What Is Trading Volume?

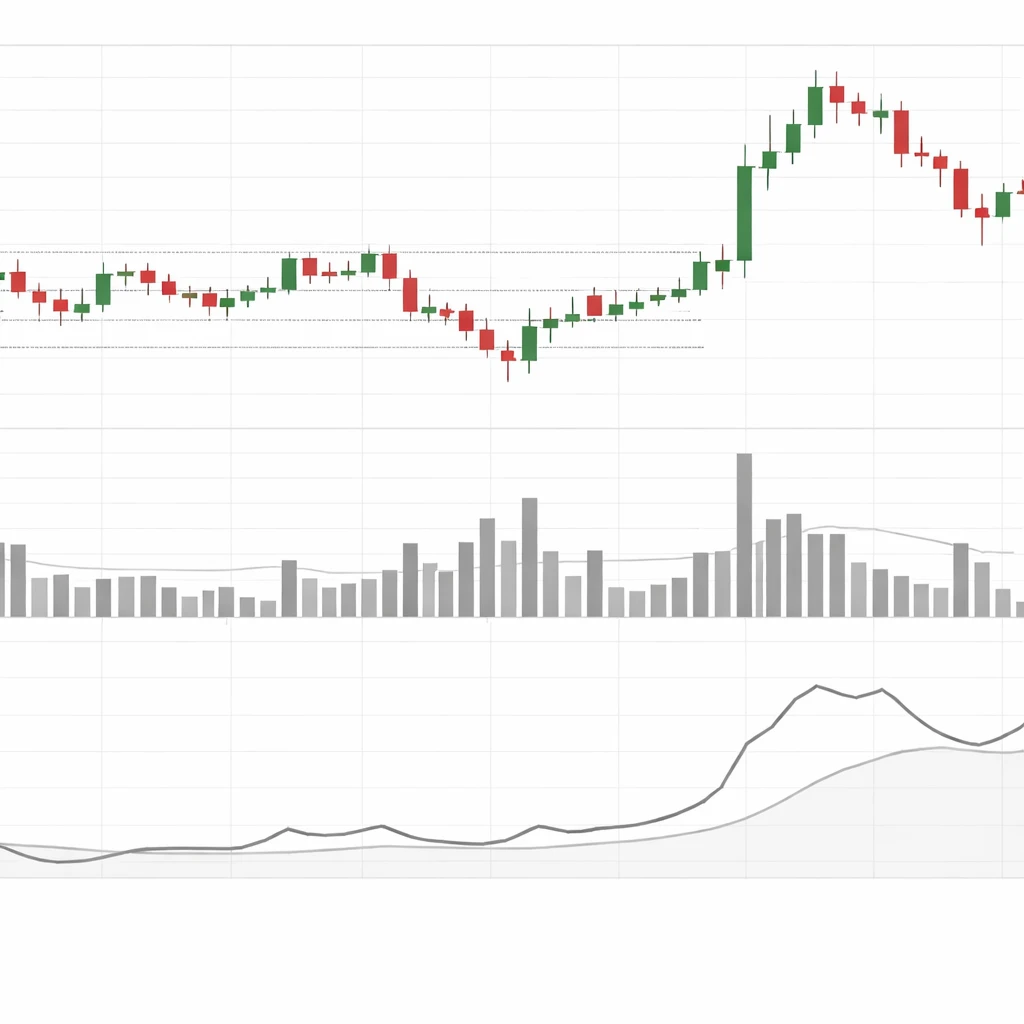

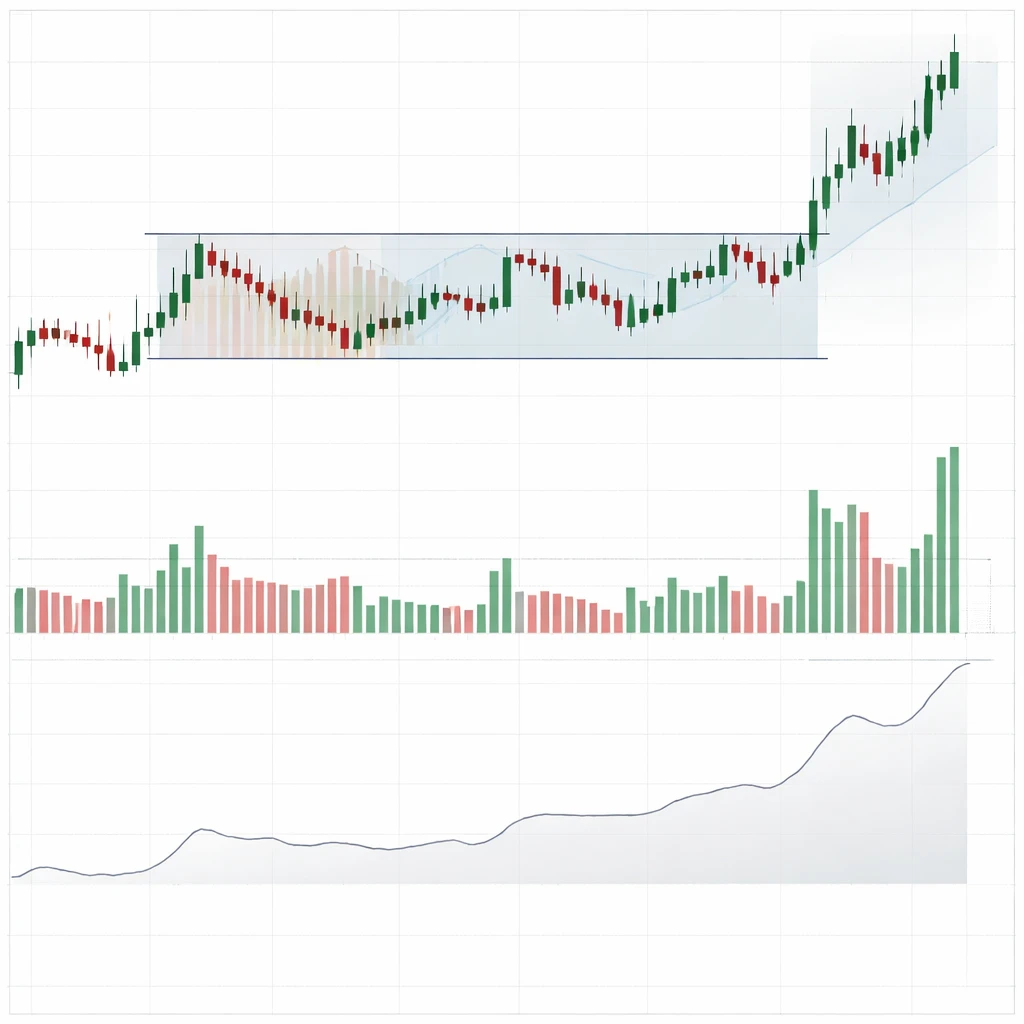

A clear explanation of trading volume as a core element of technical analysis, how it appears on charts, what it reveals about market participation and volatility, and how to read it in practical chart contexts without implying trade decisions or strategies.