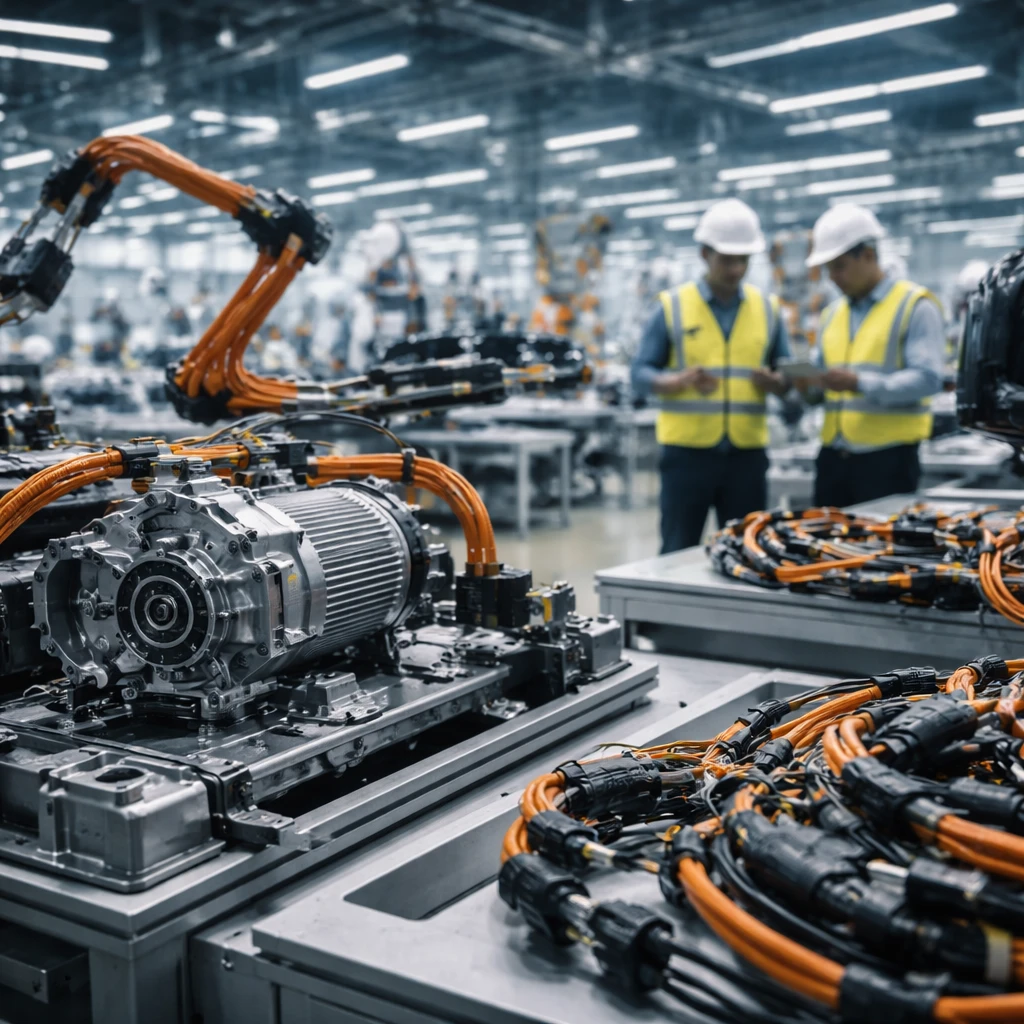

WarrenAI’s recent rankings identify three automotive suppliers that stand out for their market positioning, return profiles and income potential as vehicle manufacturers continue shifting toward electric drivetrains. The analysis focuses on firms that retain relevance in traditional vehicle production while also having exposure to the electric vehicle - EV - transition.

Company highlights

The ranking lists three suppliers with specific performance and valuation details:

- Autoliv Inc (ALV) - Autoliv is placed at the top of the list in WarrenAI’s assessment for its work in safety systems and its income characteristics. The company has generated a 27.5% one-year return and is assessed as trading 9.9% below its fair value. Autoliv also offers a dividend yield of 3.1%. Analysts’ consensus for Autoliv is characterized in the analysis as a "Strong Buy," with a cited fair value target of $139.31. The firm’s specialization in automotive safety components is noted as a strength across both conventional and electric vehicle platforms.

- BorgWarner Inc (BWA) - BorgWarner reports the strongest one-year stock performance among the three, with a 44.4% return. According to WarrenAI, the company is trading about 6.0% below its fair value. The analysis emphasizes BorgWarner’s notable exposure to hybrid systems as an advantage, enabling the supplier to participate across multiple powertrain technologies during the industry’s transition toward electrification.

- Lear Corporation (LEA) - Lear records a 27.2% return over the past year and, per WarrenAI, offers the largest upside to fair value at 25.9%. The company is also shown as delivering the highest dividend yield among the trio at 3.4%. WarrenAI describes Lear as providing a strong combination of value and yield for investors seeking both potential growth and income from automotive suppliers.

Brokerage-style AI stock selection note

In addition to the WarrenAI ranking, the write-up references a related AI-driven stock selection tool called ProPicks AI, which evaluates Autoliv alongside many other companies using more than 100 financial metrics. The description of that tool states it is designed to identify stocks with attractive risk-reward characteristics by assessing fundamentals, momentum and valuation without bias. The tool’s past notable winners, as listed in the analysis, include Super Micro Computer and AppLovin, with the reported performance figures attached to those names.

Context and takeaway

The ranking underscores how suppliers with established roles in traditional vehicle production can retain relevance while participating in the EV transition. The combination of recent share-price gains, measured upside to fair value and dividend yields is the basis for WarrenAI’s attention to these companies. The analysis presents these firms as examples of suppliers navigating industry change while delivering returns and income to shareholders.

Note: The information in this report reflects the metrics and characterizations provided by WarrenAI and the referenced AI stock-selection tool. No additional projections or outside data have been added.