What Are Financial Statements?

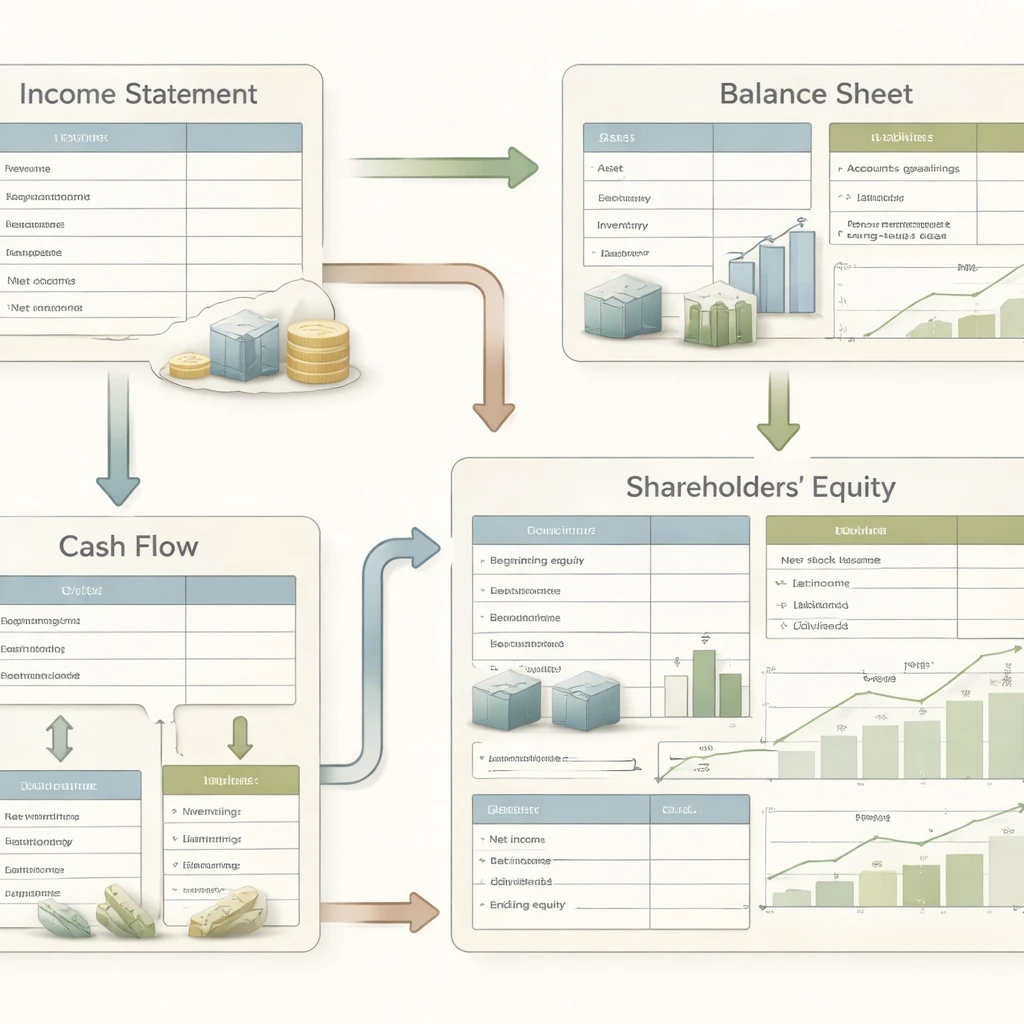

Financial statements are standardized reports that summarize a company’s financial performance, position, and cash flows. This article explains what they are, how they interrelate, and why they are central to fundamental analysis and long-term valuation.