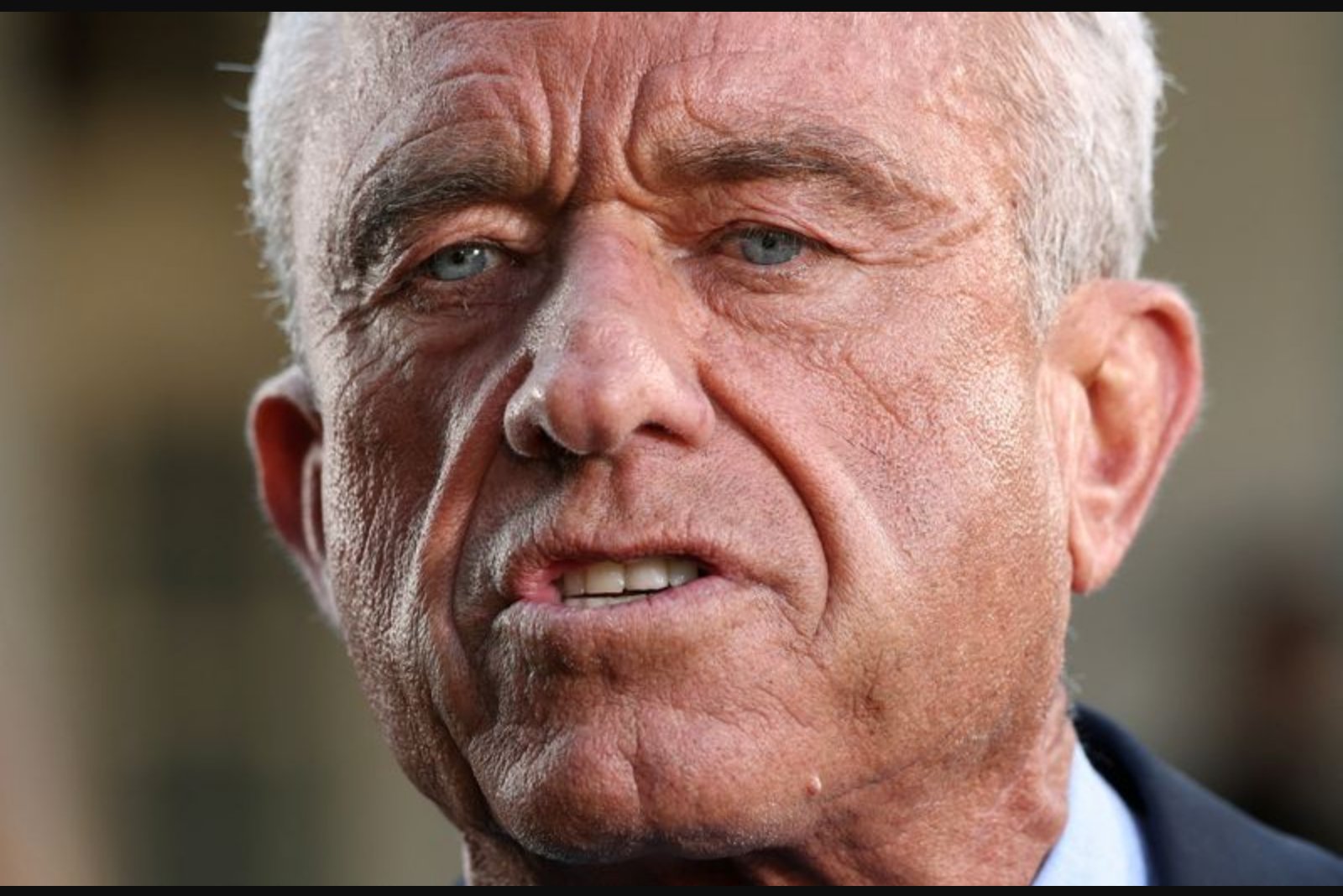

When Robert F. Kennedy Jr. assumed the role of U.S. health secretary last February, he made a high-profile plea to food companies to phase out artificial dyes. The request aligned with the priorities of the “Make America Healthy Again” movement that has supported him, and it prompted responses across the industry. Nearly a year on, however, brightly colored products using synthetic dyes remain common on store shelves, from salad dressings to breakfast cereals and sports drinks.

A review of 15 of the largest U.S. food makers shows a patchwork of responses. Two companies - soup maker The Campbell’s Co and Switzerland-based Nestle - have pledged to eliminate artificial colors before the end of 2026, matching the initial timeline proposed by the Department of Health and Human Services under the secretary's direction. Seven others, including Jell-O marketer Kraft Heinz and Conagra Brands, have announced plans to remove the dyes by the end of 2027. Six firms, among them Oreo-maker Mondelez and Coca-Cola, have not committed to dates; some of these companies are nevertheless introducing dye-free product lines or saying they are working on reformulations without setting a firm deadline.

The health department noted that almost 40% of the packaged U.S. food and beverage supply has publicly pledged to remove artificial colors in the near term. A spokesperson for the department also said it requested, and the industry largely agreed to, phasing the dyes out of school foods by the upcoming school year and from all foods starting in 2027.

Why the slow pace?

Manufacturers that are moving more slowly point to practical obstacles: higher costs, limited availability of natural color sources and other logistical headaches. Conagra Brands, which produces Duncan Hines baking mixes, has experimented with vegetables such as beets as replacements for Red 40 in its red velvet cake mix but has not yet completed the switch. The company is assessing how natural alternatives would affect retail pricing.

"Something like red velvet cake, it needs to be red, so we’re not going to sell gray velvet cake," Conagra CEO Sean Connolly said in an interview. "We use beets as an alternative and the issue there on some colors is 'Will there be a sufficient supply? If supply gets pinched, will it drive up the cost?'"

Red 40 is widely used in the United States and carries warning labels in the United Kingdom and European Union. But on a federal level in the U.S., compliance with Kennedy’s request is voluntary, leaving companies with discretion over timing and scope of reformulation.

Market and consumer forces

Companies that are reformulating say they are responding partly to consumer demand for products with fewer artificial additives. Consumer advocates and some policymakers argue that synthetic dyes worsen attention-deficit hyperactivity disorder symptoms and other behavioral issues in children - a line of concern the health secretary has echoed. Scientific consensus on the health impacts is not settled and, according to the material provided, more research is needed.

A study published last fall in the Journal of the Academy of Nutrition and Dietetics found that foods containing artificial dyes had on average significantly more sugar than foods without those additives, while also showing lower levels of sodium and saturated fat. The study additionally reported that more than one-quarter of top food categories marketed to children, such as pre-prepared meals and baked goods, contained synthetic dyes, compared with just 11% in other categories of packaged products.

Public-health voices warn that removing dyes may risk sales at a time when consumers are sensitive to price increases and are trimming purchases. Marion Nestle, professor emerita of health, nutrition and food studies at New York University, said food companies have tested dye-free variants in the past and faced sales declines. "These experiments have been done, and the results are not pretty for the food companies," she said. "Sales go down, and stockholders don’t like that."

General Mills provides a well-known example. In 2015 the company pledged to replace artificial colors in cereals such as Trix with hues derived from radishes, purple carrots and turmeric. However, consumer backlash prompted a reintroduction of the artificially colored "Classic Trix" in 2017, and the earlier dye-free alternative was shelved. The company has since renewed its commitment, promising to remove dyes from its cereals by this summer and from all products by the end of 2027. General Mills did not respond to a request for comment for the material used here.

Retailers and specific product examples

Walmart’s Sam’s Club began removing artificial colors from all of its private-label products in 2022. The retailer said removing dyes from items such as cake icing and sports drinks posed some of the greatest challenges. As a result, some previously vivid blue Member’s Mark sports drinks now appear purplish.

PepsiCo has not set a company-wide deadline to eliminate artificial colors but has introduced dye-free alternatives. Ian Puddephat, PepsiCo’s vice president of ingredients in foods research and development, said supply constraints complicate sourcing natural colors, which usually come from fruits, vegetables or algae. He noted that finding a natural blue for Quaker brands, which include Cap’n Crunch cereal, is "particularly difficult," with algae being the typical source.

PepsiCo is planning to launch a low-sugar Gatorade this spring that will use vegetable-derived coloring to maintain a bright hue, while also continuing to sell the original formulae that contain artificial colors. The company has also brought out snacks such as Doritos and Cheetos Simply NKD, which do not use artificial colors and are noticeably less orange than their mainstream counterparts.

Danone observed that some consumers will buy products stripped of their artificial color if the taste remains the same. The company is introducing Light & Fit key lime yogurt without Blue No. 1 in February, according to Susan Zaripheh, chief research and innovation officer for Danone U.S. & Canada.

Regulatory patchwork and industry response

Although there is no federal requirement forcing manufacturers to remove artificial dyes, states have begun to act. According to a trade group representing food companies, 151 bills affecting packaged food were proposed last year across 40 states. In 2025, ten states including Arizona and Utah passed laws banning the use of certain food additives, primarily within school lunch programs; some of those laws have begun to take effect this year.

Against this backdrop of varying state-level rules, a trade group called Americans For Ingredient Transparency - which counts PepsiCo, Kraft Heinz and General Mills among its backers - is advocating for a single federal standard on ingredient disclosure and regulation, rather than multiple, differing state mandates that would complicate compliance.

On the international front, the International Association of Color Manufacturers has observed that the European Union often approves some naturally derived colors more quickly than the United States, in part because those colors are classified as a type of food rather than as additives, which can facilitate manufacturers’ transitions away from synthetic dyes.

Where the sector stands

The cumulative picture is one of uneven progress. Several major food companies have committed to phased removal of artificial colors, signaling material shifts for segments of the packaged-food market. Others are piloting dye-free SKUs while withholding comprehensive timelines. Supply-chain questions, potential cost pass-throughs to consumers and fears of sales decline are driving caution.

At the same time, emerging state laws and public demand for fewer artificial ingredients are increasing pressure on the sector. School food programs have become a focal point for near-term change, with industry and regulators aligning in some instances to phase dyes out of meals served to children.

Ultimately, whether the industry accelerates or stalls further will hinge on the interplay between consumer acceptance of less vibrant products, the availability and price of natural colorants, and how policymakers at state and federal levels elect to regulate additives and ingredient standards.