Intel has projected its first-quarter sales and earnings to come in below Wall Street forecasts, citing difficulties aligning supply with surging demand for its conventional server chips used in artificial intelligence data centers. The company anticipates revenue from $11.7 billion to $12.7 billion and expects adjusted earnings per share to break even, both falling short compared to analyst predictions. Intel shares declined approximately 5% in after-hours trading following the announcement.

Key Points

- Intel forecasts first-quarter revenue of $11.7 billion to $12.7 billion, below the analyst consensus of $12.51 billion.

- The company expects adjusted earnings per share to break even, missing the 5 cents per share analysts anticipated.

- Supply constraints and low yields on its advanced 18A manufacturing technology chips are creating margin pressures.

- High-profile investments from Nvidia, SoftBank, and U.S. government indicate strong investor confidence in Intel’s turnaround strategy led by CEO Tan, focusing on cost-cutting and product roadmap renewal.

Investor hopes have been high on the potential for rapid expansion of data centers by major technology firms to bolster their AI capabilities, which was expected to fuel sales of Intel's server chips operating alongside Nvidia’s prominent graphics processing units (GPU). However, Intel has been grappling with supply chain bottlenecks as it aims to meet this growing demand.

Following several years of strategic missteps that left the company struggling in the AI chip sector and draining financial resources, CEO Pat Gelsinger’s successor, Tan, has initiated a turnaround plan focusing on cost reduction, organizational streamlining, and a renewed product development roadmap. This has garnered significant investor confidence, reflected by high-profile investments throughout the past year, including Nvidia’s $5 billion injection, SoftBank’s $2 billion investment, and a stake acquired by the U.S. government.

Tan has also chosen to significantly scale back previous ambitions for contract manufacturing that were pursued by his predecessor, aiming to strengthen Intel's financial position after extensive capital-intensive projects adversely affected profit margins.

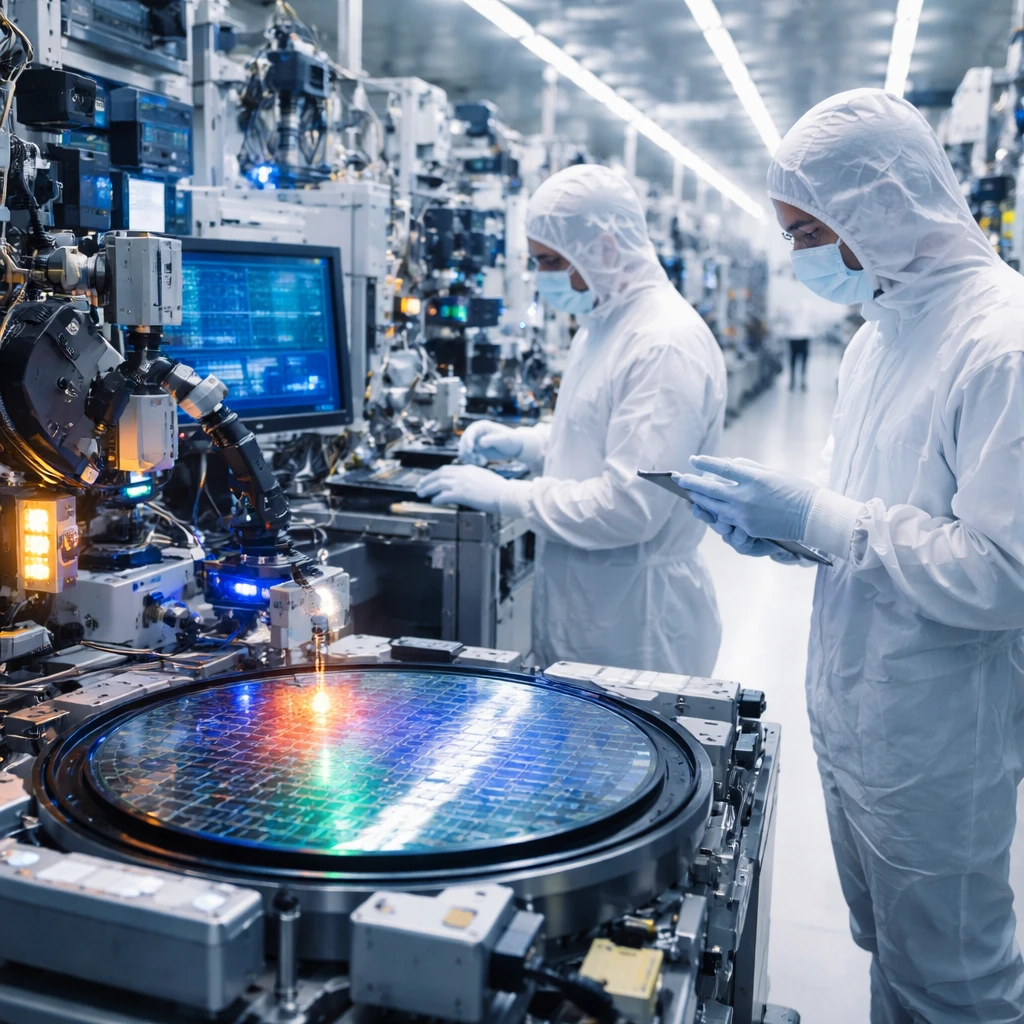

Intel’s stock price experienced a steep decline exceeding 60% in 2024 but rebounded strongly in 2025 with an 84% increase, outperforming the semiconductor sector index gain of 42%. Furthermore, Intel shares have risen over 40% so far in the current month. The company recently commenced the shipment of its new "Panther Lake" PC processors, the first products produced using its critical 18A manufacturing technology. Analysts had anticipated that the scale-up of this production would exert margin pressure.

Reports have indicated that only a small fraction of the chips fabricated via the 18A process have met quality standards for customer delivery. Intel has stated that its chip yields—meaning the number of functional chips per silicon wafer—are improving on a monthly basis. These yield challenges typically impose consistent downward pressure on margins.

Concurrently, a global shortage of memory chips has elevated prices in this segment and increased costs for personal computers, a key market for Intel.

David Zinsner, Intel’s Chief Financial Officer, commented on the supply situation, noting that the company successfully navigated broad industry supply shortages and expects its available inventory to be at its lowest level during the first quarter, with improvements anticipated from the second quarter onward.

Intel continues to face competitive pressure and has been steadily losing market share in the PC segment to rivals including AMD and Arm Holdings, whose chip designs are licensed widely.

This outlook and performance underscore both ongoing industry challenges and the operational hurdles Intel must overcome to regain stronger market positioning and financial performance.

Risks

- Supply chain limitations and production yield issues with new 18A technology chips pose significant risks to Intel’s profitability and margin expansion, impacting the semiconductor sector.

- Competitive pressures in the PC market from AMD and Arm Holdings hamper Intel’s ability to regain market share, affecting the broader personal computing industry.

- Global memory chip shortages have increased component costs, contributing to higher prices for PCs and impacting demand, thereby affecting Intel’s revenue streams in the consumer electronics sector.