RBC Capital has maintained its Outperform rating on Intuitive Surgical (NASDAQ:ISRG) with a price target set at $650.00, following the company’s robust earnings and revenue performance in 2025. Analysts cite the firm’s solid 22.18% revenue growth and favorable positioning for further expansion within the surgical robotics market. While valuations present both opportunities and caution, industry evaluations reflect a complex view on the company’s near- and long-term prospects.

Key Points

- RBC Capital reiterates Outperform rating on Intuitive Surgical with a $650 price target, citing strong 2025 financial results exceeding revenue and EPS expectations.

- The surgical robotics firm achieved 22.18% revenue growth over the last year, with revenue totaling $9.61 billion, reflecting solid market demand and expansion.

- Analysts highlight that robotic surgery remains early in adoption, offering significant potential growth as Intuitive Surgical continues its multi-year trade-in cycle and expands within a procedural market exceeding 20 million cases.

RBC Capital’s positive stance follows the company’s impressive quarterly performance across 2025, with revenue and earnings per share surpassing expectations by roughly 4% and 11%, respectively. The reported annual revenue of $9.61 billion reflects a substantial 22.18% increase over the past year, underscoring Intuitive Surgical’s dominant market presence.

The outlook for 2026 remains optimistic, as RBC Capital anticipates the company will continue to beat early forecasts. This confidence stems from ongoing industry dynamics, including a comprehensive multi-year trade-in cycle expected to sustain sales momentum. Additionally, Intuitive Surgical’s penetration into an addressable market exceeding 20 million procedures presents significant long-term expansion prospects.

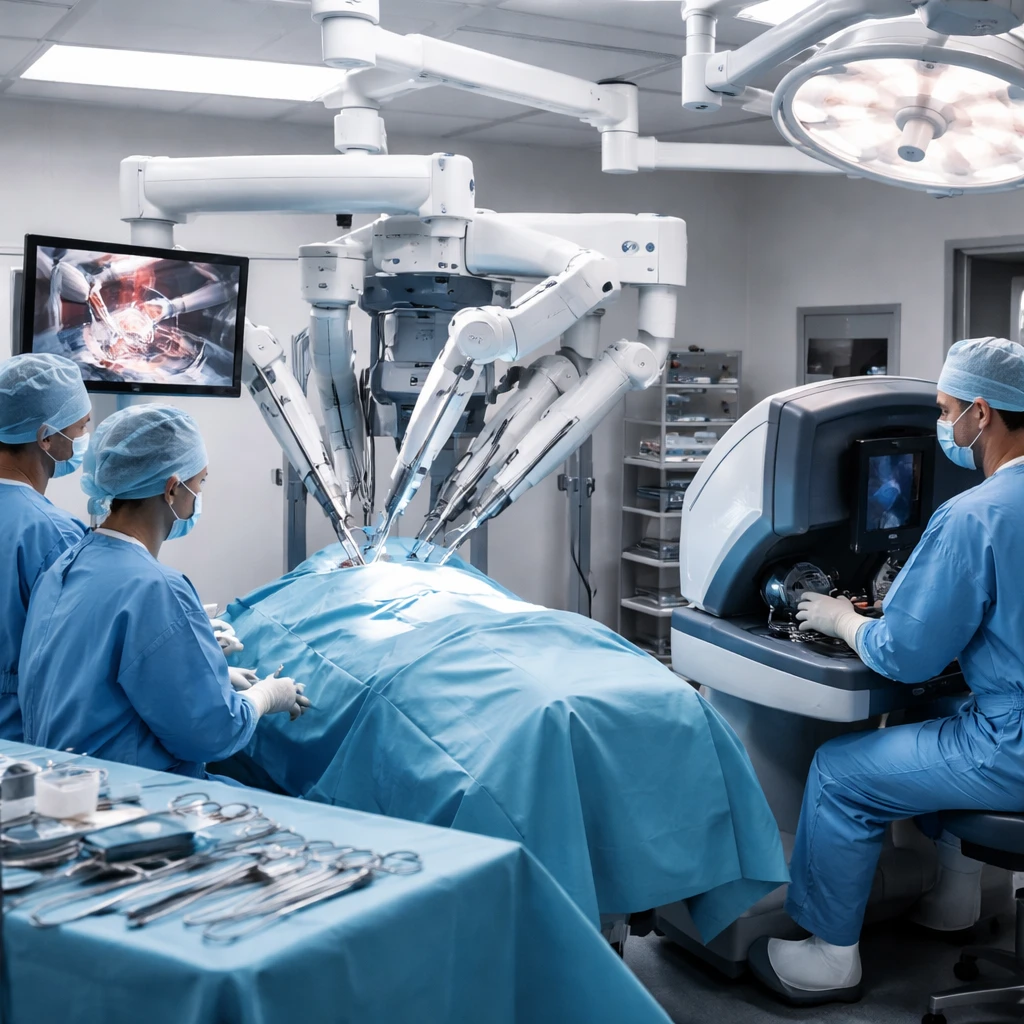

Importantly, the adoption of robotic technology in surgery is still regarded as being in the foundational phase, implying ample room for growth of the da Vinci surgical systems and associated innovations. RBC Capital further notes that despite recent price advances, the current valuation of Intuitive Surgical’s shares remains below its average historical five-year forward price-to-earnings ratio. This discrepancy signals a potential buying opportunity for investors.

Nonetheless, valuation metrics merit careful consideration. InvestingPro data indicates the stock trades at a relatively high price-to-earnings ratio of 69.6, with multiple cautionary signals flagged regarding elevated valuation multiples.

Recent quarterly earnings confirmed strong operational performance. Intuitive Surgical reported fourth-quarter 2025 earnings per share of $2.53, surpassing analyst forecasts of $2.26. Revenue also exceeded expectations, achieving $2.87 billion versus projected $2.75 billion, further consolidating the company's position.

Following these results, analyst responses have been varied. Piper Sandler lifted its price target to $620, praising margin strength, while Raymond James raised its target to $615 citing favorable earnings and margin trends. Contrarily, Evercore ISI adjusted its target downward to $550 despite acknowledging high revenue growth and system deployments. Bernstein SocGen stands out with an ambitious $750 target, emphasizing the company’s solid quarterly performance even while accounting for a charitable donation’s impact on earnings.

These divergent targets illustrate the spectrum of market expectations surrounding Intuitive Surgical’s ongoing performance and valuation considerations. Stakeholders should weigh these perspectives alongside inherent industry risks before making investment decisions.

Overall, Intuitive Surgical’s continuous innovation within the early-stage surgical robotics industry and its demonstrated financial strength contribute to a cautiously optimistic investment profile, with the evolving market landscape demanding vigilant assessment of growth sustainability and valuation levels.

Risks

- High valuation metrics with a current P/E ratio of 69.6 raise concerns about potential overvaluation and market corrections.

- Analyst price targets vary significantly, reflecting uncertainty around sustaining margin and earnings growth, as well as the impact of non-operational factors like charitable donations.

- The relatively nascent stage of robotic surgery adoption implies that future growth depends on broader market acceptance and continuous technological innovation, introducing execution risk for sustained expansion.