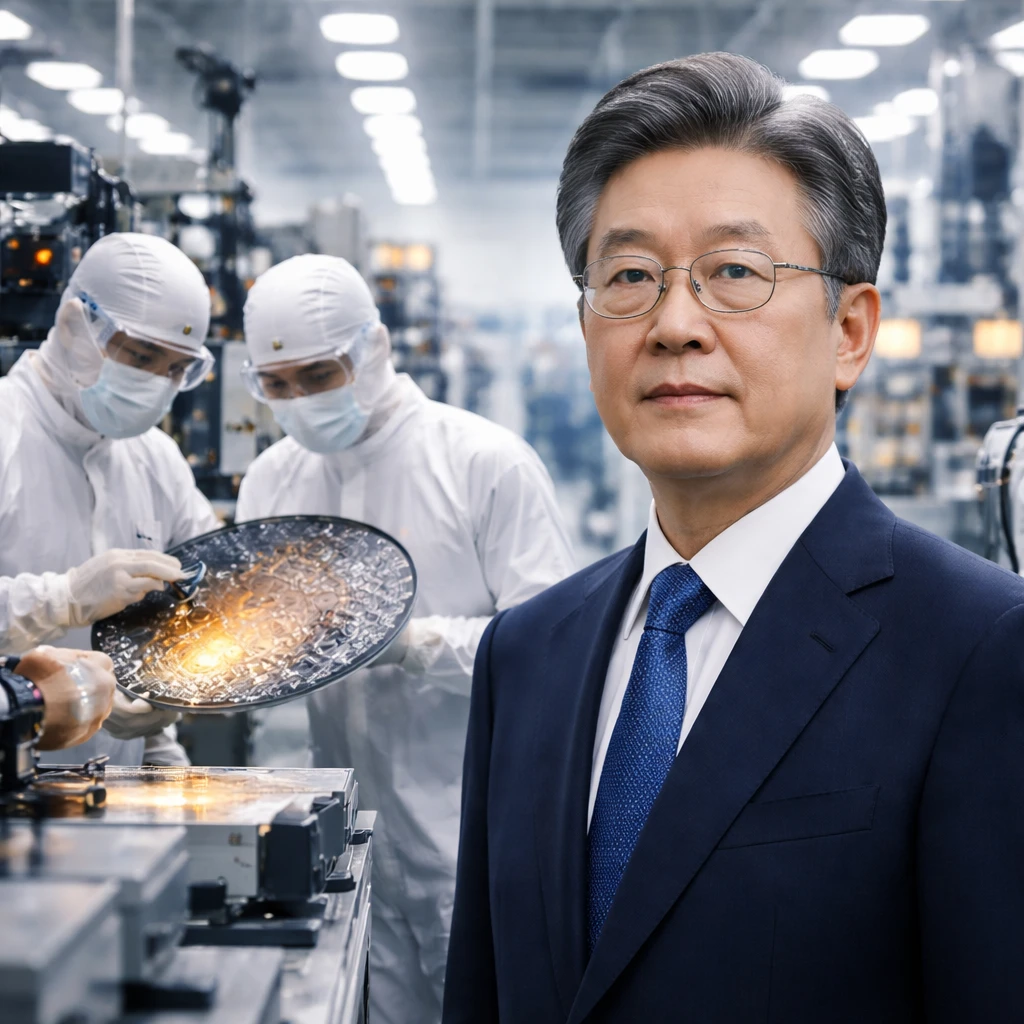

South Korean President Lee Jae Myung provided remarks on January 21 regarding the potential effects of higher US tariffs on semiconductor imports proposed by Washington. He suggested that such duties would tend to raise prices within the US market rather than discouraging imports or production overseas. Lee emphasized the significant control exerted by South Korean and Taiwanese chip manufacturers over the global semiconductor market, noting that imposing a tariff as high as 100% could lead to a considerable price increase for chip products in the United States.

"They have a monopoly of 80 to 90% ... so most of it is likely to be passed on to US prices," Lee stated during a news conference. Key players like South Korea's Samsung Electronics and SK Hynix, in addition to Taiwan's TSMC, hold leading positions in the production of memory chips and contract chip manufacturing, respectively.

President Lee also indicated that South Korea benefits from existing safeguards under a trade agreement with the US, designed to prevent its chipmakers from being disadvantaged relative to Taiwanese or other international competitors should these tariffs be implemented. Reflecting South Korea's robust export profile, the country recorded a record $709.4 billion in exports for 2025, marking a 3.8% increase compared to the previous year. Semiconductor exports surged by 22%, driven by intensified demand for artificial intelligence technology investments. While chip exports to the US represented roughly 8% of the total $173.4 billion semiconductor exports, China remained South Korea's largest destination, followed by Taiwan and Vietnam.

Regarding currency concerns, President Lee addressed the recent depreciation of South Korea's won. He indicated expectations from South Korean officials that the currency would strengthen to approximately 1,400 won per US dollar within the next month or two. However, he cautioned that domestic policy mechanisms alone may not suffice to stabilize foreign exchange dynamics, pointing out correlations with weakness in Japan's yen. Despite this, Lee asserted that the won was performing relatively better in comparison.

Turning to financial markets, Lee highlighted the domestic stock market's exceptional performance, noting it was the top global performer last year with a 76% increase. Nonetheless, he described the market as still undervalued.

On diplomatic matters, Lee outlined his pursuit of resuming dialogue between North Korea and the United States. He advocated a pragmatic strategy geared toward engagement, aiming to halt North Korea's nuclear material production and prevent nuclear exports and intercontinental ballistic missile development. He observed that while efforts to fully denuclearize the North appear unlikely, halting further advancements would offer strategic benefits. According to Lee, North Korea is estimated to produce sufficient nuclear material for 10 to 20 nuclear weapons annually. The North has yet to respond to outreach from both Lee and US President Donald Trump, with talks stalled since 2019 over disagreements regarding sanctions relief and nuclear dismantlement.

In the domestic political arena, Lee stressed the necessity of maintaining strict separation between church and state, highlighting the importance of stringent consequences for breaches. He referenced current parliamentary discussions surrounding the establishment of a special prosecutor to investigate the influence of religious organizations like the Unification Church in politics. The investigation could potentially extend to the Shincheonji Church of Jesus, led by self-proclaimed messiah Lee Man-hee. Additionally, Han Hak-ja, leader of the Unification Church, currently faces trial for alleged attempts to bribe associates of former President Yoon Suk Yeol, allegations Han denies.