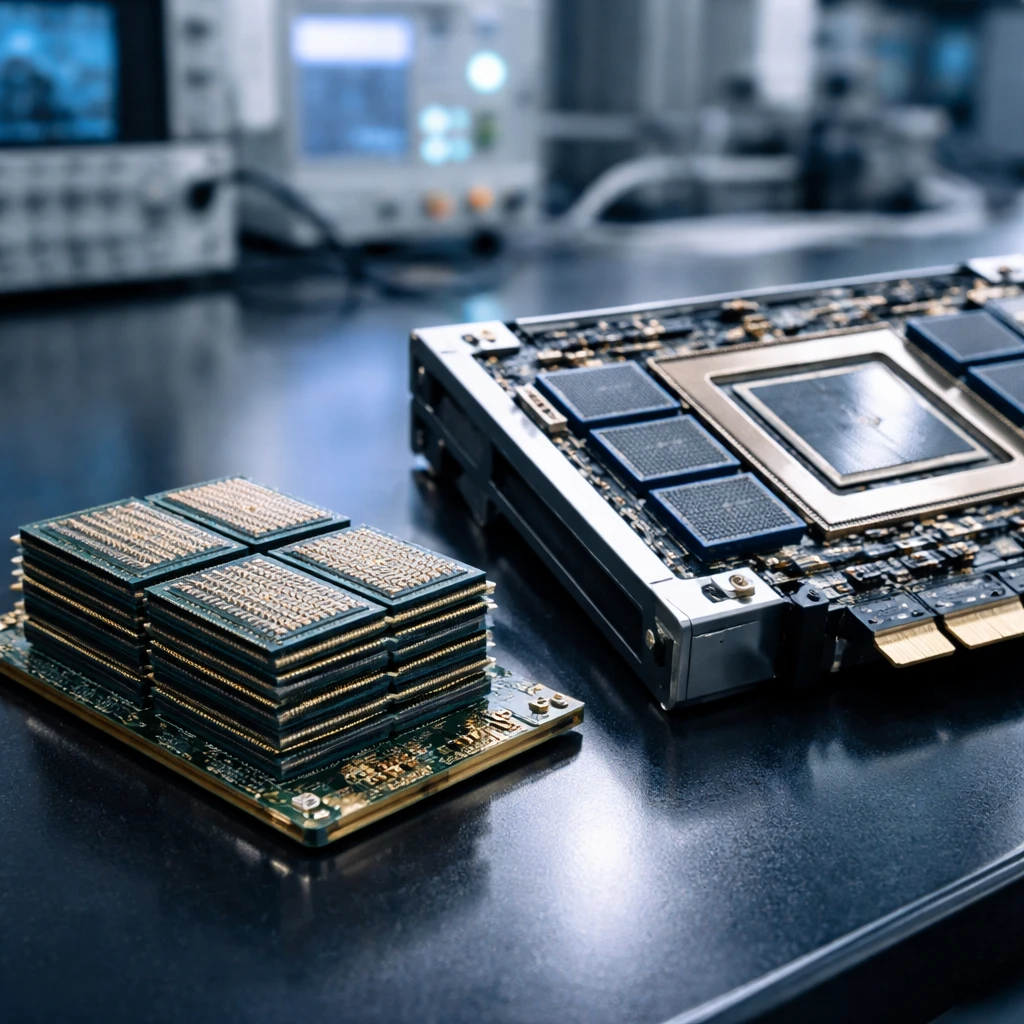

Samsung Electronics is scheduled to start shipments of its next-generation HBM4 high-bandwidth memory to Nvidia in February, South Korean media reported, citing industry sources. The reports indicate the company has cleared qualification tests for its sixth-generation HBM4 with both Nvidia and Advanced Micro Devices.

According to the coverage, Samsung will begin production of HBM4 next month and plans to commence deliveries to customers, including Nvidia, shortly thereafter. HBM4 memory is described in the reports as a key component for high-performance artificial intelligence accelerators because it offers substantial improvements in data bandwidth and energy efficiency compared with earlier memory generations.

The developments represent a step forward for Samsung as it works to narrow the lead held by rival SK Hynix in the high-performance memory segment. Industry reporting noted that Samsung has been seeking to close that gap and that the forthcoming production and shipment schedule signals an accelerated push into the advanced AI memory supply chain.

Market reaction was muted at the time the reports circulated. Seoul-listed Samsung shares were trading flat after earlier gains, having risen as much as 2.8% to 156,400 won during the trading session, according to the reporting. That intraday high remained slightly under the stock's record level of 157,000 won.

Context and technical notes

The reports attribute the information to industry sources and name the Korea Economic Daily as reporting that Samsung had passed qualification checks with Nvidia and Advanced Micro Devices. The articles emphasise that HBM4 chips are integral to AI accelerator designs because of the memory's higher bandwidth and improved efficiency.

What we know from the reports

- Samsung has passed qualification tests for its sixth-generation HBM4 with Nvidia and Advanced Micro Devices, according to industry sources cited in South Korean media.

- Production of HBM4 at Samsung is reported to begin next month, with shipments to customers, including Nvidia, slated to start in February.

- The move is presented as part of Samsung's effort to catch up to SK Hynix in the market for high-performance memory used in AI applications.

Limitations of the reporting

The information in these reports is based on industry sources cited by South Korean media. The coverage provides specific production and shipment timing and notes qualification status but does not include additional corporate confirmation or detailed production volumes.