Common vs Preferred Stock

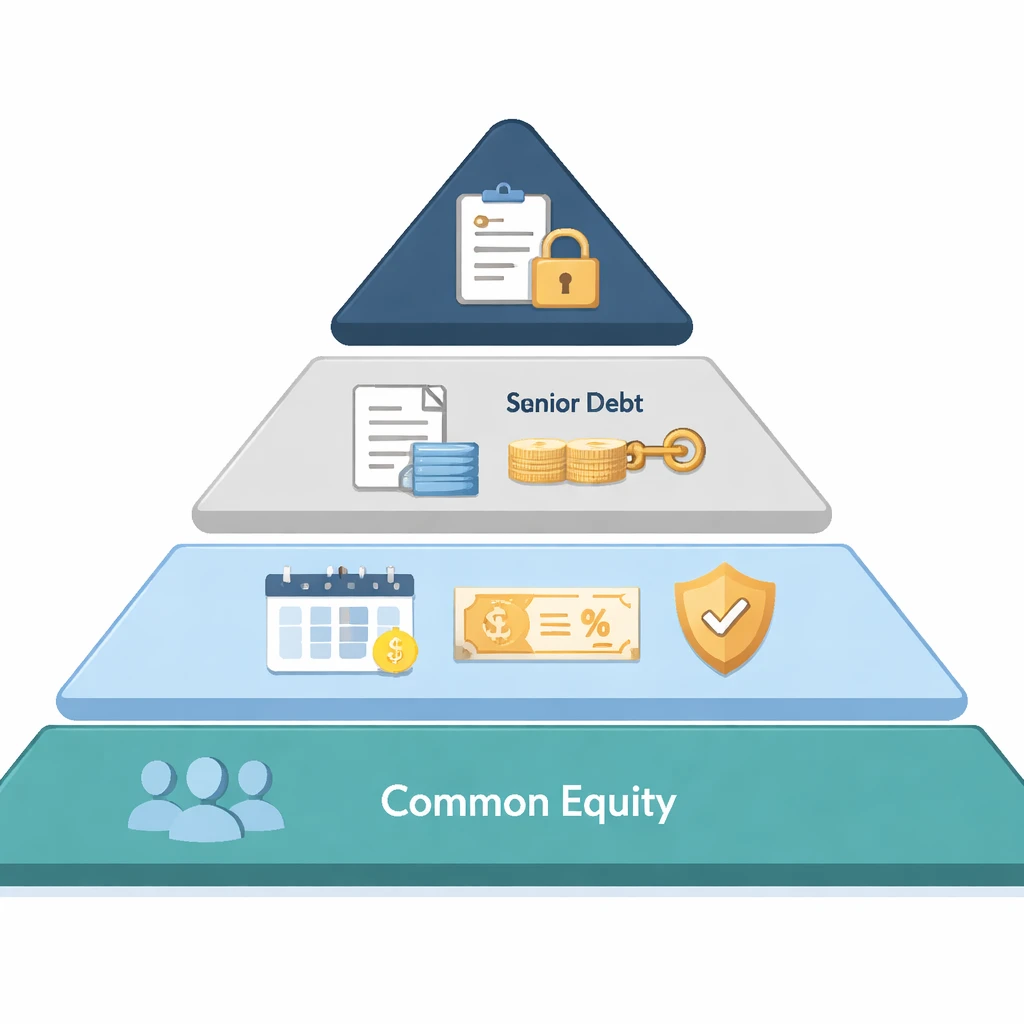

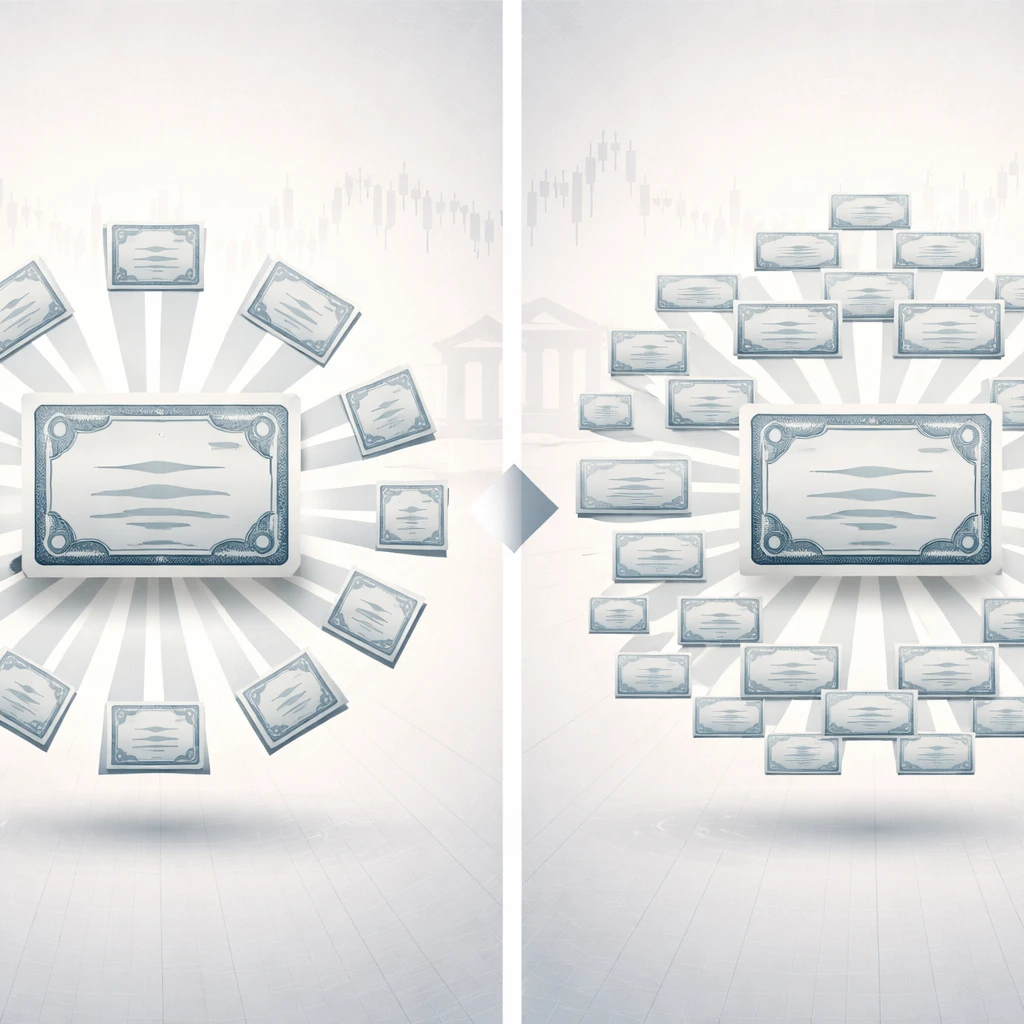

An in-depth explanation of common and preferred stock, how they fit into the corporate capital structure, why firms issue them, and how dividend, voting, and liquidation rights differ in practice. Includes real-world context and practical examples for clarity.