JPMorgan has increased its 12-month price target on Corning Inc. (NYSE:GLW) to $115.00 from $100.00 while retaining an Overweight rating in the wake of the company’s announcement of a multiyear supply arrangement with Meta valued at up to $6 billion. The stock has climbed roughly 100% over the past six months and is trading near recent highs, at $109.74 and just below its 52-week peak of $113.99.

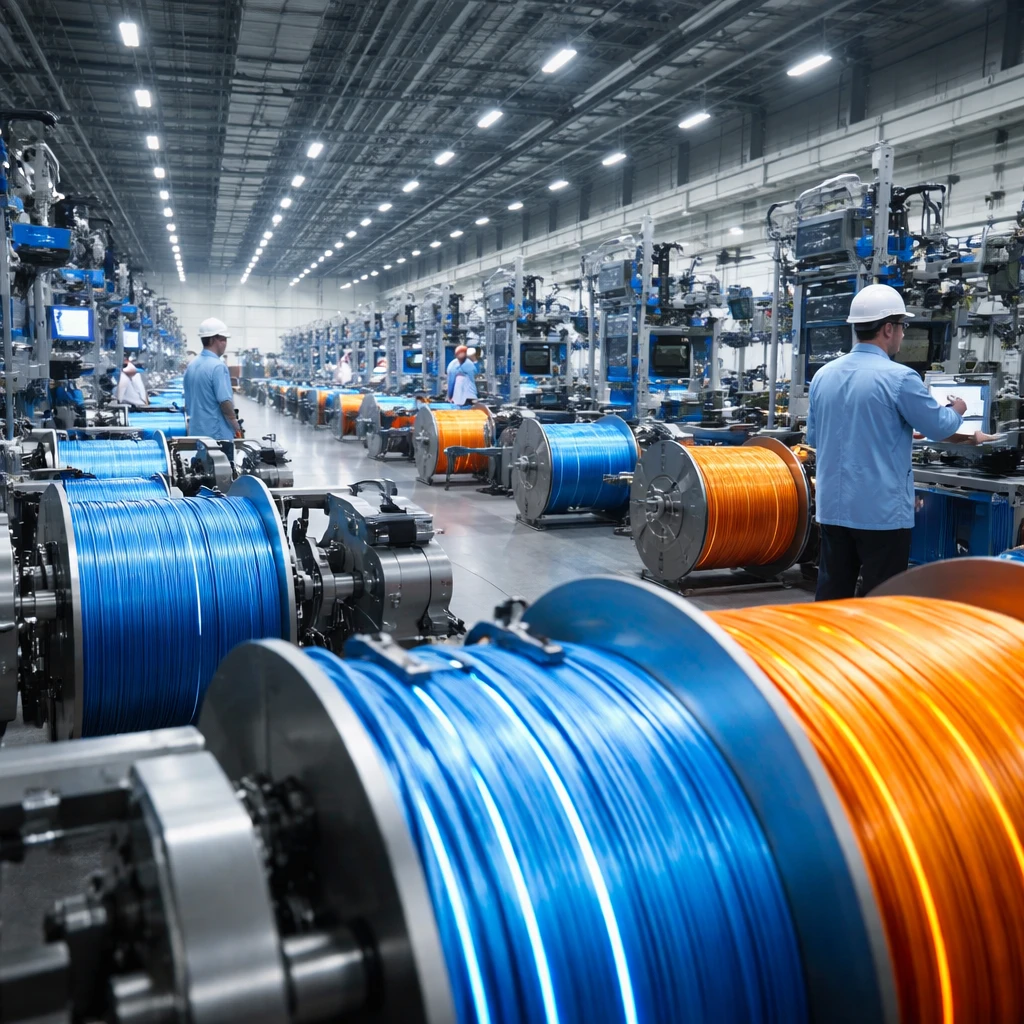

Under the terms disclosed by Corning, the agreement will underwrite Meta’s accelerated buildout of data center infrastructure across the United States and drive incremental investment in Corning’s manufacturing footprint in North Carolina. Plans tied to the deal include the construction of a new optical cable facility in Hickory and expanded capacity across Corning’s existing operations in the state. The company operates in the Electronic Equipment, Instruments & Components industry and carries a market capitalization of $94.09 billion.

JPMorgan analyst Samik Chatterjee characterized the Meta agreement as evidence of strong demand for data center infrastructure equipment, noting that hyperscalers are increasingly making multi-year commitments to secure supply. Chatterjee highlighted Corning’s positioning with its latest generation of optical fiber, cable and connectivity products as a key advantage heading into an expanded build cycle.

Company leadership has also signaled a shift in customer mix. Corning’s CEO, Wendell Weeks, has expressed expectations that hyperscale cloud providers will become the company’s largest customer cohort by 2027, overtaking traditional carriers. Within that framework, Meta was singled out as a potential single largest customer for Corning.

JPMorgan has attempted to quantify the financial impact of the Meta agreement. The firm estimates that annualized revenue tied to the deal could reach roughly $1.5 billion, with the potential to contribute up to $0.50 of incremental earnings power in 2027 and beyond. The bank also noted room for additional upside should Corning capture further business from other hyperscalers, subject to manufacturing capacity constraints.

Despite the upside narrative, valuation metrics indicate that the market is assigning a premium to Corning. The company is trading with a price-to-earnings ratio of 70.45 and an EV/EBITDA multiple of 30.1. Corning has also sustained dividend payments for 19 consecutive years and currently yields 1.02%.

Other sell-side responses to the Meta announcement and Corning’s outlook followed quickly. Wolfe Research raised its price target to $130 and kept an Outperform rating, citing the sizable business opportunity presented by the Meta agreement. Mizuho reiterated an Outperform rating with a $97 price target, noting the potential to spread the $6 billion opportunity over a five-year window. UBS boosted its price target to $109, pointing to strong growth in Corning’s optical segment as data center expansion ramps and forecasting higher sales in 2026 and 2027 after revising growth assumptions upward by about 13% since the third quarter reports from hyperscalers.

The deal illustrates several dynamics relevant to investors and to sectors tied to data center expansion. For Corning, the agreement is a direct commercial win for its optical portfolio and a catalyst for concentrated investment in manufacturing capacity within North Carolina. For the broader market, the transaction underscores sustained demand from hyperscalers for fiber, cable and related connectivity solutions as they accelerate infrastructure spending.

At the same time, the company’s premium valuation and the concentration of revenues toward hyperscale customers are variables market participants will be monitoring as the business scales production and translates incremental top-line gains into earnings.

Overall, analysts view the Meta agreement as a meaningful growth opportunity for Corning, while also flagging valuation and operational considerations tied to capacity and customer mix as the company implements the planned manufacturing expansions.