Introduction

Intrinsic value and extrinsic value form the basic decomposition of an options premium. Understanding this split is essential for interpreting quoted prices, evaluating how time and volatility affect those prices, and placing options within the broader structure of modern markets. The distinction is simple in definition yet rich in implications. It connects the immediate exercise value of an option to the probabilistic value of waiting, which is discovered through competitive trading and formalized in risk models and clearing rules.

This article develops precise definitions, explains why the split exists, and shows how it functions in practice. The discussion avoids trading strategies and focuses on the mechanics, economics, and institutional context that give intrinsic and extrinsic value their meaning.

Definitions

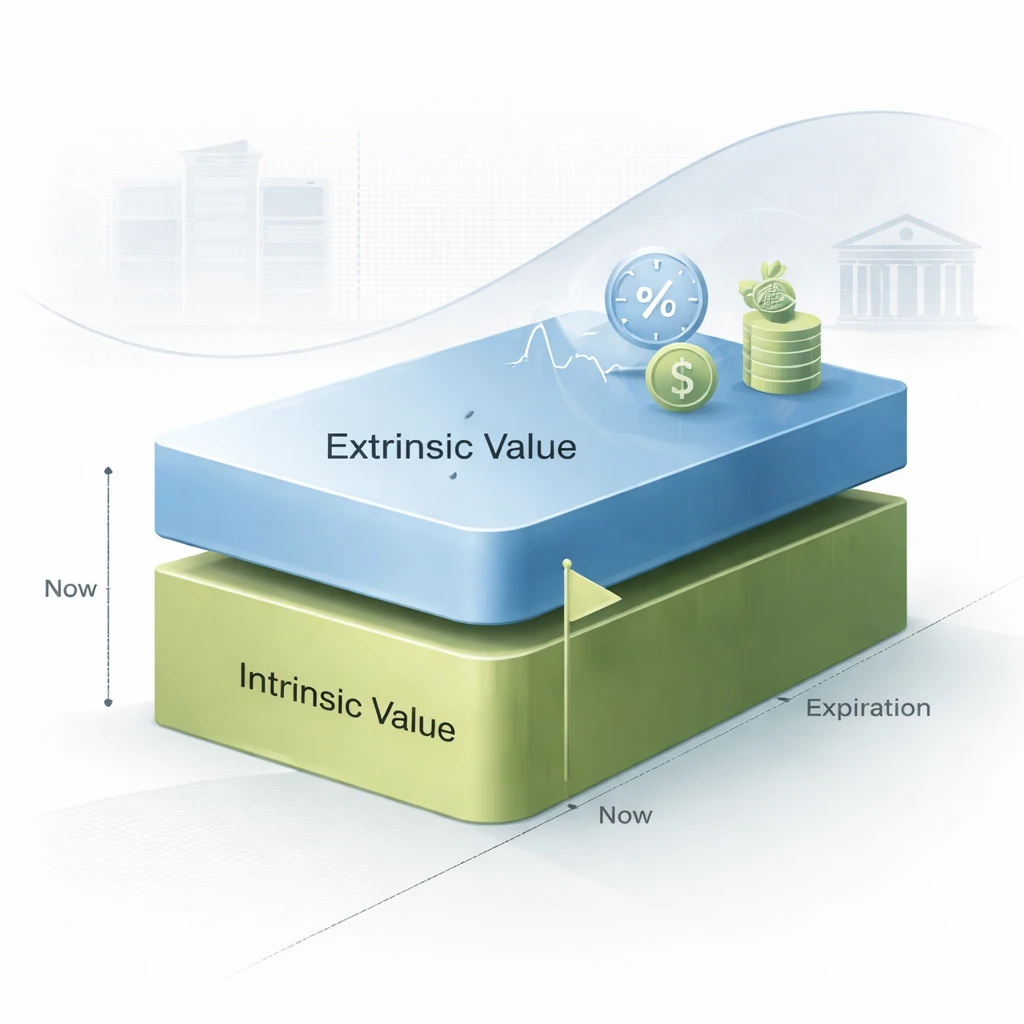

Intrinsic value is the immediate exercise value of an option. For a call option on a stock with current price S and strike K, intrinsic value is the larger of S minus K or zero. For a put option, intrinsic value is the larger of K minus S or zero. If exercising would not produce a positive payoff now, intrinsic value is zero. Intrinsic value never takes a negative number because an option holder is not obliged to exercise.

Extrinsic value is the portion of the option’s market price in excess of intrinsic value. It is sometimes called time value, though time is only one driver. Extrinsic value reflects the value of optionality itself, which includes time remaining to expiration, expected variability of the underlying, interest rates, expected dividends or carry costs, and the market’s assessment of risk and opportunity embedded in waiting rather than exercising immediately.

Premium is the market price of the option. It equals intrinsic value plus extrinsic value by definition. At expiration, the option’s premium converges to its intrinsic value. Before expiration, the premium typically exceeds intrinsic value because waiting can be valuable.

Moneyness and the Role of Intrinsic Value

Moneyness classifies options by the relationship between the underlying price and the strike:

- In the money (ITM): immediate exercise produces a positive payoff. Calls are ITM if S > K. Puts are ITM if S < K.

- At the money (ATM): the strike is near the current underlying price. Small price changes can flip the option from ITM to out of the money.

- Out of the money (OTM): immediate exercise would not produce a positive payoff. Calls are OTM if S ≤ K. Puts are OTM if S ≥ K.

Only ITM options have positive intrinsic value. ATM and OTM options have zero intrinsic value yet can trade at nonzero prices because extrinsic value captures the possibility that, before or at expiration, the option could end up in the money.

Why Intrinsic and Extrinsic Value Exist

Intrinsic value is a mechanical concept tied to immediate exercise. Extrinsic value is an economic concept tied to uncertainty and time. Two ideas support its existence:

- Optionality and deferral. The option grants the holder the right, but not the obligation, to exercise before or at expiration. The ability to wait has value when future outcomes are uncertain. Even if exercise is not profitable today, there is a chance it could become profitable later.

- Risk transfer. Option writers take on uncertain future payoffs. They require compensation for that risk. The premium above intrinsic value represents the market price of bearing uncertainty under prevailing conditions of supply and demand.

In modern finance theory, the premium equals the present value of expected payoffs under a risk-neutral probability measure. Intrinsic value is the immediate payoff. The difference between the total value and the immediate payoff is the value of waiting. Market microstructure, clearing rules, and competition among market makers translate these ideas into quoted prices.

How Markets Determine Extrinsic Value

Options trade on organized exchanges with competitive quoting by market makers and participation by institutions and individuals. The market sets the premium through order flow and continuous auction. Since intrinsic value is a simple function of S and K, the residual of price over intrinsic is extrinsic value.

Although pricing models like Black–Scholes–Merton and binomial trees provide theoretical benchmarks, the market often quotes and thinks in terms of implied volatility. Implied volatility is the volatility input that, when used in a pricing model, generates the observed premium. It packages many drivers of extrinsic value into one observable number. Different strikes and maturities carry different implied volatilities, creating a volatility surface that reflects supply, demand, and perceived risks for various scenarios.

Clearinghouses guarantee settlement and enforce exercise and assignment rules. These rules affect extrinsic value because they define when exercise can occur, how dividends and interest are handled, and how positions are margined. The institutional framework ensures that the option’s time value is realized in a consistent, enforceable way across all participants.

Components That Influence Extrinsic Value

Several factors, often interacting, shape extrinsic value:

- Time to expiration. More time generally increases extrinsic value because there are more opportunities for favorable moves. All else equal, a 90-day option carries more extrinsic value than a 7-day option.

- Expected volatility. Greater expected variability in the underlying’s price path increases extrinsic value. When the market expects larger swings, the chance of a profitable outcome rises for both calls and puts.

- Interest rates. Higher risk-free rates tend to increase call extrinsic value and reduce put extrinsic value for options on non-dividend-paying assets. This reflects the cost of carrying cash versus the underlying and the present value of the strike.

- Dividends and carry. For dividend-paying equities, expected dividends before expiration reduce call extrinsic value and increase put extrinsic value, all else equal. In futures and commodities, storage costs, convenience yield, and other carry elements play analogous roles.

- Moneyness. ATM options typically have the highest extrinsic value because small changes in the underlying most affect their probability of finishing in the money. Deep ITM or deep OTM options often have lower extrinsic value per contract.

These factors are interrelated. For instance, rising rates can coincide with changing volatility expectations, and dividend forecasts can shift around corporate events. The market’s continuous repricing integrates these influences into the premium at each moment.

Time Behavior and Decay

Time decay describes how extrinsic value typically decreases as expiration approaches, holding other inputs constant. This decay is not linear. The loss of extrinsic value often accelerates when little time remains, especially for options near the money. The market refers to this sensitivity as theta. A short calendar of time can remove much of an option’s extrinsic value, while the final hours before expiration can still be meaningful for ATM options because small price moves carry large implications for finishing in or out of the money.

It is important to separate mechanical time decay from changes in other inputs. Extrinsic value can rise even as time passes if implied volatility increases or if interest rates or dividend expectations change in a way that offsets time decay. Observed price changes reflect the net effect of all drivers.

Early Exercise and the Disappearance of Extrinsic Value

American-style options permit exercise at any time up to expiration. European-style options permit exercise only at expiration. The option’s extrinsic value represents the benefit of waiting. Exercising early discards that value. As a result, early exercise is usually suboptimal for many American-style options unless a specific feature, such as an upcoming dividend for calls or the time value of money for deep in the money puts, justifies giving up the remaining extrinsic value.

Two guiding principles help interpret this:

- For American calls on non-dividend-paying stocks, early exercise is generally not optimal because the call’s extrinsic value is strictly positive before expiration. Holding the option preserves upside without forgoing time value.

- For American puts that are deep in the money, early exercise can be optimal in theory when interest earned on the strike proceeds and the lack of further time value outweigh the benefit of waiting. Whether this occurs depends on rates, remaining time, and the option’s current extrinsic value.

Exercise extinguishes extrinsic value at the moment of exercise. At expiration, extrinsic value collapses to zero for all options, and premiums equal intrinsic value. The assignment and exercise process through the clearinghouse finalizes this transition.

Put–Call Parity and Value Decomposition

Put–call parity links the values of calls and puts with the same strike and expiration on the same underlying. In words, the value of a call minus the value of a put equals the current underlying price adjusted for the present value of the strike and the present value of expected dividends or carry. This identity holds under broad conditions and provides a consistency check on quoted prices.

Parity helps explain the distribution of extrinsic value across calls and puts. When interest rates rise, the present value of paying the strike at expiration falls, which tends to support higher call prices relative to puts, other things equal. Expected dividends shift the relationship in the opposite direction for equities, since dividends reduce the value of holding the stock over the option’s life. Deviations from parity beyond transaction costs and frictions indicate mispricings that market makers attempt to arbitrage away.

Examples

Consider a stock currently trading at S = 100.

- ITM call. A 95-strike call trades at a premium of 8. Intrinsic value is max(100 − 95, 0) = 5. Extrinsic value is 8 − 5 = 3. The 3 reflects time remaining, volatility expectations, rates, and any dividends.

- OTM call. A 110-strike call trades at 2.5. Intrinsic value is zero. Extrinsic value is 2.5, reflecting the chance that the stock rises above 110 by expiration.

- ITM put. A 105-strike put trades at 7. Intrinsic value is max(105 − 100, 0) = 5. Extrinsic value is 7 − 5 = 2.

Now change time to expiration.

- With 30 days to expiration, the 95-strike call may trade at 8 as above. With 1 day left and the stock still at 100, it might trade near 5.20. Intrinsic value remains 5. Extrinsic value has shrunk to 0.20. The loss of 2.80 in extrinsic value over 29 days illustrates time decay.

Change volatility expectations while holding time constant.

- If implied volatility rises because of an upcoming earnings announcement, the 110-strike call may increase from 2.5 to, say, 3.4 even if the stock remains at 100. Intrinsic value stays zero. The entire change is extrinsic value responding to higher expected variability.

Change interest rates and dividends.

- With higher short-term interest rates and no dividends, call extrinsic value tends to be higher and put extrinsic value lower relative to a low-rate environment, because the present value of paying the strike at expiration is smaller. If the stock is expected to pay a cash dividend before expiration, the relationship shifts. The call’s extrinsic value tends to be lower and the put’s higher compared with a no-dividend baseline, reflecting the advantage of holding the stock through the dividend rather than the call.

These examples are stylized. Real markets include bid–ask spreads, discrete tick sizes, and other microstructure features. Still, the underlying decomposition remains the same.

Interpreting Extrinsic Value Probabilistically

Extrinsic value can be interpreted as the value of the right to wait for information. In option pricing theory, the premium equals the discounted expected payoff under a risk-neutral probability distribution. Subtracting intrinsic value isolates the value that comes from possible future states that differ from the current state. In other words, extrinsic value captures the probability-weighted potential of more favorable outcomes that have not yet materialized.

This viewpoint helps connect market-implied probabilities to observed premiums. If two options have the same intrinsic value but different extrinsic values, the market is implicitly assigning different probabilities or magnitudes to future moves, or is reflecting differences in rates, dividends, or carry. The implied volatility surface operationalizes these beliefs for each strike and maturity.

Surface Effects: Moneyness, Skew, and Term Structure

Extrinsic value varies across strikes and maturities, creating a rich structure often called the volatility surface.

- Strike skew or smile. Options with strikes far from the current price can trade with higher or lower implied volatility than at-the-money options. This alters extrinsic value across moneyness. For many equity indices, out-of-the-money puts command higher implied volatility than calls, raising put extrinsic value relative to calls at similar distances from the money.

- Term structure. Implied volatilities often differ across expirations. Short-dated options may carry less extrinsic value in calm periods but can show elevated extrinsic value around scheduled events. Longer-dated options usually carry more extrinsic value due to greater time, but can also reflect long-horizon uncertainty differently from near-term uncertainty.

These surface effects originate in supply and demand, hedging costs, and institutional positioning. They are not anomalies but features of how markets aggregate risk preferences and information.

Institutional and Market Structure Context

Exchange-traded options are supported by a clearinghouse that guarantees performance and administers exercise and assignment. Market makers post two-sided quotes and hedge their exposures dynamically. The cost and feasibility of hedging influence quoted premiums and, therefore, extrinsic value. For example:

- Hedging costs. If it is expensive or difficult to hedge an option, market makers require a higher premium, adding to extrinsic value.

- Liquidity and order flow. Heavy demand for certain strikes or maturities can lift extrinsic value relative to theoretical benchmarks. Conversely, thinly traded options may exhibit wider bid–ask spreads, which affect the observed extrinsic value an investor could realize when buying or selling.

- Margin and capital. The capital required to write options and maintain hedges influences supply. When capital is constrained, extrinsic value can rise because fewer participants are willing to take the other side.

These features connect the clean theoretical split between intrinsic and extrinsic value with the real-world constraints of trading, funding, and regulation.

Edge Cases and Common Misconceptions

Extrinsic value cannot be negative in a frictionless market because the right to wait cannot be worth less than zero. If an option’s premium were below its intrinsic value, arbitrageurs could exercise and lock in a riskless profit. In practice, small and temporary deviations can appear due to transaction costs, exercise timing, or market stress, but competitive forces usually correct them.

Intrinsic value is not the option’s true worth. It is the immediate exercise value only. An option with zero intrinsic value can still be valuable. For example, a far out-of-the-money call with zero intrinsic value can have meaningful extrinsic value if the market expects substantial volatility before expiration.

Time value is not only about the calendar. Calling extrinsic value time value is convenient, but it risks obscuring the roles of volatility, rates, dividends, and carry. Time is necessary for uncertainty to resolve, yet it is not sufficient. Extrinsic value depends on what might happen during that time.

Exercise decisions depend on extrinsic value. Exercising an American option forfeits remaining extrinsic value. The choice to exercise or hold cannot be assessed solely by intrinsic value without considering rates, dividends, and the option’s remaining time value.

Application Across Asset Classes

The intrinsic–extrinsic split applies to equity options, index options, options on futures, currency options, and many others. The economic drivers persist, while the specifics of rates, carry, and payout conventions vary:

- Equities. Dividends are central. Ex-dividend dates can alter relative extrinsic value between calls and puts with the same strike and maturity.

- Futures and commodities. Carry costs and convenience yield influence parity relationships and extrinsic value. Storage feasibility, seasonality, and inventory levels can matter.

- Currencies. Interest rate differentials between currency pairs play the role of carry, shaping put–call relationships and the distribution of extrinsic value across calls and puts.

Across all these markets, the clearing framework and quoting practices uphold the same decomposition. Differences arise from how the underlying asset earns or costs money over time and from market conventions for settlement and exercise.

Quantitative Intuition Without Heavy Mathematics

A few guiding relationships provide intuition for how extrinsic value responds to inputs:

- More time to expiration, holding all else constant, tends to increase extrinsic value.

- Higher implied volatility, holding all else constant, tends to increase extrinsic value for both calls and puts.

- Higher interest rates, holding all else constant and absent dividends, tend to increase call extrinsic value and decrease put extrinsic value.

- Higher expected dividends before expiration, holding all else constant, tend to reduce call extrinsic value and increase put extrinsic value on equities.

- ATM options generally exhibit the highest extrinsic value for a given expiration, relative to deep ITM or deep OTM strikes.

These are tendencies rather than guarantees. Real quotes incorporate transaction costs, discrete price jumps, and evolving expectations.

Real-World Context

Intrinsic and extrinsic value are visible in many routine market situations:

- Earnings announcements. Before scheduled earnings, implied volatility often increases. OTM and ATM options can see higher extrinsic value as the market prices the possibility of a significant gap move. After the announcement, implied volatility can fall, reducing extrinsic value even if the underlying price does not change much.

- Macro uncertainty. Ahead of central bank decisions or major data releases, extrinsic value often rises across maturities near the event date. The adjustment is more pronounced in shorter expirations that directly straddle the announcement window.

- Dividend cycles. Approaching an ex-dividend date, the relative pricing of calls and puts adjusts. The option market reflects the cash distribution and its timing, shifting extrinsic value between calls and puts in a way consistent with parity.

- Rate regime shifts. When interest rates move materially, the present value of the strike changes. Call and put extrinsic values adjust in predictable directions given the sign of the rate change and the dividend or carry backdrop.

Putting the Concepts Together

Intrinsic value anchors an option to the current state of the world. Extrinsic value links the option to future possibilities and the market’s assessment of them. The premium that traders observe and quote every day is the sum. As expiration approaches, the weight shifts toward intrinsic value. Early in the option’s life, extrinsic value often dominates, especially near the money, because small changes can substantially alter the distribution of outcomes.

In a market setting, this framework provides a common language. A participant can say that an option is trading with little extrinsic value left, or that extrinsic value has expanded ahead of an event, and all parties understand what is meant. The decomposition also assists in comparing options across strikes and maturities, diagnosing the impact of rates and dividends, and checking price consistency using put–call parity.

Key Takeaways

- Intrinsic value is the immediate exercise value, never negative, and exists only for in-the-money options.

- Extrinsic value equals premium minus intrinsic and reflects time, implied volatility, interest rates, dividends or carry, and moneyness.

- Time decay typically reduces extrinsic value as expiration nears, though changes in volatility, rates, and dividends can offset or overwhelm this effect.

- Put–call parity links call and put values and helps explain how extrinsic value shifts with rates and dividends across strikes and maturities.

- The market structure of quoting, hedging, and clearing translates theoretical optionality into observed premiums, with extrinsic value discovered through competitive trading.