Options strategies are defined as much by their boundaries as by their intended exposures. The concept of limits of options strategies refers to the explicit and implicit constraints that bound outcomes, shape risk, and govern how a strategy functions under different market conditions. Limits arise from the payoff structure of the options themselves, from the risk controls chosen by the trader, and from market microstructure such as liquidity, assignment mechanics, and transaction costs. Treating these limits as first-class design elements is essential for creating structured, repeatable trading systems that can be measured, monitored, and improved.

Defining the Limits of Options Strategies

The limits of an options strategy are the set of boundaries that cap or confine its payoffs, risks, and operating conditions. These boundaries come in several forms.

- Payoff limits. Many strategies have mathematically bounded profit or loss. A long put has a limited loss equal to its premium and theoretically large potential gain if the underlying declines. A short put spread has a maximum loss equal to the strike width minus the received premium and a maximum gain equal to that premium. Butterflies and iron condors have both gains and losses capped within known ranges.

- Exposure limits. Greeks describe sensitivity to price, time, and volatility. A delta-neutral calendar spread has a limit on directional exposure at trade initiation, but gamma and vega increase its sensitivity to time decay and volatility changes. Exposure limits are often set as thresholds on aggregated delta, vega, theta, and gamma at the position or portfolio level.

- Time limits. Options expire. Many systems apply time-based rules such as a maximum days-in-trade or a last day to hold before expiration to avoid fast-changing risks, including assignment and pin risk.

- Operational limits. Liquidity constraints, assignment mechanics for American-style options, exchange trading hours, and order execution methods all create practical boundaries. For example, wide bid-ask spreads can impose an effective limit on achievable edge.

- Regime limits. Strategies can be constrained to operate only under certain volatility regimes, trend states, or event calendars. In practice, a system may suspend trading around earnings or scheduled macro announcements to contain gap risk.

These limits are not merely precautions. They are integral to how options strategies deliver their intended risk-reward profiles. A trader who uses spreads to bound risk is not only limiting losses. The trader is also choosing a specific pattern of convexity and theta exposure that changes as time and price evolve.

Why Limits Are Central to a Structured System

A structured, repeatable trading system requires consistent definitions of risk and exposure. Limits serve several essential functions in such systems.

- Predictability. Bounded payoffs let the system estimate worst-case loss and best-case gain under defined assumptions. This improves scenario planning and capital budgeting.

- Measurement. Limits simplify performance attribution. If a spread has a known maximum loss, position sizing can be calibrated to a risk budget without relying on ad hoc stop levels.

- Control. Exposure limits on Greeks and capital prevent the accumulation of unintended risks across multiple positions and underlyings. They help avoid hidden concentration during volatile periods.

- Repeatability. Rules for entry windows, days to expiration, and exit timing are forms of limits that make processes consistent. Consistency supports meaningful evaluation of results over time.

In short, limits translate abstract strategy concepts into constraints that a system can enforce and audit.

Core Logic Behind Limited Strategies

Options provide non-linear payoffs. Limited strategies make deliberate trade-offs between convexity, probability of profit, and exposure to time decay and volatility. The logic behind using limits can be summarized in several principles.

- Trading bounded outcomes instead of open-ended tails. A short naked option carries theoretically large adverse outcomes. Converting that exposure to a defined-risk spread changes the economic problem from unlimited tail risk to a maximum loss that can be budgeted.

- Exchanging convexity for carry. Selling premium with defined risk often targets positive theta at the cost of negative convexity. Long option structures acquire convexity at an explicit cost and may be designed to have negative theta. Limits make these trade-offs transparent.

- Confining risk to selected states. Strategies like butterflies concentrate exposure near a target price range, limiting sensitivity outside that range. This concentrates risk and potential reward in deliberately chosen states of the world.

- Modulating sensitivity to volatility. Using spreads, calendars, or diagonals can limit vega exposure relative to outright long or short options. The system can set vega bands to remain within a preferred volatility profile.

- Portfolio aggregation. Limits at the position level must be consistent with portfolio limits. For instance, several small positions near the same expiration and strikes can create a large aggregate gamma exposure as expiration approaches.

Risk Management Considerations

Limits enable risk management, but they are not a substitute for it. Several dimensions deserve careful attention.

Position Sizing and Capital at Risk

Defined-risk strategies allow sizing relative to a maximum loss that is known ex-ante. Practical systems still incorporate buffers for slippage, early assignment costs, and volatility shocks. Capital usage can change as markets evolve. Margin requirements can increase during stress, which can force reductions even in defined-risk positions.

Gap Risk and Discrete Events

Options mark-to-market continuously, yet price jumps at earnings or macro announcements can bypass intermediate levels. Short premium strategies near the money are especially sensitive to gap risk. Some systems limit exposure during known event windows or require larger reserves when holding positions through them.

Greeks Through Time

Greek exposures shift with price and time. A position that begins delta-neutral can gain meaningful directional exposure after a move. Short-dated positions tend to have higher gamma and lower vega, which can amplify intraday risk. Long-dated positions are more vega-sensitive and less responsive to small price changes. Systems often include Greek bands that tighten as expiration approaches.

Volatility Regime and Skew

Implied volatility is not a single number. Term structure and skew change the behavior of spreads. For example, short put spreads may load more vega on the downside where skew is steeper. Limits that account for skew can prevent unintended concentration of tail risk.

Liquidity and Execution Costs

Bid-ask spreads, market depth, and the presence of hidden liquidity influence realized outcomes. Wide markets reduce effective edge and can turn seemingly favorable expected values into negative ones. Systems often impose minimum volume or open interest thresholds and maximum allowable spread widths to bound execution risk.

Assignment and Exercise

American-style options can be exercised before expiration. Early assignment risk increases for in-the-money short calls ahead of ex-dividend dates when the intrinsic value exceeds remaining time value. Systems place limits around dividend schedules, borrow availability for covered shorts, and operational readiness to manage assignments. Assignment changes the form of exposure but not necessarily the economic risk if hedges and offsets are managed correctly.

Pin Risk Near Expiration

When the underlying trades near a short strike into expiration, final assignment is uncertain until the close and subsequent processing. Systems often reduce or close exposure before the last trading session to avoid unintended positions from late price moves or exercise decisions by counterparties.

Correlation and Concentration

Portfolio risk is not the sum of isolated positions. Positions in related underlyings, or across indices and their constituents, can become highly correlated during stress. Limits on sector exposure, expiration clustering, and strike concentration are part of practical risk control.

Backtesting and Model Risk

Historical testing of options strategies is sensitive to assumptions. Fill prices, availability of historical implied volatility surfaces, and survivorship bias can distort results. Conservative slippage models, realistic commission schedules, and stress tests across volatility regimes reduce model risk. Systems also benefit from out-of-sample evaluation and forward testing on small scale before allocating more capital.

How Limits Fit Into a Repeatable Trading System

A repeatable system translates conceptual limits into operational rules that can be executed consistently. The following components are typical of such a design.

Trade Templates With Explicit Boundaries

A system can maintain a library of strategies, each with defined payoff limits, target Greeks at entry, and acceptable ranges for days to expiration, moneyness, and spread width. Each template includes position-level caps on maximum loss, maximum theoretical gain, and expected exposure to theta and vega.

Pre-Trade Checks

- Market state. Volatility regime within a predefined band, absence or presence of scheduled events, and recent realized volatility versus implied volatility.

- Liquidity standards. Minimum average daily volume in the underlying, minimum open interest at chosen strikes, and maximum bid-ask width per contract.

- Risk budget. Remaining capacity relative to daily, weekly, and portfolio-level loss limits. Systems often block new trades if drawdown thresholds or utilization caps are reached.

- Scenario tests. Price up and down, implied volatility changes, and time passage to map P and L along with Greek shifts. The emphasis is on worst-case and plausible stress rather than median outcomes.

In-Trade Monitoring

Monitoring focuses on whether live exposures remain inside limits. Common checks include net delta and vega bands, gamma thresholds as expiration approaches, time-in-trade limits, and alerts tied to scheduled events. When exposures breach limits, predefined adjustments or exits are triggered by the system rules, not by discretionary judgment.

Exit and Lifecycle Rules

Lifecycle rules define when a position is reduced, hedged, held, or closed. Exits can be tied to time remaining to expiration, degree of moneyness relative to short strikes in spreads, or aggregate portfolio metric breaches. The key is that the system acts on limit breaches rather than on ad hoc interpretations of price moves.

Post-Trade Review

Structured review identifies whether outcomes fell within modeled ranges, whether slippage matched expectations, and whether risk limits were hit earlier than anticipated. This feedback loop informs updates to limits, not only adjustments to entry conditions.

High-Level Operational Example

The following example illustrates how limits define a system without prescribing specific trades or prices. Consider a system that uses defined-risk vertical spreads to engage with markets across different volatility regimes.

- Strategy skeleton. The system employs debit and credit vertical spreads with specified days to expiration windows. Spread width is limited to a band that constrains maximum loss per contract and keeps gamma exposure within tolerable bounds near expiration.

- Entry validation. Prior to entry, the system requires that the underlying meet liquidity standards and that the implied volatility regime falls within a predefined range. The expected bid-ask cost and modeled slippage must not exceed a percentage of the spread’s theoretical edge.

- Risk budgeting. Each position’s maximum loss, based on spread width and paid or received premium, is allocated to a per-trade risk bucket. Portfolio rules cap total at-risk capital in a single expiration week and limit concentration in correlated underlyings.

- Scenario analysis. The system evaluates P and L under price moves of several standard deviations, both up and down, alongside implied volatility shifts up and down, and a time step forward. Exposures must remain inside defined Greek bands under these scenarios or the trade is rejected.

- Lifecycle. Positions are reviewed daily. If time to expiration falls below a threshold, or if net delta or gamma exceeds limits, the system either reduces size or exits. If a scheduled event approaches and breaches an event-risk rule, exposure is cut back according to preset instructions.

- Assignment handling. If a short leg becomes deeply in the money ahead of an ex-dividend date, the system considers the risk of early exercise as part of the monitoring process. Contingency procedures govern how to handle an assignment while maintaining the defined-risk posture of the overall book.

This example shows how limits convert general strategy ideas into a predictable operating framework. The system becomes a set of constraints and checks that enforce discipline across diverse market states.

Illustrative Limits Across Common Strategies

Covered Call

The upside is capped at the strike plus premium received, while the downside remains exposed to declines in the underlying less the premium cushion. Liquidity and dividend timing create operational limits because early exercise is more likely around ex-dividend dates when the call is in the money with little time value. Portfolio-level limits often restrict the percentage of capital committed to covered positions in a single sector to manage correlation risk.

Protective Put

A protective put sets a floor under the combined stock and put position. The cost of the put defines ongoing negative theta, which the system must budget. Vega exposure rises, particularly for longer maturities, and the limit on loss is set by the strike minus the premium paid, net of any stock cost basis definition the system uses for tracking risk. Time-based exit rules often prevent holding very short-dated puts with rapidly decaying time value unless they are part of a specific event hedge.

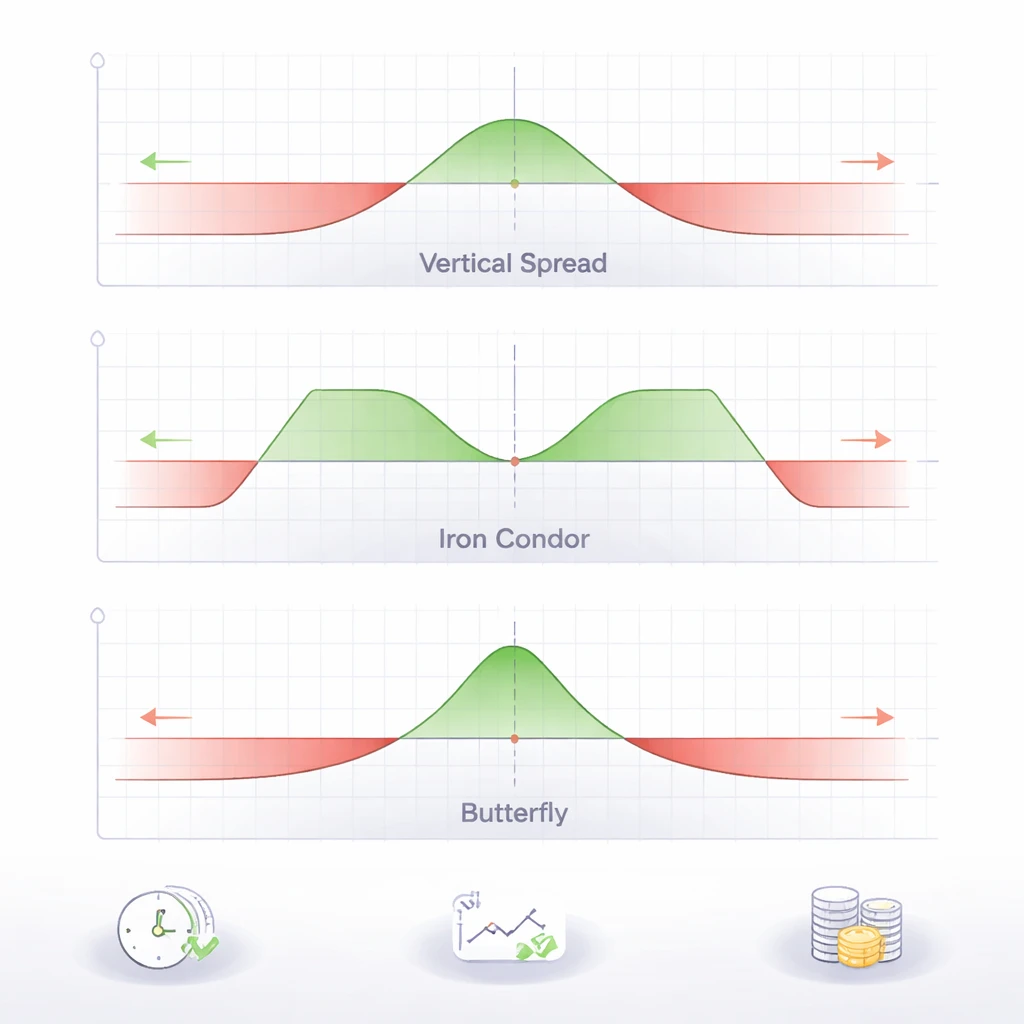

Vertical Spreads

Both credit and debit verticals offer defined loss and defined gain. The spread width and moneyness determine not only the payoff range but also the shape of gamma and vega exposures. Systems often limit the ratio of credit received to width as a quality filter, and they cap the number of spreads in the same expiration to avoid gamma concentration near expiry.

Iron Condor

An iron condor combines short call and short put spreads, creating a zone of maximum profit between the short strikes with bounded losses on both sides. Limits involve the distance between spreads, the overall credit to width relationship, and the portfolio’s aggregate short vega. Condors are sensitive to volatility expansion and to clustering of realized moves, so regime and correlation limits are particularly relevant.

Butterfly

Butterflies concentrate reward near a central strike, with limited loss elsewhere. While the risk is capped, pin risk can be material if the underlying trades near the body strike into expiration. Systems often include time-based reductions to avoid last-day exposure to late price moves or exercise decisions by counterparties.

Measuring and Enforcing Limits

For limits to be effective, the system must measure exposures and enforce constraints consistently.

- Greek-aware risk engine. The system calculates delta, gamma, theta, vega, and, when possible, higher-order sensitivities such as vanna and volga to understand how exposures will change with price and volatility.

- Scenario grid. A standardized set of price and volatility shocks combined with a time step forward provides a map of P and L and Greeks under plausible conditions. This grid is used for both pre-trade screening and daily monitoring.

- Order standards. Execution limits include maximum bid-ask width, minimum acceptable fill improvement relative to mid, and preferred order types for different liquidity conditions. These standards aim to keep realized costs within a modeled range.

- Capital and drawdown rules. Hard stops on daily and cumulative losses prevent new risk from being added when limits are reached. These rules are documented and enforced automatically where possible.

- Data and audit trail. Each decision is logged with market conditions, modeled exposures, and limit checks. This record enables later evaluation of whether breaches occurred and how they affected outcomes.

Common Misconceptions and Pitfalls

Misunderstanding limits leads to fragile systems. Several misconceptions recur in practice.

- Limited risk equals low risk. A capped loss is helpful, but the probability of that loss and the correlation of losses across positions matter. A portfolio of defined-risk positions can still experience large drawdowns if many positions fail together.

- High probability of profit guarantees favorable expectancy. Selling spreads with small credits can produce frequent small gains and occasional large losses within the defined maximum. Expected value depends on both probability and payoff, and on costs and slippage. Limits should be evaluated on expectancy, not on win rate alone.

- Backtests with optimistic fills reflect live outcomes. Real execution frequently deviates from mid prices, especially in stressed or illiquid conditions. Systems should encode conservative fill assumptions and validate them in forward tests.

- Ignoring path dependency. Greek exposures evolve as the underlying moves. A position that appears safe at entry may become riskier after a modest move, particularly near expiration when gamma increases. Monitoring limits must account for this evolution.

- Underestimating operational risk. Assignment, corporate actions, and settlement differences between cash-settled and physically settled options can impose costs and exposures not visible in simple payoff diagrams. Operational limits and procedures are part of the strategy’s true boundary conditions.

Designing Limits for Robustness

Well-chosen limits increase the chance that a strategy behaves as modeled across market regimes. Robust limit design often includes the following features.

- Redundancy. Multiple independent limits catch different failure modes. For example, a capital-at-risk cap, a Greek band, and an event-driven exposure rule together reduce the likelihood of a single-point failure.

- Adaptivity within bounds. Limits can be parameterized to respond to regime changes within a defined envelope. For instance, allowable vega exposure might scale down as implied volatility rises above a threshold.

- Conservatism where modeling is weak. When implied volatility surface data are sparse or slippage is hard to predict, limits should err on the side of lower exposure and higher cost assumptions.

- Clarity. Limits are stated in measurable terms, such as maximum portfolio net delta, maximum open risk into a specific event, or maximum percentage of capital per expiration week. Ambiguous limits are difficult to enforce.

Evaluating Strategy Limits Over Time

Limits are not static. Review cycles assess whether limits remain appropriate as markets and execution quality evolve.

- Performance attribution. Decompose P and L into sources such as theta, delta moves, volatility changes, and transaction costs. If a strategy’s results depend heavily on one source, consider whether limits adequately control the associated risk.

- Stress outcomes. Compare realized outcomes during volatility spikes to modeled scenarios. If breaches occurred, adjust scenario severity or tighten limits.

- Capacity analysis. As assets scale, liquidity and market impact can change. Reassess open interest and volume thresholds and widen or narrow allowable strike ranges as needed.

- Operational review. Audit assignment events, order rejects, and late-day risk near expiration to refine procedures and reduce operational slippage.

Putting It All Together

The limits of options strategies are the architecture that holds a system together. Payoff caps, exposure bands, time rules, and operational constraints transform complex derivatives into instruments that a disciplined process can manage. Limits do not eliminate uncertainty. They define the space in which uncertainty is acceptable and the conditions under which the system stands down.

Key Takeaways

- Limits are the explicit boundaries on payoff, exposure, time, and operations that make options strategies measurable and controllable.

- Defined-risk structures trade capped losses and gains for specific patterns of convexity, theta, and vega that evolve with price and time.

- Robust systems encode limits as pre-trade checks, Greek bands, capital budgets, lifecycle rules, and operational procedures.

- Risk management must consider gap risk, volatility regime shifts, liquidity, assignment mechanics, and portfolio concentration.

- Backtests and live oversight should use conservative assumptions and continual monitoring to ensure exposures remain inside stated limits.