Trading decisions are always made in time. Prices arrive as a sequence of observations, orders queue and fill within specific sessions, and risk accumulates differently over minutes, days, and weeks. Comparing trading timeframes means deliberately viewing the same market through multiple time horizons to understand how execution conditions, risk windows, and management choices change as the clock changes. The practice is not about predicting prices. It is about matching the pace of decision making and monitoring to the time structure of the market one participates in.

What Comparing Trading Timeframes Means

Comparing trading timeframes is the process of examining the same instrument or exposure across several time units, such as minutes, hours, days, and weeks, and then using the differences among those views to inform execution and ongoing management. The concept does not require technical indicators or pattern recognition. It relies on the recognition that market microstructure, liquidity, and information flow vary with time.

In practice, many traders adopt a primary timeframe that matches their intended holding period, then reference one or two adjacent timeframes for context and execution. For example, a trader focused on a several-day holding period may monitor daily data for planning and risk, and intraday data for fills and order scheduling. The comparison helps identify when the behavior seen on one horizon is meaningful or simply noise relative to the decision horizon.

Why Markets Look Different Across Timeframes

Prices do not evolve uniformly. Several features of modern markets cause the same asset to exhibit different characteristics when viewed over minutes versus months.

- Liquidity cycles by time of day: Many venues have predictable surges in activity near the open and close, during index rebalancing windows, and around scheduled announcements. Spreads and depth vary accordingly, which affects fill quality on short horizons.

- Information release schedules: Earnings calls, macro data, and policy decisions occur at defined times. The effect on prices within minutes of release can differ sharply from the slower repricing that unfolds across days.

- Overnight and weekend gaps: Instruments that do not trade continuously can open at prices far from the previous close after new information arrives. This creates risk that exists on daily horizons but not within a single continuous intraday session.

- Variance scaling: The dispersion of returns typically grows with the square root of time under simple models, yet real markets experience volatility clustering and regime shifts. Short horizons can show relative noise dominated by microstructure, while longer horizons aggregate that noise into clearer ranges of movement.

- Participants with different mandates: Market makers, high-frequency firms, hedgers, and long-horizon asset managers operate on different clocks. Their interactions shape order flow differently across minutes, days, and months.

Defining the Main Timeframes

Any timeframe is a choice of how to aggregate trades or quotes over a fixed interval. Three broad categories are commonly referenced for practical decision making.

- Intraday: Seconds to hours. Focused on execution quality, order book conditions, and time-of-day effects. Exposure to overnight gaps is absent if positions are flat into the close. Transaction costs and slippage are prominent considerations.

- Daily: Close-to-close or session-to-session. Captures overnight risk, scheduled announcement effects, and larger swings in realized volatility. Many portfolio controls and reporting conventions operate at this cadence.

- Weekly or monthly: Aggregates many sessions into a slower view of dispersion and drawdown. Useful for understanding the background pace of risk, funding cycles, and structural changes that are not visible intraday.

How Comparison Works in Practice

Comparing timeframes involves three basic steps. First, define the primary decision horizon. Second, identify adjacent horizons that provide execution context and risk context. Third, normalize what is being compared so that differences across horizons are meaningful rather than artifacts of scaling.

Primary decision horizon: This is the timeframe aligned with the intended holding period and review cadence. A day-level horizon, for example, implies tolerance for intraday fluctuations that do not change session-level risk estimates, and particular attention to overnight announcements and gap risk.

Adjacency for execution and risk: Shorter horizons help refine order timing, partial fills, and expected slippage. Longer horizons help evaluate whether current dispersion, drawdown, or liquidity conditions are typical or unusual, given the broader environment.

Normalization: Comparing raw price moves across minutes and weeks is misleading without rescaling. Common normalizations include percentage return rather than absolute price change, standard deviation per unit time, and average spread as a fraction of price. These provide a consistent yardstick to judge whether a move is large or small relative to the horizon.

What Practitioners Actually Compare

Although techniques vary, several comparisons recur in professional workflows because they address execution quality and risk management without dictating strategy.

- Dispersion across horizons: Comparing the typical intraday range to the typical daily range indicates how much of the session movement happens within the day versus across the close. This affects whether fills should be sought near liquid windows or spread across time.

- Spread and depth by clock time: Observing how bid-ask spreads and quote depth change at the open, midday, and close helps determine when execution is likely to be cheapest. The same analysis on a weekly cadence highlights the impact of month-end or quarter-end flows.

- Event sensitivity: Measuring the distribution of returns in the minutes around scheduled data versus ordinary minutes reveals whether event risk dominates intraday movement. A daily comparison then shows whether those events also shape close-to-close outcomes.

- Gap frequency and size: For instruments with pauses in trading, estimating how often and how far prices jump between sessions helps calibrate overnight exposure. This consideration exists at the daily horizon and is invisible to a purely intraday view.

- Time to fill: On shorter horizons, average time in queue and slippage relative to mid-price matter. On longer horizons, the question is whether partial fills across several sessions change exposure in ways that align with risk limits.

Why the Concept Exists

Comparing timeframes exists because markets are layered. The same asset is a different proposition for a market maker quoting in milliseconds, a discretionary trader managing day-to-day risk, and an allocator measuring results monthly. Each layer experiences a different shape of liquidity, cost, and risk. Without explicit comparison, a trader can easily misinterpret noise on the wrong horizon as a meaningful signal, or ignore structural risks that appear only on slower clocks.

Historical conventions reinforce the practice. Many risk systems and reports operate at the daily close, since accounting and margin processes rely on end-of-day marks. Exchange opening and closing auctions concentrate liquidity and price discovery, creating natural intraday landmarks. Institutional mandates often reference weekly or monthly drawdown thresholds. Comparing timeframes links the trader’s actions to these institutional rhythms.

A Concrete, Real-World Context

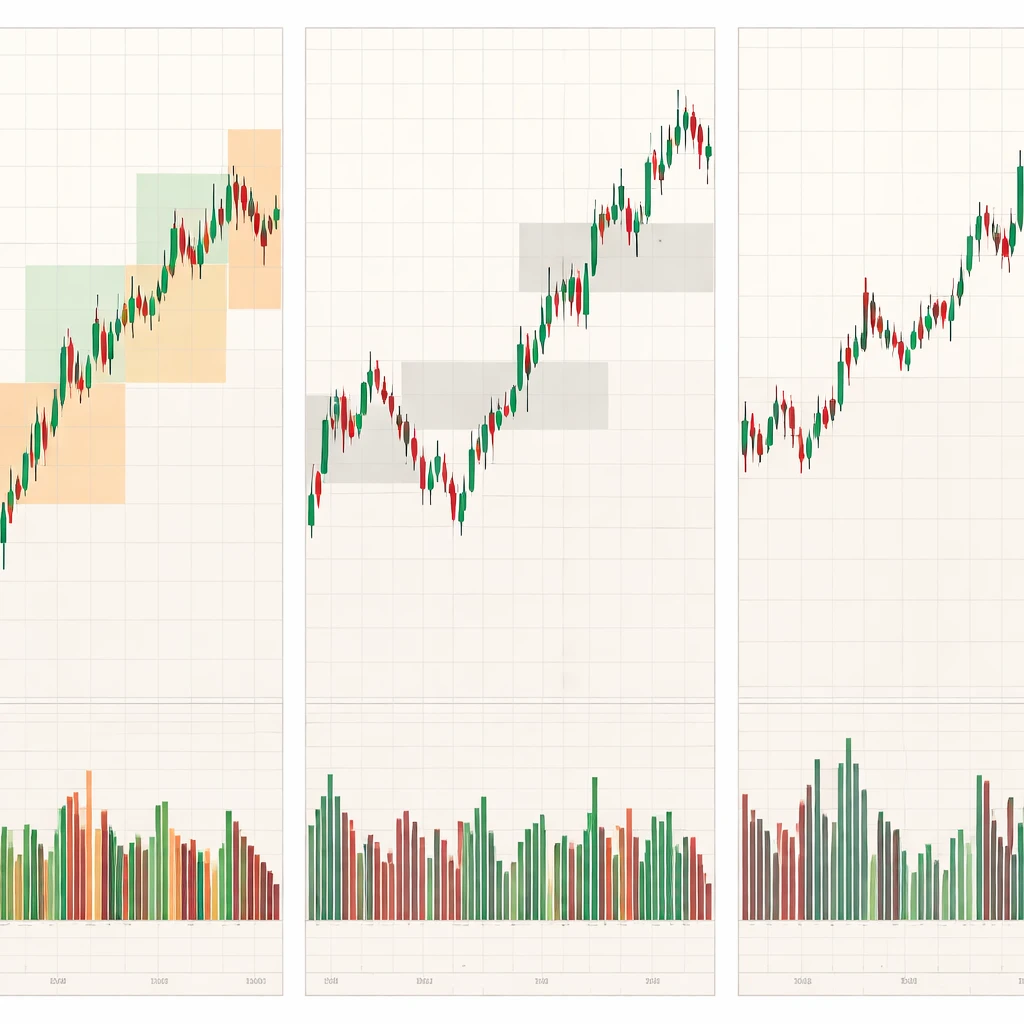

Consider a liquid equity index future on a day with a scheduled policy announcement. The weekly view across the prior quarter shows relatively modest fluctuations and few drawdowns, suggesting a calm background regime. The daily view over the previous two weeks shows realized volatility increasing as the announcement approaches, along with larger close-to-close changes, including one sizable gap after a data release. The intraday view on the morning of the announcement shows tight spreads early in the session, a brief widening as participants pause, and then sudden surges in volume and range around the release time.

None of these observations prescribes a strategy. What they do is shape execution and management logistics. A trader who intends to hold for several days may recognize that most of the immediate price impact is likely to occur within minutes of the announcement, which increases the chance of slippage if submitting marketable orders during that window. The same trader, informed by the daily view, might recognize that overnight gap risk is currently elevated compared to prior weeks, which affects how comfortable they are with exposure through the close. The weekly view provides context for whether these conditions look exceptional or simply a modest uptick within a longer stable period.

Execution Considerations by Timeframe

Execution quality is heavily dependent on the horizon at which orders are placed and the microstructure prevailing at that time.

- Intraday: Attention often centers on spreads, depth, and the predictability of queue positioning. Liquidity is rarely uniform. Some instruments exhibit tighter spreads and deeper books at the open due to the auction, then a lull, then renewed activity into the close. Comparing these patterns across days helps determine whether conditions are typical or unusual for the instrument.

- Daily: With exposure held across sessions, overnight announcements become relevant. Fill decisions near the close may face wider or narrower spreads depending on the day’s character. Comparing several recent closes provides a grounded sense of typical end-of-day liquidity, which in turn shapes the likely cost of adjusting exposure late in the session.

- Weekly: Aggregate execution across multiple sessions introduces questions about pacing. If an order is large relative to average daily volume, breaking it over several days raises the chance that interim price changes alter the effective average price in ways that matter for risk. Weekly comparisons of average volume and end-of-week rebalancing flows are useful context.

Risk Windows and Management Cadence

Each timeframe implies a different risk window, the period during which price changes can affect outcomes before the trader can reasonably review or intervene.

- Intraday risk window: Minutes to hours. Interruptions can arise from microstructure events such as pause auctions, temporary spread widening, or bursts of activity around a headline. Management typically focuses on slippage and immediate adverse movement.

- Daily risk window: Close to next open, including gap risk. Management often revolves around sizing relative to expected daily dispersion, and whether any scheduled events occur outside cash-session hours.

- Weekly risk window: Session clusters that include cumulative exposure to multiple data releases, funding dates, or rebalancing. Management focuses on drawdown over multiple closes and the persistence of higher or lower volatility.

Comparing these windows helps align review intervals to the primary horizon. For example, a daily-horizon trader might check intraday conditions for execution, then evaluate risk once per session based on close-to-close results, reserving weekly reviews for larger questions about dispersion and drawdown that are not visible day by day.

Normalization and Measurement Across Horizons

To compare horizons meaningfully, it helps to convert raw movement into metrics that scale with time.

- Percentage returns: Expressing changes in percent allows direct comparison of moves across price levels.

- Standard deviation per unit time: Estimating the standard deviation of returns at intraday and daily frequencies, then annualizing or de-annualizing, allows a sense of proportional risk. The square root of time is a starting approximation, while recognizing that volatility clustering and jumps cause deviations.

- Range-based measures: Comparing the typical intraday high-low range to the typical daily range clarifies how much of the total movement happens within versus across sessions.

- Transaction cost metrics: Average spread as a fraction of price, median slippage relative to the mid, and time-to-fill statistics align execution decisions with actual cost conditions at different times of day.

How Timeframe Comparison Informs Order Placement

Even without specifying a strategy, certain execution realities follow from timeframe comparisons.

- When short-horizon dispersion spikes around specific times, the risk of paying through the spread rises. Traders often address this by observing the instrument’s historical spread and volume profile across the session and choosing order types and schedules that reflect those profiles.

- When daily gap frequency increases, the cost of carrying exposure across the close rises relative to purely intraday risk. That may prompt a re-evaluation of whether adjustments should occur earlier in the session to reduce last-minute slippage.

- When weekly comparisons show end-of-period volume surges, large orders that would otherwise finish midweek may be paced differently to avoid or participate in those flows, depending on the objective.

These are not recommendations. They are examples of how knowledge about time-dependent liquidity and risk, derived from comparing horizons, shapes the logistics of placing and managing orders in real venues with real frictions.

Managing a Position Across Multiple Horizons

Once a position exists, comparing timeframes helps separate meaningful information from noise. A few guidelines illustrate the logic.

- Primary horizon as the anchor: If the decision was made on a daily horizon, then intraday wiggles that fall within typical intraday dispersion may be treated as noise for management purposes. Conversely, daily moves that exceed usual daily dispersion deserve attention, even if intraday periods were uneventful.

- Scheduled review cadence: Establishing a consistent review clock reduces the impulse to react to information that is irrelevant to the chosen horizon. For example, daily-horizon decisions are reviewed after the close, while execution checks occur intraday.

- Escalation criteria: Thresholds based on normalized movement, liquidity shifts, or event risk can trigger a higher-frequency review. The key is that the triggers are defined and related to the primary horizon rather than ad hoc reactions.

Data Quality and Practical Complications

Timeframe comparisons only help if the underlying data and timestamps are consistent.

- Session definitions: Some instruments trade nearly 24 hours, others only within a cash session. Define precisely what constitutes a day, including premarket and aftermarket segments when applicable.

- Corporate actions and contract rolls: For equities, splits and dividends alter raw prices. For futures, rolling contracts introduces jumps that are not true price movements. Adjustments are needed to make cross-timeframe comparisons coherent.

- Time zone and daylight shifts: Scheduled events may move relative to local market hours during daylight saving transitions. Align comparisons to a consistent reference clock.

- Outliers and missing data: Ensure that spikes, halts, and data gaps are correctly labeled so that calculations of range, volatility, and spread behavior are not distorted.

Human Factors and Common Pitfalls

Comparing timeframes introduces cognitive challenges. Awareness of these issues can prevent unforced errors.

- Anchoring on a single horizon: Focusing exclusively on intraday behavior can ignore material overnight risk. Focusing only on weekly aggregation can miss execution cost swings that dominate short-horizon results.

- Chasing cross-timeframe alignment: Waiting for every timeframe to appear favorable can lead to indecision. The remedy is to define the primary horizon clearly and treat others as context rather than as vetoes.

- Confirmation bias: It is easy to cherry-pick the timeframe that supports a preexisting view. A structured comparison with predefined metrics reduces this risk.

- Overreaction to noise: Intraday fluctuations can feel important. Comparing their size to typical intraday dispersion helps calibrate responses.

Institutional and Retail Contexts

The value of timeframe comparison depends partly on constraints. Institutional desks often face obligations such as participation rates, internal crossing opportunities, and end-of-day benchmarks. These constraints anchor execution to particular times, making intraday comparisons of spread and depth critical. Retail participants may have more flexibility but less ability to internalize order flow, which makes awareness of public order book conditions and scheduled liquidity windows especially relevant. In both contexts, aligning the decision horizon with the practical constraints of execution is the main benefit.

Illustrative Example: A Single Name Around Earnings

Imagine a large-cap stock with an earnings release after the close on Wednesday. The weekly view over the last quarter shows mild movement with two modest drawdowns. The daily view across the last ten sessions shows expanding ranges as the date approaches and two noticeable gaps on prior earnings days. Intraday data from recent earnings days show widened spreads in the minutes before the close, followed by thin liquidity in the after-hours session and a volatile open the next morning.

For a trader whose actions occur on a daily horizon, the comparison highlights two management issues. First, the probability of a large close-to-next-open gap appears elevated compared to typical days. Second, the intraday spread dynamics near the close suggest that any adjustments placed late on earnings day may face a higher expected cost. The weekly view indicates whether this pattern is unusual for the stock or consistent with its historical behavior around quarterly reports. The trader’s choices about order timing or exposure are shaped by these observations, not dictated by a strategy rule.

From Concept to Repeatable Process

Turning comparison into routine practice requires a small set of consistent steps.

- Define the primary horizon: Match it to the intended holding period and the cadence of risk evaluation.

- Select supporting horizons: One shorter for execution conditions and one longer for regime and drawdown context is often sufficient.

- Establish metrics: Use percentage moves, standard deviation per unit time, typical range, and cost metrics like spread and slippage. Keep definitions stable across reviews.

- Schedule reviews: Tie intraday checks to known liquidity windows and daily checks to the close. Reserve a weekly or monthly review for larger environment changes.

- Document deviations: When conditions diverge from typical patterns, note the magnitude and implications for execution and management. Over time, these notes form a practical map of the instrument’s time-dependent behavior.

What Comparing Timeframes Does Not Do

It does not guarantee better outcomes. It does not replace risk controls, nor does it provide a directional view on price. Its value lies in reducing avoidable frictions and misunderstandings that arise when decisions are made on one clock but executed or evaluated on another. By clarifying when and where risk enters the picture, and when liquidity is most or least supportive, timeframe comparison supports a cleaner separation between analysis, execution, and ongoing management.

Key Takeaways

- Comparing trading timeframes means viewing the same market across intraday, daily, and longer horizons to align execution and management with the relevant risk windows.

- Markets look different across horizons because liquidity, information flow, and participant behavior vary by time of day and calendar period.

- Useful comparisons focus on normalized measures such as percentage moves, dispersion per unit time, spread costs, and gap frequency.

- The practice shapes real-world logistics, including order timing, pacing, and review cadence, without prescribing strategy or direction.

- Consistency in data definitions, session clocks, and review schedules is essential for comparisons to be reliable and actionable in routine workflows.