What Is a Breakout Strategy?

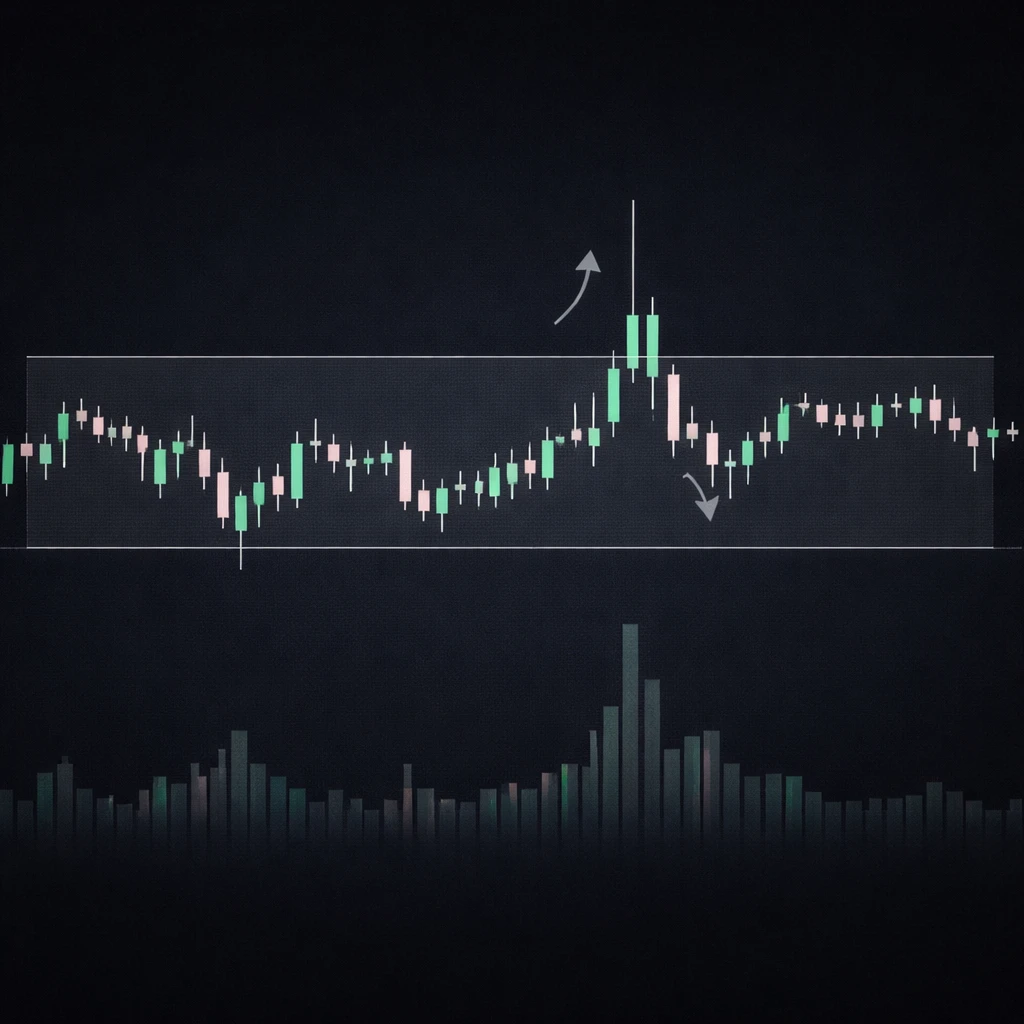

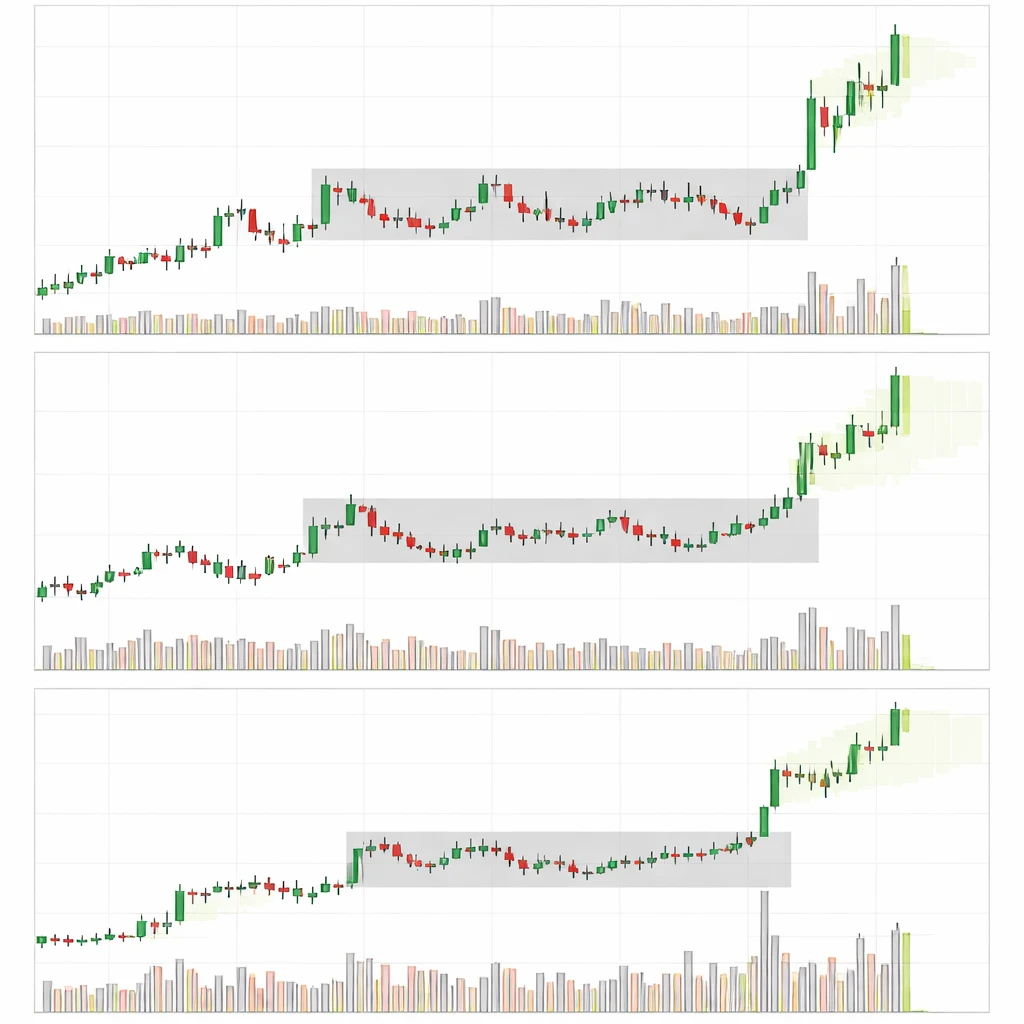

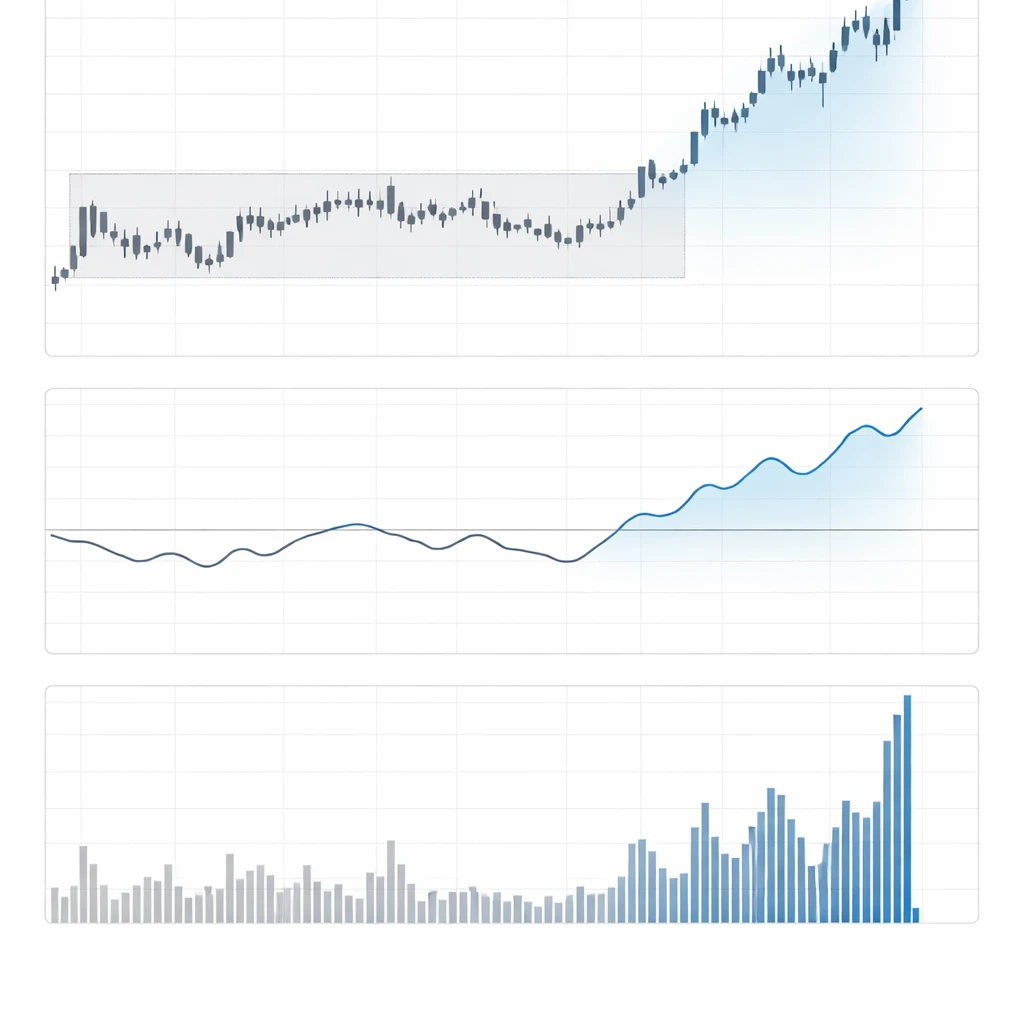

A breakout strategy seeks to capture price movement that follows a decisive move beyond a well-defined boundary such as a trading range, trendline, or volatility band. This article explains the core logic, structure, and risk controls that support breakout methods within disciplined trading systems.