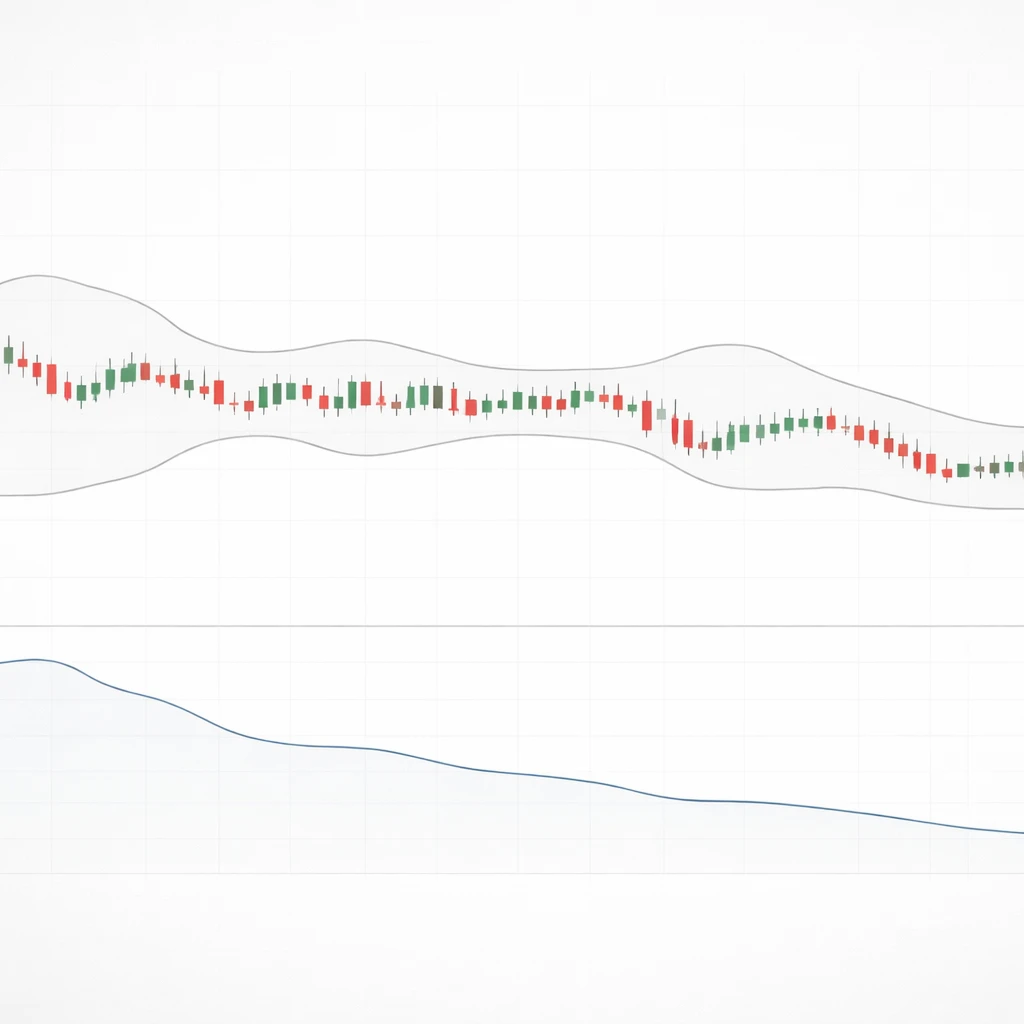

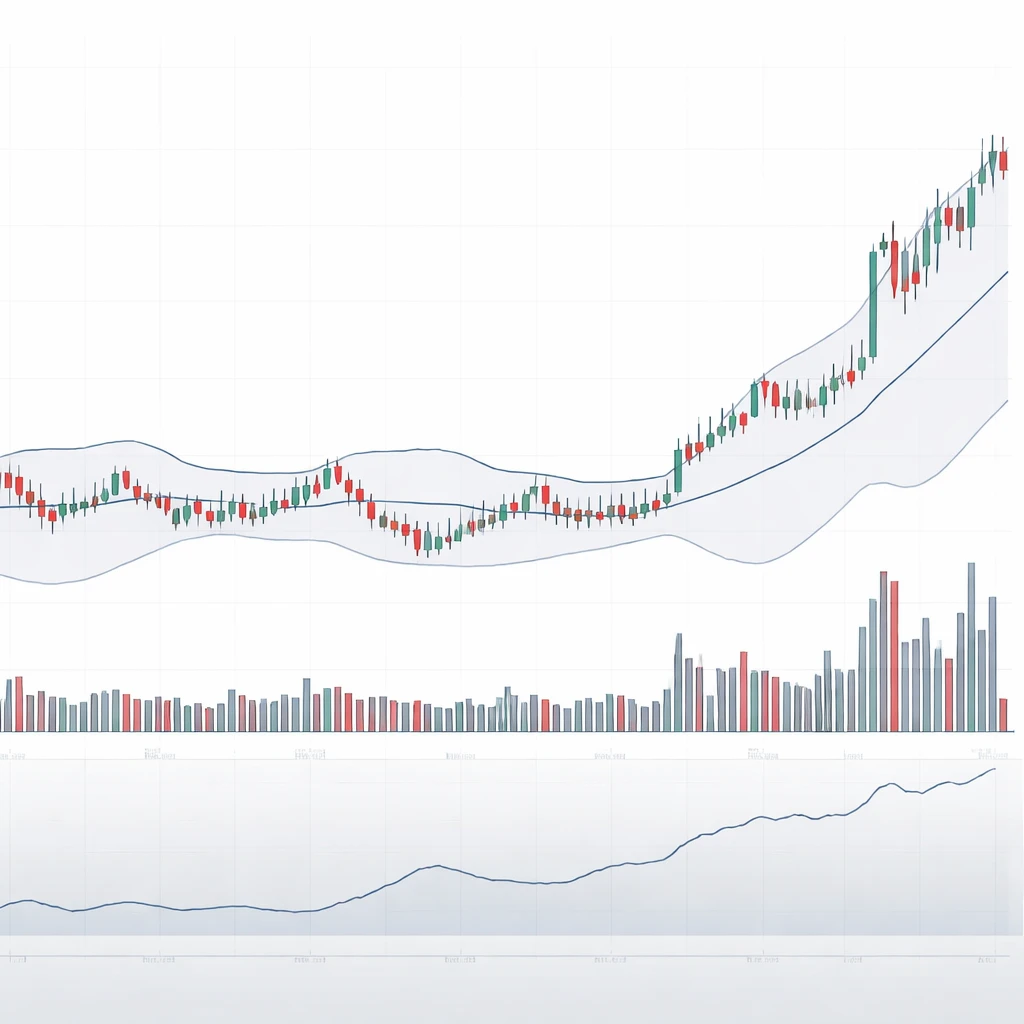

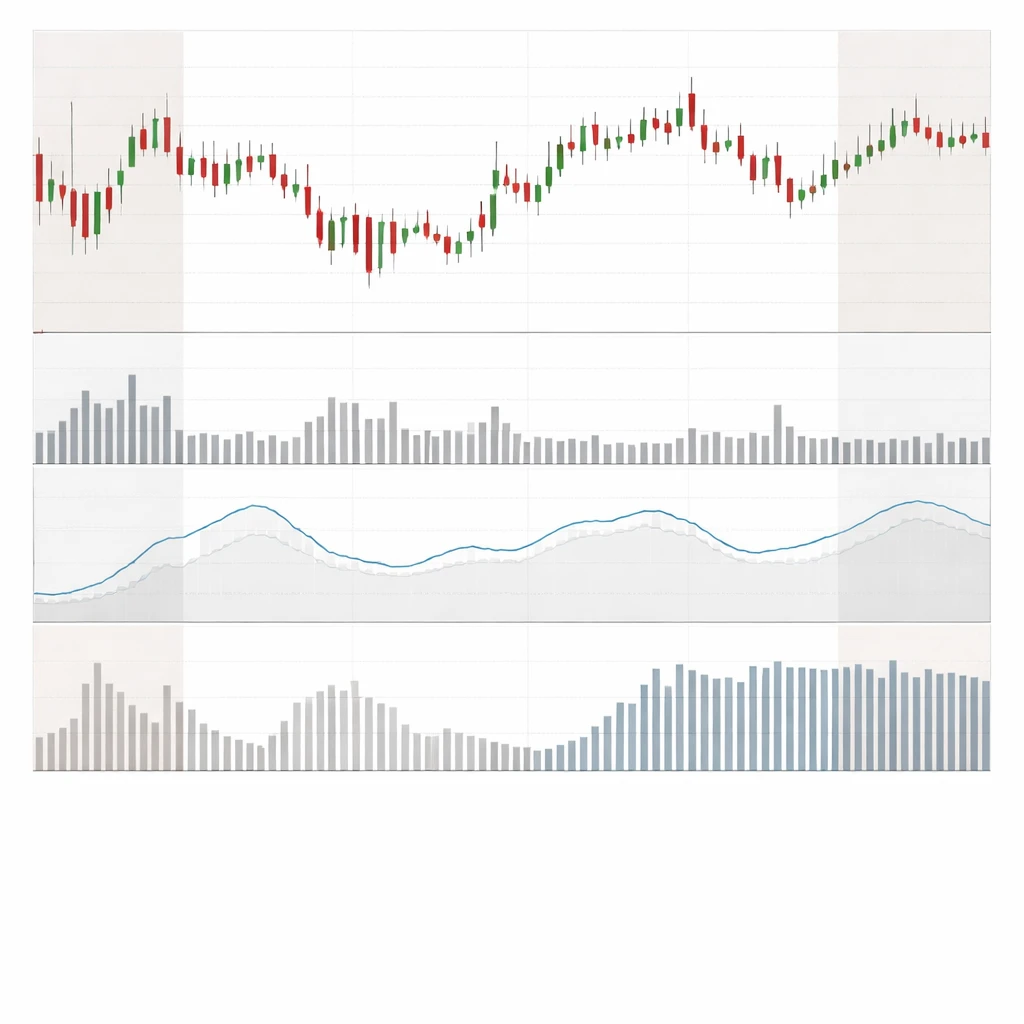

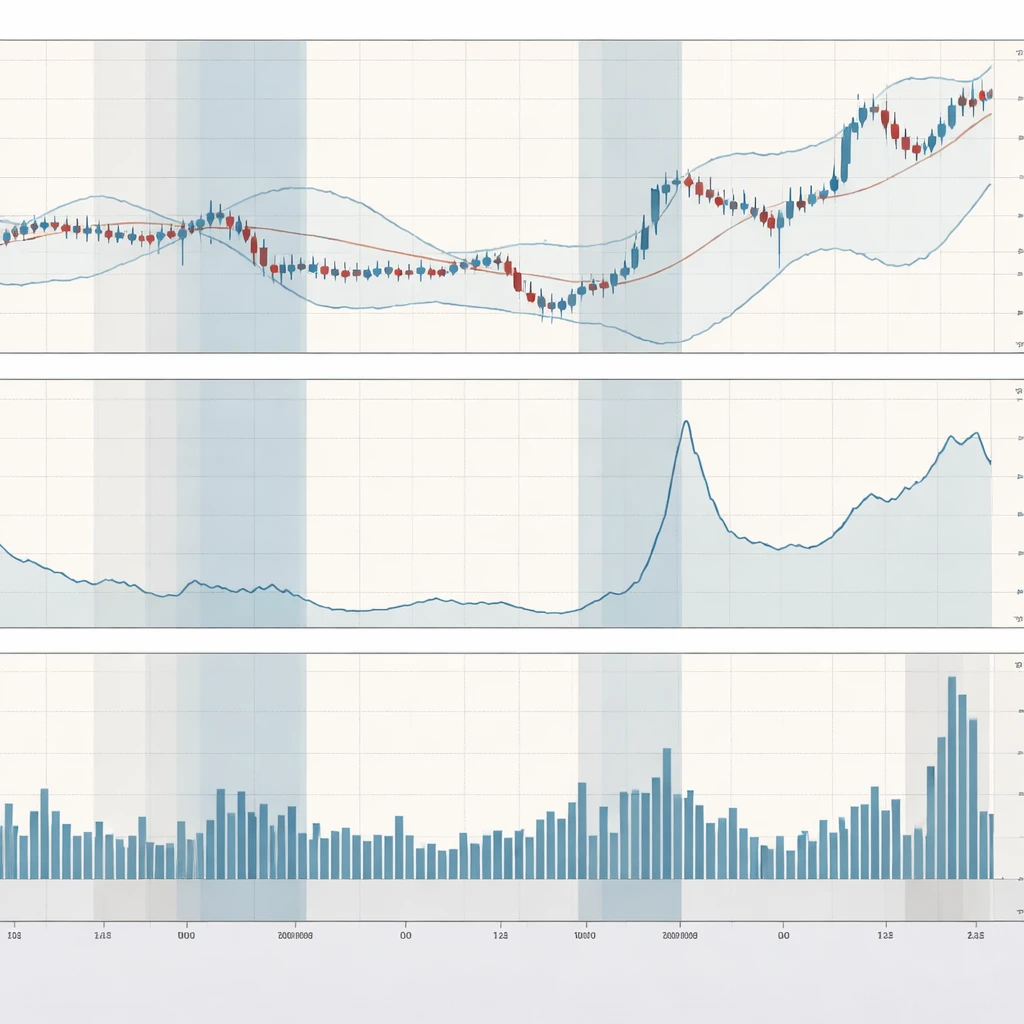

Low Volatility Environments

An in-depth explanation of low volatility environments in technical analysis, how they appear on charts, why they matter for interpreting market behavior, and how to contextualize them with volume and common volatility measures without proposing trades or setups.