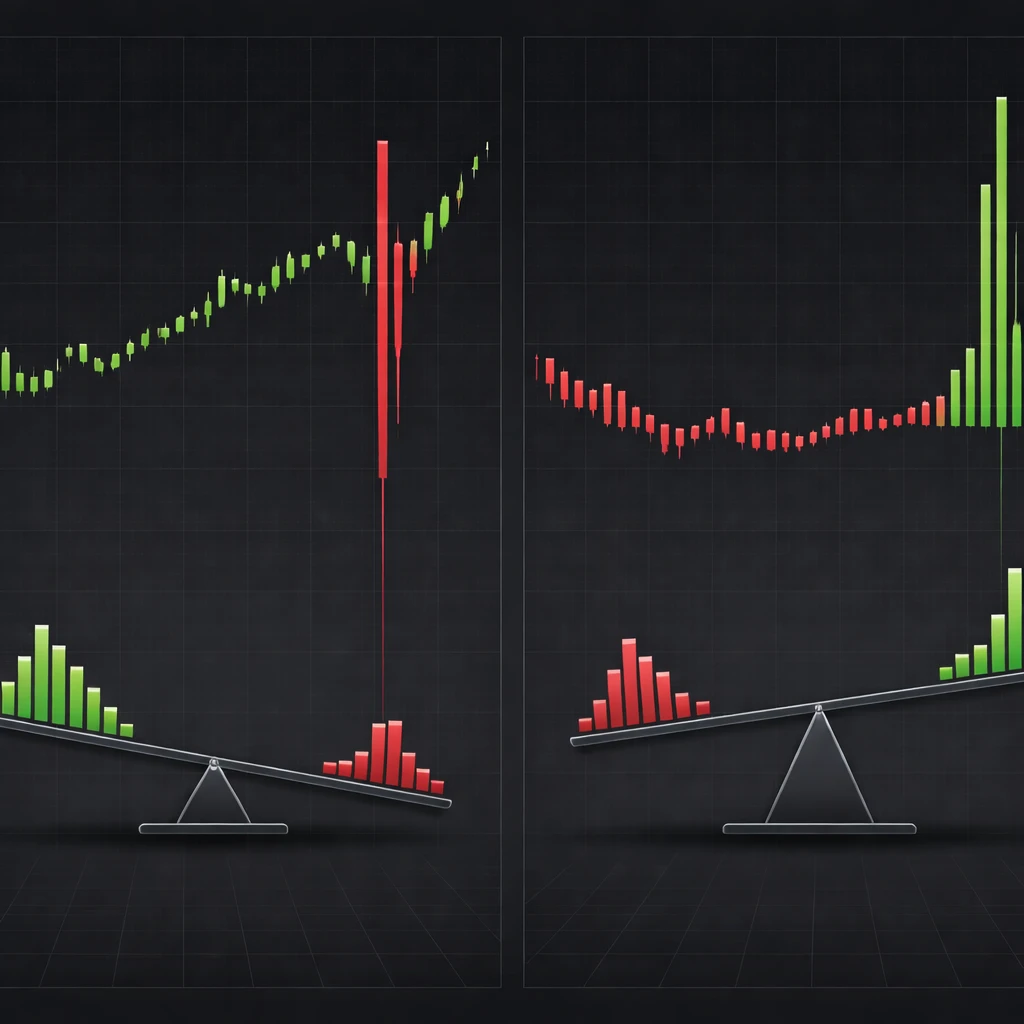

What Is Risk/Reward?

A clear explanation of risk/reward, why it matters for capital protection and long-term survivability, and how to evaluate it realistically in trading decisions without making predictions or recommendations. Includes practical examples and common pitfalls.