What Is Position Sizing?

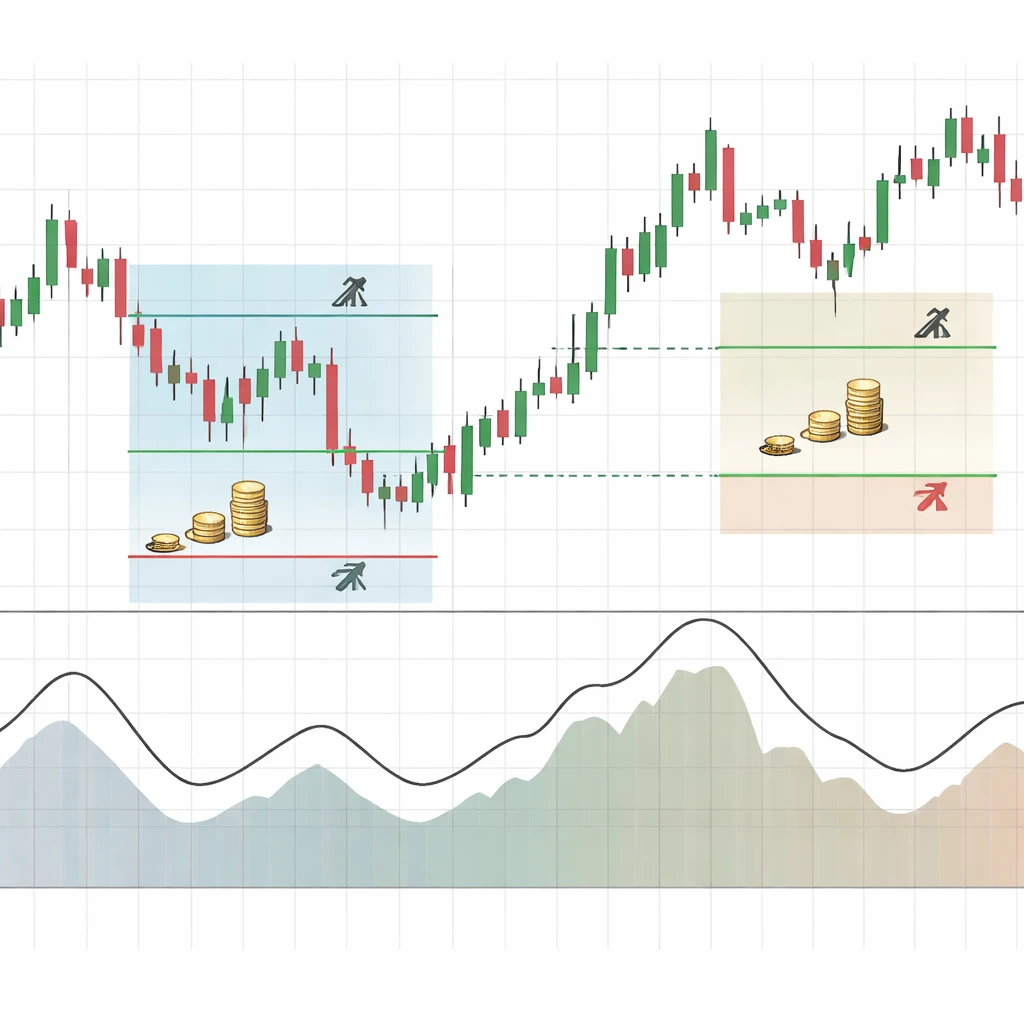

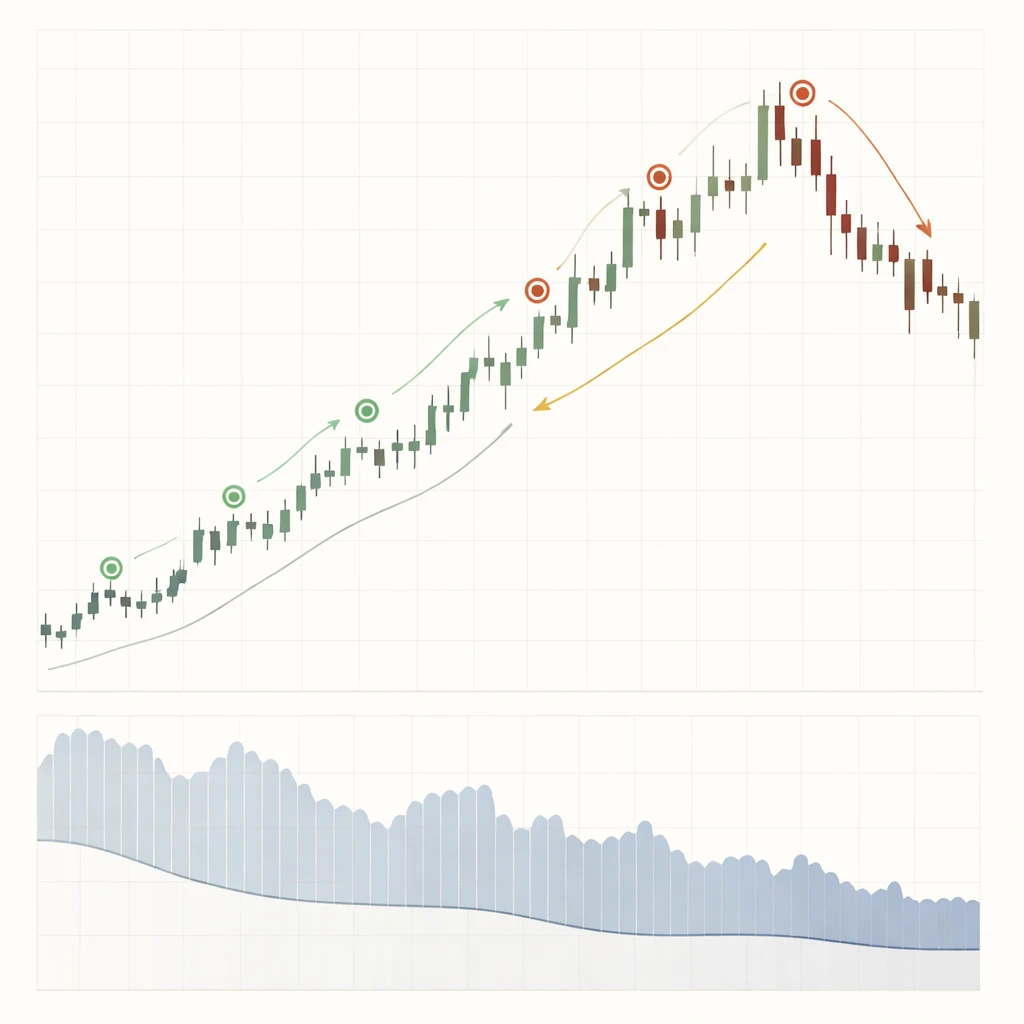

Position sizing is the systematic determination of how many units of a security to buy or sell so that each trade’s potential loss remains within a predefined risk limit. It is central to capital preservation, controls drawdowns, and underpins long-term survivability across changing market conditions.