Aletheia Capital has begun coverage of Teradyne (NASDAQ:TER), assigning a Buy rating and setting a $400.00 price target. The research note, published Monday, frames the stock as well positioned to benefit from a pronounced expansion in the semiconductor testing market.

The firm expects Teradyne’s earnings to increase roughly threefold between the company’s fiscal years 2025 and 2027. Aletheia attributes that projection to a combination of what it describes as explosive market growth for testing equipment, the capture of new customer engagements, and an uptick in content value per device.

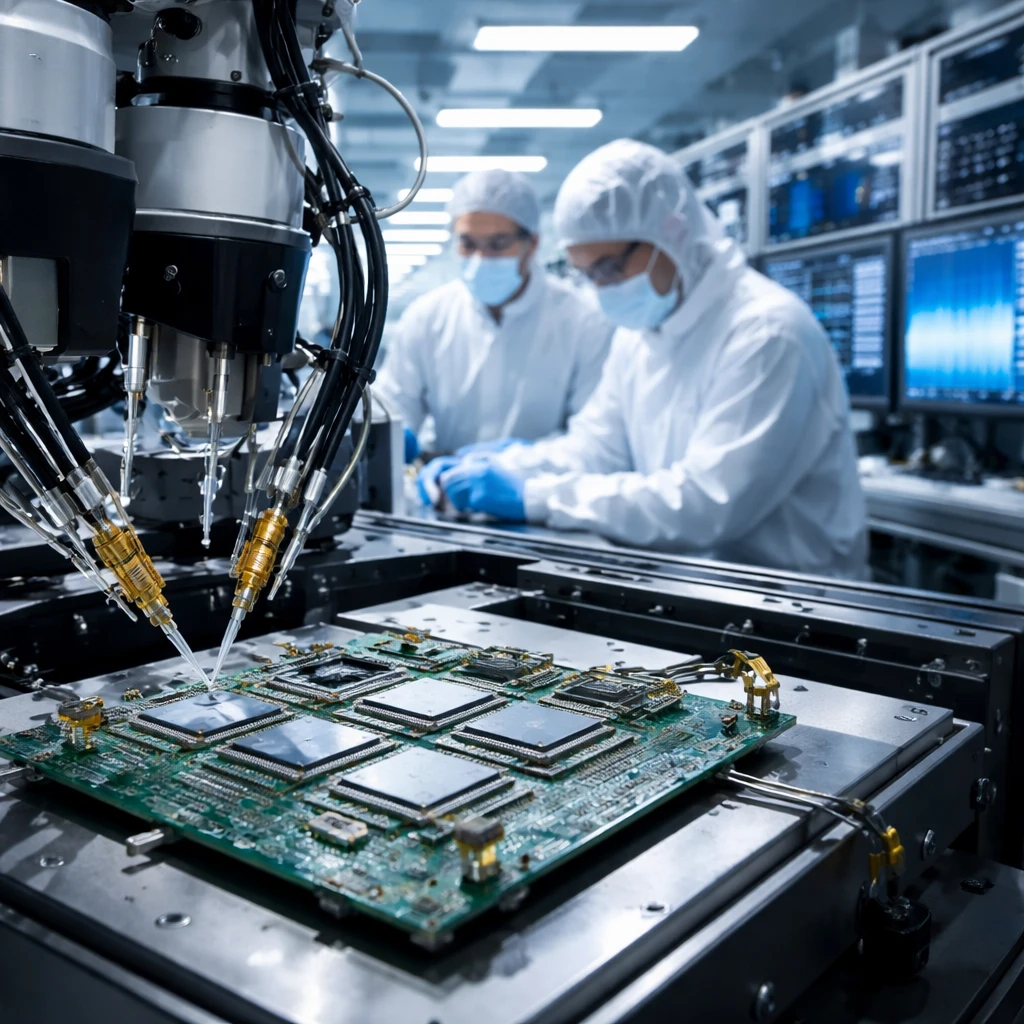

Central to the thesis is Aletheia’s view that Teradyne stands to gain materially from the rapid adoption of heterogeneous chiplet architectures within artificial intelligence and high-performance computing devices. The research note states that such architectural shifts could, in Aletheia’s view, drive the testing market to roughly double in size by the end of the decade.

Specific device and component opportunities cited by the firm include Rubin and Rubin Ultra GPUs, the Vera CPU, CPX, Google’s Axion CPU, and increased test content across networking and system components such as Mellanox’s networking portfolio, Broadcom switches, Apple’s A20 SoC, HBM4E memory, and CPO (co-packaged optics). Aletheia argues these product-level engagements would raise the per-unit revenue opportunity for test equipment providers like Teradyne.

Aletheia Capital added Teradyne to its Alpha Portfolio as part of the initiation. The $400 price target represents a 30x price-to-earnings multiple based on the firm’s fiscal year 2027 earnings estimates.

Alongside the note on Teradyne, the research environment referenced several other technology-sector developments. The firm noted that Google, a division of Alphabet, took legal action against the Chinese company Ipidea, reportedly taking down domains over concerns about unauthorized software installations on millions of devices.

Analyst coverage across large-cap technology names has also been active. KeyBanc raised its price target for Alphabet to $360, citing favorable artificial intelligence market conditions, while Stifel lifted its target to $346, pointing to healthy advertising trends in Search and YouTube. DA Davidson called out Microsoft’s Azure cloud as growing faster than peers and observed that Microsoft’s shares currently trade below the company’s historical valuation range, according to the analyst note. Separately, OpenAI’s CEO Sam Altman announced plans to roll out several Codex-related products with an expressed emphasis on cybersecurity.

Taken together, these updates reflect a series of strategic, legal, and analyst-driven developments across the technology sector that accompany Aletheia’s initiation on Teradyne.