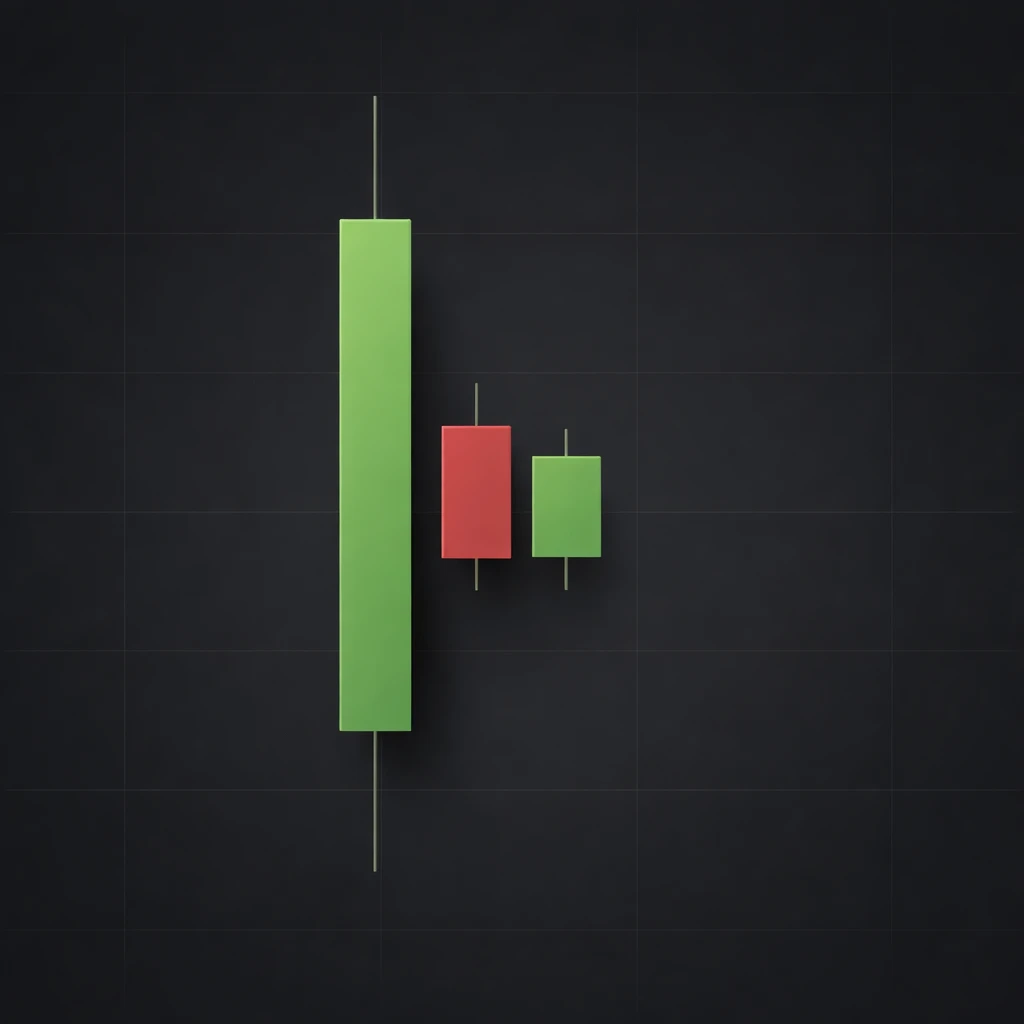

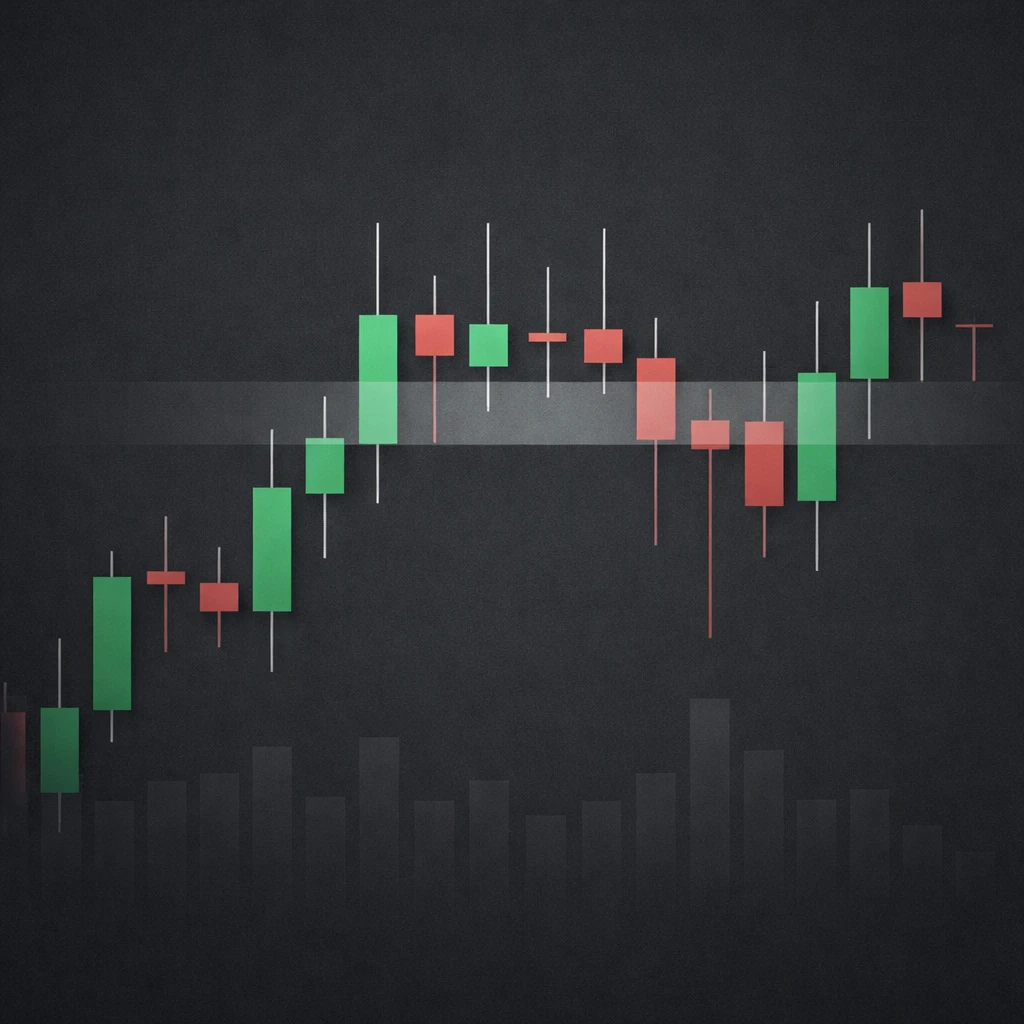

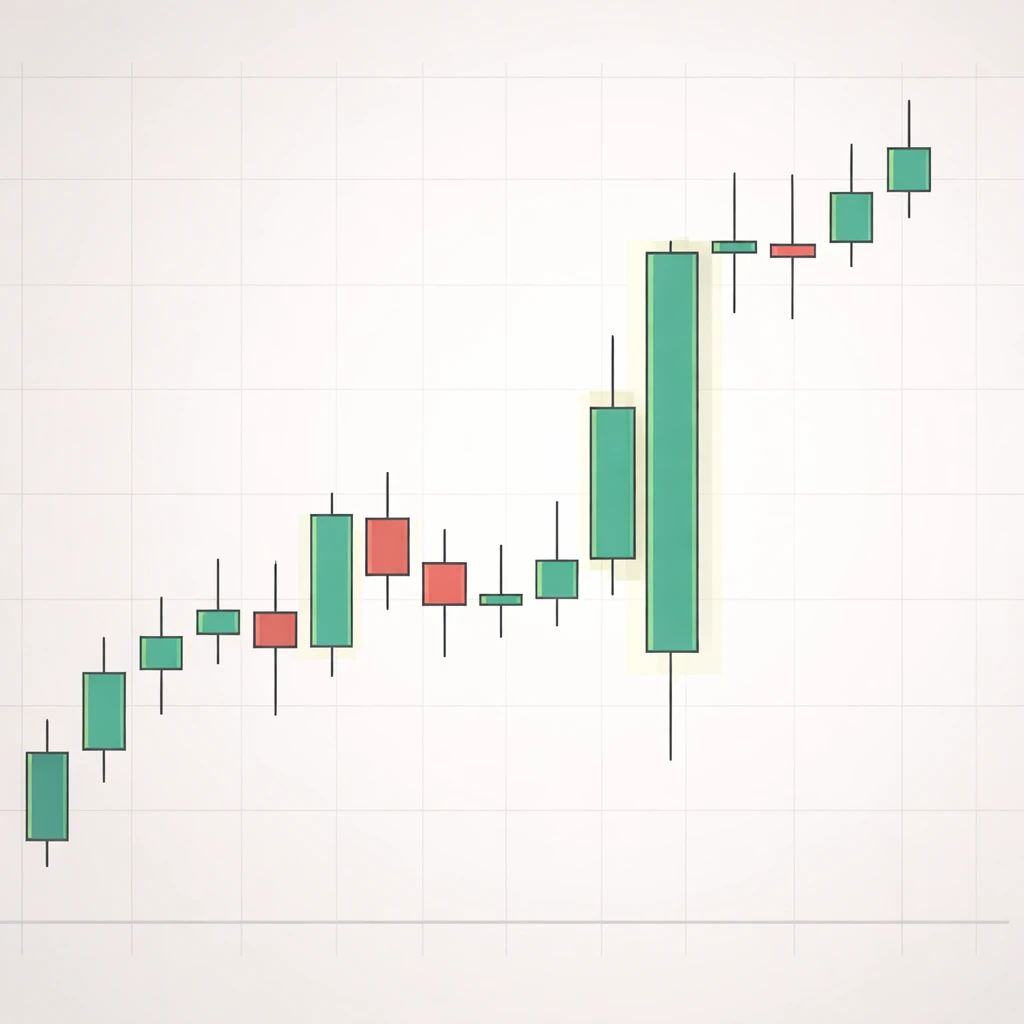

Candlesticks Explained

A clear, academically grounded guide to candlestick charts: how they are constructed, what they represent about intraperiod order flow, and how to read their bodies and shadows in context without drifting into prescriptive trading rules or setups. The article focuses on interpretation within price action, data nuances, and practical chart-based exa…