Portfolio Construction

Building resilient portfolios through diversification, asset allocation, correlation management, rebalancing strategies, and long-term capital planning.

You will learn: The core concepts in this topic, common misconceptions, and how professionals think about the subject.

Educational content only. Not financial advice.

What you will get from this topic

- Clear definitions and real-world context

- Practical examples without trade recommendations

- Common mistakes to avoid

- A progression from basics to deeper understanding

Scopes in Portfolio Construction

Asset Allocation

Distributing capital across asset classes to balance risk and return.

Explore ScopeLong-Term vs Trading Capital

Separating long-term investments from active trading capital.

Explore ScopePortfolio Risk Management

Managing portfolio-level risk rather than single-trade risk.

Explore ScopePopular in Portfolio Construction

What Is Asset Allocation?

Asset allocation is the disciplined process of dividing a portfolio across asset classes to balance growth, income, risk, and liquidity under real-world constraints. This article defines the concept, explains its portfolio-level application, and situates it within long-term capital planning using practical examples.

Why Asset Allocation Matters

Asset allocation is the primary driver of a portfolio’s long-run risk and return. This article explains what asset allocation is, how it operates at the portfolio level, and why it is central to long-term capital planning and resilient portfolio design.

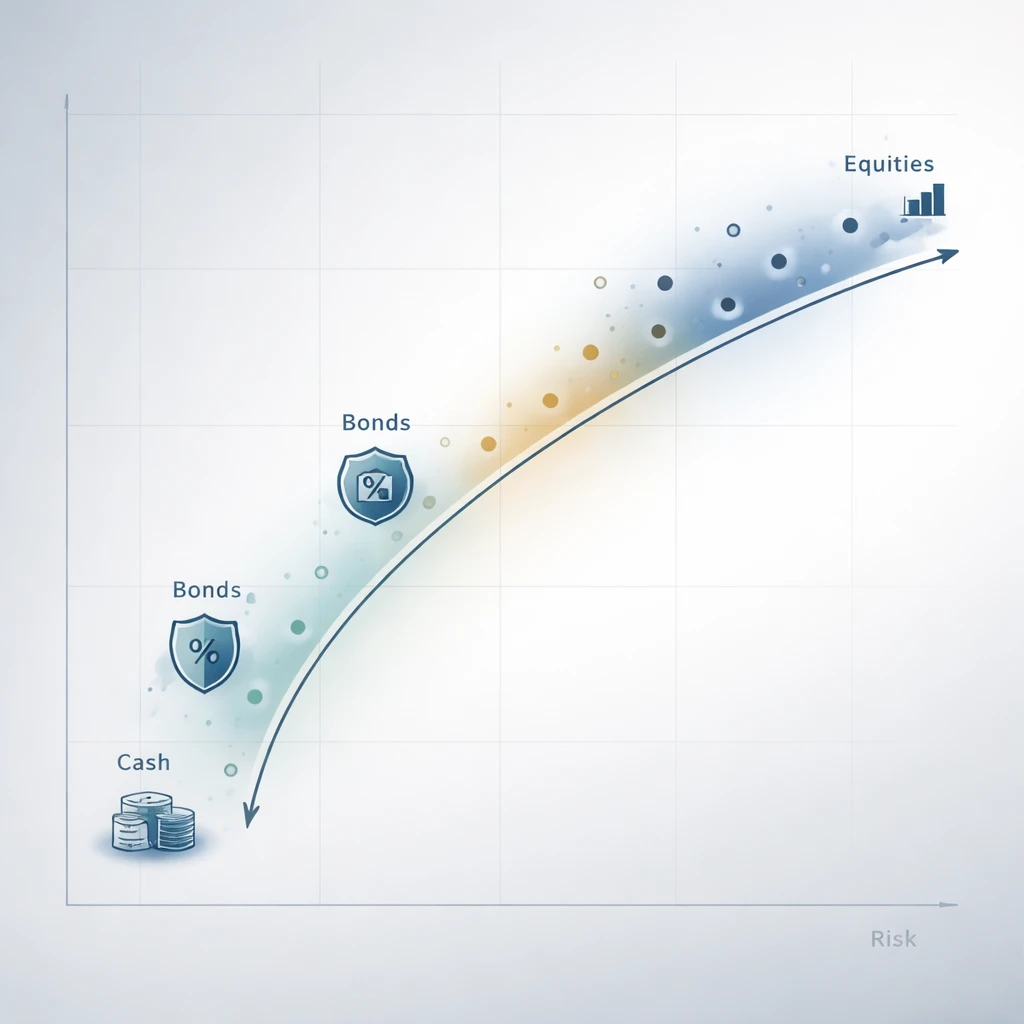

Risk vs Return Tradeoffs

An in-depth explanation of the risk–return tradeoff in portfolio construction, showing how asset allocation, diversification, and time horizon shape long-term outcomes and resilience without prescribing investments or strategies. Built for readers seeking a clear analytical framework.

Alternative Assets Explained

A clear, academically grounded overview of alternative assets, how they function within portfolio construction, and why they matter for long‑horizon, resilience‑focused capital planning. The article defines major categories, examines return drivers, correlation behavior, liquidity considerations, measurement issues, and real‑world allocation contexts.

Equities vs Fixed Income

An in-depth explanation of the roles that equities and fixed income play in portfolio construction, why their balance shapes long-term outcomes, and how the allocation framework operates across different real-world contexts without offering recommendations.

Role of Cash in Portfolios

A detailed, academically grounded explanation of how cash functions inside diversified portfolios, including liquidity management, volatility control, optionality for rebalancing, and long-term capital planning considerations such as inflation risk, liability matching, and governance.

Ready to begin?

Start with the first scope to build a clean foundation, then move forward in order.

Start Asset Allocation