Why Use Options in Trading?

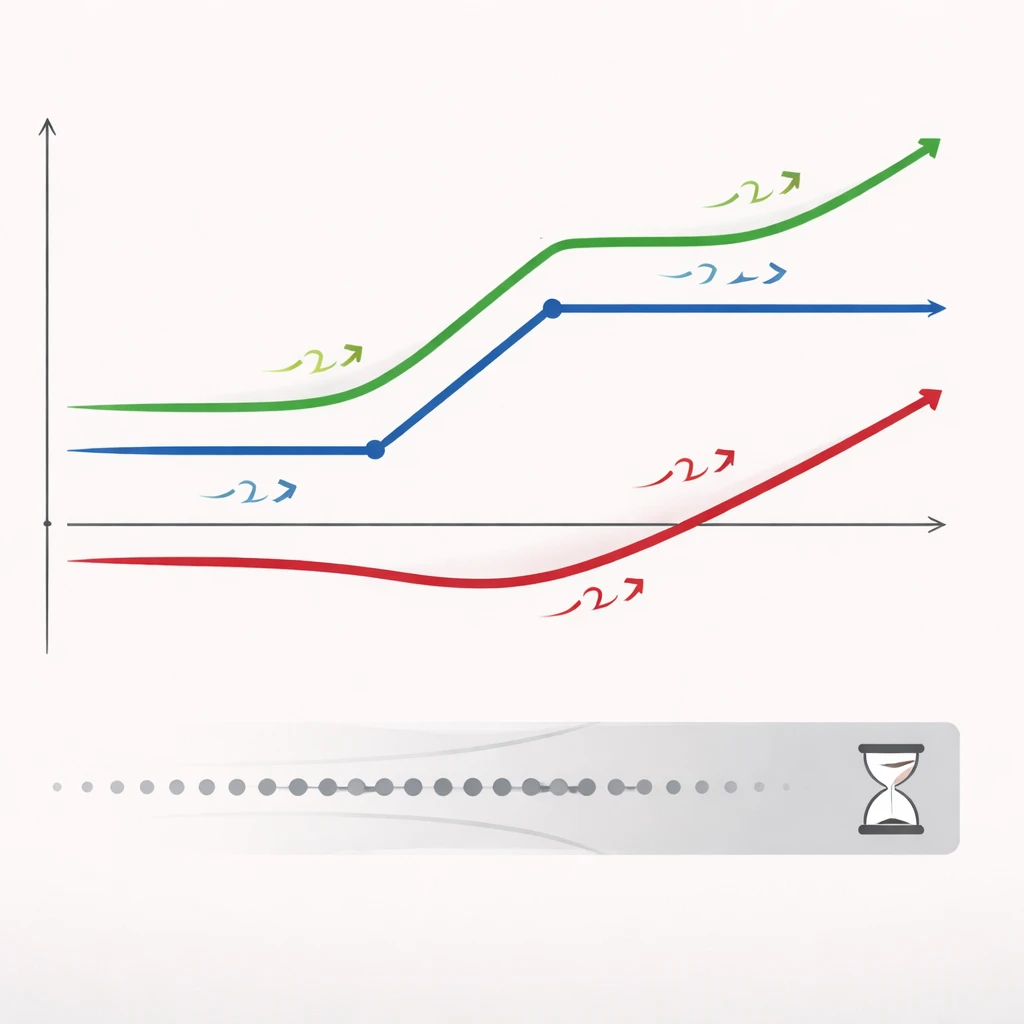

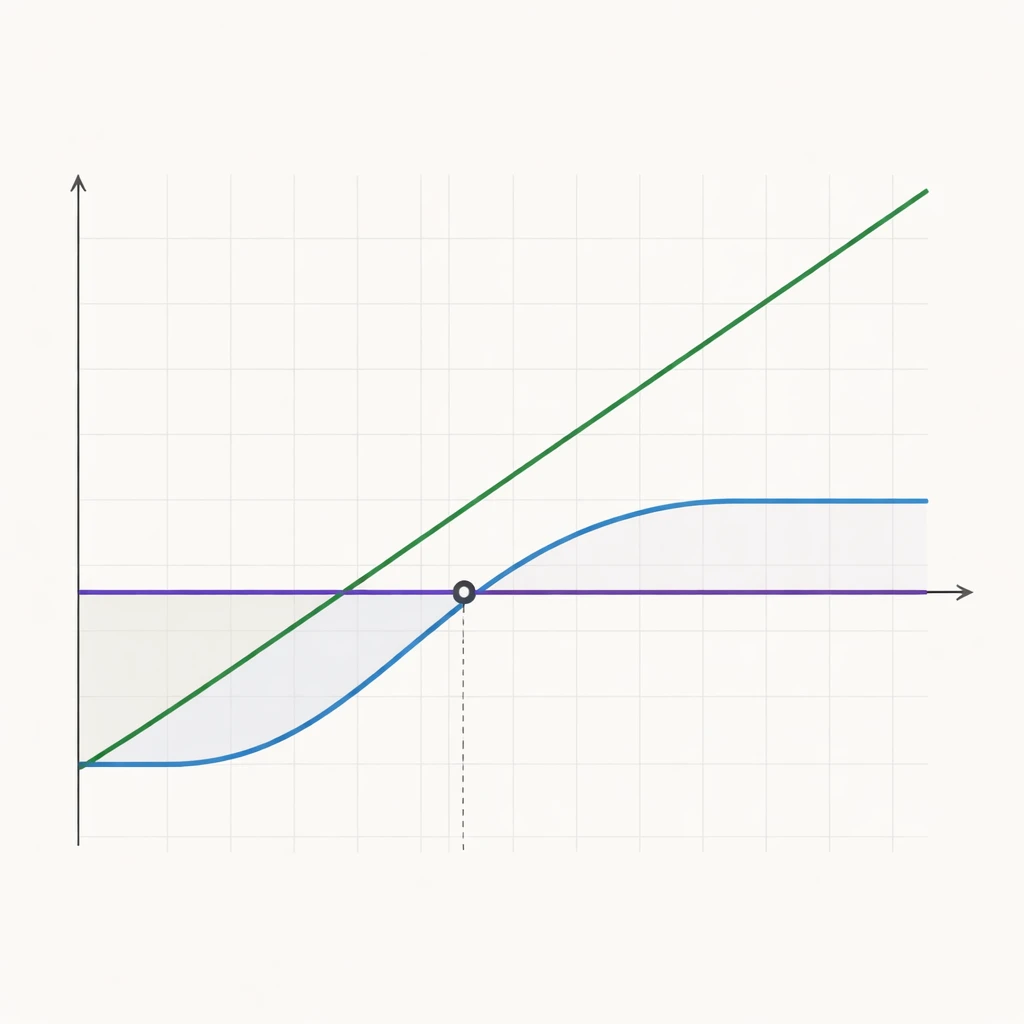

Options can reshape risk, isolate specific market views, and formalize repeatable trading rules. This article explains what options add to a trading system, the core logic behind option-based strategies, and the risk management practices that keep them disciplined.