Why Platform Fees and Costs Matter

Every trade passes through an infrastructure of brokers, exchanges, clearinghouses, and data providers. Each piece of that infrastructure has a cost. Platforms package those costs into commissions, pass-through exchange and regulatory fees, data subscriptions, and a variety of account charges. Even where commissions are set to zero, costs remain in the form of bid-ask spreads, slippage, margin interest, and other operational charges. Understanding these components helps a trader interpret fills, reconcile account statements, and evaluate the practical economics of trade execution and ongoing position management.

This article explains what “platform fees and costs” typically include, how they arise in practice, why they exist in market structure, and how they appear in real trade lifecycles. The objective is clarity about the mechanics, not recommendations about trading activity.

Defining Platform Fees and Costs

Platform fees and costs are the explicit and implicit charges associated with using a brokerage or trading venue to place, execute, clear, and maintain trades. They can be grouped into two broad categories:

- Explicit costs: directly itemized charges such as commissions, exchange and regulatory fees, platform subscriptions, real-time market data, routing fees, clearing fees, account maintenance, wire withdrawals, and margin interest.

- Implicit costs: costs that are not line items on a statement, such as the bid-ask spread paid to cross the market, slippage relative to the quoted price, market impact from larger orders, and opportunity costs linked to delays or unsettled funds.

The mix and level of these costs differ by asset class, venue type, order characteristics, and account status. Some are assessed per trade, some per share or per contract, and others accrue daily or monthly.

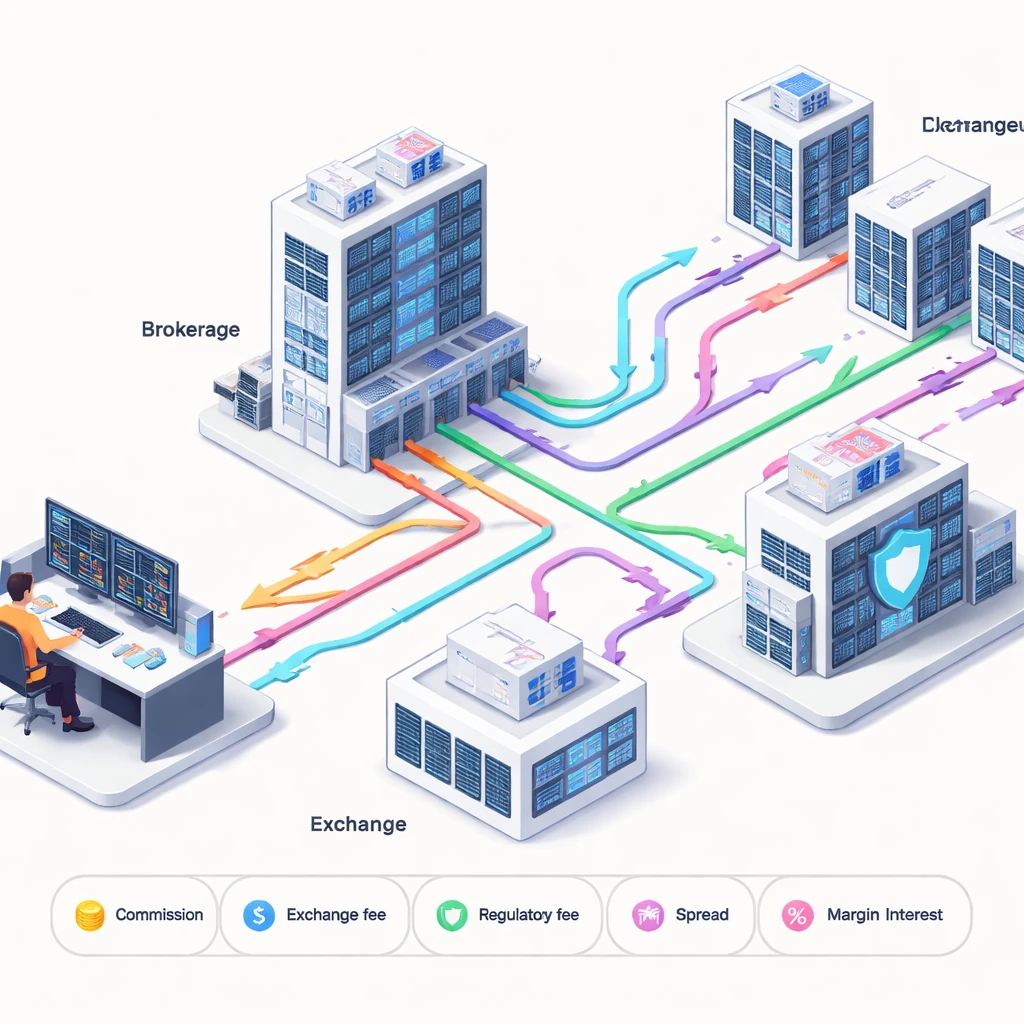

Who Gets Paid When a Trade Occurs

Fees reflect compensation for services across market infrastructure:

- Broker or platform: provides access, customer service, order entry, smart routing, risk controls, and recordkeeping. May charge commissions, platform subscriptions, and account fees. May also receive compensation from market centers for routing order flow where permitted.

- Exchange or venue: matches orders and may assess taker or removal fees, or pay rebates to liquidity providers under maker-taker models. Some brokers pass these through, others internalize them.

- Clearinghouse and clearing broker: guarantees trades through novation, nets obligations, and manages settlement risk. Fees may appear as clearing or pass-through charges.

- Regulatory bodies: certain jurisdictions impose assessments on sell transactions or contract volume. Brokers usually collect and remit these as line items labeled regulatory fees.

- Data providers: real-time quotes, depth-of-book data, and news services charge monthly subscriptions that differ for non-professional and professional users.

Each participant supplies an operational service that lowers counterparty risk, enhances price discovery, or supports transparency. Fees compensate those functions.

Explicit Costs You Can See

1) Commissions

Commissions are broker charges for executing trades. Models vary:

- Per trade: a flat amount per order ticket, regardless of size.

- Per share or per contract: scales with order size. Equity commissions may be quoted per share; options often per contract; futures per contract per side.

- Tiered pricing: lower rates for higher monthly volumes.

- Zero-commission structures: commission removed on certain products, while other costs such as spreads, routing charges, or financing remain.

2) Exchange, Venue, and Clearing Fees

Exchanges and alternative trading systems commonly charge fees for removing liquidity and may offer rebates for adding liquidity. Some brokers pass these through line by line, while others incorporate them into their pricing. Clearing fees compensate the clearinghouse and the clearing broker for novation, margin processing, and settlement operations.

3) Regulatory and Transaction Assessments

Many jurisdictions impose small assessments on sell transactions in equities or on derivatives volume. Brokers collect these as pass-through charges. The exact rates and applicability change periodically and may depend on the instrument, venue, and side of the trade.

4) Market Data and Platform Subscriptions

Platforms often offer multiple data tiers and optional tools:

- Level 1 consolidated best bid and offer with last trade.

- Depth-of-book showing multiple price levels by venue.

- Futures and options exchange data sold by each exchange group.

- Premium tools such as scanners, API access, advanced analytics, and historical tick data.

Fees differ for non-professional and professional classifications, with the latter usually much higher under exchange licensing rules.

5) Order Routing and DMA

Direct market access (DMA) may carry routing fees that reflect the chosen venue, especially when a user selects specific exchanges, dark pools, or midpoint books. Smart order routers that seek price improvement may work within broker arrangements that include rebates or fees. Whether these are passed through depends on the platform’s pricing policy.

6) Margin Interest and Financing

If a position is financed, margin interest accrues daily on the debit balance. Rate schedules are typically tiered by borrowed amount and expressed as a spread over a benchmark rate. In leveraged products such as contracts for difference or certain overnight index products, financing may appear as a separate overnight rate. Interest costs affect the economics of holding a position beyond trade day.

7) Securities Lending and Short Borrow Fees

Short sales require borrowing the security. The borrow can carry a daily fee that varies with supply and demand. For hard-to-borrow securities, rates can be substantial relative to the notional value. Some platforms also include locate fees or stock loan transaction charges.

8) Currency Conversion and Cross-Border Charges

Trading instruments denominated in a foreign currency can trigger conversion costs. These may be explicit commissions on the conversion trade or an embedded markup relative to an interbank rate. Certain markets assess stamp duties or financial transaction taxes on purchases or sales. Brokers typically collect and remit these as pass-through items.

9) Deposits, Withdrawals, and Account Fees

Common items include outgoing wire fees, expedited withdrawals, paper statements, transfer-out fees, and in some cases inactivity charges. While not tied to a single trade, they affect the overall cost of maintaining an account on a particular platform.

Implicit Costs You Do Not See on a Line Item

Bid-Ask Spread

The spread is the immediate cost to trade at the quoted market if you cross the spread. For example, if a stock is quoted 50.00 bid and 50.02 ask, a marketable buy order at 50.02 pays a 2 cent spread per share. For 1,000 shares, that is 20 dollars before considering any explicit fees. A marketable sell order faces the same effect in reverse.

Slippage

Slippage is the difference between the expected price and the actual fill price. It can arise from quote updates during order processing, partial fills at different prices, or market movements caused by other orders. Slippage can be positive or negative and depends on liquidity, volatility, and order handling.

Market Impact

Large or urgent orders can move the market. That movement becomes part of the realized cost. Market impact is influenced by the relative size of the order to average displayed depth and overall trading volume in the instrument.

Latency and Opportunity Costs

Delays in routing or confirmation can cause missed prices. Settlement timing may limit the reuse of capital, which has an opportunity cost, especially when funds are tied up during processing cycles.

How Costs Are Calculated and Charged

Platforms express fees in various units and time frames. The details matter because identical nominal rates can lead to different all-in costs.

- Per side vs. round turn: Futures and options fees are often quoted per contract per side. A round turn is both entry and exit combined.

- Per share vs. per order: Equity commission schedules may charge a fixed amount per order or a rate per share with a minimum ticket charge.

- Sale-only assessments: Some regulatory fees apply only when selling. The charge may be proportional to notional value or shares sold.

- Maker-taker economics: Venues may pay a rebate for adding liquidity and charge for removing it. Whether the customer sees these as pass-throughs depends on the platform.

- Daily accruals: Margin interest and borrow fees accrue daily and are posted monthly. The accrual uses the end-of-day debit or borrow value multiplied by the annualized rate divided by a day-count convention.

- Currency conversions: FX conversions may be quoted as a separate commission or included as a spread around a reference rate at the time of conversion.

Asset-Class Contexts

Equities

Common line items include commissions, regulatory assessments on sells, and in some models exchange or ECN fees and rebates. For short sales, borrow fees may apply. For international equities, stamp duties or transaction taxes may be assessed by the local market.

Options

Options transactions typically show per-contract commissions and exchange fees. There may be pass-through clearing costs. Some platforms itemize regulatory assessments per contract. Complex orders that route to multiple legs can incur separate exchange fees by leg.

Futures

Futures pricing commonly lists a commission per contract per side plus exchange, clearing, and regulatory fees. The sum is often quoted as an “all-in” rate per side. Overnight holding does not incur margin interest in the same way as securities margin, but the position must meet exchange margin requirements. Market data for futures is sold by exchange group and often priced separately.

Foreign Exchange

Retail FX platforms typically embed compensation in the spread or charge a commission per million of notional traded. Financing for positions held past a rollover time is reflected in swap rates or overnight financing adjustments.

Contracts for Difference

CFDs combine spread-based pricing with overnight financing for leveraged exposure. Additional costs can include currency conversion and market data depending on the underlying venue.

Cryptoassets

Crypto venues frequently use maker-taker fee schedules, with lower rates for higher monthly volume. Withdrawals may incur network fees that reflect blockchain conditions. Some platforms add a fixed withdrawal charge on top of the network fee. Data and advanced tools may be provided through separate subscriptions.

Why These Costs Exist

Trading requires organized infrastructure. Exchanges provide matching engines, connectivity, surveillance, and disaster recovery. Clearinghouses guarantee settlement through novation and risk management, which requires capital, default funds, and daily margin processing. Regulators oversee market integrity and investor protection, financed in part by assessments. Brokers maintain customer accounts, deliver best execution obligations under their jurisdiction, supply statements and tax reporting, and operate risk controls to prevent settlement failures. Data must be aggregated, validated, and distributed in real time. Fees fund these services.

Market design also shapes fees. Maker-taker pricing is intended to incentivize displayed liquidity by paying rebates to resting orders and charging for removal. Smart order routers and payment arrangements affect how venues compete for order flow. These models change over time as venues update fee schedules, and brokers adjust pass-through policies and routing logic.

Real-World Illustrations

Example 1: U.S. Equity Purchase

Suppose an investor buys 100 shares at a quoted ask of 50.02 when the bid is 50.00. Ignoring commissions for the moment, crossing the spread implies an immediate spread cost of 2 dollars. If the platform charges a modest per-order commission, that adds to the explicit total. If the broker passes exchange remove-liquidity fees through, those appear as a small additional charge. If the investor later sells the shares, there may be a regulatory assessment on the sale. The combined result is an all-in cost that includes both explicit fees and the implicit spread.

Example 2: Options Trade

Buying three call option contracts might involve a per-contract commission and exchange fees. Many platforms list a separate line for regulatory assessments per contract on the sale. The bid-ask spread on options can be wider in percentage terms than on the underlying, so the implicit cost can be significant relative to premium paid. If the option is later exercised or assigned, the resulting stock transaction may also create the usual equity-related fees on the underlying position.

Example 3: Futures Round Turn

Entering and exiting one futures contract involves exchange fees, clearing fees, and any regulatory assessment per side, plus the platform’s commission. Brokers often present an all-in per side number that aggregates these items. If the position is held overnight, the trader posts initial and variation margin through the clearing system, but does not pay securities-style margin interest. Data for the futures exchange is typically a monthly subscription independent of the trade.

Example 4: Short Sale With Borrow Fee

Shorting a hard-to-borrow stock can include a daily borrow rate applied to the short market value. If the short remains open for multiple weeks, the financing cost can rival or exceed explicit trading fees. When the stock becomes easier to borrow, the rate may fall, and when inventory tightens, it may rise. The platform may also have locate or transaction charges specific to securities lending operations.

Example 5: FX Conversion and International Equity

Purchasing shares in a foreign market in local currency usually involves converting base currency to the local currency. The conversion can be priced as a commission or a spread around a reference rate. The local market may charge a stamp duty or transaction tax on purchases or sales. The total cost is the sum of conversion costs, any stamp duty, and the platform’s usual commissions or pass-throughs.

Example 6: Crypto Order and Withdrawal

A crypto purchase on a maker-taker venue may incur a taker fee if the order crosses the book immediately. If assets are later withdrawn to an external wallet, a network fee applies that depends on current blockchain congestion. Some platforms also charge a fixed withdrawal fee, which is separate from the network’s fee.

All numerical effects in these examples are illustrative and depend on the platform, venue, instrument, and time period. Actual schedules change and are published by each provider.Reading Fee Schedules and Confirmations

Platforms publish fee schedules that classify charges by product, venue, and account status. Several practical points help interpret them:

- Unit of measure: note whether a fee is per order, per share, per contract, or proportional to notional value.

- Side of trade: some assessments apply only on sells or vary by add vs remove liquidity.

- All-in bundles: a single number may include exchange, clearing, and regulatory fees embedded with the commission.

- Pass-through policies: some platforms retain rebates and absorb exchange fees within their pricing, while others pass both through to customers.

- Tier definitions: volume tiers may reset monthly and apply to future trades, not retroactively.

Trade confirmations and monthly statements usually include a breakdown. Common labels include commission, exchange fees, clearing fees, regulatory fees, and other pass-throughs. For short positions, borrow or stock loan charges appear separately in daily or monthly interest activity. Market data and platform subscriptions are listed in the monthly billing section.

Zero-Commission Models and Their Implications

In some markets, listed products trade with zero stated commission on retail platforms. The platform is compensated through other channels such as payment arrangements with market centers where permitted, interest on idle cash, securities lending revenue, or subscription services. While stated commissions are zero, the all-in cost still includes the spread, any pass-through fees, and any financing or subscription charges. Execution quality metrics published by brokers and venues provide context for the realized prices relative to the quotes.

Operational Effects on Trade Management

Costs affect the realized economics of trading and holding positions. Turnover multiplies explicit fees and spreads. Financing charges accrue with time. Borrow fees can change the cost of a short sale from negligible to significant. Data packages and platform tools are fixed costs that support decision-making and order entry, and may be required for access to certain features or venues. In cross-border activity, conversion and local market assessments are integral to the total cost.

Some practitioners track all-in metrics such as effective spread (the difference between the execution price and the midpoint at the time of trade) and implementation shortfall (the difference between a benchmark price and the realized execution price, inclusive of explicit fees). These metrics place implicit and explicit costs on a comparable footing for internal evaluation. The calculations rely on accurate timestamps, quote feeds, and consistent benchmarks.

Special Situations and Less Obvious Charges

- Corporate actions: certain events, such as voluntary reorganizations or dividend processing for foreign securities, may generate small handling charges or pass-through fees from custodians.

- American Depositary Receipts: ADRs sometimes include periodic depositary service fees that are collected through the brokerage account.

- Request-for-quote venues: in products like fixed income, part of the cost is reflected in the dealer spread rather than a discrete commission.

- Order cancellations and modifications: some venues assess message traffic or excessive order activity fees to members, which can influence platform-level pricing for very high message volumes.

Practical Checklist When Interpreting Costs

- Identify explicit per-trade or per-contract fees and whether they are per side or round turn.

- Note any sale-only regulatory assessments that will appear on closing transactions.

- Account for financing and borrow fees for leveraged or short positions over the intended holding period.

- Include data and platform subscriptions in the monthly cost of access.

- Recognize the role of spreads, slippage, and market impact as non-itemized costs.

- For cross-border activity, include currency conversion and local market taxes or duties where they apply.

Conservative Framing About Variability

Fee schedules are not static. Exchanges update maker-taker rates, regulators revise assessments, and brokers adjust pass-through policies and tier thresholds. Data licensing rules change the classification of non-professional and professional users. Crypto network conditions alter withdrawal fees from hour to hour. The only authoritative source for any specific account is the platform’s current published schedule and trade confirmation details.

Terminology Summary

- Commission: broker fee for trade execution and services.

- Exchange fee or rebate: venue charge to remove liquidity or payment to add liquidity.

- Clearing fee: charge for novation and settlement processing.

- Regulatory assessment: pass-through charge collected for market oversight, often on sells.

- Spread: difference between best bid and best ask; a primary implicit cost.

- Slippage: deviation between expected and actual execution price.

- Market impact: price movement caused by the order itself.

- Margin interest: financing cost on borrowed funds.

- Borrow fee: daily rate paid to borrow a security for short selling.

- Data subscription: monthly fee for real-time quotes and market depth.

- Maker-taker: pricing model that pays for adding and charges for removing liquidity.

Key Takeaways

- Platform fees and costs include both explicit charges and implicit trading frictions, and they vary by asset class and venue.

- Exchanges, clearinghouses, regulators, brokers, and data providers each supply services that the fee structure compensates.

- Zero-commission does not mean zero cost; spreads, pass-through fees, and financing still affect realized outcomes.

- Reading fee schedules, confirmations, and monthly statements clarifies the unit of charge and how it applies to each trade.

- All-in evaluation that combines explicit line items with spreads and slippage provides a more accurate picture of trade economics.