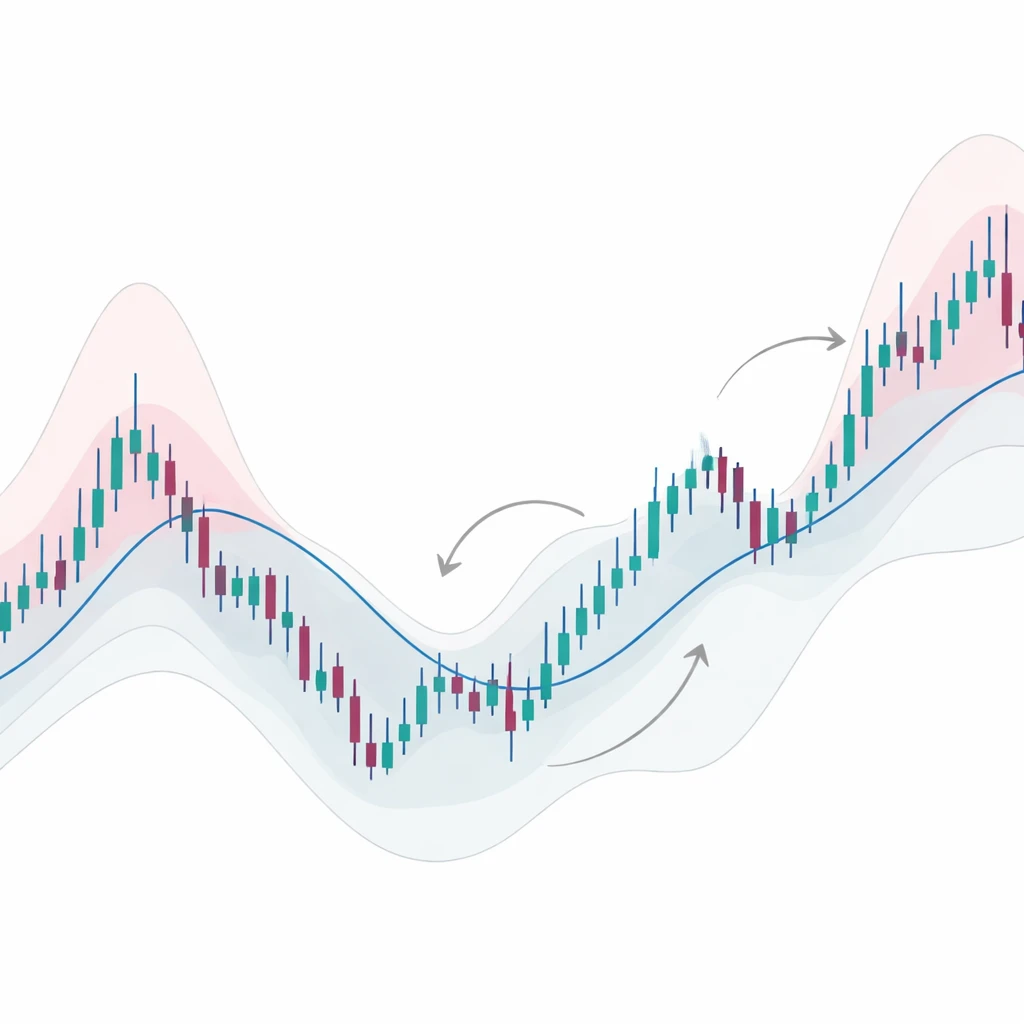

Overextension and reversion describes a family of mean reversion strategies that seek to exploit temporary deviations of price from a reference benchmark. The benchmark might be a moving average, a volume-weighted average price, a median over a lookback window, or another statistically grounded estimate of equilibrium. Overextension refers to a price move that pushes meaningfully away from this reference. Reversion refers to the subsequent tendency of price to move back toward that reference. The approach is not a claim that markets always revert. It is a framework that assumes deviations can be measured probabilistically and that they occasionally offer favorable payoff asymmetry when combined with disciplined risk management and carefully defined trading rules.

Core Definition and Scope

Overextension is a state in which the current price lies materially far from a chosen reference mean according to a predefined distance metric. The state must be defined in advance and should be repeatable. The definition is agnostic to direction. Price can be extended above or below the reference.

Reversion is the observed tendency for price to drift or snap back toward the reference mean after an overextension. A reversion does not need to fully reach the mean to be considered a reversion. It only needs to reduce the deviation meaningfully relative to the initial overextension.

The strategy class fits within structured, repeatable systems by translating the overextension state into observable setups, applying regime filters, codifying position rules, and enforcing risk constraints. It is compatible with multiple horizons, from intraday to multiweek, provided the reference mean and the measurement window are aligned with the intended holding period.

Why Overextension Occurs

Several mechanisms can produce temporary displacement from a reference mean.

- Liquidity imbalances. Order flow shocks can push price away from the range where marginal buyers and sellers are balanced. Thin liquidity can amplify the move.

- Behavioral dynamics. Extrapolation, overreaction, disposition effects, and herding can exaggerate short-term trends that later fade as information is digested.

- Mechanical demand or supply. Rebalancing flows, hedging adjustments, and option-related positioning can force price away from short-term equilibrium before the pressure dissipates.

- Information diffusion. Markets process information at different speeds. Early reactions can overshoot, particularly around news or macro releases. Later participants may trade against the overshoot.

These drivers do not guarantee reversion. They provide economic intuition for why temporary dislocations can arise and why the path back to equilibrium can vary in speed and magnitude.

Measuring Overextension

A structured system must specify how it measures distance from the reference mean. Several approaches are common in research practice. The choice should match the asset class, the horizon, and the distributional features of returns.

- Standardized distance. Compare price to a moving average in units of recent volatility. A simple implementation computes the difference between price and the average, scaled by an estimate of dispersion such as rolling standard deviation or an average true range. The resulting score indicates how unusual the deviation is relative to recent conditions.

- Band-based methods. Construct dynamic bands around a reference mean and identify overextension when price moves outside the bands. The depth of the excursion can be measured by how far price is beyond the band.

- Momentum and oscillator states. Oscillators that summarize short-horizon momentum can flag stretched conditions when they register extreme values. The oscillator is not the signal by itself. It is evidence that price has accelerated away from typical ranges.

- VWAP deviation. During a session, volume-weighted average price can serve as a reference. Distance from VWAP, scaled by intraday volatility, can represent temporary dislocation driven by uneven order flow.

- Robust statistics. Medians, trimmed means, or quantile-based centers can reduce the influence of outliers. Measuring distance from a robust center can be helpful in noisy series.

Each measurement approach encodes assumptions about the distribution of returns and the stability of volatility. Systems that ignore these assumptions risk mistaking persistent trends for overextension.

Choosing the Reference Mean

The reference mean should be aligned to the horizon of the expected reversion.

- Short-horizon strategies. For intraday or single-day horizons, practitioners often use session-based measures such as VWAP, short moving averages, or rolling medians over compact windows. These respond quickly to new information and to changes in volatility.

- Intermediate horizons. Multi-day strategies may rely on slightly longer moving averages, multi-session VWAPs, or hybrid references that blend a short-term mean with a slower anchor. The goal is to capture dislocations that resolve over several days without relying on long-term equilibrium concepts.

- Asset-specific considerations. Mean choice can differ across equities, futures, currencies, and fixed income. For example, overnight gaps are common in equities, while futures trade nearly around the clock, which changes the usefulness of session-defined references.

There is no universal best mean. The system must treat the choice as a design decision to be tested and validated, not as an assumption that holds for all regimes.

Reversion Dynamics and Time Horizon

Reversion can occur through different paths that affect design choices.

- Sharp snap-back. Price may quickly retrace a portion of the extension after the initial shock. Strategies that seek this path rely on short holding periods and strict timing rules.

- Gradual drift. Price can move sideways while the reference mean catches up. This path involves lower directional movement but can still reduce the deviation.

- Partial reversion. Price may retrace part of the distance then resume the prior trend. Systems must recognize that partial reversion is common and design exits accordingly.

Time horizon matters. Short-horizon reversion often competes with microstructural noise and transaction costs. Longer-horizon reversion faces regime shifts and news risk. The system must match the reference mean, the signal window, and the expected holding period to the observed reversion path in historical data.

From Concept to Structured System

To fit overextension and reversion into a structured, repeatable framework, the strategy design typically includes the following components:

- Universe definition. Identify eligible instruments and trading sessions. Specify liquidity criteria and data quality checks. Exclude instruments that fail minimum standards for spread, depth, or continuity.

- Regime and risk filters. Use filters to avoid obvious non-stationarity. Examples include volatility state classification, event calendars, or higher-level trend state tags that identify environments where mean reversion historically underperforms.

- Overextension measurement. Choose a distance metric, define the reference mean, and determine how to standardize or scale the deviation. The metric should be stable, interpretable, and computable in real time.

- Setup qualification. Describe the contextual features that must accompany an overextension. Context might include volume conditions, intraday timing, cross-asset confirmation, or dispersion across related instruments.

- Position rules. Define how the system reacts to a qualified setup. Position rules include side determination, position size model, scaling policies, and maximum exposure limits. These rules should not rely on discretionary overrides.

- Exit logic. Specify how the system leaves trades. Common approaches include deviation reduction to a target range, time-based exits, or volatility-adjusted stop-outs. Exits should be consistent with the expected reversion path.

- Risk controls. Implement caps on inventory, per-trade loss, drawdown, concentration, and correlation. Include a process to disable the strategy if monitors detect instability or slippage beyond tolerance.

- Monitoring and review. Track live performance, execution quality, and diagnostic metrics that test whether core assumptions hold. Establish rules for parameter review and for pausing the strategy in abnormal market states.

Risk Management Considerations

Mean reversion strategies can appear attractive in backtests because they harvest many small gains. Without robust risk controls, losses during adverse environments can dominate the distribution. The following considerations are central to design.

- Trend persistence risk. What looks like overextension may be the early phase of a larger trend. Strategies should control adverse excursion with volatility-aware sizing, predefined stops, and time-based exits that recognize when the thesis is no longer valid.

- Gap and event risk. News, earnings, and macro releases can create gaps that bypass intended exit levels. Systems can incorporate event calendars, reduced exposure around scheduled announcements, and conservative position sizes when gap risk is elevated.

- Volatility regime shifts. The dispersion used to standardize distance can change abruptly. Using adaptive volatility estimates and stress-aware exposure caps can reduce sensitivity to regime transitions.

- Crowding and liquidity. Strategies that exploit similar deviations can become crowded, widening spreads and reducing edge. Monitoring slippage, order book depth, and fill ratios helps detect crowding early.

- Serial correlation in signals. Overlapping signals can create hidden correlation in the portfolio. Aggregation rules should limit simultaneous exposures that rely on the same underlying driver.

- Transaction costs. Rapid reversion setups may not survive realistic costs. Include conservative assumptions for spread, fees, and market impact during testing. Use execution logic that adapts to liquidity and urgency.

- Structural breaks. Market microstructure evolves. A strategy that relied on specific exchange mechanics, tick sizes, or dark pool dynamics may degrade as rules change. Continuous validation and periodic re-estimation of parameters are necessary.

Designing Measurement and Threshold Logic

Translating the concept into code often revolves around how to combine distance, volatility, and context. Although exact thresholds are excluded here, several design choices recur in practice.

- Multi-signal confirmation. Combine a primary distance measure with a secondary context indicator. Examples include pairing a standardized deviation with a short-horizon volume measure or with intraday timing constraints.

- Adaptive thresholds. Instead of fixed cutoffs, thresholds can vary with volatility state, liquidity, or time of day. Adaptive logic reduces brittleness across regimes.

- Asymmetry by direction. Overextensions to the downside may revert differently from upside stretches, especially in equities where downside shocks can be sharper. Direction-specific rules can reflect this asymmetry.

- Decay and freshness. Signals can be time stamped and decayed if not acted upon promptly. This avoids using stale extensions that have already normalized.

High-Level Operating Example

Consider an equity index future during a regular session. The system uses an intraday reference mean aligned to the session and a volatility estimate that updates through the day. The design specifies what constitutes an overextension relative to that reference and requires confirmation that liquidity conditions are adequate.

During a mid-session surge, price lifts meaningfully above the reference mean while participation remains healthy. The standardized distance exceeds the design’s threshold for a setup, and contextual checks pass. The system initiates a position sized according to volatility and account constraints. It does not target a specific price. Its objective is a reduction in deviation toward a predefined neutral zone or, failing that, a time-based exit window.

As the afternoon progresses, order flow stabilizes and the distance narrows. The system trims or fully exits as the deviation approaches the neutral zone. If the reduction stalls or if volatility increases beyond tolerance, a protective exit triggers. If price accelerates away from the reference and the thesis is invalidated, a stop rule closes the position to protect risk capital.

This example illustrates the operational flow without prescribing entry or exit prices. It emphasizes alignment between the reference mean, the volatility model, and the execution window.

Validation and Robustness Testing

Mean reversion strategies are sensitive to testing procedures. Robust validation reduces the risk of overfitting and helps identify environments where the approach is unlikely to perform.

- Out-of-sample evaluation. Separate data by time and by market regime. Favor stable performance across multiple periods rather than peak results in a single span.

- Transaction cost modeling. Include conservative cost assumptions that reflect liquidity at the time signals are generated. Evaluate slippage drift during adverse conditions.

- Turnover and holding period. Measure turnover explicitly. Check whether performance relies on impractically fast recycling of positions.

- State conditioning. Analyze results by volatility state, time of day, day of week, and around scheduled events. Concentrated performance in one narrow state can be fragile.

- Stress and scenario tests. Replay episodes of elevated volatility or unusual market structure. Confirm that risk controls limited drawdowns to tolerable levels and that exits functioned as intended.

Execution and Microstructure

Execution quality can determine whether the theoretical edge survives in practice.

- Order types and urgency. Overly aggressive orders can consume edge through spread and impact. Overly passive orders risk missing the reversion window. Execution logic must balance these trade-offs based on signal strength and liquidity.

- Queue dynamics. In limit order books, queue position and cancellation rates matter. Systems should account for fill probabilities, not just quoted spreads.

- Latency and timing. For intraday approaches, small timing errors can convert expected reversion into noise. Timestamp integrity and synchronized data feeds are essential.

- Cross-venue routing. In fragmented markets, routing logic influences cost and slippage. Execution simulators that reflect venue microstructure can improve realism during testing.

Portfolio Construction with Mean Reversion

Overextension and reversion strategies often coexist with momentum, carry, or relative value strategies. Diversification across uncorrelated sources of return can reduce drawdown volatility and improve capital efficiency. Several practices help integrate mean reversion into a broader portfolio without drifting into advice or prescription.

- Risk budgeting. Allocate exposure based on risk contribution rather than nominal capital. Use volatility targeting or expected shortfall limits to keep the contribution of mean reversion within bounds.

- Correlation control. Monitor correlations that rise during stress. A cluster of mean reversion trades across related instruments can behave like one position.

- Position netting. Implement rules to net exposures when signals overlap across assets or horizons. This avoids unintended concentration.

- Capital recycling. Since many reversion trades are short duration, released capital can be redeployed selectively. Controls should prevent over-leveraging during busy periods.

When Mean Reversion Underperforms

It is important to recognize the conditions under which overextension does not imply opportunity.

- Information-driven trends. Durable news that shifts fundamental expectations can produce sustained moves that invalidate the reversion premise.

- Breakouts from compressed ranges. Periods of low volatility can precede structural regime changes. Early extensions in such breakouts often persist longer than historical averages.

- Policy or macro shocks. Sudden changes in policy rates, liquidity facilities, or geopolitical events can create new equilibria. Reversion to an outdated mean becomes less relevant.

- Market-wide de-risking. During broad risk-off episodes, correlations rise and liquidity evaporates. Overextensions can be frequent yet revert unpredictably or not at all within the intended horizon.

Governance and Ongoing Oversight

A mean reversion system benefits from explicit governance. Document assumptions, parameter choices, and kill-switch criteria. Establish pre-trade checks to confirm data quality and to verify that market conditions match the system’s design envelope. Use post-trade analytics to evaluate slippage, rule adherence, and the behavior of exits under stress. Regularly revisit whether the measurement of overextension remains aligned with current microstructure and volatility regimes.

Illustrative Extensions and Variations

The core idea adapts to multiple contexts without deviating from its structured foundation.

- Relative reversion. Instead of absolute price deviations, measure overextension relative to a peer group, a sector index, or a cross-asset driver. For example, a single stock can be evaluated relative to its sector’s short-term mean.

- Pairs and spreads. Some designs operate on spreads between two related instruments. The reference mean is the equilibrium spread rather than a price series. Cointegration tests can support the statistical justification.

- Regime-conditioned reversion. Switch measurement techniques based on volatility or liquidity state. A robust mean may be favored in high-noise states, while a faster mean may be appropriate in stable conditions.

- Multi-horizon stacking. Combine a very short reversion component with a slower reversion component, each with separate risk budgets. The system can net exposures to avoid fighting a larger backdrop trend.

Putting It All Together

Overextension and reversion as a strategy class hinges on a clear definition of distance from a reference mean, a credible expectation that part of the deviation will normalize within a chosen horizon, and disciplined risk controls that limit adverse excursions. The structured approach relies on repeatable rules for setup qualification, position sizing, and exits. It also requires a conservative view of transaction costs and a realistic assessment of how execution quality affects realized outcomes.

There is no single canonical specification. The focus should be on internal consistency. The reference mean must match the horizon. The distance metric must be stable under the volatility regime. The risk constraints must reflect the worst-case path, including gaps and crowding. Diagnostics must be able to detect when assumptions stop holding. With these elements in place, overextension and reversion can function as a coherent component within a diversified system rather than a collection of ad hoc trades.

Key Takeaways

- Overextension is a measurable deviation from a chosen reference mean, and reversion is the partial or full normalization of that deviation.

- Strategy design depends on aligning the reference mean, the measurement window, and the expected holding period to the observed reversion path.

- Risk management is central, with controls for trend persistence, gaps, volatility shifts, crowding, and transaction costs.

- Validation must include conservative cost modeling, out-of-sample testing, and state-conditioned analysis to avoid overfitting.

- A structured system integrates setup qualification, execution logic, and governance so the approach remains consistent across regimes without relying on discretionary decisions.