Introduction

Stop losses exist to define, limit, and enforce the maximum loss a trader is willing to accept on a position. They translate abstract risk tolerance into a concrete exit rule that can be measured and audited. Without a precommitted exit, loss control relies on discretion in the heat of the moment, where cognitive biases and market noise often overwhelm judgment. The stop loss is not a sign of pessimism. It is a structural tool designed to preserve trading capital and, by extension, the ability to continue participating long enough for a strategy’s statistical edge to emerge.

There are many forms of stop losses, from hard stop orders placed with a broker to discretionary or time-based exits enforced by process. They all serve the same core purpose. They cap downside on individual positions and limit the compounding effect of adverse runs on the portfolio. Understanding why stop losses exist requires looking beyond any single trade. The primary objective is survivability and the protection of the distribution of long-run outcomes.

The Economic Rationale for Stop Losses

Risk control is not only about avoiding catastrophic losses. It is about regulating the size and frequency of drawdowns so that compounding can work. The geometric growth of capital is sensitive to volatility and large losses. A 50 percent drawdown requires a subsequent 100 percent gain to recover. That asymmetry is not an opinion. It is arithmetic. Stop losses exist to interrupt the path to large drawdowns at the level of the individual trade and at the level of the aggregate portfolio.

Trading outcomes are uncertain and lumpy. Even profitable methods experience streaks of losses due to randomness and changing market conditions. A stop loss does not improve the quality of entries. It improves the quality of exits by enforcing a tolerance threshold that aligns with the trader’s risk budget. This is essential because many strategies produce positive expectancy only if losses are cut at a predefined level while gains are allowed room to develop. Removing the loss constraint can invert the expectancy by letting a few large losses overwhelm many smaller wins.

Risk of Ruin and Capital Preservation

Risk of ruin refers to the probability that an account falls to a level from which it cannot reasonably recover, either due to capital depletion or institutional constraints such as margin requirements. Stop losses reduce risk of ruin by limiting the tail of the loss distribution. They do not eliminate losses, gaps, or slippage, but they constrain the dispersion of possible outcomes. Lower dispersion in losses, combined with appropriate position sizing, lowers the likelihood that a run of adverse outcomes forces exit from the market.

From a capital preservation perspective, the stop loss is a governance tool. It embeds a circuit breaker into each trade, so that the portfolio does not depend on perfect forecasts or continuous attention. Markets move while traders sleep, commute, and attend to other tasks. A standing exit instruction reduces the cost of inattention and the risks attached to overconfidence.

The Asymmetry of Losses and Gains

Losses have a nonlinear effect on future opportunity. A 10 percent loss requires an 11.1 percent gain to recover. A 25 percent loss requires a 33.3 percent gain, and so on. The nonlinearity compounds when losses cluster. Stop losses limit the size of individual losses and can help prevent the compounding of damage across correlated positions. In practice, two traders with the same average return can end with very different long-run results if one experiences large, infrequent losses while the other contains them. The difference is often the disciplined use of exits.

What a Stop Loss Is, and What It Is Not

A stop loss is an exit rule. It can be a price level, a volatility threshold, a time constraint, or a condition tied to a thesis being invalidated. It is not a prediction of where the market will go, nor is it a guarantee of execution at the chosen price. Price gaps and liquidity conditions can cause slippage. Stops exist to enforce discipline and shape the loss distribution, not to outsmart the market or ensure perfect fills.

There are several common forms of stop losses:

- Stop market orders. An order that becomes a market order once a trigger price is touched. It prioritizes getting out, with the risk of slippage in fast conditions.

- Stop limit orders. An order that becomes a limit order once triggered. It prioritizes price control, with the risk of not executing during gaps or illiquid conditions.

- Trailing stops. An order that adjusts as price moves favorably, designed to lock in profits while allowing room for fluctuations.

- Time stops. An exit after a fixed duration if the trade has not progressed as intended, designed to release stagnant capital.

- Mental or discretionary stops. A rule the trader intends to follow without placing a live order. These rely on discipline and constant monitoring.

Regardless of the format, the intellectual purpose is consistent. Stops convert a risk budget into an enforceable action. The emphasis is on enforceable. A stop that cannot or will not be executed when needed does not serve its function.

Stops as Governance Against Cognitive Bias

Human decision making in markets is vulnerable to loss aversion, the sunk cost fallacy, anchoring to entry price, and overconfidence. Stop losses exist to precommit to an action that is hard to take in the moment. When a position is moving against the trader, it is psychologically costly to realize a loss. The mind searches for confirming information, invents narratives, or widens the loss threshold. Predefined exits reduce the degrees of freedom for rationalization. They shift the problem from real-time persuasion to prior design and documentation.

Stops also neutralize the temptation to average down mechanically. While adding to positions can be part of a planned risk framework, unplanned averaging to reduce the visible loss per share often magnifies exposure when information is deteriorating. A stop loss makes the default response to adverse movement a reduction of risk rather than an increase.

How Stop Losses Operate in Real Trading

The operational behavior of stop losses depends on market structure, liquidity, and volatility. A stop placed on a thinly traded instrument can fill at a price far inferior to the trigger due to order book depth. A stop during an earnings announcement or macro release can be subject to wide slippage. In futures and foreign exchange, overnight sessions may be less liquid, although they trade nearly around the clock. In equities, premarket and aftermarket liquidity can be sparse, which affects execution quality for stops that trigger outside the main session.

Consider an example to illustrate slippage. A trader owns a share at 100 with a stop market order at 95. If the next opening print after news is 92, the stop becomes a market order at 95 and fills near 92. The stop did not fail. It did exactly what it was meant to do, which is to exit when price crossed the defined level. The gap created slippage. The alternative, refusing to exit because the fill is worse than anticipated, converts a controlled loss into an unbounded one. The existence of slippage is not an argument against stops. It is a parameter that must be recognized when sizing positions and setting expectations.

Another example illustrates position stagnation. Suppose a position enters at 50 with the thesis that momentum will materialize within two weeks. Price oscillates between 49 and 51 for ten trading days with declining volume. A time stop could be used to recycle capital rather than paying the opportunity cost of an idle position. This type of exit is not based on price hitting a threshold, but on the erosion of the original rationale for the trade.

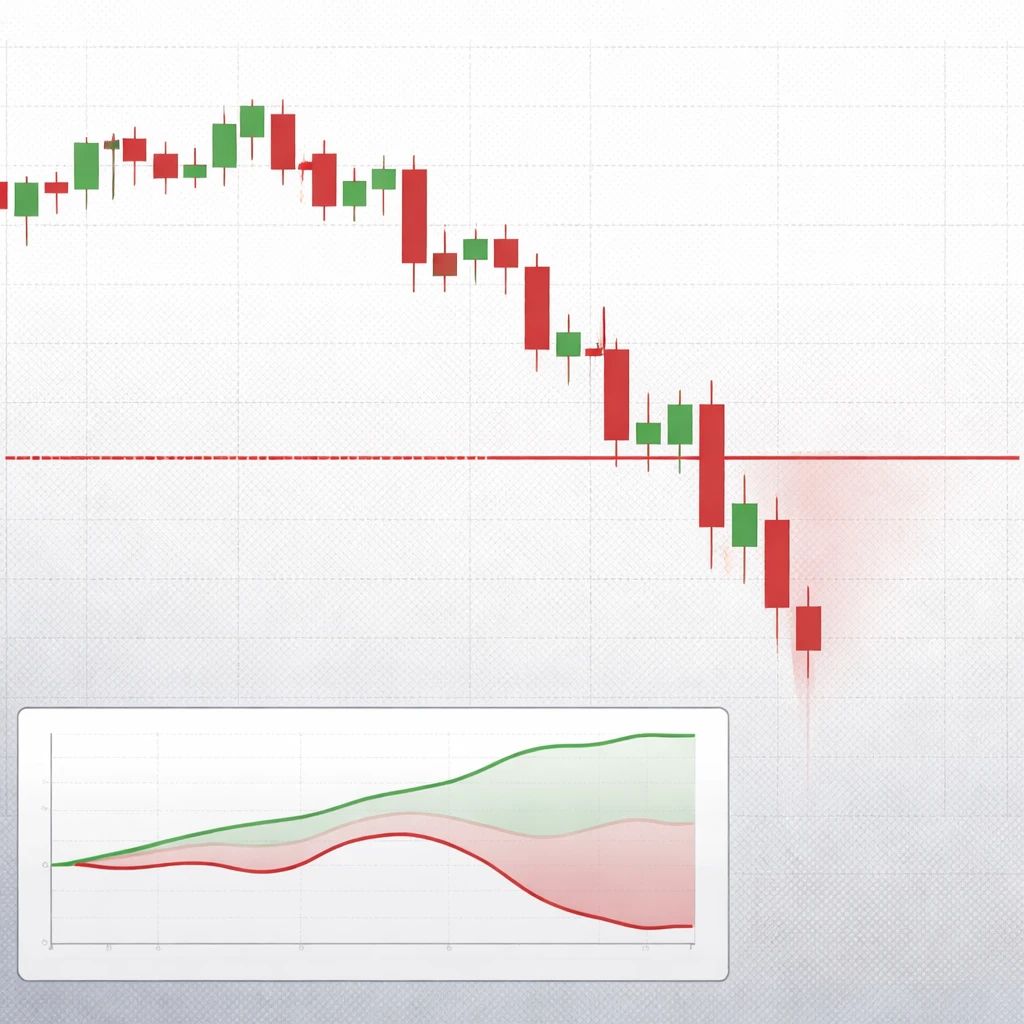

Real-world stop management also considers volatility regimes. In a quiet regime, a narrow stop might suffice to protect against noise. In a turbulent regime, a narrow stop may be repeatedly triggered by random fluctuation. The purpose of the stop is not to avoid being wrong. It is to define the cost of being wrong. Volatility-aware placement aligns the exit with the scale of typical fluctuations, so that stops represent a genuine change in state rather than a routine wiggle.

Portfolio-Level Perspective

Stops protect the portfolio by limiting position-level losses, but their design should reflect aggregate risk. A set of small positions that are highly correlated can generate a large portfolio drawdown if they all hit stops together. If the portfolio risk budget tolerates a 5 percent daily loss, but three correlated positions each carry a stop that implies a 2 percent portfolio loss, a synchronized move can exceed the tolerance. Stops exist within this system to cap the impact of any single thesis and to prevent cascading losses from correlated exposures.

Portfolio construction also interacts with stops through position sizing. If a stop defines the worst acceptable loss per share or contract, position size translates that into a total dollar or percentage risk. This conversion is mechanical. Without it, a stop at a distant price level might still create excessive risk if size is too large. Conversely, a close stop with very small size might protect capital but also generate frequent small losses that degrade performance through costs and slippage. The coordination of stops and size is where risk control becomes systematic rather than ad hoc.

Finally, stops influence compounding. Smaller drawdowns preserve more capital for the next opportunity, and they reduce the recovery threshold after a losing streak. This is one reason why long-run performance often depends more on the absence of crippling losses than on the occasional large gain.

Common Misconceptions and Pitfalls

Misconception 1: Stops Cause Losses

It is common to hear that stops repeatedly take small losses that would have recovered if given more time. The stop did not cause the loss. Price movement did. The stop simply enforced the predetermined cost of being wrong. There are valid debates about placement, volatility adjustment, and timing, but blaming the exit mechanism for adverse movement confuses cause and effect.

Misconception 2: Stops Guarantee Execution at the Trigger Price

Stop market orders guarantee an attempt to exit once triggered, not a fill at the trigger price. In fast markets, gaps and slippage are normal. Stop limit orders can control price but introduce execution risk. Selecting an order type involves a tradeoff between price certainty and exit certainty. Understanding this tradeoff prevents the false expectation that the stop is a precision instrument.

Misconception 3: Tighter Stops Are Always Better

Tight stops reduce the loss per trade but can increase the frequency of being stopped out by noise. A stop should align with the level at which the original thesis is no longer valid, or with a volatility measure that differentiates noise from change in state. Too tight, and the trader pays friction repeatedly. Too loose, and the losses grow beyond the intended budget.

Misconception 4: Moving Stops Away From Price Buys Time

Widening a stop after entry without a measured reason converts a bounded loss into an unbounded one. It may feel like allowing the trade to breathe. In practice it often shifts the loss from tolerable to harmful. If new information justifies a different risk assessment, the appropriate response is to reassess position size and exit logic, not to drift the boundary to match discomfort.

Misconception 5: Mental Stops Are Equivalent to Live Orders

Mental stops assume perfect attention and perfect discipline. In reality, distractions, platform issues, and the discomfort of realizing a loss can delay action. A live stop order outsources execution to the market infrastructure. Mental stops rely on the trader’s willpower and speed. For some traders, discretion is appropriate, but equivalence should not be assumed.

Pitfall: Ignoring Regime Shifts

A stop that fits a low-volatility environment can be dysfunctional in a high-volatility environment. Conversely, a volatility-expanded stop in calm conditions may allow unnecessary losses. Calibration to regime helps maintain the intended risk profile.

Pitfall: Overfitting Stop Placement

Stops designed by fitting historical noise patterns too precisely can fail when the pattern changes. Robust stops tolerate deviations around the expected behavior and still protect capital when surprise arrives. Over-optimization improves backtests and weakens live resilience.

Pitfall: Belief in Stop Hunting

Markets often revisit local extremes because liquidity clusters there. This is supply and demand, not evidence of a conspiracy aimed at a single retail stop. Designing stops to avoid every potential liquidity sweep is not realistic. Better to accept that some stops will be tagged and focus on the overall distribution of outcomes rather than any single event.

Stops Across Time Horizons and Instruments

Time horizon frames the relevant risks. Intraday traders manage microstructure noise, queue dynamics, and short bursts of volatility. Their stops are typically tighter and rely on immediate execution quality. Swing and position traders work across days or weeks, so they confront overnight gaps, earnings, and macro releases. Their stops must account for lower control during closed sessions, including the possibility that the first available exit is far from the trigger.

Instruments add nuances. In equities, halts and limit up or limit down conditions can delay execution. In futures and foreign exchange, near 24 hour trading reduces but does not eliminate gap risk. In options, time decay and changing implied volatility create exit challenges that price-only triggers may not capture. In all cases, the function of the stop is the same. It defines the loss boundary and enforces it within the constraints of market structure.

Alternative and Complementary Exit Mechanisms

Stop losses are one tool among several for risk control. Some approaches complement or substitute price stops with other mechanisms:

- Time-based exits. Close after a set duration if progress is inadequate. This controls opportunity cost and reduces exposure to event risk.

- Volatility-based exits. Use measures such as average true range to set stops that adapt to current conditions rather than fixed price distances.

- Options as defined-risk structures. Replacing or hedging a position with options can convert unknown downside into a known premium cost, though this introduces additional variables such as implied volatility and liquidity.

- Portfolio heat limits. Cap the total open risk across all positions. If the cap is reached, reduce exposure rather than adding new positions.

- Thesis invalidation rules. Exit when a fundamental or structural condition that motivated the trade is demonstrably false, even if price has not breached a technical level.

These mechanisms are not exclusive. Many practitioners combine them. The unifying principle is the predefinition of unacceptable outcomes and a reliable process to enforce exits when those outcomes materialize.

Implementation Details That Matter

Operational choices affect the reliability of stops:

- Stop market vs stop limit. Stop market prioritizes exit. Stop limit prioritizes price. Each carries a different failure mode. Select intentionally.

- Broker handling. Some brokers hold stops server side, others client side. Server side stops may trigger even if the platform disconnects. Understanding infrastructure reduces operational risk.

- Order duration. Day orders expire at session end. Good til canceled orders persist across days. Duration interacts with overnight risk and with the desire for continuous protection.

- Venue and liquidity. Fragmented markets can route orders differently. A stop might trigger from a print on one venue but not another, depending on broker logic. Liquidity depth influences slippage.

- Event calendars. Earnings, dividends, contract rolls, and macro releases change the slippage profile. Stops function, but fills can deviate substantially from triggers during events.

These details do not change the reason stop losses exist. They simply shape how predictable execution will be and how to interpret fills relative to expectations.

Documentation and Review

Stop losses work best when they are designed, recorded, and reviewed. A trade journal that captures entry rationale, stop logic, and post-trade outcomes helps distinguish between a good decision with a bad outcome and a lax process that luck occasionally rescues. Over time, the journal reveals whether stops are too tight, too loose, or inconsistently applied across instruments and regimes.

Statistical review also clarifies the contribution of stops to expectancy. For example, a distribution of R multiples, where R is the initial risk per trade, shows whether winners compensate for losers and whether losses are actually contained at the intended level. If a strategy repeatedly produces losses larger than 1 R due to slippage, then position sizing, event exposure, or order type may need adjustment to restore the intended risk profile.

Ethics, Discipline, and Professional Standards

At an institutional level, risk management is part of fiduciary duty and regulatory expectations. At an individual level, it is part of professional conduct. Stop losses formalize the promise to clients and to oneself that no single idea will jeopardize the portfolio. They are a commitment to a process that values longevity and repeatability over stories about any one trade.

Discipline is visible in the small choices. Cancelling a stop because price is near it changes the distribution of outcomes in ways that are hard to reverse. Moving a stop without a method replaces design with impulse. The consistent application of predefined exits is often the difference between a strategy that survives cold spells and one that sets new low watermarks from which it never recovers.

Why Stop Losses Endure

Stop losses endure because markets are uncertain and because human psychology resists realizing losses. They are a conservative response to both facts. The purpose is not to avoid being wrong. It is to survive being wrong. A robust approach to trading assumes that errors and surprises are inevitable. It builds gates that prevent those surprises from becoming terminal.

When a stop is hit, it is tempting to reinterpret it as a failure of timing or as evidence that someone else knows more. In a well designed process, a hit stop is simply data about risk and variance. It says nothing about the trader’s identity or competence. It confirms that the rule for unacceptable outcomes is working as designed.

Key Takeaways

- Stop losses exist to convert risk tolerance into enforceable exits, preserving capital and long-term survivability.

- They do not predict direction or guarantee fills at the trigger price, and they must account for gaps, slippage, and liquidity.

- Effective stops align with thesis invalidation and volatility, and they are coordinated with position sizing and portfolio risk limits.

- Common pitfalls include moving stops away from price, using stops that are too tight for the volatility regime, and relying on mental stops without infrastructure.

- Consistent documentation and review ensure that stops function as a governance tool rather than as an afterthought, supporting repeatable decision making.