Trading Strategies

Structured approaches that combine analysis, risk management, and execution into repeatable trading systems across different markets and timeframes.

You will learn: The core concepts in this topic, common misconceptions, and how professionals think about the subject.

Educational content only. Not financial advice.

What you will get from this topic

- Clear definitions and real-world context

- Practical examples without trade recommendations

- Common mistakes to avoid

- A progression from basics to deeper understanding

Scopes in Trading Strategies

Options Strategies

Using options to express directional, neutral, or volatility-based views.

Explore ScopeEvent & News-Based Trading

Trading around earnings, economic releases, and major events.

Explore ScopePopular in Trading Strategies

Why Trends Persist

An in-depth explanation of why market trends persist and how trend following systems translate that persistence into structured, repeatable trading rules with disciplined risk management. The article covers behavioral, structural, and statistical drivers, practical design elements, and limitations.

Trend Following Across Timeframes

A structured overview of multi-timeframe trend following, explaining the logic of aligning higher- and lower-horizon trends, design choices for systematic rules, and the risk management principles that support robustness without giving trade signals or recommendations.

Trend Strength Explained

A rigorous explanation of trend strength in trend following systems, including definitions, measurement frameworks, and how strength integrates with filters, position sizing, and risk controls in structured, repeatable workflows. No signals or recommendations are provided.

Identifying Trend Direction

An academically grounded guide to defining and measuring trend direction, integrating it into structured trend following systems, and managing the practical risks that arise when markets change state and momentum decays or reverses. Suitable for readers building rule-based processes without prescribing trade entries or exits.

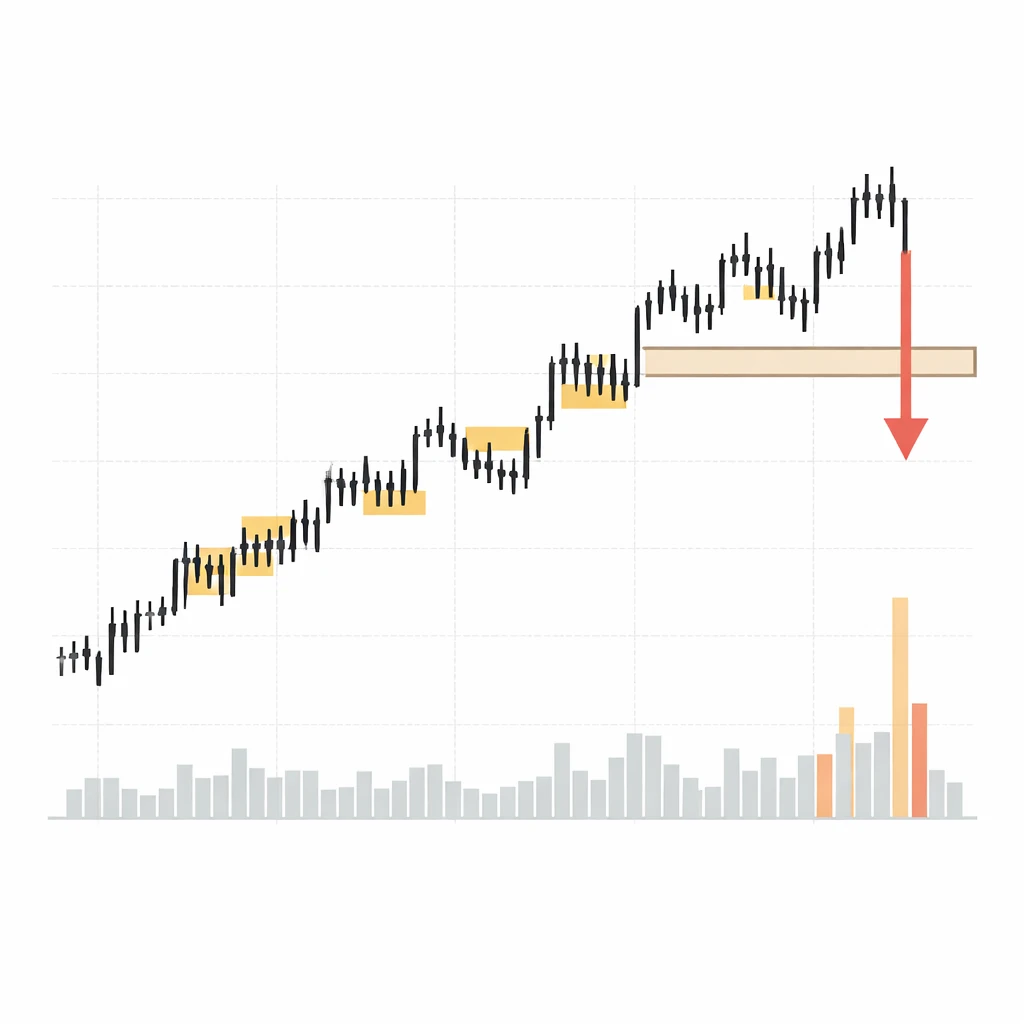

Pullbacks in Trend Following

A structured overview of pullback concepts within trend following, including the core logic, system design elements, risk management considerations, and a high-level example of how the approach operates without prescribing specific trade signals or prices.

Breakdowns vs Trend Continuations

A rigorous treatment of how trend followers distinguish between continuation and breakdown states, why the distinction matters, and how to structure rules, risk controls, and evaluation to make the approach repeatable without relying on discretionary judgment.

Ready to begin?

Start with the first scope to build a clean foundation, then move forward in order.

Start Trend Following