Jones Trading has initiated coverage of Rein Therapeutics (NASDAQ:RNTX) and assigned a Buy rating with a price target of $8.00. That target represents a material potential increase from the stock's prevailing market quote of $1.43. Rein Therapeutics is a small-cap biotechnology company with an approximate market capitalization of $37.6 million and has recorded share appreciation of more than 31% year-to-date.

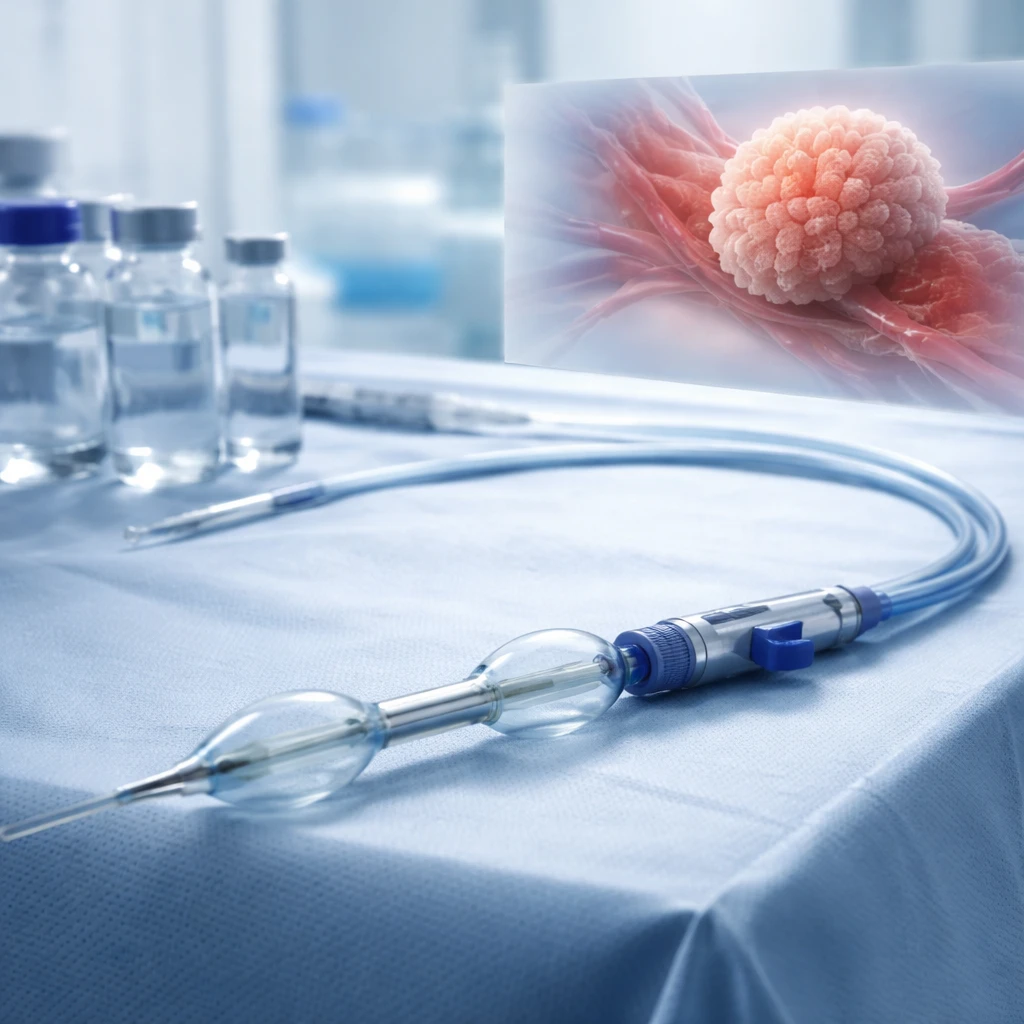

The brokerage's report centers on Rein Therapeutics' commercial-stage medical device, RenovoCath, an FDA-cleared dual-balloon catheter. The device is engineered to enhance delivery of anti-cancer agents into tumors that are poorly vascularized - described in the report as hypovascular tumors. Jones Trading singled out the catheter's prospective utility in pancreatic cancer, identifying that indication as a particularly relevant area of unmet medical need in oncology.

InvestingPro data cited in the analysis indicate that RNTX currently trades slightly above its Fair Value, even as consensus among analysts remains on the Buy side. Market activity has recently reflected increased investor attention: the stock has gained in excess of 13% over the past week, consistent with the broader year-to-date advance described above.

Beyond pancreatic cancer, the report notes physician interest in exploring RenovoCath across a range of other solid tumor types. The device has been discussed for potential use in lung cancer, bile duct cancer, glioblastoma, sarcomas, and uterine cancer, according to the firm.

Rein Therapeutics has also reported multiple corporate and clinical updates. The company received orphan drug designation from the European Medicines Agency for its lead drug candidate, LTI-03, which targets idiopathic pulmonary fibrosis (IPF). That designation followed a favorable opinion from the EMA's Committee for Orphan Medicinal Products.

In addition, Rein Therapeutics disclosed positive results from a dose-escalation study of LTI-03 assessing safety and biological activity in IPF patients; those findings were made available in a preprint posted on medRxiv. Separately, the U.S. Food and Drug Administration has lifted a clinical hold on the company’s Phase 2 RENEW trial for LTI-03, clearing the way for Rein Therapeutics to resume enrollment of U.S. participants.

On the financing and market-rating front, the company terminated agreements with Yorkville without incurring any penalties. Following the FDA's decision to lift the clinical hold, Brookline Capital Markets upgraded Rein Therapeutics' stock rating from Hold to Buy and set a price target of $6.00.

What this means for investors and markets

The initiation by Jones Trading foregrounds both Rein Therapeutics' product-level value proposition - a device designed to improve intratumoral drug delivery in hypovascular cancers - and a string of clinical and regulatory developments for its drug candidate LTI-03. Investors will continue to monitor valuation signals, regulatory milestones, and physician adoption as drivers of near-term performance.