Neutral options strategies target outcomes that do not depend primarily on forecasting the direction of the underlying asset. Instead, they aim to exploit the passage of time, the behavior of implied volatility relative to realized volatility, or the shape of the implied volatility surface. When designed methodically, these strategies can be integrated into structured, repeatable trading systems that focus on risk budgeting, consistent execution, and well-defined monitoring rules.

This article defines neutral options strategies, presents the core logic behind them, and examines how they can be operationalized prudently. The focus remains on conceptual clarity rather than specific trade instructions. The aim is to show how neutrality can be modeled, measured, and managed within a disciplined framework.

What Are Neutral Options Strategies

A neutral options strategy is constructed so that the position’s initial directional sensitivity is limited, commonly measured by near-zero net delta. The outcome depends less on whether the underlying price rises or falls and more on factors such as the speed and range of price changes, time decay, and changes in implied volatility. The label neutral does not imply a risk-free profile. Rather, it indicates that directional exposure is constrained relative to many single-leg options or outright stock positions.

Neutrality exists on a continuum. A position can be delta neutral at initiation, yet develop directional exposure as the underlying moves or as time passes. In practice, traders often tolerate small delta levels or rebalance when the exposure drifts beyond predefined bounds. Neutral strategies can be expressed with defined risk structures, such as iron condors and butterflies, or with undefined risk structures like short straddles or short strangles. They can also be vega positive or vega negative, depending on whether the strategy benefits from increases or decreases in implied volatility.

Core Logic Behind Neutral Strategies

The logic rests on three pillars: probability, time, and volatility.

- Probability and price distribution. Without a directional view, the question becomes how far the underlying is likely to move. Neutral strategies typically reference a range around the current price based on distributional assumptions. Whether one assumes normality, fat tails, or regime-dependent volatility, the expected price range over the holding period is central.

- Time decay. Options lose extrinsic value as time passes. Positions such as iron condors and butterflies can be structured to collect premium if the underlying remains within a certain interval. Time decay is not a guaranteed source of profit, but when combined with an appropriate range and volatility assumption, it can be harvested with controlled risk.

- Implied versus realized volatility. If implied volatility tends to overestimate realized volatility over the holding horizon, short-premium structures may benefit. If implied volatility is low relative to anticipated realized volatility or event risk, long-premium structures may be preferable conceptually. The edge depends on the relationship between what is priced and what actually occurs.

These pillars connect directly to the Greeks. Neutral strategies emphasize low delta, manage gamma risk as expiration approaches, depend on theta for decay dynamics, and are sensitive to vega when changes in implied volatility occur. Understanding how the Greeks evolve is essential to monitoring and adjustment.

Common Neutral Strategy Families

Iron Condor

An iron condor combines a short call spread and a short put spread at different strikes, typically equidistant from the current price. The profit region is between the short strikes. The position benefits if the underlying remains in a range and if implied volatility contracts or stays stable. The risk is capped by the long options embedded in each spread. As a defined risk structure, it provides predictable maximum loss, which aids in risk budgeting within a systematic program.

Short Straddle or Short Strangle

A short straddle sells an at-the-money call and put, while a short strangle sells an out-of-the-money call and put. Both collect premium and benefit if realized volatility is low relative to the implied premium. The primary distinction between them is the degree of distance from the current price and the shape of the payoff region. These are undefined risk structures. They can be effective if managed with strict risk controls, but tail events and gap moves can overwhelm premium collected. Systematic use requires conservative position sizing, predefined adjustment thresholds, and an understanding of assignment mechanics.

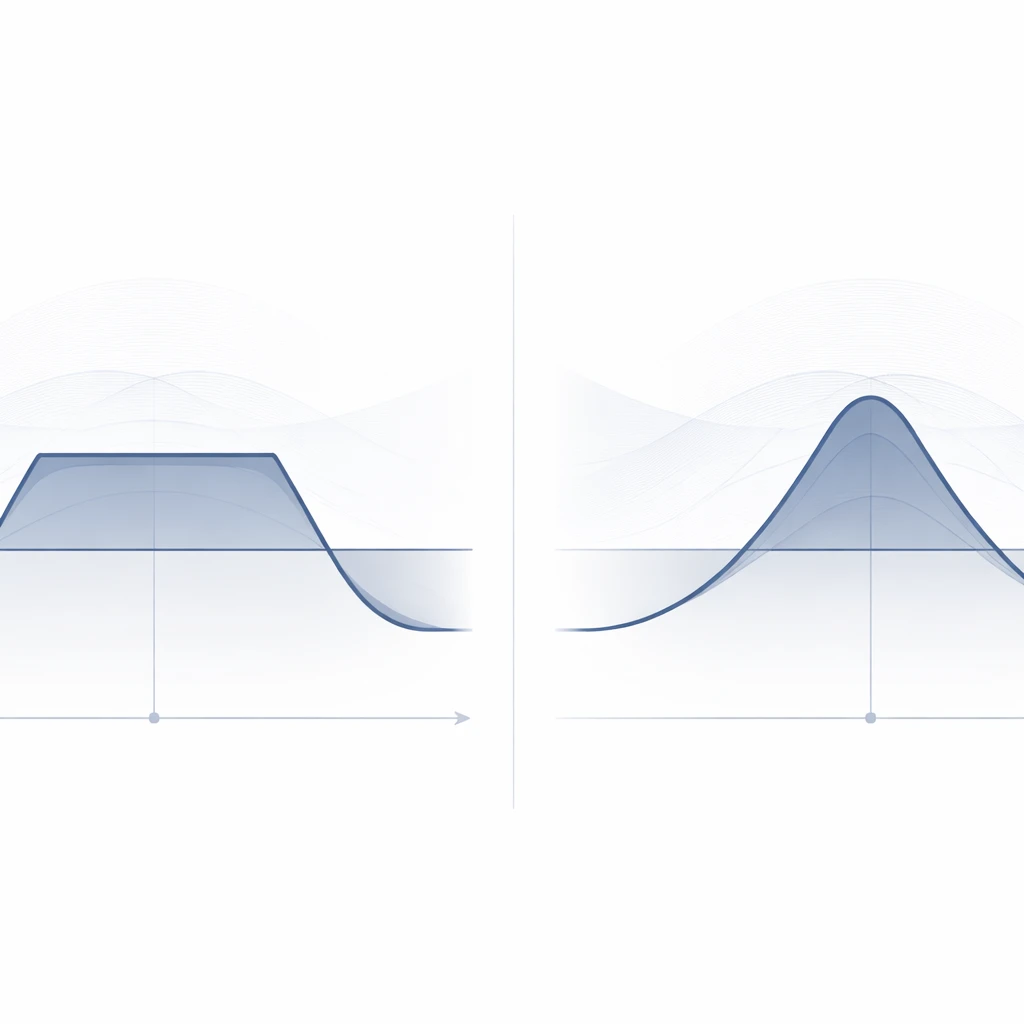

Butterfly (Long and Short)

A long butterfly uses two options at a middle strike and one option each at higher and lower strikes, creating a tent-shaped payoff at expiration. Placed around the current price, it is neutral with limited risk and limited reward. It benefits from the underlying ending near the center strike and from time decay. A short butterfly, less common in practice, inverts this profile. Long butterflies can be cost-efficient ways to express a view that price will gravitate to a central region without assuming large directional risk.

Calendar and Diagonal Spreads

Calendar spreads combine a short option in a nearer month with a long option in a farther month at the same strike. A diagonal spread varies the strike as well. These are often used when implied volatility is lower in the back month relative to the front month, or when a trader expects mean reversion in the term structure. Calendars are typically vega positive and theta positive near the center strike, which creates neutral exposure to small price changes while benefiting from time decay and potential increases in implied volatility. The risk factors include term structure shifts, unexpected volatility collapses, and changes in the underlying that migrate the position off its optimal region.

Payoff Geometry and the Greeks

A neutral position’s payoff is best understood through the Greeks, which also determine how the profile evolves before expiration.

- Delta. Neutral strategies target low net delta at entry. Delta will drift as price moves and as time passes. Systematic approaches define acceptable delta bands and rules for whether and how to rebalance or accept drift.

- Gamma. Gamma indicates how quickly delta changes as price moves. Near expiration, gamma can rise sharply, increasing the potential for large P&L swings from small price moves. This is a key risk for short-premium structures approaching expiration. Time-based exits or earlier risk reductions can mitigate extreme gamma exposure.

- Theta. Time decay works in favor of short-premium strategies and against long-premium strategies. Theta is not linear with time and is most pronounced close to expiration. A structured system aligns the holding period with the theta profile it intends to capture while controlling for the rising gamma risk late in the cycle.

- Vega. Vega measures sensitivity to changes in implied volatility. Short iron condors and short strangles are generally vega negative, benefiting from stable or falling implied volatility. Calendars are often vega positive. A neutral system defines acceptable vega exposure and recognizes that volatility regimes shift over time.

Risk Management Considerations

Neutral strategies concentrate risk in areas that differ from directional trading. Effective control rests on quantitative limits, process discipline, and a clear view of how positions behave under stress.

Defined Risk versus Undefined Risk

Defined risk structures cap the worst-case loss at entry, allowing for straightforward sizing. Undefined risk structures, such as naked short options, require greater conservatism because losses can grow without a hard cap if the underlying moves beyond expected ranges. A rules-based framework can impose maximum position sizes, notional caps, and event exclusions to bound catastrophic outcomes.

Range and Distribution Assumptions

Neutral strategies depend on price remaining within a probabilistic range. The distribution of returns is not static. Volatility clustering, jumps, and regime transitions affect realized ranges. A systematic approach can reference historical realized volatility, forward-looking implied measures, and regime filters to avoid anchoring on a single estimate. Stress tests that apply shocks to price and volatility provide visibility into tail risk beyond nominal probabilities.

Volatility Regime and Term Structure

Vega exposure should be sized with awareness of the volatility regime. In low-volatility environments, the risk of a volatility expansion may outweigh the apparent attractiveness of selling premium. In high-volatility environments, mean reversion may benefit short-premium positions, but the distribution of price moves can remain wide. Term structure matters as well. Calendars that are vega positive can suffer if back-month implied volatility compresses unexpectedly or if the front-month expands more rapidly than anticipated.

Time to Expiration and Gamma Risk

Strategies closer to expiration provide faster theta decay but often carry higher gamma risk. A systematic system might favor earlier exits to avoid the final days when small price changes translate into outsized P&L swings. Alternatively, the system may accept gamma in exchange for decay but compensate by reducing size or widening strikes in advance.

Assignment, Exercise, and Pin Risk

American-style options may be exercised early, especially around ex-dividend dates for deep-in-the-money calls or when extrinsic value is minimal. Assignment can introduce unintended directional exposure. Pin risk occurs when the underlying closes near a short strike at expiration, increasing uncertainty about which options will be exercised. Systems should specify procedures for handling early assignment and expiration management, including whether to close, roll, or let options expire when appropriate.

Liquidity and Transaction Costs

Neutral strategies often use multi-leg structures. Tight bid-ask spreads and consistent depth are valuable. Slippage from entering and exiting complex spreads can materially affect expectancy. Liquidity filters and routing preferences help maintain fill quality. Monitoring actual versus theoretical pricing around execution windows can highlight recurring frictions and guide process refinement.

Concentration and Correlation

Concentrating positions in a single underlying or correlated cluster can magnify tail risk. Diversifying across symbols, sectors, and expirations spreads risk. Correlation can rise during stress periods, so a portfolio-level view of exposure is necessary even if each individual position appears neutral.

How Neutral Strategies Fit into Structured, Repeatable Systems

A structured system defines what to trade, how much to trade, when to initiate, and how to manage positions until exit. Neutral strategies integrate into such systems through measurable criteria and explicit boundaries.

- Setup criteria. Examples include volatility regime filters, liquidity thresholds, and distance metrics for strikes relative to a modelled price distribution. The system documents which expirations are eligible and how the term structure is selected.

- Position sizing. Sizing aligns with defined or undefined risk, portfolio risk limits, and margin capacity. A cap on worst-case portfolio loss and per-position exposure constrains the impact of a single adverse move.

- Monitoring rules. Daily or intraday checks review delta drift, vega exposure, and time remaining. The system specifies what constitutes a material deviation from the intended profile.

- Adjustment logic. If price or volatility moves beyond predefined bounds, the system describes allowable actions, such as rolling strikes, adding hedges to realign delta, or reducing size. These are rules, not discretionary predictions.

- Exit conditions. Time-based exits, risk-based exits, and event-based exits can be defined in advance. The goal is to avoid improvisation when conditions are stressful.

A repeatable program depends on recordkeeping. Each position can be logged with the rationale, Greeks at entry, target holding period, and risk limits. After exit, results are classified by volatility regime, spread width, days to expiration, and rollover behavior. Over time, the data inform whether the neutral approach is behaving in line with expectations.

High-Level Examples

Example 1: Defined-Risk Range Harvesting with an Iron Condor

Consider an index option where liquidity is deep and expirations are available in regular intervals. A system that seeks to benefit from stable markets might select a defined-risk iron condor around the current price with strikes chosen so the short options sit outside an estimated price range based on a volatility model. The long options cap risk on both sides. The portfolio sizing is set so that the maximum defined loss fits within the portfolio’s risk budget even if several positions reach worst-case outcomes simultaneously.

Monitoring focuses on whether the index drifts into the short put or call region and on whether implied volatility shifts meaningfully. If the price approaches a short strike faster than modeled, the system may reduce the position, roll the tested side outward to re-center the risk, or take no action if the rules indicate tolerance for a temporary excursion. As days pass, theta decay accelerates, but gamma rises. Near expiration, the rules may require an exit to avoid the final period of heightened gamma regardless of whether the position is currently profitable.

Example 2: Neutral Time-Spread with a Calendar

Suppose the term structure shows front-month implied volatility at moderate levels and the back month somewhat lower, with no major events scheduled before the front expiration. A calendar is placed at a strike near the current price. The expected benefit comes from front-month time decay and a potential modest rise in implied volatility if the market prices uncertainty ahead of the near expiration. The risk includes a sharp directional move that pushes the underlying far from the strike, reducing the calendar’s sensitivity where it is most effective, as well as an unexpected volatility collapse across months.

Management rules specify acceptable delta drift and thresholds for vega exposure given the regime. If price migrates, the system can shift the calendar along the price axis or reduce size. Time-based exit rules prevent the position from rolling into an unfavorable term structure or entering the window where gamma risk overwhelms the intended theta capture.

Example 3: Short Strangle with Conservative Constraints

A short strangle targets premium collection when the modeled distribution suggests a high probability that price will remain in a wider band. To incorporate this into a disciplined program, the system can require ample liquidity, conservative initial size, and explicit risk controls such as volatility filters and price shock stress tests. The plan anticipates gap risk and specifies actions if the underlying breaches a short strike well before expiration. Adjustment could include adding defined-risk wings to convert the position into an iron condor or reducing exposure to keep worst-case loss within limits. Profit targets are not the sole exit rule. Time-based or risk-based exits make the process less dependent on discretion.

Operational Details That Matter

Neutral strategies depend heavily on operational quality. A few implementation details influence outcomes more than conceptual descriptions suggest.

- Strike selection mechanics. Using a fixed delta target, a variance-based distance, or an expected shortfall metric yields different distributions of outcomes. Consistency in method aids evaluation across samples.

- Expiration ladders. Staggering expirations spreads risk through time and can reduce the variability of daily P&L. It also complicates monitoring by adding overlapping Greeks. A portfolio view that aggregates exposures is essential.

- Event calendars. Earnings, macro announcements, and ex-dividend dates can distort implied volatility and exercise behavior. Systems should explicitly state whether to avoid, reduce, or price for events.

- Execution and fills. Entering multi-leg orders at mid-price and allowing for staged fills can improve average prices. Tracking realized slippage quantifies the hidden cost of the approach.

- Hedging protocols. Some neutral programs occasionally use stock hedges to realign delta. Hedging changes the gamma and theta dynamics, so the protocol must specify when and how much to hedge and under what conditions the hedge is removed.

Evaluating and Maintaining a Neutral Strategy Program

Neutral strategies should be evaluated by more than aggregate return. A robust evaluation focuses on distribution shape and regime dependence.

- Expectancy decomposition. Break down results by win rate and average gain versus loss. Short-premium strategies often exhibit many small gains and occasional large losses. Defined-risk structures moderate the tail but also cap gains.

- Volatility regime attribution. Partition performance by volatility level and trend. The same structure can perform differently in rising versus falling volatility periods. Attribution clarifies which conditions the system truly handles well.

- Time-to-expiration buckets. Examine outcomes across days to expiration to confirm that the chosen holding period aligns with realized decay and gamma behavior.

- Drawdown analysis. Depth and duration of drawdowns influence the sustainability of a systematic approach. Rules that reduce size after adverse volatility shifts can stabilize the profile, though at the cost of slower recovery.

- Model drift checks. Strategy logic built on historical relationships can degrade as market structure evolves. Regularly reassessing term structure patterns, skew behavior, and liquidity conditions helps maintain relevance.

Misconceptions and Practical Realities

Neutral does not mean safe. A short strangle with small daily theta can be overwhelmed by a single outsized price move. Conversely, long neutral structures are not guaranteed to benefit from rising volatility if the underlying dislocates from the region where the position is most sensitive. Neutral also does not mean static. Greeks evolve as markets move, and neutral positions may require attention even when price appears quiet.

Another misconception is that time decay is a constant edge. Theta is compensation for risk, particularly jump and tail risk. Capturing decay in a stable environment is straightforward, but the distribution of outcomes is asymmetric. A structured system recognizes that the premium collected is not a free lunch. It is a transfer of risk that must fit within portfolio limits and stress tolerances.

Integrating Neutral Strategies with Other Approaches

Neutral strategies can coexist with directional or event-driven tactics if the portfolio is managed holistically. The key is to view exposures in aggregate. A neutral options book can offset some risk in a directional equity sleeve by providing non-correlated returns during quiet regimes. However, correlation can spike during stress, and options books can become more directional near boundaries. A portfolio risk framework that aggregates delta, vega, and scenario-based losses across strategies is necessary to avoid unintended concentrations.

Designing Rules Without Overfitting

Structured systems are vulnerable to overfitting if rules are tailored too closely to past data. With neutral strategies, it is easy to tune strike distances, holding periods, and volatility filters to produce attractive historical statistics. Robust design avoids overly complex rule sets and validates ideas across multiple underlyings and volatility regimes. Simple, stable rules that make economic sense typically endure better than intricate playbooks optimized on narrow samples.

From Concept to Process

Bringing neutral strategies into a repeatable process centers on three questions. What is the intended source of edge. How is risk sized and limited. How will monitoring and exit decisions be made in real time without ad hoc judgment dominating the process. Turning these questions into written rules, coupled with disciplined recordkeeping and periodic review, transforms abstract neutrality into an operational program that can be evaluated and improved.

Key Takeaways

- Neutral options strategies constrain directional exposure and rely on time decay, price ranges, and the relationship between implied and realized volatility.

- Defined risk structures such as iron condors and butterflies aid risk budgeting, while undefined risk structures require conservative sizing and strict controls.

- Effective programs manage delta drift, gamma near expiration, and vega across volatility regimes, with clear monitoring and adjustment rules.

- Operational quality matters. Liquidity, execution, event management, and recordkeeping significantly influence realized outcomes.

- Repeatable systems emphasize explicit setup criteria, sizing limits, exits, and evaluation methods that resist overfitting and remain robust across regimes.