TTM) | $5.26 |

| P/E | ~14.4x |

| EV/EBITDA | ~15.5x |

| Free Cash Flow | $51.8M |

Catalysts - what can move this stock higher

- Data center orders accelerating: sustained large-design wins or multi-year supply agreements with hyperscalers would re-rate multiples closer to specialized infrastructure peers.

- Quarterly beats and margin expansion: further sequential improvement in operating margins and FCF would validate the structural margin thesis.

- Commercial partnerships and new product launches: the HD Hyundai Infracore tie-up (08/27/2025) expands addressable market and can accelerate North American bookings.

- De-risking accounting headlines: any formal audit closure, clean report or regulatory clarity that calms investor concerns could trigger a relief rally.

- Share buybacks or debt paydown: with positive FCF, visible capital returns or balance sheet improvement would reduce multiple risk.

Trade plan - actionable entry, targets and timing

Trade direction: Long. Entry: $72.60. Target: $95.00. Stop loss: $64.00. Risk level: Medium.

Horizon: long term (180 trading days). Rationale: I expect this position to play out over multiple quarterly reports as order flows from data-center projects and partnerships convert to revenue and margin expansion. The 180-day horizon covers at least two earnings / investor update cycles, giving time for catalysts to materialize and for accounting noise to be resolved or digested.

Position sizing guidance - treat this as a tactical allocation within a diversified portfolio. Given the company’s tight float and history of headline-driven moves, use size discipline: risk no more than 1-2% of portfolio equity to the stop at $64.00.

Technical context

Technicals are mixed but not hostile. The 10-day SMA ~$75.83 and 20-day SMA ~$72.04 show the stock is trading near short-term moving averages, while the 50-day SMA ~$64.81 is comfortably below the current price, suggesting a constructive medium-term trend. RSI around ~51.9 is neutral; MACD shows slightly bearish momentum but nothing extreme. Short interest is meaningful (roughly 1.84 million shares at the 01/15/2026 settlement), which implies upside can be amplified on positive catalysts but also means downside can be pressured if sentiment sours.

Risks and counterarguments

- Accounting and governance overhang - there have been public concerns that pressured the stock historically. Any new negative finding, restatement or regulatory action would likely push the stock sharply lower.

- Customer concentration and order timing - industrial and data-center orders can be lumpy. A delay in a large hyperscaler order or push-outs by customers could hit near-term revenue and margins.

- Cyclicality in industrial markets - even with data-center tailwinds, Power Solutions operates in cyclical end markets. A macro slowdown could reduce capital spending and demand for new power systems.

- Execution risk on new product integrations and partnerships - the HD Hyundai Infracore partnership is positive, but product integration and commercial traction are not guaranteed.

- Valuation complacency - while multiples look reasonable now, continued expansion in cap rates for industrials or multiple compression could limit upside even with decent operational performance.

Counterargument: Critics will argue that accounting headlines and a history of volatile trading justify a deeper discount than currently reflected. That is fair: if the market re-prices the company to a sub-10x P/E due to perceived governance risk, the stock could underperform materially. I regard this as a real scenario; however, the base case here assumes governance noise either fades or is resolved and that the data-center demand story drives steady bookings and visible margin improvement.

Conclusion - stance and what would change my mind

Stance: Initiate a long position at $72.60 with a stop at $64.00 and a target of $95.00, held over a long-term (180 trading days) horizon. The upside here is a re-rating as the market recognizes sustainable power-systems demand from data centers and as the company converts that demand into consistent cash flow. The valuation today - mid-teens P/E coupled with positive free cash flow and manageable leverage - supports a meaningful upside to the mid-to-high double-digit target.

What would change my mind:

- Material new accounting irregularities, restatements or adverse regulatory findings would move me to exit immediately.

- A clear multi-quarter decline in bookings from data-center customers or visible erosion in margin trajectory would cause me to re-evaluate and likely trim exposure.

- Conversely, a clean audit, a string of beats on revenue and margin, or a major multi-year contract with a hyperscaler would prompt me to increase conviction and potentially raise the target above $95.

Bottom line: This is a trade on operational improvement and multiple expansion - less sexy than a pure AI software bet, but with tangible cash flows and real customer traction in a growing sub-sector. Treat it as a medium-risk, event-driven equity position with a clearly defined stop and a patient time frame to give the business time to prove the thesis.