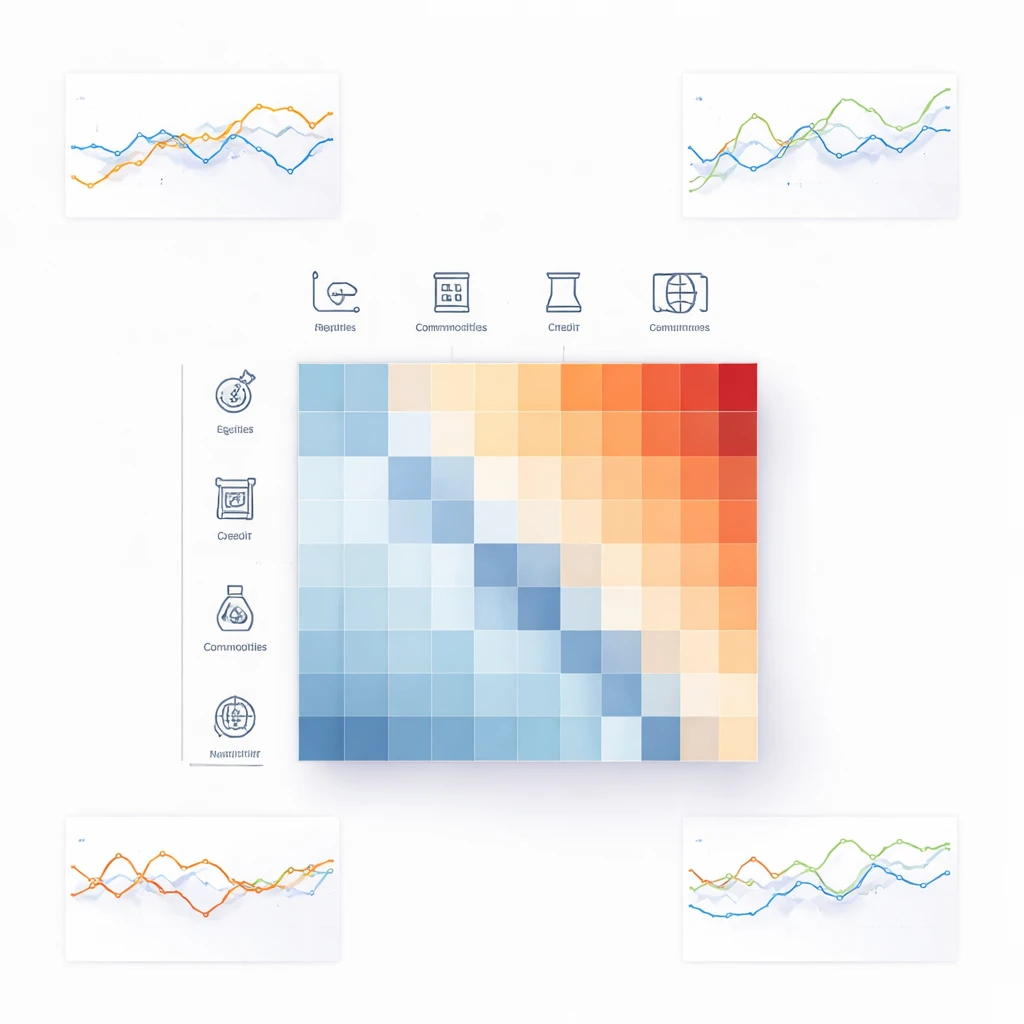

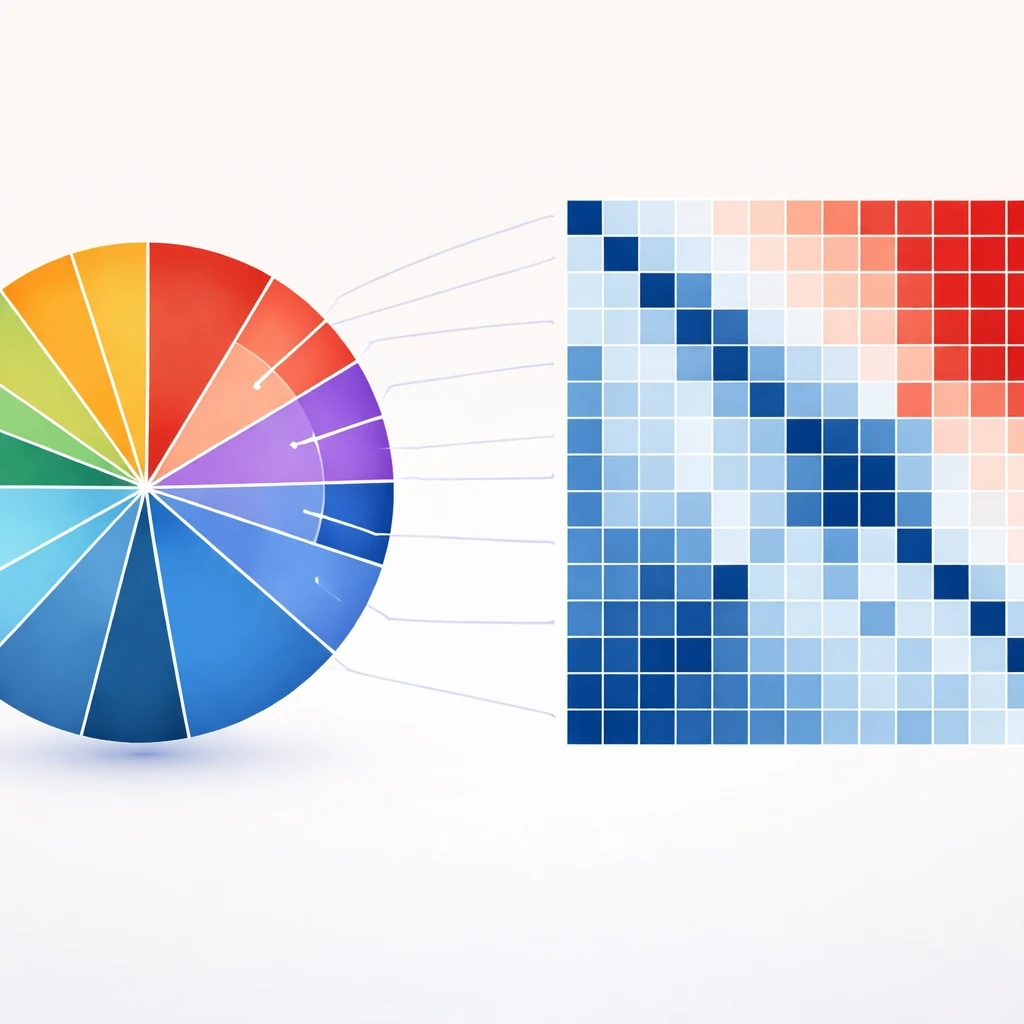

What Is Correlation?

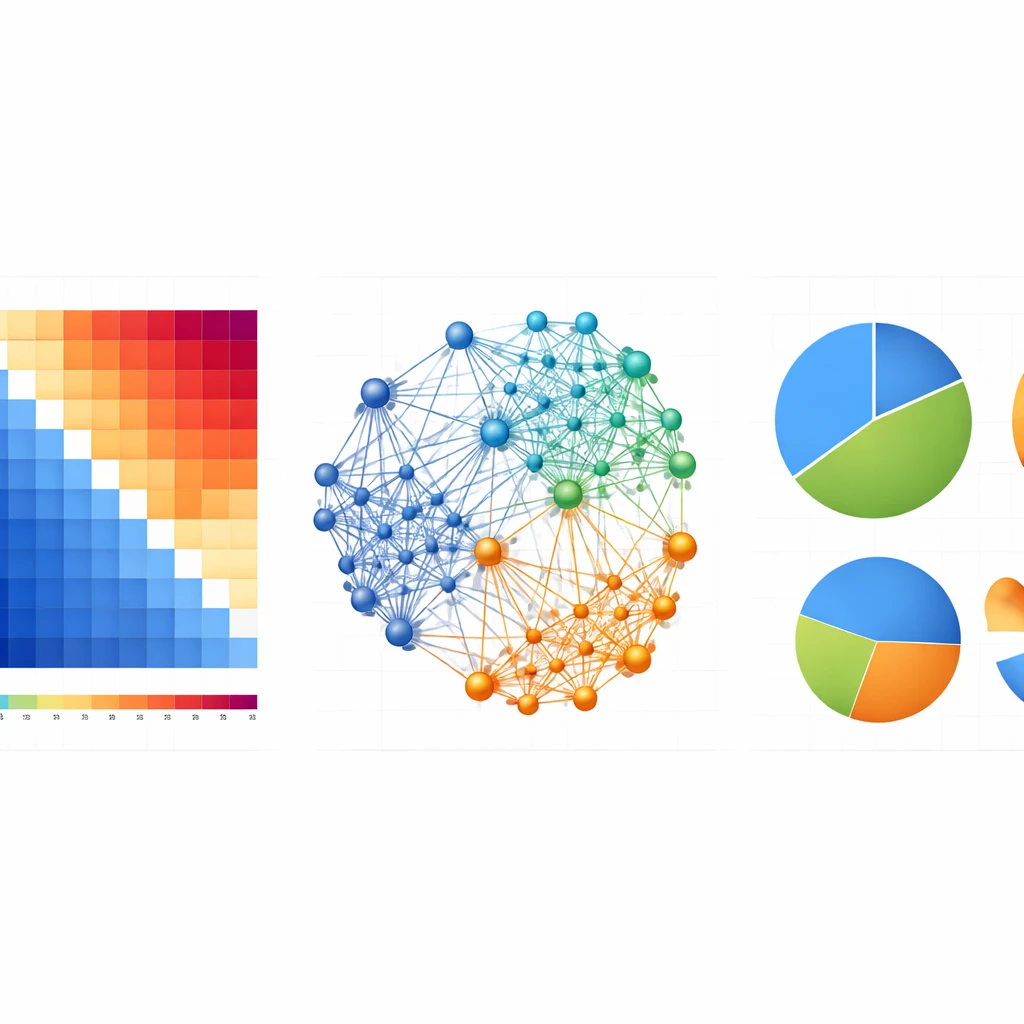

Correlation describes how two return series move together and is central to controlling aggregate exposure and portfolio drawdowns. Understanding its meaning, limits, and practical measurement helps traders avoid hidden concentrations and improve capital survivability.