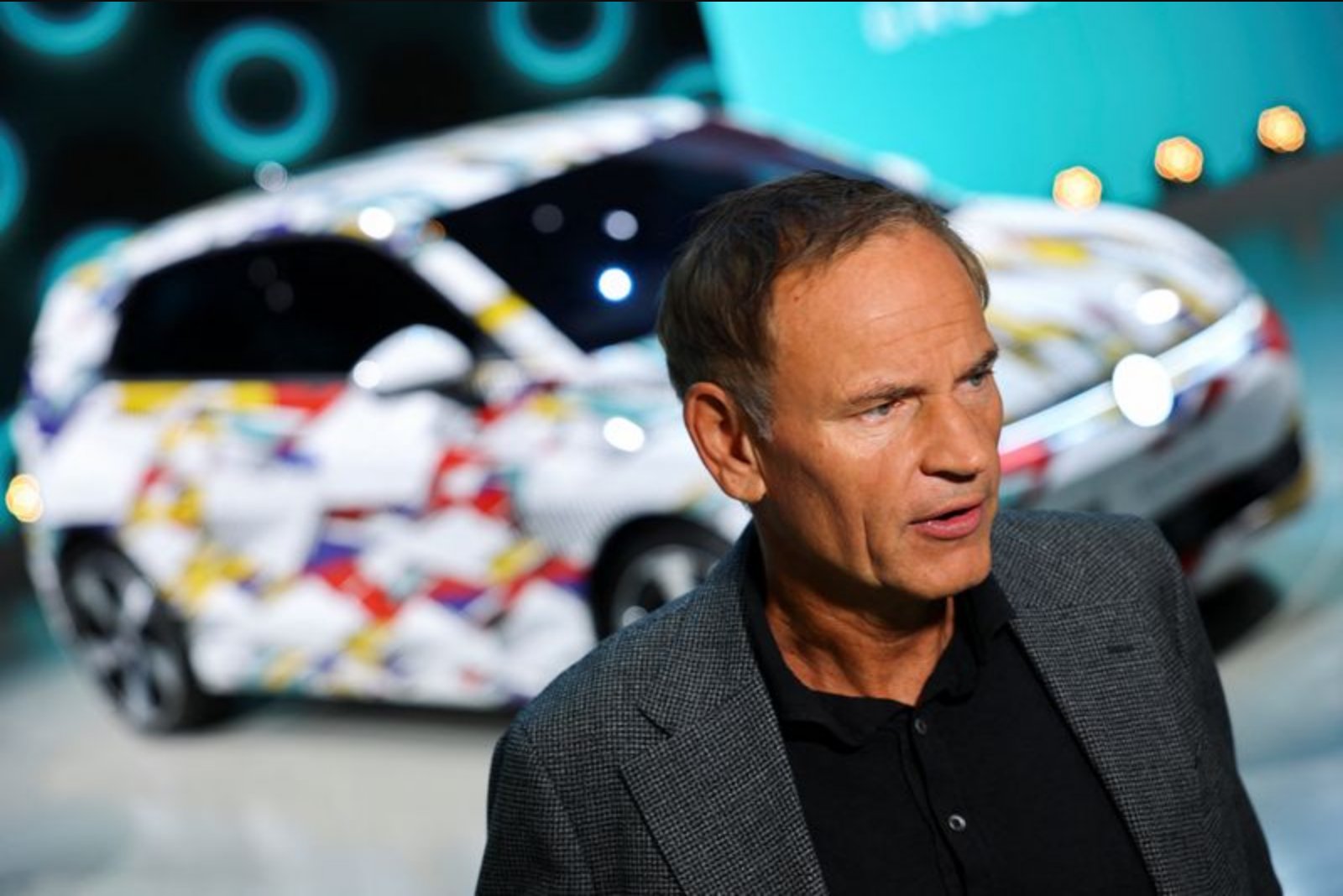

Oliver Blume’s role as chief executive of Volkswagen has entered a make-or-break phase. The board extended his contract for five years, signaling confidence in his leadership, but investors are increasingly explicit that they expect demonstrable progress on two fronts they regard as essential: halting Volkswagen’s slide in China and bridging a widening technology gap with foreign and domestic competitors.

Blume relinquished his concurrent leadership of Porsche in January after the sports car business moved into crisis territory. Removing that dual responsibility leaves him with sole accountability for the broader group at a moment when shareholders say the company needs visible results rather than reassurances. Over the period he has overseen as chief executive, Volkswagen and Porsche together lost 48 billion euros in market value - a reality that has heightened investor sensitivity to near-term performance.

Interviews with six investors - ranging from smaller shareholders represented by associations to large top-10 funds - conveyed a consistent message: Blume must show his strategy is producing outcomes. The company veteran, who has worked at Volkswagen for roughly three decades, set out the scale of the challenge last September at the Munich car show when he warned that the industry’s past operating model would not endure. "The party we have been celebrating in the automotive industry for decades is over in its current form," he said, adding that the sector must reorient.

Blume did not agree to an interview for this analysis. Instead, investors and company sources described the approaches he is using to respond to the twin problems of a weakening position in China and an internal software deficit.

China, long a reliable profit engine for Volkswagen, has become the most urgent trouble spot. During its decades as a market leader, Volkswagen generated substantial earnings from Chinese sales. But in 2024 it was overtaken by BYD and in the subsequent year fell to third place behind Geely. Sales and positioning for Volkswagen’s marquee brands, including Porsche and Audi, have been affected.

Investors acknowledge that the roots of the decline stretch back before Blume took the reins, and some credit him with more actively confronting the problem. He has pursued an "in China for China" strategy, relocating important technology and vehicle development work to the market itself and partnering with local players to better match product to Chinese consumer preferences. Company statements indicate this approach is meant to accelerate development cycles and improve market fit.

Blume is also exploring exporting cars made in China to markets beyond the country, but Europe - Volkswagen’s largest market - is not presently being targeted for such imports. Company sources say that any meaningful expansion of Chinese-made imports or parts into Europe would require approval from powerful German labour representatives. Those works councils granted Blume concessions less than two years ago permitting cuts of 35,000 jobs in Germany - painful measures that underscored internal tensions - and the same bodies would likely push back against broader import strategies.

Some investors worry that, despite clearer diagnosis of the China business’s failings, the response remains more about assessment than guaranteed solutions. Hendrik Schmidt, representing a top-10 Volkswagen investor, said that it feels like there is still a focus on identifying problems rather than delivering final, operational responses.

Compounding the China challenge is what many shareholders see as Volkswagen’s lag in software capability. For an industry increasingly defined by software and electronics, Volkswagen’s struggles in building a robust in-house solution have been a source of frustration. Years of setbacks at Cariad, the group’s software unit, were a significant factor behind the 2022 removal of former CEO Herbert Diess. At the time, sources said the Pach families - the Porsche and Piech families who control more than half of Volkswagen’s voting rights - were instrumental in that leadership change.

To address that gap, Blume has opted to bring external partners into the fold. Volkswagen has committed $5 billion to a joint venture with Rivian, a loss-making California electric vehicle maker, to co-develop a new electronics and software architecture targeted at Western markets. The partnership aims to deliver a state-of-the-art zonal architecture to underpin future software-defined Volkswagen vehicles. Winter testing of the new system is reportedly underway in Sweden.

Investors describe the Rivian tie-up as the riskiest and most fragile element of Blume’s turnaround plan. A failure to hit milestones could jeopardize the release of the next $1 billion tranche of investment tied to development progress. Moritz Kronenberg, speaking for a large Volkswagen investor, labeled the partnership mission-critical for success in Western markets and said the arrangement is the weakest link in the overall strategy.

Not all commentary is skeptical. Reports of stronger-than-expected cash flow for 2025 have given some shareholders cautious optimism that Blume’s operational moves may be starting to show impact. Nevertheless, margin for error is widely viewed as narrowing.

SdK, an association representing about 9,000 smaller Volkswagen shareholders, has been particularly vocal. Marc Liebscher of SdK said the pressure on Blume is immense and that the CEO will need to substantiate earlier commendations of his plan in what he described as a challenging market setting. Liebscher has also expressed alarm that Volkswagen cannot internally produce a competitive software solution on its own.

The company’s largest shareholder group, the Porsche-Piech family-controlled Porsche SE, has publicly said Blume has demonstrated the capacity to manage and develop the carmaker during a difficult period for the industry. A spokesperson for Porsche SE emphasized the need to focus on consistent implementation of the turnaround strategy.

While the families’ visible support was reflected in the CEO extension, past history cautions that contractual terms alone do not guarantee continuity. The removal of Diess mid-term remains a reminder that governance dynamics can change swiftly when results fall short. Investors say Blume has the interpersonal skills to manage relations with the controlling families, but they stress that such skills do not replace the obligation to deliver measurable outcomes.

The euro-dollar reference in the public record for this coverage lists $1 as equal to 0.8524 euros.

Summary

Oliver Blume’s extended tenure as Volkswagen CEO places him squarely under scrutiny. With Porsche no longer in his portfolio and shareholders still smarting from prior market-value declines, his immediate priorities are to restore Volkswagen’s competitiveness in China and to secure a reliable software platform for Western markets through a significant joint venture with Rivian. Early cash flow improvements provide some hope, but investors require clear, tangible progress.