HSBC has elevated its price target for Micron Technology (NASDAQ: MU) to $500 from its previous $350, maintaining a Buy stance on the memory chip producer. This updated target matches the highest analyst valuation for Micron, a company whose market capitalization now approximates $447.5 billion.

The bank attributes this bullish adjustment largely to a rapid upswing in DRAM prices, which catalyzed a remarkable 92% surge in Micron’s share price over the last three months. This performance vastly outpaces the NASDAQ Composite's 1% advance during the same timeframe. Currently, Micron's shares trade near their 52-week peak, at $397.58 versus $397.78. Notably, data indicates the stock’s Relative Strength Index (RSI) has entered overbought levels.

HSBC projects the company’s second-quarter operating profit will reach $12 billion, marking an 88% increase over the previous quarter, supported by expected sales of $20 billion, which would represent a 47% sequential rise. The forecast predicts that DRAM blended average selling prices (ASPs) will climb 45% quarter-over-quarter, surpassing an earlier estimate of 37%.

The analyst firm identifies robust demand precipitated by AI-driven server workloads and enterprise solid-state drive (SSD) storage. Key applications such as token management, retrieval augmented generation, and key-value caching are cited as prime drivers of heightened memory requirements. This surge in demand has prompted supply limitations, consequently boosting prices not only in server DRAM but also across consumer sectors including PC and mobile DRAM markets.

HSBC anticipates that these shortages will endure through the end of the year, contributing to stronger earnings growth for Micron in fiscal 2026. The firm estimates operating profit will soar to $51 billion—a 368% year-over-year increase—and revenues will bolster to $84 billion, up 124% year-over-year.

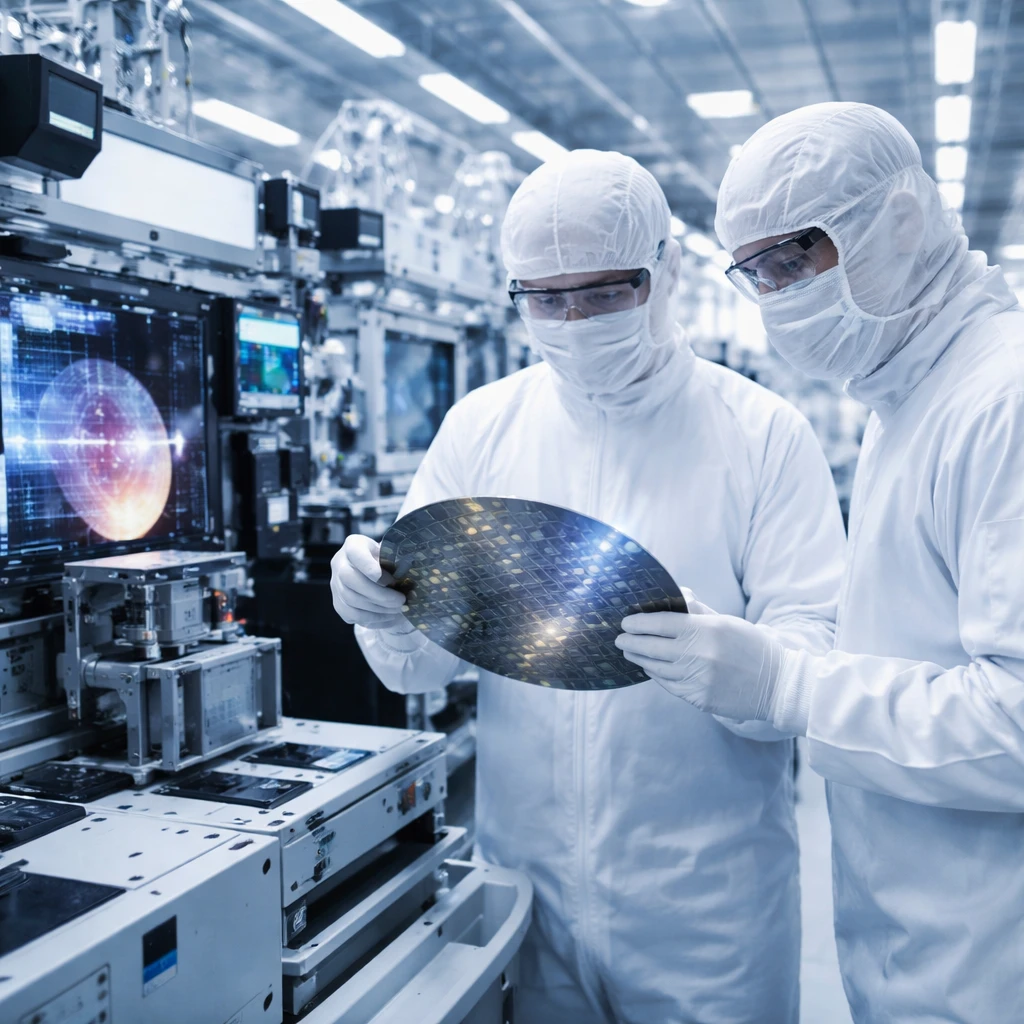

Complementing these forecasts, Micron Technology recently entered an exclusive Letter of Intent to acquire Powerchip Semiconductor Manufacturing Corporation's P5 fab site in Taiwan, committing $1.8 billion in cash. This acquisition includes a 300,000-square-foot cleanroom facility intended to expand capacity in response to growing global memory solution demand. The transaction is expected to finalize by the second quarter of 2026, pending requisite approvals.

Additional analyst commentary highlights a range of perspectives: TD Cowen raised its Micron price target to $450, emphasizing deepening shortages affecting both DRAM and NAND pricing. Stifel also lifted its target to $360, noting Micron’s enhanced flexibility via AI-driven cloud infrastructure absorbing increased DRAM supply. Conversely, Aletheia Capital downgraded Micron to Hold, withdrawing its previous $120 target due to valuation concerns and issues related to HBM3E technology.

These varied viewpoints reflect differing analyst interpretations of Micron's market positioning amid supply constraints and technology challenges, underscoring the dynamic nature of the semiconductor sector at this juncture.