Overview

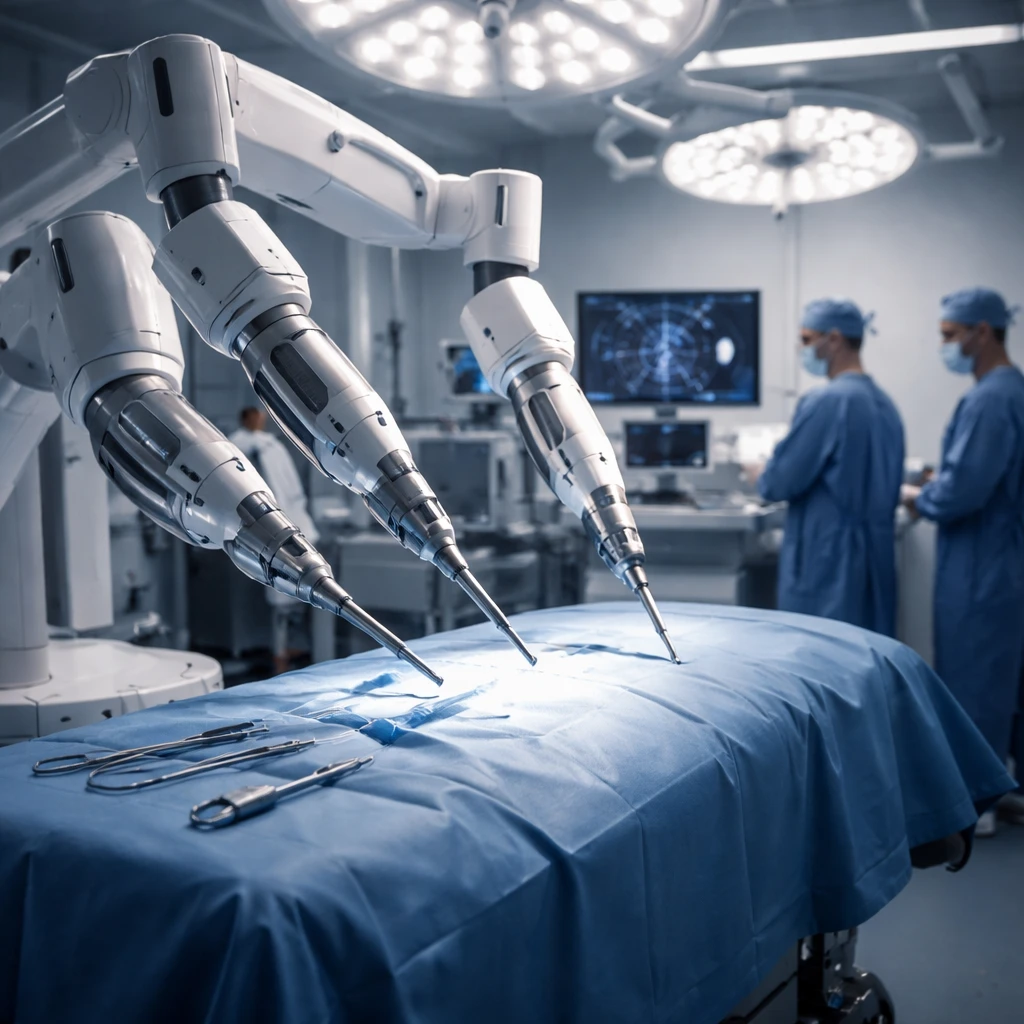

Freedom Capital Markets moved Intuitive Surgical's rating up from Hold to Buy while raising its 12-month price objective to $610 from $560. The research house cited expectations that the da Vinci 5 surgical system's continued deployment will underpin both unit sales and procedure volumes into 2026. At a recent share price of $528.82, the upgraded target implies about 15% upside, while InvestingPro data suggests the stock is trading above its Fair Value.

Drivers Cited by the Firm

Freedom Capital Markets pointed to a renewal cycle for installed systems that it believes has only begun. The firm expects elevated trade-ins and higher utilization for at least the next two years, trends it sees as supportive of revenue and procedure growth even as the company navigates margin pressures from tariffs and shifts in sales mix.

The research team indicated that operating leverage should more than offset those margin headwinds. It also judged that new market entrants do not represent a material mid-term threat to Intuitive Surgical's growth trajectory. As a result of these dynamics, the firm raised its revenue forecasts for 2026 and 2027, with the upgrade and higher price target reflecting those increased expectations tied to robotic adoption.

Company Performance and Recent Results

Intuitive has posted strong top-line momentum, with revenue growth of 20.51% over the last twelve months and annual revenue exceeding $10 billion. In its most recent quarterly report, covering the fourth quarter of 2025, the company generated $2.87 billion in revenue, a 19% year-over-year increase. That quarterly figure topped both Stifel and consensus estimates of $2.72 billion.

According to RBC Capital, Intuitive beat expectations on both earnings per share and revenue by roughly 11% and 4%, respectively. Truist Securities noted that management's gross margin guidance for 2026 improved by 90 basis points year-over-year, even while the company faces incremental tariff headwinds. Piper Sandler drew attention to strong margin performance in the quarter, with gross margins of 67.8% and operating margins of 37.4%, both above consensus estimates.

Analyst Reaction

Several sell-side firms remained constructive following the quarterly release. Stifel reiterated a Buy rating with a $670 price target. Truist Securities also reiterated a Buy with a $650 target. RBC Capital maintained an Outperform rating and a $650 target. Raymond James raised its price target to $615 from $603, citing better-than-expected margins and earnings. Piper Sandler increased its target to $620 from $610 while keeping an Overweight stance. Collectively, these actions reflect widespread positive read-throughs from Intuitive Surgical's quarterly performance.

Implications for Markets and Sectors

The upgrade and the set of reaffirmations from other analysts primarily influence equity market participants focused on medical devices, healthcare technology and growth-oriented hospitals and surgical providers that may adopt robotic systems. Upside to revenue and margins could affect valuations and investment interest across those subsectors as adoption around the da Vinci 5 progresses.

Concluding Note

Freedom Capital Markets' upgrade rests on continued system adoption, a multi-year renewal cycle and expected operating leverage that offsets margin pressures from tariffs and sales mix changes. The company's recent quarterly outperformance has been reinforced by multiple analyst firms raising or reaffirming bullish targets and ratings, leaving consensus sentiment toward Intuitive Surgical broadly positive.