European automakers have gained a meaningful policy shift in India after New Delhi and Brussels agreed to a trade package that cuts tariffs on certain imported cars from as high as 110% down to 40%. While the adjustment represents the biggest easing of access to date for makers such as Volkswagen and Renault, industry observers warn the market remains difficult to crack because domestic brands and Asian players already control the volume segments.

The two sides are set to sign the deal on Tuesday. It reduces levies on a limited set of cars from the 27-nation bloc that carry an import price above 15,000 euros. Sources briefed on the negotiations say that those duties will, in time, be reduced further to 10% for the covered models.

For European manufacturers, the near-term benefit is clearest in the premium segment. With U.S. import tariffs weighing on margins and intense price competition in China squeezing earnings, some carmakers have been scanning for growth elsewhere. A cut to 40% would make higher-end European cars relatively more competitive in India, analysts say, because many of those marques currently import much of their line-up as completely built units.

"It’s a start. When we talk about exports from Europe, it’s only about premium cars. For the volume sector it is difficult," said Stefan Bratzel of German auto research group CAM. Bratzel highlighted that brands such as Suzuki and Hyundai have developed a better fit for Indian buyers, with products tailored to local demand. "In India it’s about cheap, reliable, stable cars. The Volkswagen Group cars have been too expensive. Suzuki has benefited from the kei cars which are highly popular in Japan," he added.

The structural challenge is visible in market share statistics. Indian automobile industry data show European carmakers control under a 3% share of the domestic market. By contrast, Suzuki Motor and local marques Mahindra and Tata together account for roughly two-thirds of sales. India’s market registers about 4.4 million vehicles a year, making it the world’s third-largest auto industry by production scale, but it has historically been highly protected by import levies that ranged from 70% to 110%.

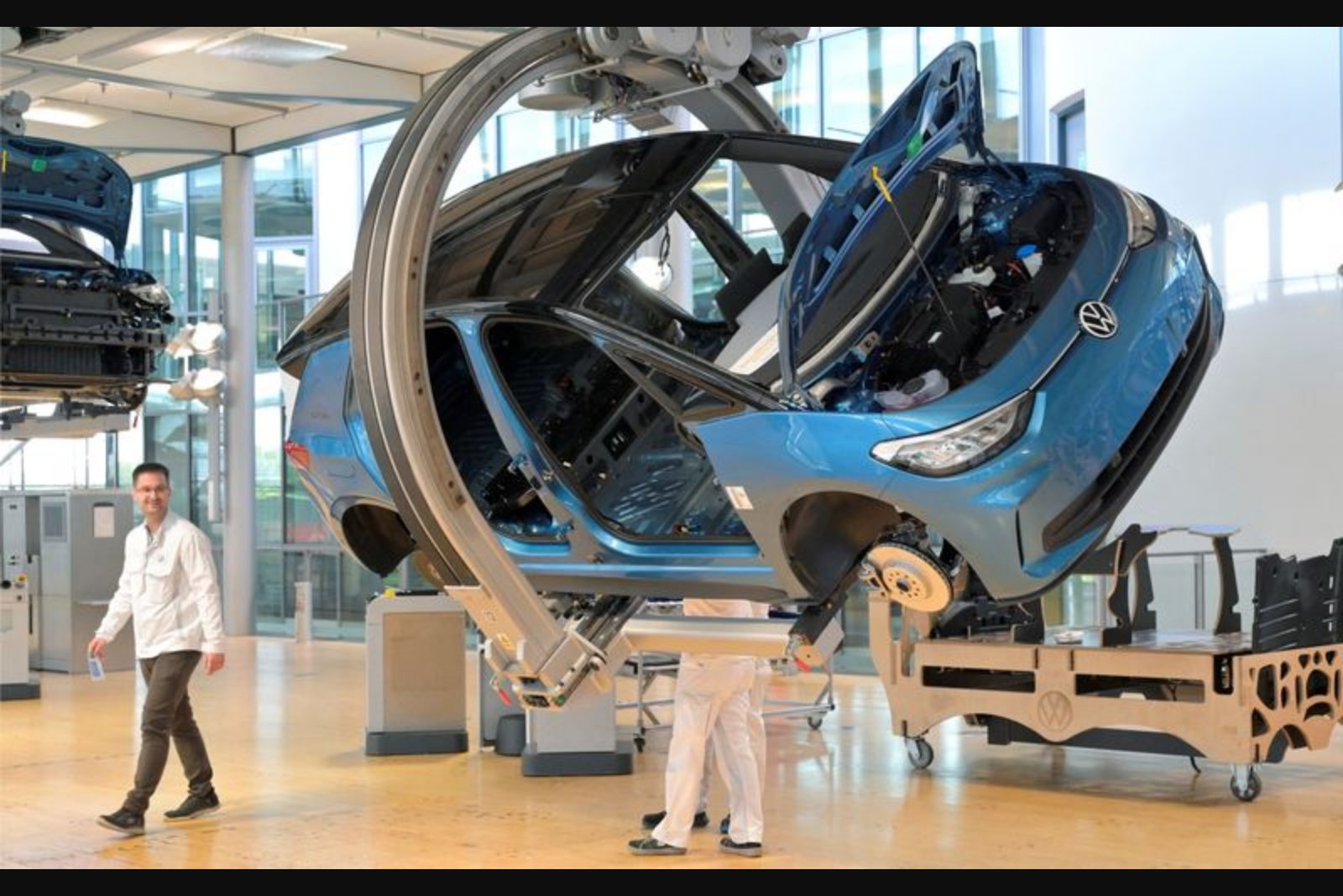

A Volkswagen Group spokesperson, noting the strategic importance of India, said the country is a dynamically growing market and that the group would assess the business impact of the trade deal. The Volkswagen Group includes brands such as Audi, Porsche and Skoda. Mercedes-Benz stated that the reduction in tariffs should benefit carmakers from both regions. BMW declined to comment.

Fabio Hoelscher of Warburg Research said the 40% tariff threshold would be particularly beneficial to luxury European marques. "The biggest winners versus before are brands like Porsche who import their entire portfolio as completely built units," he said, while also cautioning that the tariff change would take time to be reflected in profits. Hoelscher added that ongoing U.S. uncertainty would temper investor response, even as medium-term potential for local manufacturing expansion exists.

The Indian market also presents substantial growth potential. Forecasts cited in industry commentary anticipate domestic sales could expand to roughly 6 million vehicles a year by 2030, an increase of over a third from current volumes. This growth prospect, combined with protection that has historically limited imports, helps explain why some automakers view India as the next frontier after pressure from U.S. tariffs and fierce Chinese price competition.

Prime Minister Narendra Modi’s government has agreed to limit the reduced tariff treatment to a subset of imports from the EU that have an import price exceeding 15,000 euros, according to sources familiar with the talks. Those cars will see the rate cut to 40%, with a planned further drop to 10% over time for the limited category.

ING Research analyst Rico Luman described the deal as potentially transforming for European carmakers over the medium term. "The Indian car market is still in the early stages of maturing, which means there is substantial growth potential," Luman said, calling the trade package "a significant opportunity for European car makers."

Despite the new tariff framework, barriers remain for volume-oriented European models. Local manufacturers and Asian rivals, notably Suzuki and Hyundai, dominate the segments that drive unit sales. Small, inexpensive models such as the Maruti Suzuki Wagon R - part of the kei car tradition of compact, affordable vehicles smaller than a Mini Cooper - continue to be highly popular and difficult for outsiders to displace.

For European firms the road ahead will likely involve a two-track approach: leveraging the tariff relief to sell more fully built premium vehicles in India while considering medium-term investment in local production to move into the volume segments. Analysts note, however, that any shift toward expanded local manufacturing and meaningful market share gains for European volume models would likely take time to materialize.

Key Points

- Tariffs on selected EU-made cars will fall to 40% from as high as 110%, and may be reduced to 10% over time for limited models priced above 15,000 euros.

- European carmakers currently hold under 3% of India’s passenger car market, with Suzuki, Mahindra and Tata controlling about two-thirds of sales.

- The tariff cut is likely to help premium imported cars more than volume models, creating a possible avenue for luxury brands to increase competitiveness.

Risks and Uncertainties

- Local competition and entrenched preferences for low-cost, reliable small cars limit near-term prospects for European volume models - impacting the mass-market auto sector.

- Profitability gains for European automakers may be slow to appear because the benefits for imports depend on implementation timing and market response, affecting automotive sector earnings.

- Ongoing external trade friction, such as U.S. tariff uncertainty, could weigh on investor sentiment and temper share gains even if sales in India improve - influencing capital markets and auto stock performance.