Jan 29 - European equities staged a modest recovery on Thursday as firmer commodity prices - notably oil and precious metals - supported gains in resource-related sectors, tempering fallout from weaker luxury earnings reported the prior day.

The pan-European STOXX 600 was up 0.2% as of 0803 GMT, reversing part of a 0.8% drop seen the day before. Investors concerned about the macroeconomic backdrop sought safe-haven assets, sending gold higher and lifting silver to fresh peaks as some market participants looked for less expensive alternatives to the yellow metal.

Those moves in the metals complex benefited mining companies, with the miners segment advancing 2.9% on Thursday. Energy stocks also saw positive momentum, rising 1.3% as oil prices climbed amid reports that the U.S. may consider military action against major Middle Eastern producer Iran - a development that fed supply-concern narratives and underpinned the sector.

Corporate news remained prominent on an otherwise busy earnings calendar. Market participants continue to scrutinize U.S. Big Tech results for indications about the direction of artificial intelligence investments, while European corporate reports are being watched closely for evidence that firms can maintain financial resilience in an environment marked by elevated trade uncertainty.

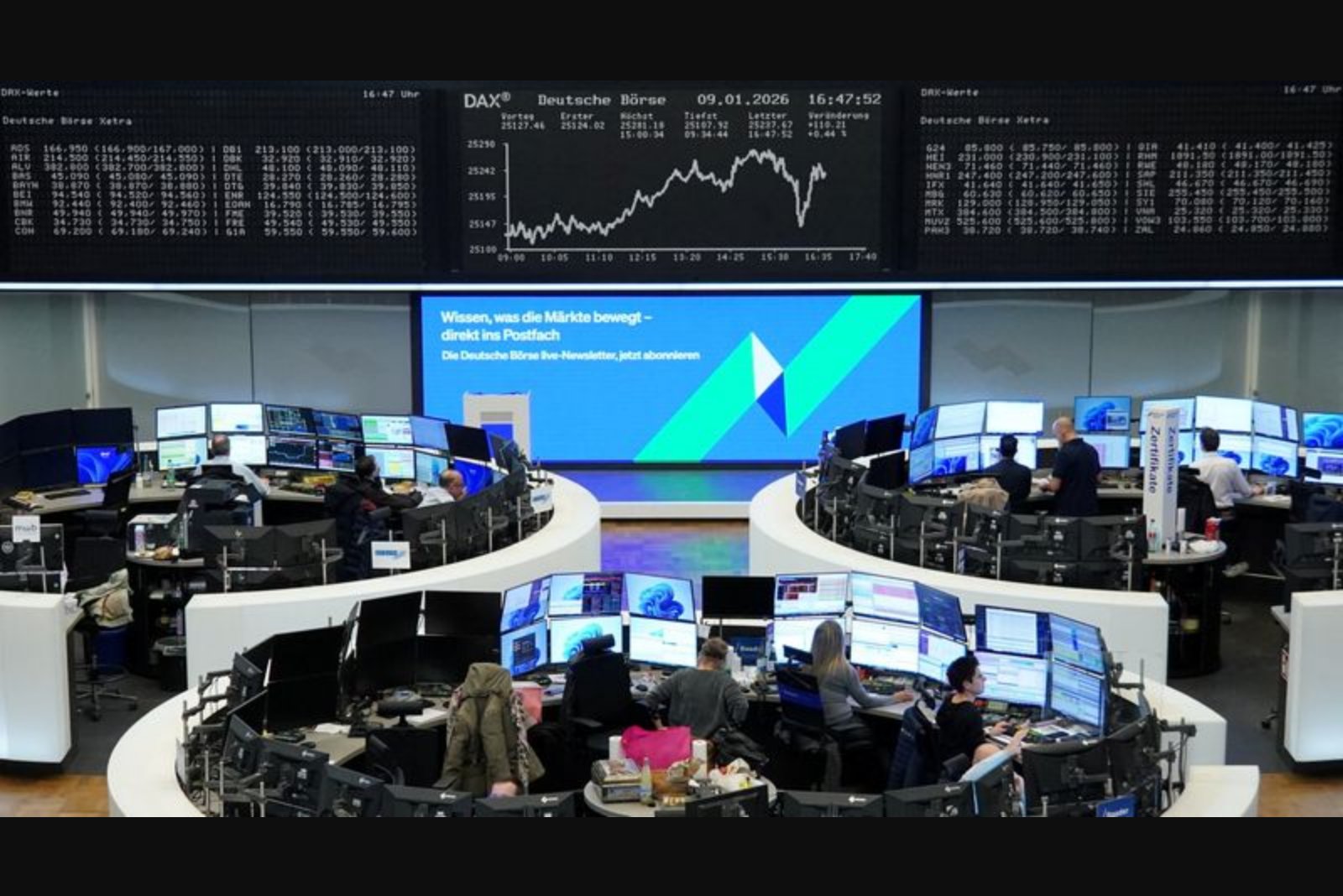

Company-specific moves weighed on parts of the market. Germany-based enterprise software group SAP plunged 11.5% after reporting fourth-quarter revenue that matched market expectations. Deutsche Bank shares fell 2% despite the bank posting its largest annual profit since 2007. The German benchmark DAX slipped 0.9% on the day. Separately, Germany - the euro zone's largest economy - revised down its growth forecasts for this year and the next, citing heightened uncertainty around global trade and a weaker-than-expected transmission of economic and fiscal measures.

Alongside market coverage, promotional material aimed at retail investors also circulated, highlighting tools that evaluate securities such as DBKGn using a wide set of financial metrics. One such tool claimed to use more than 100 metrics to generate stock ideas and cited notable past performers including Super Micro Computer (+185%) and AppLovin (+157%), while advertising a New Year sale offering 55% off.

Overall, market direction on Thursday reflected a mix of commodity-driven sector leadership and isolated company-specific weakness, set against a backdrop of macroeconomic uncertainty and a full slate of corporate results that traders are parsing for guidance on profitability and resilience.