Trading Basics

An introduction to how trading works in practice, including order types, execution, liquidity, timeframes, and how trades are placed and managed.

You will learn: The core concepts in this topic, common misconceptions, and how professionals think about the subject.

Educational content only. Not financial advice.

What you will get from this topic

- Clear definitions and real-world context

- Practical examples without trade recommendations

- Common mistakes to avoid

- A progression from basics to deeper understanding

Scopes in Trading Basics

Order Types & Execution

Market mechanics including order types, execution models, spreads, and liquidity.

Explore ScopeTimeframes & Styles

Differences between day trading, swing trading, position trading, and long-term investing.

Explore ScopeMarket Structure

How markets are structured, including exchanges, participants, and trading sessions.

Explore ScopeTrading Platforms & Tools

Overview of trading platforms, charting tools, data feeds, and execution software.

Explore ScopePopular in Trading Basics

What Is a Market Order?

A clear explanation of market orders, how they execute in real markets, why they exist, and what traders should understand about price, liquidity, and slippage when using them across different asset classes and venues. No strategies or recommendations.

What Is a Limit Order?

A limit order is an instruction to buy or sell at a specified price or better. This article explains how limit orders are entered, matched, and managed within modern markets, why they exist, and how they shape real-world execution outcomes through examples.

Stop Orders Explained

A clear, practical explanation of stop orders, how they trigger and execute, why markets support them, and what traders should understand about their behavior across venues and asset classes. No strategies or recommendations are provided, only mechanics and real-world context.

Stop-Limit Orders Explained

A clear, practical explanation of stop-limit orders, how they are constructed and triggered, and how they behave in real-world execution across different markets and conditions. Focuses on mechanics, risks, and operational details without strategy or recommendations.

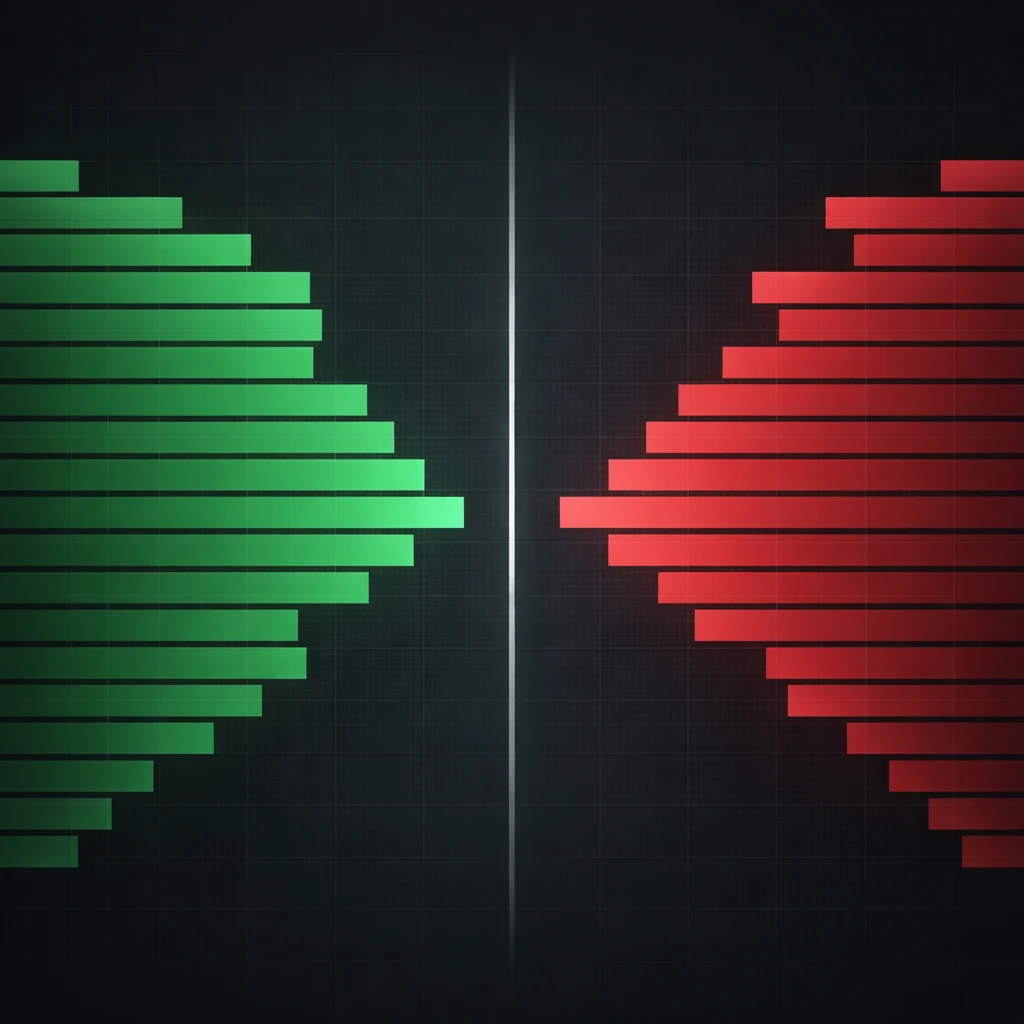

How Orders Are Matched

A clear, practical explanation of how exchanges and trading venues pair buy and sell orders, how order types interact with the limit order book, and why matching rules exist in modern markets, illustrated with real-world execution scenarios and examples.

Bid-Ask Spread Explained

A clear, practical explanation of the bid-ask spread, why it exists, how it is formed in order-driven markets, and what it means for real-world trade execution and costs across different asset classes and conditions. Includes numerical examples and definitions of quoted, effective, and realized spreads.

Ready to begin?

Start with the first scope to build a clean foundation, then move forward in order.

Start Order Types & Execution