When President Donald Trump returned to the White House a year ago with a renewed "America First" agenda, observers warned of risks for China's already slow-growing economy. Instead, Beijing has recalibrated its external economic posture - mending ties with a range of trading partners, deepening commercial links and leveraging financial-market measures to post exceptionally large external surpluses.

Analysts point to tangible results. China registered a record trade surplus of $1.2 trillion in 2025, and monthly foreign exchange inflows peaked at roughly $100 billion, the largest level on record. The yuan's footprint in international payments and lending has widened materially, a sign of growing use beyond domestic borders.

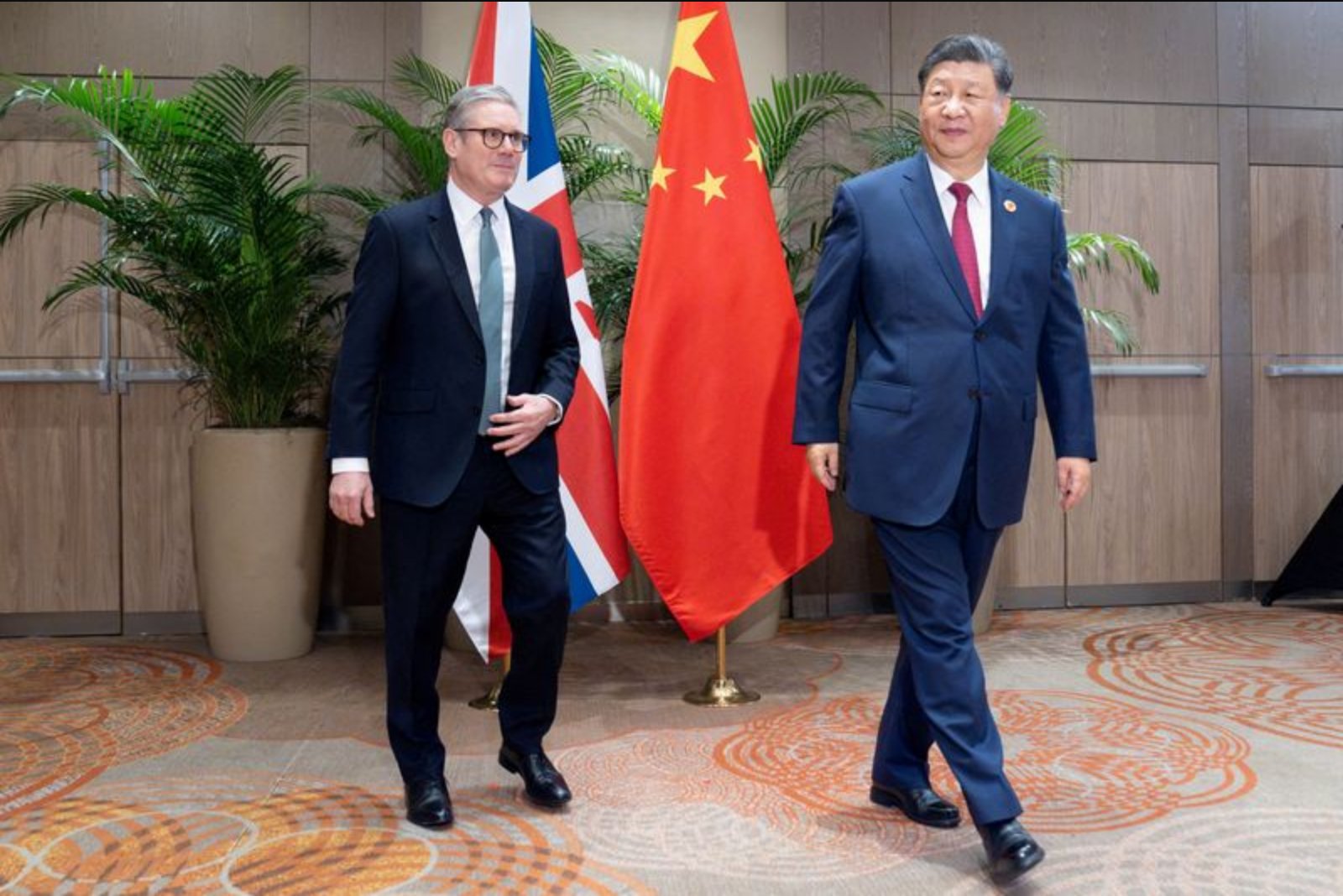

Diplomatic outreach and leadership visits

Beijing has welcomed a series of high-profile visits in recent weeks. British Prime Minister Keir Starmer arrived in China on Wednesday evening for a four-day trip - the first by a British prime minister since 2018 - as Beijing seeks to revive business ties that have cooled. The visit follows a trip earlier in the month by Canadian Prime Minister Mark Carney, the first Canadian prime ministerial visit to Beijing since 2017. During that visit, the two countries inked an economic agreement aimed at reducing trade barriers and formalising a new strategic relationship, with Carney describing China as "a more predictable and reliable partner."

Those bilateral advances reflect a broader geopolitical shift in which a number of countries are hedging against greater uncertainty from the United States and exploring deeper engagement with China. "I think China has done a good job and rightly so to position itself as the reliable and stable trade partner," said Aleksandar Tomic, an economics professor at Boston College. Derrick Irwin, co-head of intrinsic emerging markets equity at Allspring Global Investments, said China is offering predictability at a time when the U.S. is viewed as less certain: "They basically said, look, you’ve got a massive trade partner in the U.S. that’s become a little more uncertain. We can offer predictability and certainty. And I think that’s very fair."

Trade realignment and new agreements

Partnerships between other major players also reflect a move to diversify trade ties. India and the European Union concluded a long-delayed trade agreement that will slash tariffs on most goods and could substantially increase two-way trade, with the deal expected to potentially double European exports to India by 2032. Such arrangements underscore a wider trend of governments seeking to reduce dependence on a single market amid geopolitical friction.

At the same time, Beijing has responded to a harsher trade environment with a combination of export redirection and domestic support measures. After President Trump reintroduced a confrontational trade stance in January 2025, tensions have intensified across trade and technology fronts. Tariffs on Chinese goods were raised to over 100% in April before a partial rollback that produced a temporary truce. In response, China pivoted toward non-U.S. markets and enacted policy support for private firms and market stability.

The impact is reflected in trade flows. Chinese shipments to the United States fell 20% in 2025, while exports to other regions climbed: up 25.8% to Africa, 7.4% to Latin America, 13.4% to Southeast Asia and 8.4% to the European Union over the same period.

Domestic pressures and the growth outcome

Despite these external shifts, China has continued to confront notable domestic headwinds. Weak household consumption and a protracted slump in the property sector have exerted deflationary pressure at home. Even so, the economy met the government target of 5% growth in 2025.

Policymakers have pressed forward with measures to attract foreign investors and open sectors previously more restricted. Pilot programmes in Beijing, Shanghai and other regions aim to widen market access in services such as telecoms, healthcare and education, reflecting a policy emphasis on bolstering long-term foreign participation in the domestic economy.

Financial flows, markets and the yuan

Financial indicators have mirrored the commercial shift. December saw the largest monthly foreign exchange inflows on record - $100.1 billion, according to bank settlement data from China's foreign exchange regulator - while official foreign exchange reserves rose to a 10-year high of $3.36 trillion. The Shanghai stock index climbed 27% over the past year, outpacing U.S. equities, while market turnover reached record levels and the yuan's usage internationally expanded.

Bankers with knowledge of the matter say a perceived erosion of the dollar's appeal - driven in part by what they describe as erratic U.S. trade and diplomatic policy - has accelerated Beijing's push to internationalise the renminbi. Major global banks are reportedly enhancing yuan liquidity in offshore hubs and creating frameworks to speed up yuan-denominated payment settlements along trade corridors linking China with Southeast Asia, the Middle East and Europe.

A banker with a global institution that operates in China described previous cycles of push and pull around yuan internationalisation: "We have seen quite a few cycles of China trying to internationalise yuan and then pulling back. This time it s different ... Trump policies are very conducive for boosting yuan usage." Latest figures from the People's Bank of China and the State Administration of Foreign Exchange indicate that more than half of China's cross-border transactions are now settled in yuan - up from almost none 15 years ago - and that nearly half of China's overseas bank lending is now denominated in renminbi.

Voices of caution

Not all observers see the pivot to a friendlier, outward-facing China as a full remedy to geopolitical unease. Patricia Kim, a foreign policy fellow at the Brookings Institution in Washington, warned that distrust of the United States does not automatically translate into confidence in Beijing. She noted that many countries remain wary of China's trade practices, its history of economic coercion and unresolved maritime and historical disputes. "In the current moment, China may appear more restrained or pragmatic when compared with the Trump administration's extreme rhetoric and actions. But Beijing's actual behaviour has not been especially reassuring," she said.

Implications for markets and policy

China's strategy to broaden its external economic partnerships, expand market access at home and push the yuan's international role has implications across trade, finance and selected service sectors. Officials and market participants will likely monitor whether the increased use of the yuan and intensified outreach by Beijing persist if global political winds shift again, and whether partner countries sustain deepened ties despite lingering concerns about China's economic and strategic behaviour.

For now, China is presenting itself as a large, predictable trading partner backed by a $20 trillion economy and $45 trillion in stock and bond markets, a profile that supporters say offers stability in a more uncertain global environment.