KeyBanc has lowered its 12-month price target on Skyworks Solutions (SWKS) to $75 from $105, but the broker retained an Overweight rating on the semiconductor supplier. The move comes as Skyworks continues to trade well below that target, changing hands around $55.93, while offering a 5.08% dividend yield after 12 consecutive annual raises.

The reduction in the price target followed a quarter in which Skyworks exceeded market expectations. In the first fiscal quarter of 2026 the company reported earnings per share of $1.54 versus a consensus forecast of $1.40, and revenue of $1.04 billion compared with an anticipated $1.00 billion. Those results, and second-quarter revenue guidance that topped forecasts, were driven primarily by robust demand tied to the iPhone.

Despite the better-than-expected top- and bottom-line performance, KeyBanc pointed to an outlook for component content in the forthcoming iPhone 18 that is likely to be "roughly" flat on a year-over-year basis. Skyworks has held its share of that content, the analyst noted, but gains tied to Apple’s modem SKU are being offset by product mix effects.

According to KeyBanc's analysis, the observed mix dynamics could reflect either a staggered product launch cadence or a relatively lower share of consumer model builds compared with Pro models. Those mix shifts are presented as possible explanations for why content gains in one area may not translate into higher overall iPhone content for Skyworks.

The investment firm also described itself as "constructive" regarding Skyworks’ planned acquisition of Qorvo, and emphasized that the downward revision in the price target reflected a contraction in market multiples rather than a deterioration in company-specific operating performance.

Skyworks remains profitable on conventional metrics, carrying a price-to-earnings ratio of 18.45. The company also reports a strong liquidity position, with liquid assets exceeding its short-term obligations. Market reaction to the quarterly report was mixed: the stock slipped modestly during regular trading and then posted a small uptick in after-hours trading.

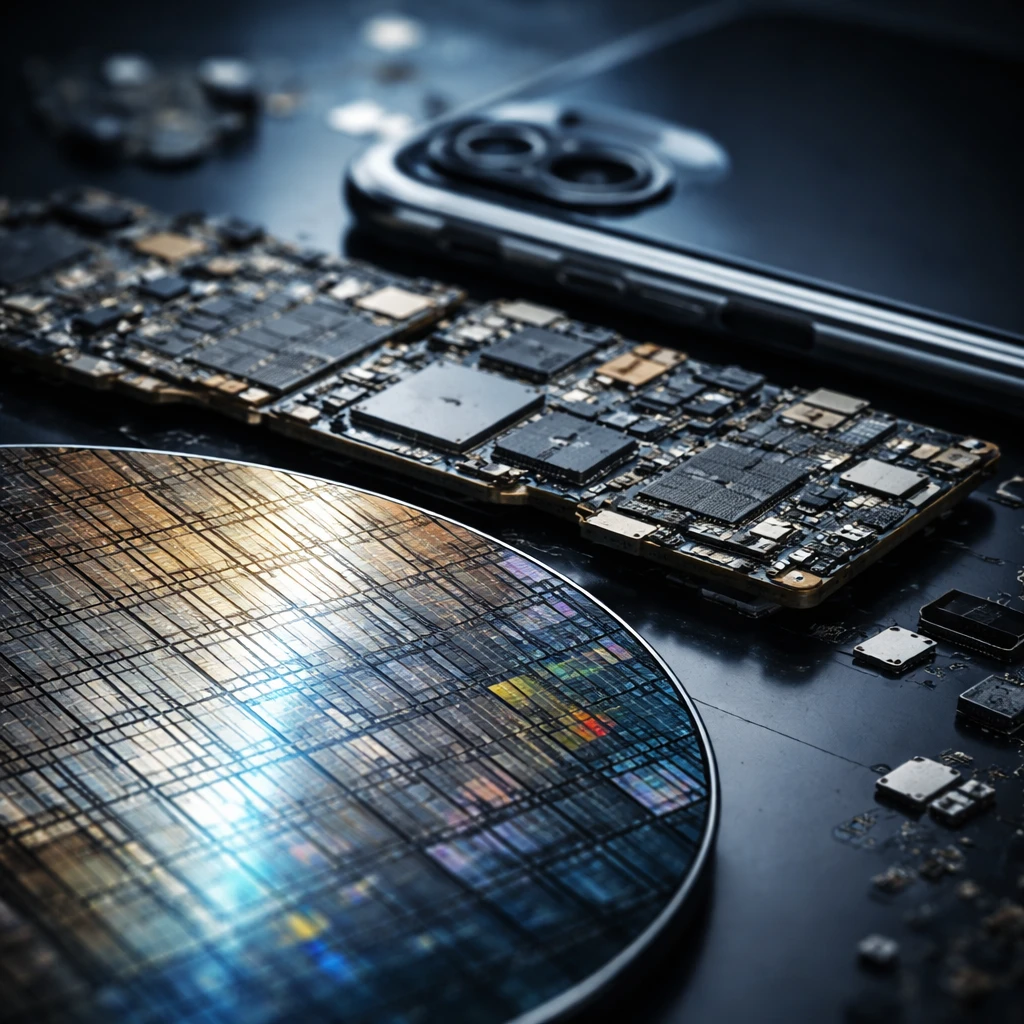

For investors watching the semiconductor and consumer electronics supply chains, the case highlights how demand tied to a single major device - in this instance, the iPhone - can be influenced not just by unit volumes but by per-device component content and product mix. KeyBanc’s adjustment signals sensitivity to market multiple trends even when company fundamentals and near-term demand drivers appear solid.