Tracking Error Explained

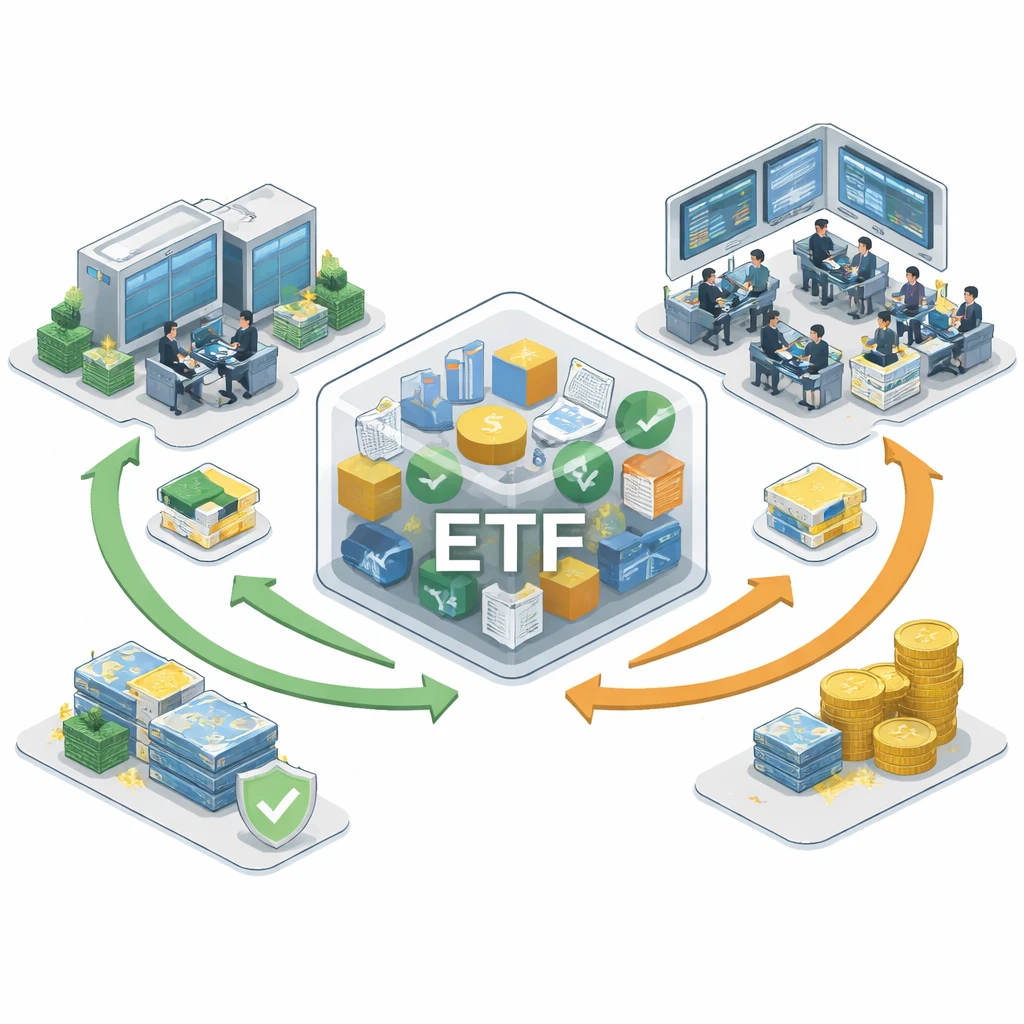

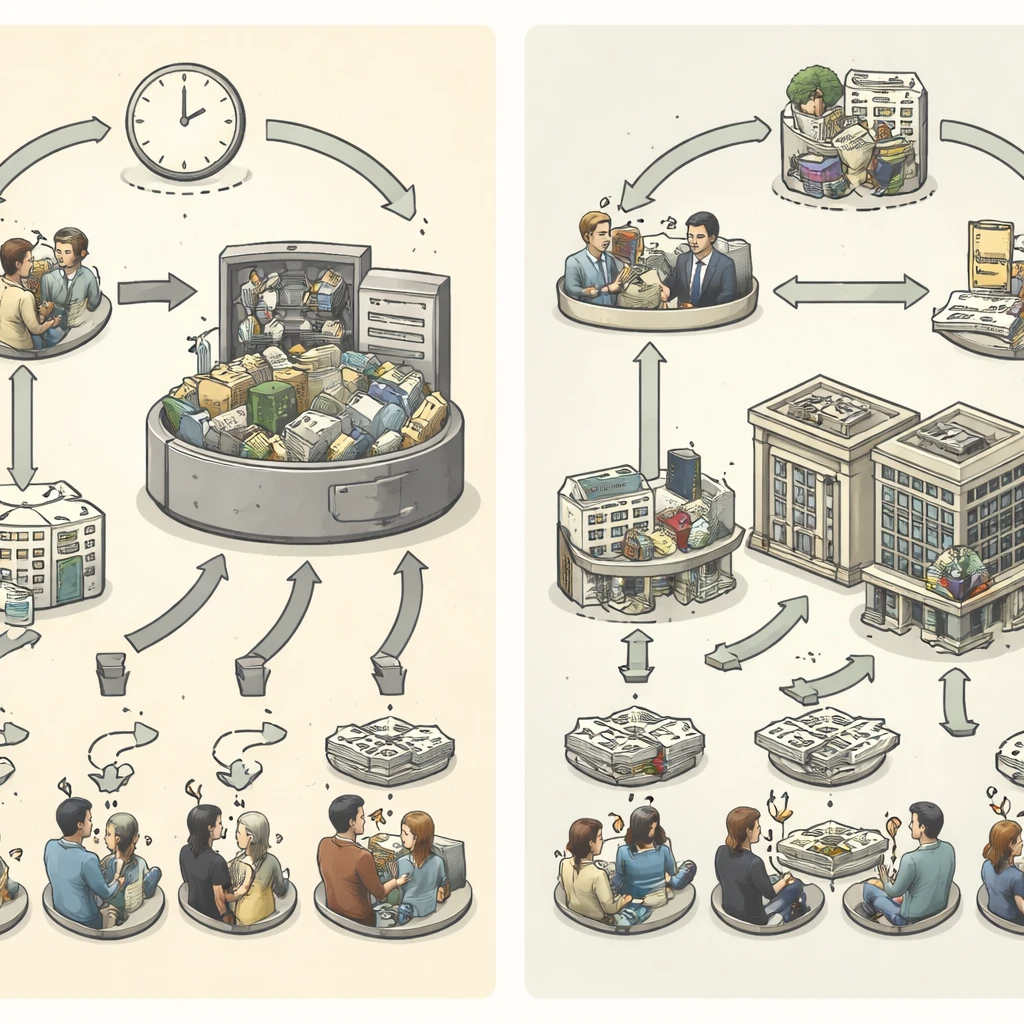

A clear, rigorous explanation of tracking error in ETFs and index funds, including what it measures, why it exists, how it is calculated, and how it fits within the broader market structure of index replication and fund operations. Practical examples highlight typical sources of deviation between a fund and its benchmark.