Introduction

Diversification is a foundational idea in portfolio construction. The basic intuition is straightforward. By combining assets that do not move perfectly together, a portfolio can achieve a given level of expected return with lower volatility than any single holding. This insight is both robust and powerful. Yet it is possible to take diversification too far. Across public and private markets, many portfolios become unwieldy, redundant, and costly. The result is not simply administrative complexity. Excessive breadth can dilute the very benefits diversification is intended to provide.

This article examines over-diversification risks. The focus is the portfolio level, not individual securities. The discussion emphasizes how excessive breadth emerges, how it affects risk and return characteristics, why it matters for long-term capital planning, and what observable signals indicate that a portfolio may have crossed from prudent diversification into counterproductive complexity. The aim is clarity, not prescription. No investment advice is provided.

Defining Over-Diversification

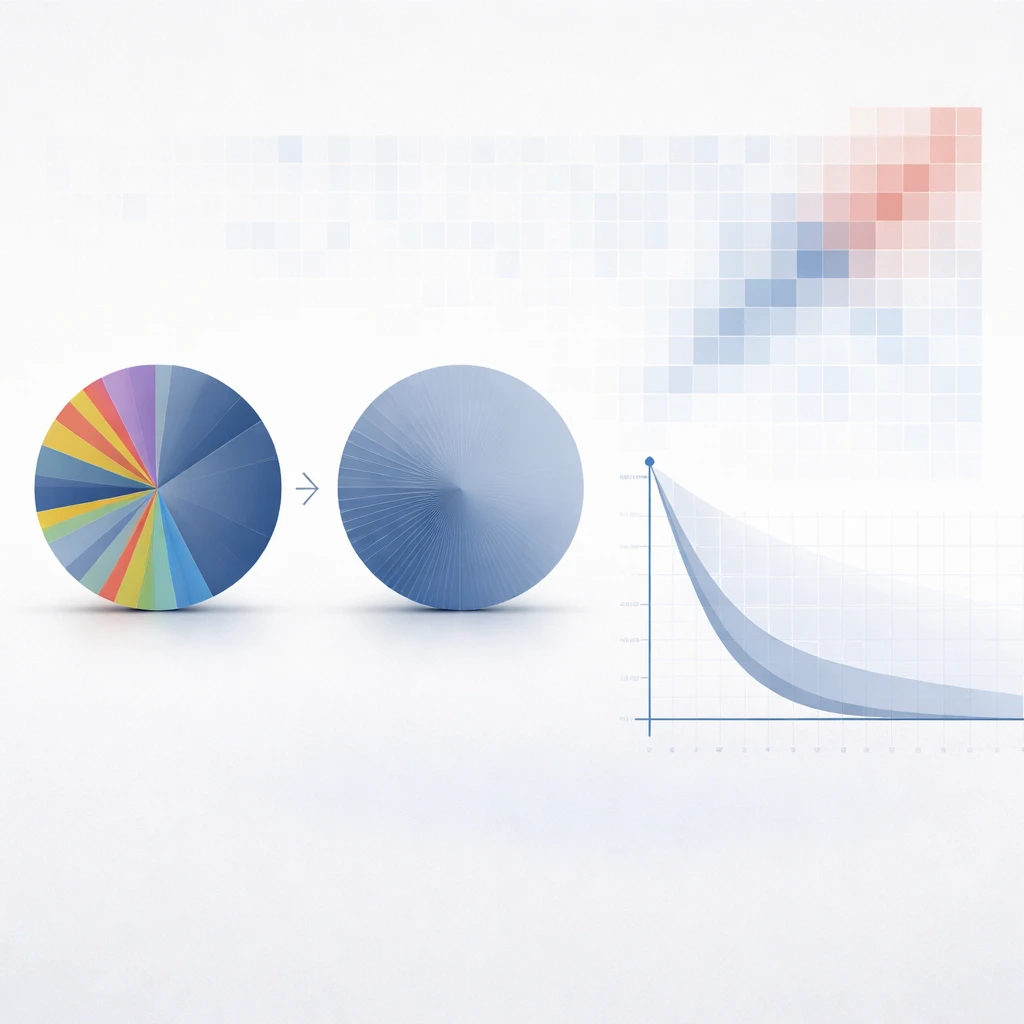

Over-diversification refers to a state in which the addition of more holdings, managers, or sleeves no longer produces a material improvement in the portfolio’s risk-adjusted characteristics and may instead increase costs, reduce transparency, and impair control of risk exposures. The phenomenon is closely related to diminishing marginal benefits of diversification. The first few uncorrelated holdings reduce portfolio variance substantially. Beyond a certain point, each new addition contributes very little variance reduction, yet still consumes attention, fees, and liquidity.

At the core lies a tension. Diversification reduces idiosyncratic risk, but market, macroeconomic, and factor risks remain. When a portfolio contains dozens or hundreds of highly overlapping exposures, the idiosyncratic component has already been diversified away. Additional line items then add mostly redundancy. The result can be a portfolio that looks diversified by name count, but that behaves as if it were a broad market index, while still carrying the administrative and cost burden of an active structure.

Diminishing marginal contribution to risk reduction

A useful way to frame the issue is the marginal contribution to risk of an added holding. Early additions with low correlations to existing holdings can materially lower the portfolio’s volatility. Over time, as the portfolio becomes more diversified, new holdings are often more correlated with existing exposures. The marginal contribution to risk reduction shrinks. If the new holding carries additional fees, trading costs, or complexity, the net effect can be negative for the overall risk-return profile.

Portfolio-level definition rather than a fixed number

There is no universal count of positions that defines over-diversification. The threshold depends on correlation structure, concentration of weights, the stability of relationships, and implementation costs. A portfolio can be over-diversified with 40 positions if they are highly overlapping, or still be under-diversified with 200 positions if they represent truly distinct and complementary risk sources. The definition is functional, not numerical.

Portfolio Mechanics That Create Over-Diversification

Correlation structure and hidden redundancy

Diversification is determined by co-movements, not labels. Two holdings in different industries can be tightly linked by common macro factors such as interest rates or energy prices. A portfolio that appears broad by sector or region can still concentrate risk in a small set of shared drivers. When new positions are added that load on the same dominant factors, they contribute little diversification. Redundancy accumulates, and the portfolio’s response to shocks becomes more uniform than intended.

Effective number of exposures versus line-item count

A count of holdings often exaggerates how diversified a portfolio is. The effective number of exposures reflects weight concentration. If 80 percent of the portfolio lies in 15 names and the remaining 20 percent is spread across 200 names with tiny weights, the true breadth is closer to 15 than 215. Concentration indices such as the Herfindahl-Hirschman Index, which sums squared portfolio weights, can be converted into an effective number of holdings by taking the inverse of that sum. While the exact measure varies by context, the principle is consistent. A long tail of immaterial positions does not create meaningful diversification, but it does add complexity.

Factor exposures and unintended neutralization

Portfolios often combine managers or funds with complementary styles. If the overlaps are not understood, these combinations can cancel intended exposures. For example, pairing a value-tilted strategy with a growth-tilted strategy may reduce active risk relative to a broad benchmark. The result can be index-like behavior at aggregate level while incurring active costs. Over-diversification can therefore erode the effectiveness of deliberate tilts by neutralizing them through offsets that were not part of the design.

Implementation costs and administrative drag

Each additional sleeve introduces costs. These include transaction costs, management fees, custody and accounting work, and governance time. Small positions can also create rebalancing friction. For taxable investors, tiny trades may trigger tax events with minimal benefit. Across a large roster of holdings, these frictions accumulate and can overwhelm the minimal risk reduction offered by the last few additions.

Liquidity, capacity, and execution quality

Some exposures cannot be scaled without affecting execution. As the number of holdings grows, the portfolio may be forced into very small allocations to less liquid assets. Slippage and market impact become more likely, especially during stress when liquidity dries up. Over-diversification can therefore increase the gap between paper portfolio characteristics and what can be implemented in practice. It can also impair the ability to rebalance quickly when conditions change.

Why Over-Diversification Matters for Long-Term Capital Planning

Clarity of objectives and accountability

Long-horizon portfolios are typically governed by explicit objectives such as maintaining a spending rate, preserving purchasing power, or tracking a liability stream. Over-diversification dilutes the link between portfolio structure and objectives. When many small allocations are present, it becomes difficult to attribute outcomes to decisions. This reduces accountability and slows learning. Over time, the absence of clear cause and effect can impair strategic alignment with the policy portfolio and risk budget.

Compounding and cost leakage

Small, persistent costs compound. A portfolio with many minor sleeves may experience slightly higher fees, wider trading spreads, and more frequent small rebalances. The cumulative effect can be material over decades. If the additional holdings do not improve expected risk-adjusted characteristics, the incremental cost reduces the capital base that compounds through time.

Tracking error management and unintended index hugging

In multi-manager settings, dispersing capital too widely often produces aggregate behavior that closely resembles a broad index. While this may appear stable, it can undermine the rationale for active management budgets and risk allocations that were intended to differ from the benchmark. The result is sometimes called closet indexing. Over-diversification is a common pathway to this outcome because offsetting bets erode the distinct features of each sleeve.

Tax efficiency and rebalancing friction

For taxable accounts, small positions can generate short holding periods and a larger number of tax lots. Routine rebalancing across many small weights can create frequent realized gains or wash sale complications. Even in tax-exempt structures, trading to maintain a complex allocation map increases operational load. Over the long run, these frictions reduce the efficiency of capital deployment without delivering meaningful diversification benefits.

Behavioral resilience and governance bandwidth

Portfolios benefit when decision-makers can monitor risks, understand drivers of performance, and act deliberately under stress. Over-diversification strains governance bandwidth. Too many moving parts complicate communication and risk oversight. During market stress, slow or diffuse decision-making can be costly. A structure that is simpler, but still robust, often enables clearer analysis of whether a drawdown reflects compensated risk or an unintended exposure.

Illustrative Real-World Contexts

Broad equity fund-of-funds with overlap

Consider a fund-of-funds that allocates across many large-cap equity managers, each diversified internally. At the aggregate level, the portfolio might hold several hundred underlying securities. If manager holdings overlap significantly in the largest benchmark constituents, the aggregate exposures align closely with the index. The portfolio’s active share declines. Additional manager slots then add operational cost and fee layers while delivering little incremental diversification. The risk reduction relative to holding a single broad equity index fund may be negligible, yet the structure is more complex and expensive.

Multi-asset bond sleeves that crowd into similar duration and credit

A multi-asset investor might hold several bond funds labeled as core, core-plus, and unconstrained. Marketing labels differ, but the actual exposures can converge toward similar duration and investment-grade credit. If interest rate risk and credit beta dominate in each sleeve, the aggregate behaves as a single bet on rates and credit spreads. Adding more funds that tilt in the same direction will not provide meaningful diversification. During a rate shock or credit selloff, the portfolio moves as one. The name count hides the concentration.

Alternative investments with many small commitments

In private markets, a common pattern is to spread commitments across a large number of funds to diversify manager risk and vintage years. This can be sensible within limits. Beyond those limits, administrative complexity and fee layers increase. Monitoring hundreds of small positions, each with capital calls and distributions, can dilute attention. If strategies are highly correlated to equity or credit cycles, the benefit of the additional lines is limited. The portfolio may still be driven largely by broad market conditions, but now with added illiquidity constraints and higher costs.

Factor overlays that cancel each other

An investor might seek exposure to value, quality, and momentum through separate sleeves. Without coordination, the combined effect can inadvertently neutralize the factor tilts. For example, the momentum sleeve may avoid many value names, while the value sleeve underweights recent winners. At the aggregate level, exposures regress toward the benchmark. The intention to diversify across styles is understandable, but when poorly integrated it can produce index-like results with additional turnover and fees.

Geographic dispersion without diversification

Allocations across several regional equity funds can appear diversified. If their constituents are heavily exposed to the same global sectors and macro variables, the benefit is smaller than expected. Global technology or energy cycles can dominate. If correlations rise during stress, the hoped-for protection from regional spread is not realized. Adding more regional funds that own similar mega-cap firms provides little diversification but increases portfolio complexity.

Conceptual Tools for Diagnosing Over-Diversification

Weight dispersion and effective breadth

The distribution of weights across holdings offers a practical lens. When many allocations are below any threshold of materiality, the long tail is unlikely to influence portfolio outcomes. Concentration indices such as the sum of squared weights, and its inverse as an estimate of effective breadth, provide a simple summary. Portfolios that report a high count of holdings but a low effective number of exposures are candidates for over-diversification review.

Overlap and look-through analysis

Look-through analysis aggregates underlying holdings across funds or managers. Overlap in the largest positions often explains a large share of aggregate risk. If the top positions are common to many sleeves, the portfolio’s primary risks are crowded. Tools that map holdings to sectors, countries, and factors provide a clear picture of redundancy. This type of analysis also helps identify where diversified labels do not translate into distinct exposures.

Diversification ratio and marginal risk reduction

The diversification ratio compares the volatility of a weighted average of individual holdings to the volatility of the aggregate portfolio. A higher ratio indicates better diversification. As more holdings are added, the ratio initially rises and then flattens. When additions no longer move the ratio meaningfully, the portfolio may be reaching the point where further breadth yields little benefit. This is a functional way to examine diminishing returns to diversification.

Active share and tracking risk at the aggregate level

In equity portfolios benchmarked to an index, active share measures how different the portfolio’s weights are from the index weights. When multiple managers are combined without coordination, aggregate active share can fall even if each manager is individually active. Tracking risk provides a related view through the lens of return volatility relative to the benchmark. Low tracking risk and low active share at the aggregate level often indicate unintended index-like behavior accompanied by the costs of an active structure.

Scenario analysis and stress testing

Scenario analysis examines how the portfolio would respond to specified macro or market shocks. If many holdings show similar responses to key scenarios, breadth is superficial. Stress testing against historical episodes, such as periods of rapid rate increases or commodity price spikes, can reveal whether the portfolio’s diversification stands up when it is most needed. Over-diversified portfolios often surprise decision-makers by behaving homogeneously under stress.

Structural Sources of Over-Diversification

Governance incentives and organizational habits

Large portfolios accumulate line items for many reasons. Teams change, new sleeves are added, and older allocations are rarely removed. Risk committees may prefer incremental additions over decisive consolidation. Over time, the roster reflects history more than design. The result is a patchwork of small, overlapping exposures that are hard to evaluate.

Benchmark constraints and fear of deviation

Concern about short-term underperformance can lead to a preference for many small bets. While this can reduce regret in any single period, it also reduces the likelihood that the portfolio will behave differently from the benchmark over time. The structure converges toward benchmark weights while retaining the appearance of activity. Over-diversification is a natural byproduct of this dynamic.

Data limitations and false comfort from labels

Labels do not guarantee diversification. Two strategies labeled differently can share core risk drivers. Without look-through data and factor analysis, differences in marketing documents can create a false sense of breadth. Reliance on broad categories rather than empirical co-movement is a frequent source of over-diversification.

Risk Control and Policy Design Considerations

Institutions commonly manage the risk of over-diversification through policy design and measurement frameworks. The aim is to preserve diversification benefits while avoiding redundant complexity. The following concepts are widely used in the field as guardrails, not as prescriptions for any particular investor.

- Materiality thresholds. Many policy statements define a minimum allocation size below which a new sleeve is not introduced. The threshold is linked to the scale of the portfolio and the expected contribution to risk. De minimis positions that cannot affect outcomes are discouraged.

- Maximum roster sizes by asset class. Some organizations cap the number of external managers or funds per asset class and refresh the roster through a disciplined review process. The goal is to maintain sufficient breadth with clear accountability.

- Risk budgeting. A risk budget allocates portions of allowable total risk to specific strategies or factors. If a new allocation cannot earn a place in the risk budget, it is not added. This anchors portfolio structure to quantitative risk contributions rather than just names.

- Overlap monitoring. Regular look-through reporting at the aggregate level helps identify growing overlaps in top holdings or factors. This reduces the likelihood that distinct sleeves will converge unintentionally.

- Rebalancing bands and trading thresholds. Rebalancing often uses tolerance bands and minimum trade sizes to reduce turnover in small positions. This limits implementation drag from an excessive number of tiny adjustments.

How Over-Diversification Appears in Performance and Risk

Flattened active results and muted dispersion

Portfolios that are over-diversified often show performance that closely tracks broad indices with modest deviations. The dispersion of returns across sleeves narrows. Attribution reveals that a small number of macro factors explain most of the variation. While low dispersion is not inherently negative, it signals that the portfolio’s breadth is not translating into distinct risk-bearing positions.

Volatility in line with the market despite many holdings

A portfolio that holds hundreds of securities can still display volatility similar to the market if common factor exposures dominate. The paradox resolves when one recognizes that diversification primarily removes idiosyncratic risk. Market and factor risks remain. If those risks are the same across many holdings, variability will not fall much with additional breadth.

Rising non-investment costs

Audit, legal, data, and operational costs tend to rise with the number of positions and counterparties. When benefits plateau, these costs become more visible in net outcomes. Over time, elevated non-investment costs reduce the capital base available for compounding.

Common Misconceptions

More line items always reduce risk

Beyond a relatively small number of uncorrelated positions, the variance reduction curve flattens. Adding names that share the same risk drivers does little to reduce volatility. In extreme cases, breadth can even raise risk if it reduces visibility into concentrated exposures or degrades execution quality.

Diversification guarantees protection in crises

Correlations tend to rise under stress. Portfolios that appear diversified in calm periods may experience convergence when liquidity is scarce and macro shocks dominate. Over-diversified structures do not avoid this feature of markets. They can be slower to diagnose and react to it because of their complexity.

Low volatility is proof of good diversification

Low volatility can reflect many things, including a tilt to lower risk assets, embedded option exposures, or smoothing in illiquid holdings. It is not definitive evidence of robust diversification. The quality of diversification depends on how exposures are spread across distinct, compensated risk sources and on how they behave in adverse conditions.

Putting the Concept into a Practical Analytical Frame

Analytically, over-diversification can be evaluated by linking three ideas. First, measure the distinctness of exposures through correlations, factor loadings, and overlap. Second, assess materiality through weight dispersion and contributions to total risk. Third, weigh the implementation and governance costs incurred by added complexity. If distinctness is low, materiality is low, and costs are nontrivial, the case for additional breadth is weak.

These assessments benefit from multiple lenses. A holdings-based analysis clarifies overlap. A returns-based factor model reveals which systematic drivers explain performance. Scenario tests examine behavior under shocks that matter for the investor’s objectives. Together, these perspectives provide a more complete view of whether the portfolio’s breadth is doing useful work or simply increasing name count.

Closing Perspective

Diversification remains essential to risk management. Its power comes from holding exposures that are sufficiently different to lower overall risk for a given expected return. Over-diversification arises when additions do not increase difference in a meaningful way but do increase cost, opacity, or operational burden. At the portfolio level, the risk is less about any single holding and more about how overlapping exposures accumulate. Over long horizons, clarity and parsimony tend to support better governance and more reliable alignment with stated objectives.

Key Takeaways

- Over-diversification occurs when added holdings no longer improve risk-adjusted characteristics and instead introduce cost and complexity.

- The effective number of exposures depends on correlations and weight dispersion, not on the raw count of positions.

- Redundant factor exposures and overlap across sleeves can neutralize intended tilts and push aggregate behavior toward benchmark-like outcomes.

- Long-term capital planning is impaired by diluted accountability, compounded costs, and operational friction that do not correspond to meaningful diversification gains.

- Diagnostic tools such as look-through overlap, diversification ratio, concentration indices, and scenario analysis help identify whether breadth is doing useful work.