Mean reversion is a broad class of strategies that assume temporary dislocations in markets tend to decay toward an estimated equilibrium. Within this class, a common design choice concerns how to define that equilibrium and how to detect dislocations. Practitioners often contrast two anchors: an indicator-defined state versus direct measures of price displacement. This article clarifies the distinction, explains the logic behind each approach, and shows how the tension between indicators and price can be used to design structured, repeatable processes. The discussion remains conceptual and methodical, without prescribing trade signals or price levels.

Defining Indicators vs Price in Mean Reversion

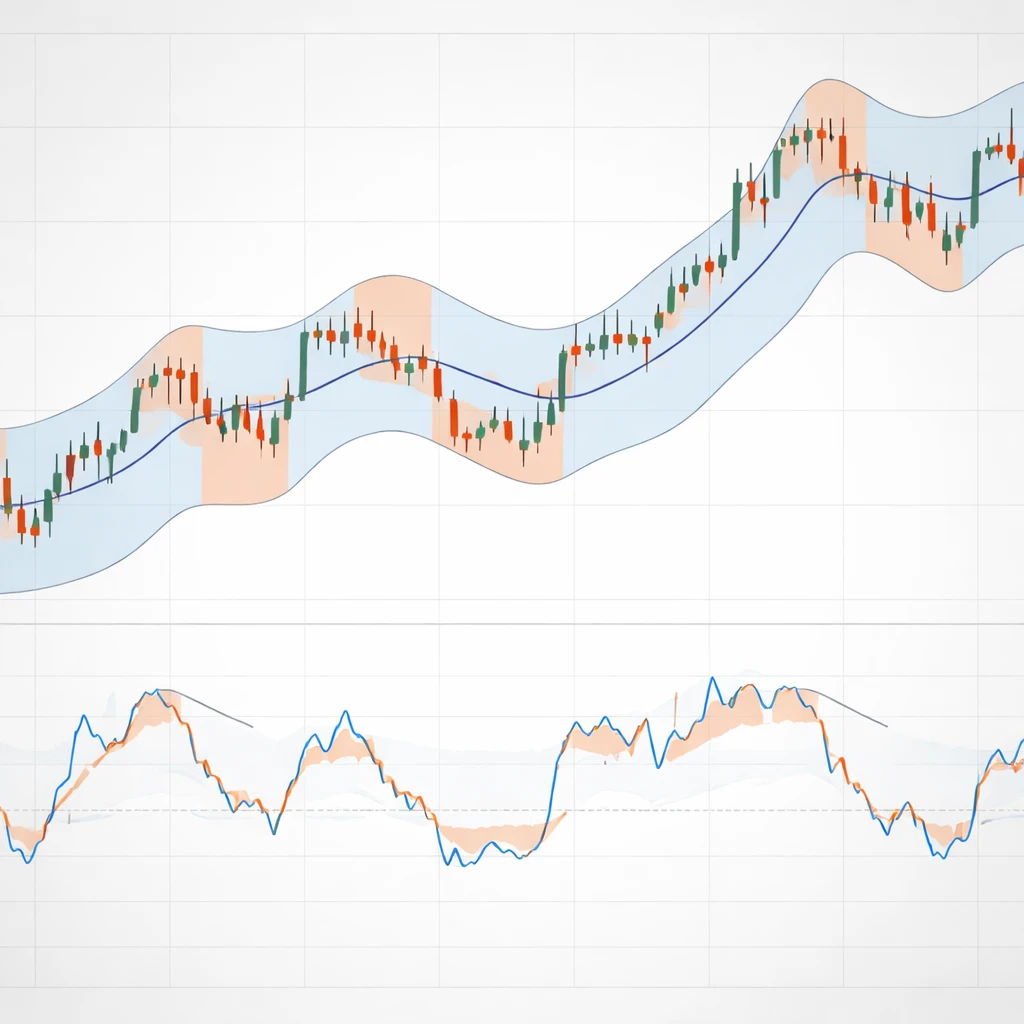

Indicators vs Price in Mean Reversion refers to strategies that either:

- Use indicator states to infer that price is extended relative to a statistical or behavioral norm, or

- Use direct price displacement from a defined mean as the primary signal, occasionally conditioning on indicator agreement or disagreement.

In the first case, indicator values such as oscillators are treated as proxies for distance from equilibrium. In the second case, the focus is on the magnitude and context of price deviation from a reference, with indicators acting as filters or secondary evidence. The approaches are not mutually exclusive. Many robust systems blend them, for example by requiring an indicator extreme when price has moved far from a moving average, or by fading price extremes only when an indicator shows loss of momentum.

Why Mean Reversion Can Be Observable

Mean reversion does not imply that markets are predictable in a simple sense. Instead, it posits that certain forces can compress deviations from a reference level after an initial shock. Several mechanisms are relevant:

- Inventory and liquidity effects. Market makers and liquidity providers often manage inventory around expected fair value. Temporary imbalances can be met with contrarian flows that reduce extremes.

- Behavioral responses. Overreaction and herding can push price away from short term equilibrium. As attention shifts or marginal investors rebalance, price may drift back toward prior levels.

- Information decay and microstructure. News surprises and order flow shocks have a half life. The initial impulse may fade as subsequent information fails to reinforce the move.

- Statistical pull toward averages. Many assets exhibit short horizon negative autocorrelation under certain regimes. That does not guarantee reversion, but it raises the probability that large one sided moves compress within defined windows.

These mechanisms are episodic and regime dependent, which is why the choice of anchor and filters matters. Indicator anchored designs and price anchored designs respond differently to these conditions.

Two Anchors for Reversion: Indicator States and Price Displacement

Price anchored mean reversion

Price anchored approaches define a numerical reference and measure the distance between current price and that reference. Common choices include a rolling average, a volatility weighted average, or a session based benchmark such as volume weighted average price. Signals arise when the displacement is large relative to recent variability or relative to a structural reference like the prior close.

This framing is attractive because it is transparent and easy to normalize. The displacement can be scaled by recent volatility so that comparably extreme moves are comparable across assets and regimes. It is also adaptable across horizons. On intraday horizons, deviation from a session benchmark captures order flow imbalances. On daily horizons, deviation from a rolling mid captures medium term overreaction or mean drift.

Risks include sensitivity to persistent trends, structural breaks, and volatility clustering. A sequence of moves away from the reference can remain uncorrected for longer than expected, especially when broader trends dominate. For this reason, many price anchored systems condition on additional information, such as higher time frame trend direction or a volatility regime filter.

Indicator anchored mean reversion

Indicator anchored approaches infer extension from the state of an oscillator or momentum measure rather than from price displacement alone. Oscillators compress price information into a bounded scale, which can be easier to interpret across assets. Extremes in such indicators often correlate with short term exhaustion. Divergences between indicator direction and price direction can also flag waning momentum.

An advantage of indicator anchoring is that it can pick up subtle shifts in participation or momentum that are not obvious from price distance alone. It can also help normalize across regimes, since properly designed oscillators adapt to changing volatility by construction.

However, indicators are transformations of price and therefore introduce lag and smoothing choices. Parameter choices affect responsiveness. Overly responsive settings create noise and whipsaws. Overly smooth settings miss reversals. Indicator states can also remain extreme in strong trends, which undermines simple mean reversion rules unless complemented by additional filters.

Indicators versus price as a design tension

The phrase indicators vs price describes a useful tension rather than a binary choice. A practical framing is to examine situations where indicator state and price displacement disagree. For example, price may be far from a rolling mean while the oscillator fails to confirm ongoing pressure, which suggests a decelerating move. Alternatively, indicator extremes can occur without significant price displacement if volatility is low, which may not justify a reversion hypothesis on its own. Designing around this tension encourages conditional logic rather than one dimensional thresholds.

Core Logic of the Strategy Type

Mean reversion strategies operate by defining a proxy for equilibrium, estimating how far price has wandered from it, and specifying conditions under which a return toward that equilibrium is plausible within a chosen horizon. The core logic involves:

- Reference definition. Choose a reference that is statistically stable for the intended horizon. Rolling averages, session benchmarks, and cross sectional peers are common choices.

- Normalization of distance. Express the deviation relative to volatility or dispersion so that a large move is large in context. This avoids comparing raw points across regimes.

- Evidence of exhaustion or disagreement. Use indicator states to assess whether the force behind the move is weakening. Indicator divergence or loss of momentum can serve as a qualitative cross check.

- Time horizon and decay expectation. Assume a half life of dislocations consistent with the strategy horizon. The longer the assumed half life, the more patience and risk capital are required.

- Exit rules aligned with the hypothesis. If the hypothesis is a return toward a mean, exits often relate to partial or full reconvergence, or to a predefined time window that recognizes model uncertainty.

These elements can be assembled in price anchored, indicator anchored, or blended designs without relying on fixed price levels or prescriptive thresholds.

Building Blocks: Measurement Choices and Their Consequences

Defining the mean

The choice of mean matters. A short rolling average hugs price and creates frequent signals with short holding periods. A longer average responds slowly and requires wider deviations to matter. Session based references, such as a volume weighted average of intraday trades, frame reversion in terms of order flow rather than historical closes.

Alternative references include robust averages that downweight outliers and regression based baselines that account for predictable seasonal effects. The more complex the reference, the greater the risk of overfitting. Simpler definitions are easier to reason about and to validate out of sample.

Normalizing displacement

Raw distance from the mean is not comparable across time. A volatility normalized measure, such as distance divided by a recent dispersion estimate, places moves on a consistent scale. Some designers prefer percentile ranks of displacement over a rolling window to decouple signals from distributional assumptions. Others rely on bands that expand and contract with volatility, which embed normalization into the reference itself.

Indicator selection and transformation

Oscillators differ in sensitivity. Some track the ratio of up to down moves, others weight recent moves more heavily, and others emphasize extremes. Bounded oscillators are convenient because they define a neutral midpoint and upper and lower extremes. Unbounded momentum measures can also be used, provided normalization is applied.

It is often useful to think of indicators as estimators of momentum decay rather than as absolute signals. An indicator extreme suggests that short horizon momentum has been spent. A divergence suggests that marginal momentum is falling even if price has not yet reverted. These are hypotheses that require risk controls and context filters.

Sampling frequency and horizon alignment

Mean reversion dynamics differ across intraday and multi day horizons. Intraday signals may lean on session benchmarks and microstructure effects. Daily signals often relate to post news drift or rebalancing flows. Mixing horizons can degrade performance because the decay profile differs. Align the reference, normalization, and indicator window to the intended holding period.

Filters and regime awareness

Simple filters often improve robustness. A higher time frame trend filter reduces the likelihood of fading strong directional moves. Volatility regime filters avoid engaging during extreme conditions when reversion assumptions weaken. Liquidity filters ensure that the instrument can be transacted at reasonable cost for the intended turnover.

How It Fits Into Structured, Repeatable Systems

A repeatable system is built from modules that each serve a clear function. For indicators vs price in mean reversion, a typical architecture includes:

- Universe and data. Define instruments, data frequency, cleaning rules, and corporate action handling. For intraday systems, account for session boundaries and opening auction effects.

- Signal engine. Compute the reference mean and the displacement measure. Compute indicator states. Encode conditional logic that relates indicator signals to price displacement and to filters.

- Risk model. Translate signal strength into position sizing using volatility scaling or similar methods. Set maximum gross and net exposure limits. Define concentration and correlation constraints when trading multiple assets.

- Execution layer. Map desired exposure changes to order types. Incorporate estimates of slippage and market impact. For high turnover mean reversion, transaction cost modeling is critical.

- Monitoring and diagnostics. Track live distribution of displacements, realized holding periods, and divergence between expected and realized reconvergence. Monitor whether regime filters are frequently engaged, which may indicate a mismatch between assumptions and current conditions.

This modular design supports testing each component independently and reduces the risk that one unstable element dominates outcomes.

Risk Management Considerations

Mean reversion strategies face specific risks that differ from trend following techniques. Managing these risks is central to system durability.

- Trend day risk. On days when directional flows dominate, price can run away from the mean and remain extended. Indicator extremes may persist. Systems often mitigate this with trend filters, time based risk limits, or dynamic position caps.

- Volatility regime shifts. When volatility rises sharply, historical dispersion estimates become stale. Normalization built on recent calm can understate risk. Adaptive volatility measures or conservative caps help address this mismatch.

- Gap and event risk. News events can reset the equilibrium. Post event reversion is not guaranteed and can be delayed or invalidated. Time based exits and logic that avoids engagement around scheduled events can reduce exposure to this risk class.

- Transaction costs and slippage. Mean reversion often implies higher turnover. Costs can erode edge. Backtests that ignore realistic costs, spread changes, and queue position effects misstate viability.

- Correlation and crowding. Cross asset signals can become correlated precisely when the strategy expands exposure. Drawdowns can be amplified if many assets revert slowly at the same time.

- Parameter drift and overfitting. Indicator thresholds, window lengths, and filters that look optimal historically may not generalize. Robustness checks and parsimony reduce fragility.

Risk management is not only about limiting losses. It reframes the hypothesis in probabilistic terms and ensures that position sizing and exits remain consistent with uncertain reconvergence timing.

High Level Example of Strategy Operation

The following example illustrates the operational flow of a blended design that uses both price displacement and indicator state. It is intentionally high level and omits specific thresholds or price levels.

- Reference and normalization. Compute a rolling average as the reference mean for the chosen horizon. Measure the distance between current price and the reference. Normalize the distance by a recent dispersion estimate so that displacement is comparable across time.

- Indicator state. Compute a bounded oscillator that summarizes recent momentum. Identify conditions that correspond to potential exhaustion or divergence relative to price movement.

- Disagreement logic. Define candidate setups when the normalized price displacement is large while the oscillator shows weakening momentum in the direction of the move. Conversely, avoid setups when both displacement and the oscillator align strongly in the same direction.

- Regime and trend filters. Apply a higher time frame filter that identifies trending conditions. Reduce or skip exposure when the filter indicates a persistent directional environment. Apply a volatility filter to avoid extreme market states.

- Sizing and constraints. Map signal strength to desired exposure using volatility scaling. Impose caps per instrument and across the portfolio. Consider correlation constraints so that multiple simultaneous signals do not create unintended concentration.

- Exits. Define exits consistent with the mean reversion hypothesis. Common forms include partial or full reconvergence toward the reference or a time based exit if reversion has not occurred within an expected window. Include a protective exit for adverse moves that exceed modeled expectations.

- Execution. Choose execution tactics suited to the expected holding period and liquidity. Incorporate cost estimates so that marginal signals do not trigger when costs would dominate expected benefit.

This workflow ties indicator information to price displacement and clarifies when the two agree or disagree. The structure supports both intraday and multi day horizons, provided that inputs and filters are aligned with the intended holding period.

Evaluation and Validation

Evaluating a mean reversion system requires evidence that the hypothesized reconvergence occurs with sufficient reliability after conditioning on filters and costs. Several diagnostics are informative:

- Distribution of displacement at entry and exit. Measure how far price tends to be from the reference when the system engages and how much reconvergence is typically realized by the exit. This ties outcomes to the hypothesis directly.

- Holding period and half life. Track the median time to partial reconvergence. A mismatch between assumed and realized half life suggests that the reference or filters are not aligned with the market microstructure.

- Payoff symmetry. Mean reversion often features high hit rates with smaller average gains versus less frequent larger losses. Verify that the tail of adverse outcomes is controlled by exits and sizing.

- Cost sensitivity. Stress test results across realistic ranges of spreads, fees, and slippage. Many backtests are viable only before costs.

- Regime robustness. Segment performance by volatility regimes, trend strength, and liquidity. Stability across segments is a positive sign. Concentration of results in a narrow regime suggests fragility.

Validation should rely on out of sample testing, walk forward analysis, and conservative assumptions. Simple designs that retain performance under these constraints are preferable to complex designs with fragile parameter tuning.

Common Pitfalls

Even conceptually sound mean reversion systems can degrade if implementation details are neglected. Common pitfalls include:

- Overlapping signals. Generating multiple entries from highly correlated assets or from successive bars during the same displacement event can overstate diversification and compress liquidity.

- Look ahead and survivorship bias. Improper data handling can inadvertently use future information. Ensure that reference calculations use only past data and that instrument lists reflect live tradability over time.

- Misaligned horizons. Using an intraday reference with multi day indicators or vice versa can create inconsistent assumptions about decay speed.

- Ignoring execution. Signal quality without executable capacity is illusory. Queue position, partial fills, and market impact matter, particularly for high turnover strategies.

- Parameter chasing. Iterating on window lengths and thresholds until performance looks optimal usually embeds noise. Favor parameters that are stable across assets and periods.

Variations and Extensions

The indicators vs price framework scales across instrument types and horizons with appropriate adaptation.

- Intraday reversion to session benchmarks. Designs may focus on distance to a session reference while using fast oscillators as confirmation. Execution and cost modeling are central due to turnover.

- Daily reversion to rolling means. Slower oscillators and trend filters often complement daily displacement signals. Event awareness is important since earnings or macro releases can reset the mean.

- Cross sectional mean reversion. Instead of time series displacement, rank assets by deviation from their peers or by standardized residuals from a factor model. Indicators can filter which deviations represent potential overextension.

- Robust statistics. Replace simple averages and standard deviations with robust measures that reduce outlier influence. This may stabilize signals during turbulent periods.

- Multi signal ensembles. Combine several weak, low correlation signals such as price displacement, oscillator divergence, and microstructure imbalance. The goal is to reduce dependency on any single estimator of reversion potential.

Practical Example Without Prescriptive Levels

Consider a daily horizon system applied to a liquid equity index future. The design objective is to engage when price appears extended relative to a rolling mean and when momentum evidence suggests exhaustion, while avoiding strong trend regimes.

Step 1: Reference and dispersion. Compute a rolling mean and a dispersion estimate over a window that reflects the intended holding period. Transform the distance between price and the mean into a standardized scale so that the same signal strength has comparable meaning across months.

Step 2: Momentum indicator. Compute a bounded momentum oscillator. Identify states that historically correlate with short term exhaustion. Track divergences between price movement and the oscillator.

Step 3: Conditional logic. Define candidate opportunities when standardized displacement is large and the oscillator either reaches an extreme or shows a divergence hinting at slowing pressure. Exclude cases where a higher time frame filter suggests a strong, persistent trend.

Step 4: Position sizing. Translate signal strength into a target position scaled by volatility. Impose caps to limit exposure during uncertainty. Consider correlation with other holdings if used in a portfolio context.

Step 5: Exits and time horizon. Use exits linked to partial reconvergence toward the rolling mean or a time based exit if reconvergence does not occur within an expected window. Include a protective exit for adverse moves that exceed modeled tail risk.

Step 6: Execution and monitoring. Execute with tactics suited to daily horizons, balancing immediacy and cost. Monitor realized reconvergence speed, drift during non trending regimes, and behavior during event windows. Adjust the reference window and filters only after robust, out of sample analysis.

This example demonstrates how indicator information and price displacement can be blended into a coherent, testable process without reliance on precise thresholds in a narrative description.

Position in a Larger Systematic Framework

In a diversified systematic program, indicators vs price in mean reversion often plays a complementary role to trend following or carry based strategies. Mean reversion tends to perform in relatively range bound or rotational regimes, while trend strategies perform during persistent directional moves. Combining them can smooth portfolio behavior provided correlation and exposure are managed deliberately.

Operationally, the same governance that supports other systematic strategies applies: clear change control over parameters, routine monitoring of slippage and model drift, and predefined conditions under which the system is scaled down or paused. Documentation of assumptions about decay speed, expected holding period, and cost thresholds helps maintain discipline during drawdowns that are characteristic of mean reversion approaches.

Conclusion

Indicators vs price in mean reversion is best viewed as a design choice about how to define equilibrium and measure extension. Price anchored approaches emphasize transparent displacement from a reference. Indicator anchored approaches emphasize momentum exhaustion and behavioral cadence. Blended approaches use the disagreement between the two to condition engagement. Whichever path is chosen, the essential tasks remain the same: define a stable reference for the horizon, normalize distance, control risk rigorously, and avoid overfitting through parsimony and robust validation.

Key Takeaways

- Indicator anchored and price anchored mean reversion are complementary ways to define and detect dislocations from equilibrium.

- Normalization of displacement and careful horizon alignment are essential for comparability and realistic expectations of reconvergence.

- Risk management must account for trend day risk, volatility regime shifts, event risk, costs, and correlation, not merely entry logic.

- Blended designs often exploit disagreement between indicator state and price displacement to improve selectivity.

- Validation should emphasize out of sample robustness, cost sensitivity, and stability across regimes rather than parameter tuning.