Options are standardized contracts that convey rights related to an underlying asset at a specified price and time. Within that framework, the distinction between in the money and out of the money is a foundational classification that summarizes the contract’s immediate economic value. This classification is called moneyness. It is central to pricing, risk measurement, market quoting conventions, and how options settle at expiration.

What Moneyness Means in Options

Moneyness describes the relationship between an option’s strike price and the current price of the underlying. It answers a simple question: if the option were exercised right now, would it deliver positive economic value, zero value, or negative value to the holder after considering only the contractual payoff and not the premium paid to acquire the option.

Because exercise occurs at a contractually fixed strike, moneyness depends on the comparison between the strike and the underlying’s current price. Market participants rely on moneyness to communicate quickly about where a contract sits relative to spot or the relevant forward price. Moneyness does not predict future outcomes. It is a snapshot classification at a given moment.

Defining In the Money, At the Money, and Out of the Money

Options come in two basic forms: calls and puts.

- Call option: Right to buy the underlying at the strike price.

- Put option: Right to sell the underlying at the strike price.

Given the current underlying price S and the strike price K, the standard definitions are:

- In the Money (ITM): The option would have positive payoff if exercised immediately.

- Call is ITM when S > K.

- Put is ITM when S < K.

- At the Money (ATM): The option’s strike is roughly equal to the current price of the underlying.

- Out of the Money (OTM): The option would have zero payoff if exercised immediately.

- Call is OTM when S ≤ K.

- Put is OTM when S ≥ K.

These labels can change as underlying prices move. A call that is OTM today can become ITM tomorrow if the underlying price rises above the strike. Moneyness therefore evolves continuously with the market.

Intrinsic Value and Time Value

Moneyness is linked to the decomposition of an option’s premium into intrinsic value and time value. The premium is the market price paid by a buyer to obtain the contractual right. It consists of:

- Intrinsic value: The immediate exercise value. For a call, max(S − K, 0). For a put, max(K − S, 0).

- Time value: The remainder of the premium above intrinsic value, reflecting uncertainty, time to expiration, interest rates, dividends or carry, and market supply and demand for protection or optionality.

ITM options have positive intrinsic value. OTM options have no intrinsic value, so their entire premium is time value. ATM options have negligible intrinsic value by definition, and their premiums are typically dominated by time value. This simple decomposition is fundamental for interpreting quoted prices and for understanding exercise and expiration outcomes.

Why the ITM and OTM Distinction Exists

The distinction exists because an option is a right, not an obligation. The right has a defined payoff function that depends on the strike and the underlying price. At any moment, that payoff either has immediate realizable value or it does not. Market participants need a concise way to label this status for pricing, risk control, documentation, and settlement.

Moneyness also reflects the economic logic of optionality. An ITM option behaves like partial ownership exposure to the underlying because it already has exercise value. An OTM option behaves like a conditional exposure that will only become valuable if the market moves sufficiently before expiration. These differences help explain why ITM and OTM options are priced and risk managed differently even when they reference the same underlying and maturity.

How Moneyness Fits into Market Structure

Modern options markets are organized around standardized contracts listed by exchanges and cleared by central counterparties. Moneyness fits into this structure in several ways:

- Contract listings: Exchanges list a range of strikes above and below the current price so that investors can transact in ITM, ATM, and OTM options across multiple expirations.

- Order books and quoting: Quotes are displayed by strike and expiration. Market makers continuously update bid and ask prices across the strike grid. The distribution of quotes often reflects supply and demand differences between ITM and OTM contracts, as well as the underlying’s volatility characteristics.

- Risk management and margin: Clearinghouses and brokers assess potential losses under adverse moves. Moneyness is a key input because ITM and OTM options respond differently to price changes and to volatility. Risk-based margin methodologies incorporate the sensitivity of positions across strikes to stress scenarios.

- Volatility surface: Implied volatility is not constant across strikes or maturities. The pattern of implied vols across moneyness is called the smile or skew. OTM puts on equity indices, for example, often trade at higher implied vol than ATM options because market participants value downside protection. This feature embeds information about perceived tail risks and the cost of insurance-like payoffs.

Price Behavior Across Moneyness

Although precise pricing involves stochastic models and interest rate or dividend inputs, several patterns are well established in practice:

- ITM options: Premium includes intrinsic value plus usually a smaller proportion of time value relative to the total price. The option’s price tends to move more closely with the underlying. The delta of an ITM call is typically high and the delta of an ITM put typically has high magnitude.

- ATM options: Premium is mostly time value. ATM options are usually most sensitive to changes in implied volatility and to the passage of time. The gamma of ATM options is often prominent, reflecting higher curvature in the price relationship near the strike.

- OTM options: Premium is entirely time value. OTM options tend to be inexpensive in absolute terms but can be sensitive to changes in implied volatility. Small changes in the underlying price near the strike can materially alter the probability of finishing ITM, especially as expiration approaches.

These patterns are qualitative and hold across asset classes. The exact magnitudes depend on the underlying’s volatility, time to expiration, interest rates, dividends, and the market’s implied volatility surface.

Real-World Illustrations

Equity Example

Consider a stock trading at 100. Examine call options with strike prices of 90, 100, and 110, all with the same expiration.

- The 90 strike call is ITM because S > K. Its intrinsic value is 10. If its market premium is 12, then time value is 2.

- The 100 strike call is ATM. It has essentially zero intrinsic value and its premium is entirely time value. Suppose it trades at 5.

- The 110 strike call is OTM. It has no intrinsic value, so the entire premium is time value. If it trades at 2, that 2 reflects the market’s view of the chance that S will exceed 110 before expiration, modified by carry factors and risk preferences.

For puts on the same stock, the classification reverses across the same strikes. The 110 strike put is ITM because S < K, the 100 strike put is ATM, and the 90 strike put is OTM.

Futures Option Example

Options on futures are common in commodities, interest rates, and equity indices. The underlying for the option is a futures contract price F rather than a spot price S. Moneyness is therefore defined relative to F, not spot. If crude oil futures for a particular delivery month are at 75, then a 70 strike call on that futures contract is ITM and a 80 strike call is OTM at that moment. The economic logic is the same even though the underlying is a futures price that already incorporates carry.

Currency Option Example

In foreign exchange, the underlying is a currency pair quotation. If EURUSD trades at 1.10, a 1.05 strike EUR call USD put is ITM, while a 1.15 strike EUR call USD put is OTM. Market participants frequently discuss moneyness using delta rather than a simple price distance in FX, because a change from 1.10 to 1.15 has a different proportional effect than the same absolute change at other levels. The underlying principle remains that ITM indicates positive exercise value at that moment and OTM indicates none.

Expiration, Exercise, and Assignment

Moneyness directly affects what happens at expiration. At expiration, time value has decayed to zero, so the option’s value equals its intrinsic value:

- An ITM call finishes with value equal to max(S − K, 0). An ITM put finishes with value equal to max(K − S, 0).

- An OTM option finishes with zero value and typically expires worthless.

Many listed options are American style, which permits exercise at any time up to expiration. European style options allow exercise only at expiration. In either case, ITM status is what determines whether an option has positive value at the end of its life. For American contracts, early exercise decisions depend on factors such as dividends and interest rates, but ITM status is a necessary condition for early exercise to be economically rational for calls on non-dividend-paying underlyings and a similar logic applies to puts under certain carrying cost conditions.

If a short position is assigned on an American option, the short party must fulfill the obligation implied by the contract. For a call, that means delivering the underlying at the strike if assigned. For a put, that means purchasing the underlying at the strike if assigned. Assignment risk is tied to ITM status because only ITM options have a reason to be exercised. Near dividends or before expiration, assignment patterns often reflect the trade-offs between time value and carry rather than only intrinsic value.

The Role of Time and Volatility

Time to expiration and implied volatility shape how an option’s moneyness evolves and how its price responds to market changes:

- Time decay: All else equal, time value declines as expiration approaches. OTM options lose value if the expected probability of becoming ITM does not increase sufficiently. ITM options can lose time value but retain intrinsic value unless the underlying moves in the opposite direction.

- Volatility: Higher implied volatility raises the premiums of both ITM and OTM options by increasing the range of potential future prices. The proportional effect can be larger on options with more time value, such as ATM and OTM contracts, though the exact pattern depends on the implied volatility surface.

- Closeness to the strike: Options near the money are the most sensitive to small changes in the underlying because the classification can switch between OTM and ITM with smaller price movements. This is one reason why ATM options often anchor market attention.

How Markets Communicate Moneyness

Moneyness is often discussed in more than one way, depending on the asset class and context:

- Absolute strike distance: Refers to the difference between S and K. Simple and intuitive for equities with a moderately stable price level.

- Percentage or log moneyness: Useful when the underlying price level changes over time or when comparing across underlyings with different price scales.

- Delta-based moneyness: Common in FX and rates. Delta approximately captures the probability of finishing ITM under risk-neutral assumptions for European options. Quoting by delta makes it easier to compare options across different underlyings and price levels because a 25 delta call represents a similar probability region of the distribution regardless of nominal price.

These conventions all map back to the same underlying idea. They frame how far the current price is from the strike and, therefore, the option’s classification and risk characteristics.

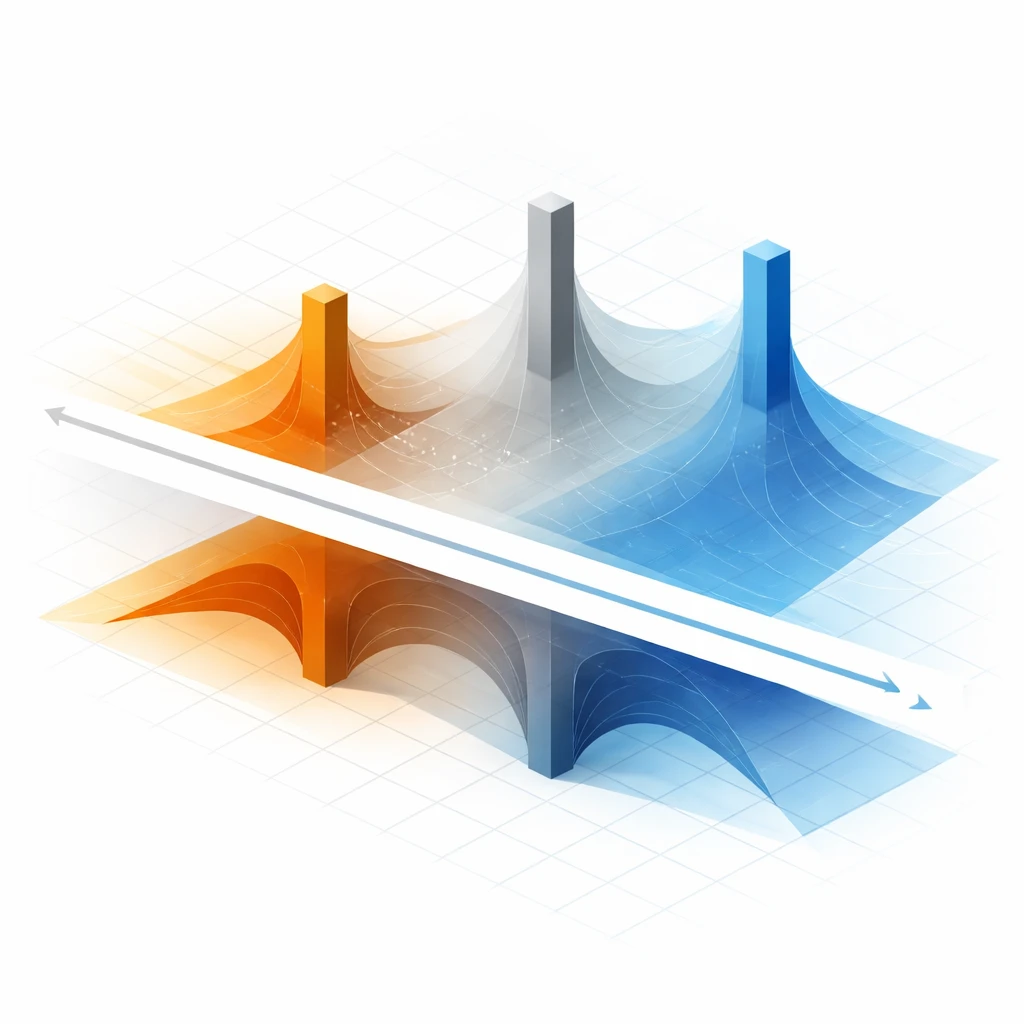

Moneyness and the Volatility Surface

The implied volatility surface is a three-dimensional representation of implied vol across strikes and expirations. Moneyness is the principal horizontal dimension. Several recurring features relate directly to ITM and OTM status:

- Skew: In equity index options, OTM puts often carry higher implied volatility than ATM or OTM calls. This pattern is consistent with demand for crash protection and the asymmetric distribution of returns.

- Smile: In some assets, both deep ITM and deep OTM options exhibit higher implied vol than ATM options, producing a smile shape. This can occur due to supply and demand imbalances or due to dynamics of the underlying risk factors.

- Term structure: The shape of implied volatility across expirations interacts with moneyness. Short-dated OTM options can be highly sensitive to event risk, while longer-dated ITM options reflect more of the long-run variance expectation.

These features influence premiums across moneyness and help explain why two options at different strikes may have very different time value even if they share the same expiration.

Settlement Conventions and Practical Details

Settlement depends on the product. Equity options often settle physically by delivery of shares against payment of the strike. Index options commonly settle in cash based on a published settlement price. Options on futures settle through the futures clearing system, and exercise results in a futures position at the strike, which then marks to market daily. The mechanics matter because they determine what actually happens if an ITM option is held at expiration or exercised earlier.

Automatic exercise conventions can apply to ITM options at expiration when the intrinsic value exceeds a defined threshold. Clearinghouses and brokers use these conventions to avoid leaving small amounts of value unclaimed. The threshold is not universal and operational rules vary by exchange and region. The important conceptual point is that ITM status at expiration drives whether an exercise occurs, while OTM contracts typically lapse.

Common Misconceptions

- “OTM options are safer because they are cheaper.” Low premium does not imply low risk of loss. An OTM option can expire worthless with a 100 percent loss of the premium paid if the underlying does not move sufficiently.

- “ITM options always track the underlying one-for-one.” ITM calls and puts can have high deltas, but not necessarily one. Dividends, interest rates, time to expiration, and early exercise features affect the relationship. Deep ITM options tend to have deltas close to plus or minus one, but they still include time value and may not move identically to the underlying.

- “Moneyness is the same across products.” The core definition is consistent, but the relevant reference price can differ. For futures options it is the futures price. For some cash-settled index options it is a special settlement calculation. Contract specifications matter.

- “An OTM option has no value.” OTM options have no intrinsic value, but they can have meaningful time value. That time value reflects the chance of becoming ITM before expiration.

- “ITM vs OTM is a fixed classification.” Moneyness changes with the underlying price. A contract can move from OTM to ITM and back within a single trading session.

Broader Context in Portfolio and Market Dynamics

Although this discussion focuses on definitions rather than strategies, it is useful to understand how moneyness interacts with broader market dynamics and portfolio mechanics:

- Hedging demand: Institutional investors often use OTM puts for downside insurance and ITM calls or puts for adjusting exposure when transacting directly in the underlying is less efficient. This demand affects implied volatility at different moneyness levels.

- Supply from option writers: Market makers and other liquidity providers respond to order flow across the strike grid. Their hedging practices can transmit pressure into the underlying market, especially near ATM strikes where sensitivity is acute.

- Regulatory and capital considerations: Risk-based capital rules and margin methodologies account for moneyness because it affects potential losses under stress. These constraints influence which areas of the strike grid have abundant liquidity at any time.

These forces help explain why ITM, ATM, and OTM options can exhibit different liquidity and different bid-ask spreads even within the same expiration.

Putting the Concepts Together

Moneyness is not a prediction tool. It is a classification that guides understanding of immediate exercise value, the composition of the option premium, and the contract’s sensitivity to market variables. ITM options embed intrinsic value and often move more closely with the underlying. OTM options are entirely time value and are more sensitive to changes in volatility and time decay. ATM options sit at the fulcrum where small price moves can change classification and where sensitivity to volatility is usually pronounced.

Across asset classes and contract styles, the logic is consistent. Identify the reference price, compare it with the strike, and classify the option. From that starting point, interpret quoted premiums, implied volatilities, and settlement outcomes within the contractual framework of the specific market.

Key Takeaways

- Moneyness classifies options by immediate exercise value relative to the strike and the current underlying price.

- ITM options have intrinsic value, OTM options have none, and ATM options are near the point where intrinsic value is minimal.

- Moneyness shapes premiums, sensitivities, and settlement outcomes, and it is a core dimension of the implied volatility surface.

- The reference price for moneyness can be spot or futures, depending on the contract, but the economic logic is consistent across asset classes.

- OTM does not mean worthless and ITM does not mean one-for-one with the underlying; time to expiration, volatility, and contract terms matter.