Moog's Aerospace Rerating Is Real — Buy the Continuation, Ride the Re-rating

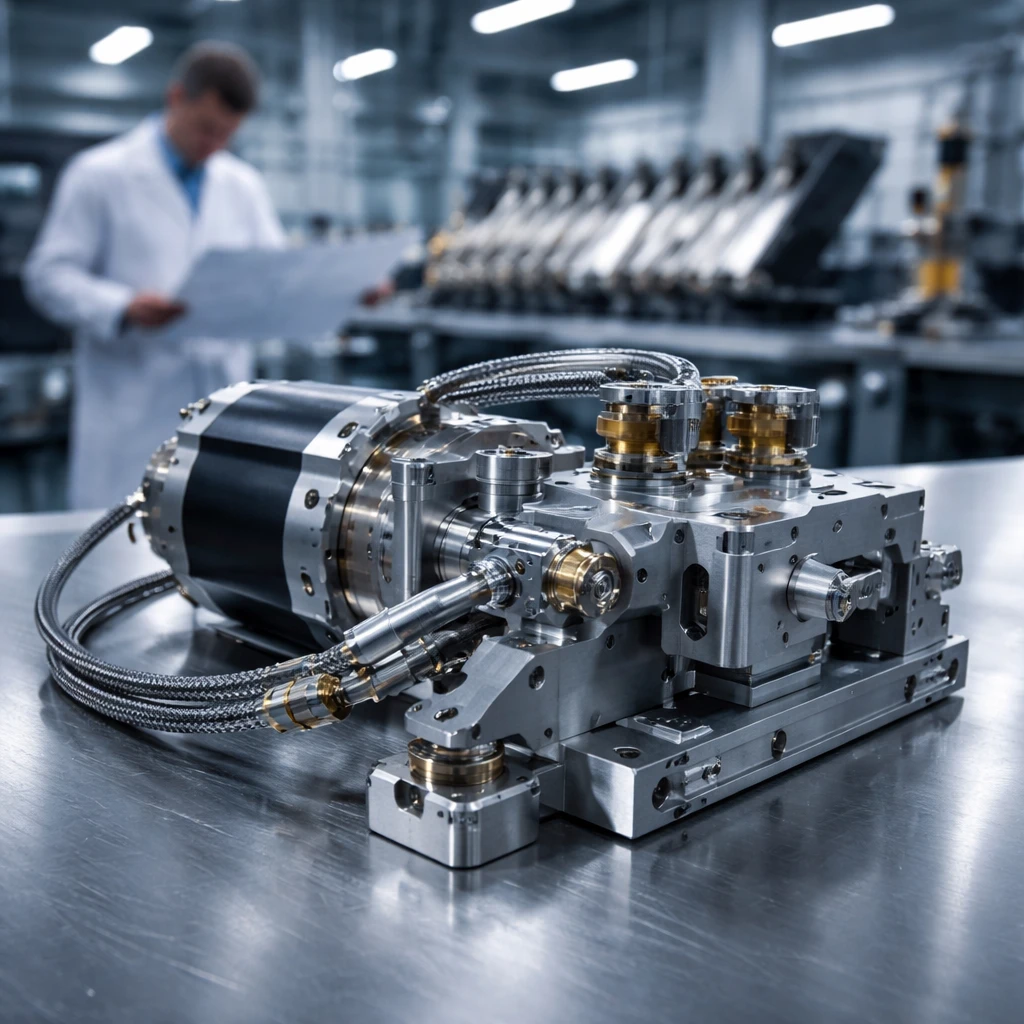

Moog (MOG.A) has run to a new 52-week high on renewed investor interest in aerospace and space systems. The company pairs double-digit ROE, healthy free cash flow and modest leverage with exposure to fast-growing space sensors and aircraft components markets. This trade calls for a long position at $305.00 with a $360.00 target and a $285.00 stop, …